We SHARE 2.0, the Generali Ownership Plan

With the ambition to promote a meritocratic environment that fosters alignment with strategic goals and people’s participation in the value creation process, in 2019 Generali developed and launched We SHARE, the first Share Plan of its kind for Group employees.

Based on the high employee participation in the first edition of the Plan and to further promote our culture of ownership, in April 2023 the Annual General Meeting approved a new Plan with ~90% of favourable votes.

In continuity with the previous edition, the new Plan “We SHARE 2.0”, provides employees* with the opportunity to purchase Generali shares at favourable conditions within a protected framework, awarding them additional free shares in case of share price appreciation.

In this new edition, with the aim to embed the Group’s climate strategy objectives and to make the new Plan more effective with respect to the current market context, some enhancements have been introduced:

- the introduction of an Environmental Social Governance (ESG) goal;

- the allocation of additional free shares linked to the new ESG goal;

- the broadening of the exercise period, assessing the share price appreciation condition up to 3 times instead of 1;

- the allocation, in case of share price depreciation, of free additional shares linked to the dividends distributed, if the Net Holding Cash Flow (NHCF) goal is reached.

Moreover, also in this new edition, Generali renewed its support to The Human Safety Net Foundation, by making a donation for each employee joining the Plan, and participants will have the opportunity to do the same. This is a demonstration of the Group’s commitment towards the shared purpose of enabling people to shape a safer and more sustainable future by caring for their lives and dreams.

Therefore, We SHARE 2.0 is a tangible sign of Generali’s drive to promote across the Group employee engagement towards the achievement of strategic objectives, a culture of ownership and empowerment, and their participation in Group sustainable value creation.

The Plan, having a duration of indicatively 3 years, was launched in June 2023. Over 23,000 Generali employees from more than 30 countries joined We SHARE 2.0 and the opportunity will soon be extended also to the employees of additional countries, which for regulatory reasons will be able to enrol by the end of this year.

* We SHARE 2.0 is addressed to employees of Generali and the companies belonging to the Group, excluding members of the Group Management Committee and the Global Leadership Group who cannot subscribe to the Plan, as well as employees operating in Countries and Companies in which it is not possible to implement the Plan on the terms set and approved by Generali, for reasons of a legal, fiscal, operational or organisational nature.

In some Countries, the Plan is also subject to local authorities’ approval.

How We SHARE 2.0 Works

Start of the Plan

At the beginning of the Plan, employees decide whether to participate and define the amount of their individual contribution, i.e. the amount of money they wish to set aside by monthly payroll deduction to purchase Generali shares at the end of the Plan.

Based on the amount of the individual contribution confirmed by Generali, participants receive free of charge the right (“Options”) to purchase, at the end of the Plan, Generali shares at a price set from the start at the favourable rate of €16.45 (“Initial Price”). The number of options assigned to each participant are equal to the ratio between the individual contribution and the Initial Price.

During the Plan

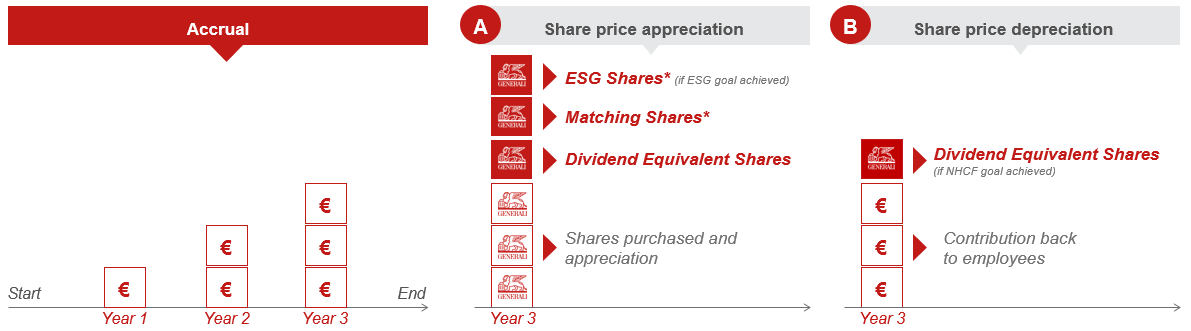

The overall amount of the individual contribution is accrued through monthly payroll deductions and secured in a dedicated cash account, where it is locked up for the entire duration of the Plan.

End of the Plan

In April 2026, the Final Price will be compared with the Initial Price to assess if the share price appreciation condition is achieved (Final Price equal to or higher than the Initial Price of €16.45).

In case of share price depreciation in April 2026 (Final Price lower than the Initial Price), the performance condition can be assessed up to 2 additional times (May 2026, June 2026) to increase the likelihood of a rising share price.

A. In case of share price appreciation, participants will automatically purchase the Generali shares by paying Assicurazioni Generali S.p.A. the individual contribution accrued throughout the Plan and will receive free of charge:

- free Dividend Equivalent Shares, in proportion to the shares purchased and the dividends paid in 2023, 2024 and 2025;

- 2 free Matching Shares every 10 shares purchased;

- 2 free ESG Shares for every 10 shares purchased, if the ESG Goal is also achieved.

The ESG goal refers to the CO2 Emissions Reduction Target for Group Operations equal to 35% measured comparing the year 2025 against the 2019 baseline.

B. In case of share price depreciation, participants will receive:

- the refund of the individual contribution accrued (protection mechanism);

- free Dividend Equivalent Shares, in case the Net Holding Cash Flow (NHCF) goal is achieved.

The NHCF goal is one of Generali’s key strategic targets that enables to pay dividends to all shareholders and refers to the 2023-2025 NHCF target equal to € 8.7 billion.

* 2 ESG shares every 10 shares purchased; 2 Matching shares every 10 shares purchased

In March 2026, each participant can decide:

- to sell all Generali shares received, thereby receiving the corresponding amount of money through payroll, after having covered tax withholding (“Sell All” choice);

- to hold the Generali shares received, except for those sold in order to pay the taxes due (“Sell to Cover” choice).

Download

Choose your country