Our rules

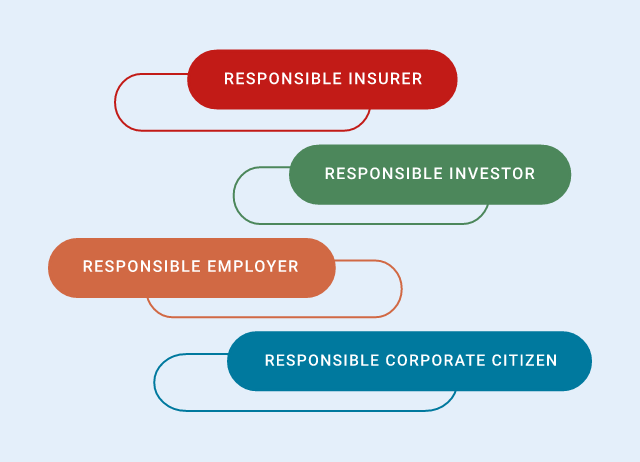

Generali’s Corporate Governance structure is an effective model recognised by several rating agencies that enables us to pursue the Company’s sustainable success, integrating sustainability and social responsibility principles into everything we do: from investments to underwriting activities, partnerships, and initiatives for individuals, families, and companies. This allows us to act as a true Lifetime Partner to all our stakeholders.

The integrated governance, management and reporting system through which we operate guarantees compliance with our sustainability principles and their tangible integration into daily decision-making. Our Board of Directors hosts an Innovation Social and Environmental Sustainability Committee, composed of 4 non-executive and independent directors with specific Sustainability & Innovation competencies. The Committee performs an advisory, recommendatory and preparatory role for the Board on the issues of technological innovation and social and environmental sustainability.

Policies and guidelines

Generali Protocol Against Violence and Harassment in our Group

Resulting from a dedicated collaboration between GHO and Country Italy, including Generali Italia, Welion, Genertel, GOSP, Alleanza, and Cattolica Immobiliare, as well as constructive dialogue with trade unions within the Joint Committee for Equal Opportunities, the Generali against violence and harassment in our Group aims primarily to cultivate a work environment that is not only safe but also respectful for all Generali People.

Code of conduct

It defines the basic behavioural principles which all the personnel of the Group are required to comply with. These principles are outlined in a specific internal regulation that refer, for example, to the promotion of diversity and inclusion , fair competition and antitrust, conflicts of interest, bribery and corruption prevention, money laundering, terrorist financing and international sanctions violations, as well as personal data protection.

Discover more about the Code of conduct.

Ethical Code for Suppliers

It highlights the general principles for the correct and profitable management of relations with contractual partners.

Discover more about the Ethical Code for Suppliers.

Policy for engagement with investors and other relevant stakeholders

It regulates engagement between the Board of Directors and representatives of investors and other relevant stakeholders on issues within the Board’s purview, and defines the rules for engagement by identifying interlocutors, discussion topics, timing and channels.

Download the Document.

Security Group Policy

It defines the processes and activities suitable for the purpose of guaranteeing the protection of corporate assets.

Discover more about the Security Group Policy.

Group Sustainability policy

It defines how sustainability is managed through the Group Sustainability Framework; in particular: the direction Generali wants sustainability to evolve into and the underlying principles driving the strategic choices and their execution; the identification and prioritisation of sustainability matters through a materiality assessment and their integration into key business processes; the underpinning elements necessary to enable sustainability integration.

Download the Document.

Integration of Sustainability into investments and Active Ownership Group guideline

It codifies the responsible investment activities at Group level and defines the principles, main activities and responsibilities that guide the Group’s role as active owner.

Discover more about the Active Ownership Group guideline.

Responsible Underwriting Group guideline

It outlines principles and rules aimed at factoring-in clients’/companies’ sustainability matters within the P&C underwriting process.

Download the Document.

Green, Social & Sustainability Bond framework

It defines rules and processes for the use of proceeds from the issuance of green bonds, social bonds and sustainability bonds, as well as recommendations for disclosure.

Discover more about Green, Social & Sustainability Bond framework.

Green Insurance-linked securities framework

It defines the guidelines for integrating ESG aspects in alternative mechanisms for the transfer of insurance risk to institutional investors, as well as recommendations for disclosure.

Discover more about the Green Insurance-linked securities framework.

Generali Group Strategy on Climate change

It defines the rules by which we intend to foster a just transition towards a low-GHG economy through our investments, underwriting activities and our direct operations.

Discover more about the Generali Group Strategy on Climate change.

Group Tax Strategy

It is an essential part of the tax risk control system, and defines sound and prudent taxation management methods for all of the Group’s companies.

Discover more about the Group Tax Strategy.