Our activities

Total gross written premium by country (*)

Life

LIFE NET INFLOWS

€ 9,674 mln

NEW BUSINESS VALUE (NBV)

+2.3%

€ 2,383 mln

OPERATING RESULT

+6.6%

€ 3,982 mln

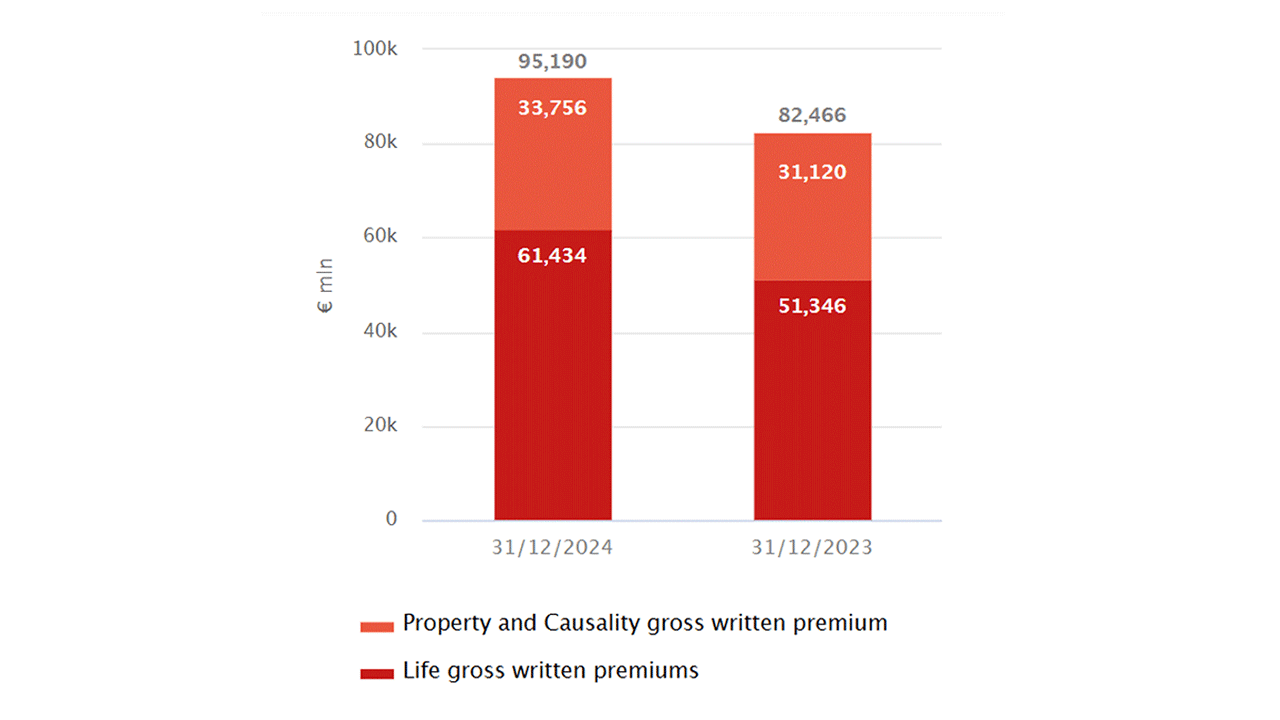

Gross written premiums € 61,434 mln (+19.2%)

Property and Casualty (P&C)

GROSS WRITTEN PREMIUMS

+7.7%

€ 33,756 mln

COMBINED RATIO (COR)

0.0 p.p.

94.0%

OPERATING RESULT

+5.1%

€ 3,052 mln

Asset Management

OPERATING RESULT

+18.3%

€ 616 mln

Wealth Management

OPERATING RESULT

+27.6%

€ 560 mln

Holding and other businesses

OPERATING RESULT

+29.1%

€ -536 mln

(Figures at December 31, 2024)