Board of Directors

The Board of Directors has the broadest powers of management and is responsible for ensuring that the decisions of the shareholders’ meeting are implemented promptly and correctly.

The current Board of Directors was elected on 24 April 2025 and will remain in office until the shareholders’ meeting called to approve the 2027 financial statements.

The Board of Directors comprises currently 13 directors. A significant effort is made to ensure "gender quotas" (there are six women on the board, equal to 46%) and a broad range of expertise. Considering international best practices and increasingly established requirements in the world of finance, the majority of the members of Board of Directors are independent: ten out of thirteen directors (77%) are classified as independent according to the Italian CG Code, well above the minimum requirement under current regulations.

Giuseppe Catalano (Secretary of the Board of Directors)

Composition and independence

In accordance with the list voting system, AGM 2025 appointed 10 directors from the majority slate presented by Mediobanca S.p.A. and 3 directors were elected from the minority slate presented by the shareholder VM2006 S.r.l.

All the board members are independent in accordance with the Italian legislation for insurance companies (Decree of the Ministry for economic development no. 220 of 11 November 2011). Among them 12 are independent pursuant the legislation applicable to companies listed in the Italian regulated market (CFBA) and 10 as for the Italian CG Code.

| Independent as defined by the... | CFBA |

CG Code |

| Andrea Sironi | X | X |

| Philippe Donnet | ||

| Marina Brogi | X | X |

| Flavio Cattaneo | X | X |

| Patricia Estany | X | X |

| Alessia Falsarone | X | X |

| Clara Furse | X | X |

| Umberto Malesci | X | X |

| Antonella Mei-Pochtler | X | X |

| Fabrizio Palermo | X | X |

| Lorenzo Pellicioli | X | |

| Clemente Rebecchini | X | |

| Luisa Torchia | X | X |

| 12 of 13 | 10 of 13 |

According to the analysis conducted by Generali, with the exception of the CEO, Philippe Donnet, who holds an executive role, the remaining 12 directors corresponds to the independence criterion set by S&P Global.

Generali has not appointed a Lead Independent Director and such choice is compliant with the Italian Corporate Governance Code. In fact, the role of Lead Independent Director (LID) - the introduction of which is recommended by the CG Code only in specific cases, which do not apply in the case of Generali - is not necessary in relation to our Company's organisational structure, since the Chairman, who is an independent director, is neither an executive nor a controlling shareholder of the Company; moreover, the majority of Independent Directors have not yet deemed it necessary to make a proposal to the Board for the appointment of a LID.

Experience and skills

For information on experience and skills of our directors, see the experience and skills section.

Comparison with peers in Italy and Europe

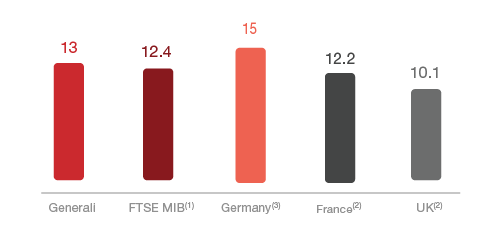

- The size of the Board of Directors is above average of European peers and in line with the average of Italian peers.

Size - European and Domestic comparison

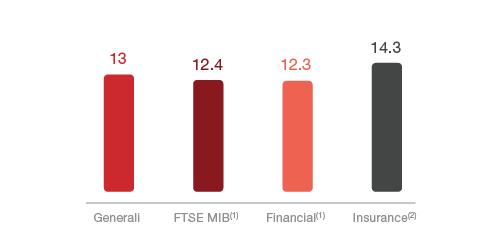

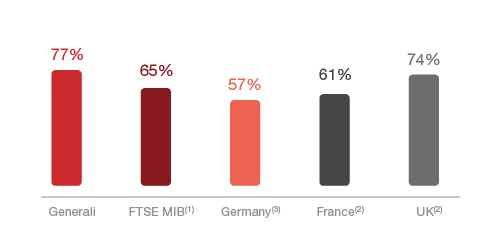

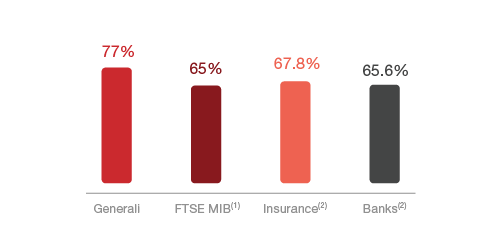

- The level of independence of the Board of Directors is above average of European and Italian peers.

% Independence - European and Domestic Comparison

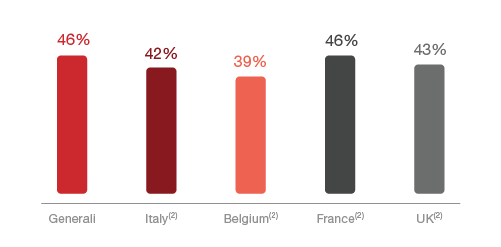

- The presence of women on the Board of Directors exceeds the average of Italian and European peers.

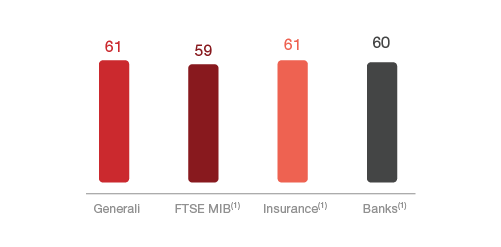

- The average age of the Board of Directors is 61 years and is above average of Italian peers.

(1) Assonime "La Corporate Governance in Italia: autodisciplina, remunerazioni e comply or explain (anno 2024)"

(2) Spencer Stuart "Italia Board Index 2024" and "Boards around the world 2024"

(3) Spencer Stuart "2023 Germany Spencer Stuart Boards Index"

Training

During 2024, as in previous years, regular and periodical training sessions were organised to provide Directors and Statutory Auditors with updates and insights on strategic topics and relevant risk items.

In 2024, the Board had training sessions on:

- Valuation of equity instruments, particularly in the insurance market;

- Generali Group’s customer journey;

- Challenges and opportunities of natural catastrophes for the insurance industry;

- Value for money and the implications for the Generali Group;

- The Digital Operational Resilience Act (DORA) programme for the Generali Group;

- The CSRD and its strategic and informative implications.

Update and in-depth sessions on international sanctions in relation to anti-financial crime were also held during 2024, both for the Risk and Control Committee and the Board. In light of the new European legislation, training sessions were held on two emerging issues: on the one hand, the Digital Operational Resilience Act (DORA), designed to align operational resilience standards within the financial sector, with a specific focus on the programme identified for the Group; on the other hand, the EU Corporate Sustainability Reporting Directive (CSRD) and its transposition into Italian law, with a focus on its strategic implications and public disclosure.

Since last years, the Directors have had access to the corporate “We-Learn” educational platform to follow video courses on cyber security.

Additional regular risk focused sessions include the periodical review of the Own Risk and Solvency Assessment (ORSA) Report, the Risk Appetite Framework, the periodical reporting on solvency position and the risk management system as well as additional deep dives on selected risks (ie. climate risk, operational risks, etc.). More details on Group Risk Appetite and ORSA can be found in Group Risk Report included in the Annual Integrated Report and Consolidated Financial Statement.

New training and updating sessions are already in place in 2025.

Compensation

For information on directors’ compensation, see the remuneration section.

Shareholdings

For information on directors’ shareholdings, see the shareholdings section.

Engagement

For information about the engagement with the Board of Directors, see the engagement section.