Dividends

The shareholder remuneration policy

During the Investor Day that took place in Venice on January 30th, 2025, Generali launched the Group’s new three-year strategy Lifetime Partner 27: Driving Excellence. In its strategic plan, Assicurazioni Generali commits to a dividend per share (DPS) CAGR of above 10%1 with ratchet policy, targeting more than €7 billion in cumulative dividends over the plan horizon, ca. 30% higher than the €5.5 billion distributed during Lifetime Partner 2024, plus a commitment to a minimum annual € 0.5 billion share buyback, to be assessed at the beginning of each year (for a total commitment of at least € 1.5 billion over the plan), with a € 0.5 billion share buyback to be launched already in 2025.

The Group CEO Philippe Donnet stated:“Generali has successfully over-delivered against the financial targets of its ‘ Lifetime Partner 24: Driving Growth’ plan in a tough global macro environment. We will now accelerate our pursuit of excellence to drive higher earnings growth and cash generation, targeting increased shareholder returns with double-digit growth in the dividend per share leading to over €7 billion in cumulative dividends plus a commitment to at least €1.5 billion in share buybacks over the plan horizon, including the €0.5 billion buyback that we are launching in 2025 as presented today.”

13-year compound annual growth rate in dividend per share with 2024 baseline at € 1.28 per share.

2024 dividend

The dividend per share, approved by the Annual General Meeting of April 24th 2025, is € 1.43, and was paid starting May 21st, 2025. Shares traded ex-dividend from May 19th, 2025, while shareholders were entitled to receive the dividend based on holdings on May 20th, 2025. The dividend per share marks an 11.7% increase compared to the dividend paid in 2024, reflecting the Group’s excellent results, the strong cash and capital position of the Group and the increasing focus on shareholder returns.

The dividend approved entails a total maximum pay-out of € 2,172 million.

Dividends in the history of Generali

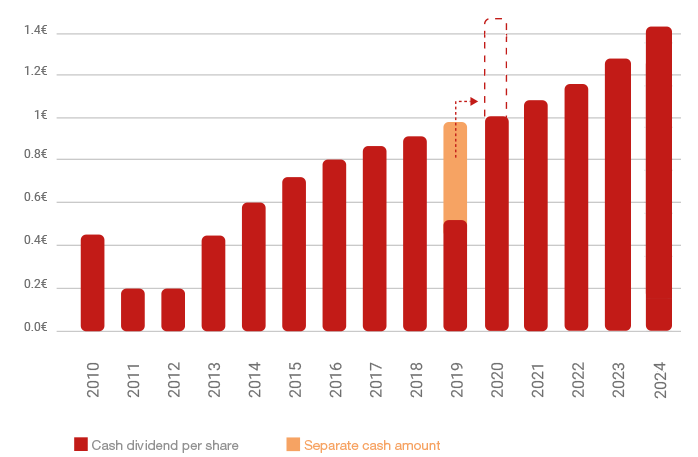

Generali has always placed great importance on rewarding its shareholders. The ex-dividends paid over the last 15 years are shown in the graph below.

Dividends per share

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Dividend per share (€) | 0.45 | 0.20 | 0.20 | 0.45 | 0.60 | 0.72 | 0.80 | 0.85 | 0.90 | 0.96* | 1.01* | 1.07 | 1.16 | 1.28 | 1.43 |

* The dividend per share proposed for the 2020 financial year was € 1.47, split into two tranches of € 1.01 and € 0.46, respectively. The first tranche was payable as from 26 May 2021, represents the ordinary pay-out from 2020 earnings. The second tranche was related to the second part of the 2019 retained dividend and was payable as from 20 October 2021 following the verification by the Board of Directors of the absence of impeding supervisory provisions or recommendations in force at that time which was carried out on 1 October 2021. As a consequence the amount of € 0.46, paid out in 2021, has been shown here in the amount related to the fiscal year of 2019.

Dividends distributed from 2023

| Year | Dividend per share (€) | % Previous year increase | Aggregate payout (€ mln) |

% Previous year increase | Maximum aggregate payout (€ mln) | % Previous year increase | Parent Company net profit (€ mln) | % Previous year increase | Adjusted net result (€ mln) | % Previous year increase |

| 2024 | 1.43 | 11.7 | 2,172 | 9,29 | 3.689,9 | +155,1 | 3,769 | 5.4 | ||

| 2023 | 1.28 | 10.3 | 1,987 | 11.05 | 1,987 | 11.05 | 1,446.3 | -48.72 | 3,575 | 14.1 |

Dividends distributed from 2001 to 2022

| Year | Dividend per share (€) | % Previous year increase | Aggregate payout (€ mln) |

% Previous year increase | Maximum aggregate payout (€ mln) | % Previous year increase | Parent Company net profit (€ mln) | % Previous year increase | Consolidated net profit (€ mln) | % Previous year increase |

| 2022 | 1.16 | 8.41 | 1,790 | 5.85 | 1,790 | 5.85 | 2,820.5 | 52.72 | 2,912 | 2,25 |

| 2021 | 1.07 | 5.94 | 1,691 | 6.29 | 1,691 | 6.29 | 1,846.9 | -37,81 | 2,847 | 63.3 |

| 2020 | 1.47*** | 5.21 | 1,591**** | 5.13 | 1,591**** | 5.13 | 2,969.9 | 96.12 | 2,076 | -12.7 |

| 2019 | 0.50*** | 6.67 | 1,513*** | 7.1 | 1,513*** | 7.1 | 1,514.3 | 2.78 | 2,379 | 6.6 |

| 2018 | 0.90 | 5.88 | 1,412.6 | 5.88 | 1,412.6 | 5.88 | 1,473.3 | 4.90 | 2,309 | 9.4 |

|

2017 |

0.85 |

6.25 |

1,330.4 |

6.25 |

1,330.4 |

6.25 |

1,404.5 |

28.11 |

2,110 |

1.4 |

|

2016 |

0.80 |

11.11 |

1,249.4 |

11.25 |

1,249.4 |

11.25 |

1,096.2 |

17.68 |

2,081 |

2.51 |

|

2015 |

0.72 |

20.00 |

1,123.1 |

20.00 |

1,123.1 |

20.00 |

931.5 |

26.26 |

2,030 |

15.34 |

|

2014 |

0.6 |

33.33 |

934.1 |

33.33 |

934.1 |

33.33 |

737.8 |

29.57 |

1,760 |

-8.08 |

|

2013 |

0.45 |

125 |

700.6 |

125.56 |

700.6 |

124.98 |

569.4 |

335.63 |

1,915 |

2,036.80 |

|

2012 |

0.2 |

= |

310.6 |

= |

311.4 |

= |

130.7 |

-59.85 |

90 |

-89.53 |

|

2011 |

0.2 |

-55.55 |

310.6 |

-55.55 |

311.4 |

-55.55 |

325.5 |

-48.64 |

856 |

-49.70 |

|

2010 |

0.45 |

28.57 |

698.8 |

28.57 |

700.6 |

28.57 |

633,8 |

14,05 |

1,702 |

30.01 |

|

2009 |

0.35 |

133.33** |

543.5 |

167.21** |

544.9 |

157.64** |

555.7 |

-32.91 |

1,309 |

52.07 |

|

2008 |

0.15 |

-13.33 |

203.4 |

-12.8 |

211.5 |

-15.51 |

828.3 |

-40.88 |

861 |

-70.47 |

|

0.63* |

860.6* |

860.6* |

||||||||

|

2007 |

0.9 |

20 |

1,220.1 |

27.74 |

1,269.0 |

32.37 |

1,401.1 |

15.45 |

2,916 |

21.24 |

|

2006 |

0.75 |

38.89 |

955.2 |

38.64 |

958.7 |

39.15 |

1,213,6 |

32.38 |

2,405 |

25.35 |

|

2005 |

0.54 |

25.58 |

689 |

25.61 |

689 |

25.61 |

916.8 |

-9.42 |

1,919 |

15.18 |

|

2004 |

0.43 |

30.3 |

548.5 |

30.3 |

548.5 |

30.3 |

1,012.1 |

83.88 |

1,666 |

64.1 |

|

2003 |

0.33 |

17.86 |

420.9 |

17.89 |

420.9 |

17.89 |

550.4 |

166.9 |

1,015 |

234.56 |

|

2002 |

0.28 |

0 |

357.1 |

0.03 |

357.1 |

0.03 |

206.2 |

-53.35 |

-754 |

-168.58 |

|

2001 |

0.28 |

--- |

356.9 |

--- |

356.9 |

--- |

442,1 |

--- |

1,100 |

--- |

Italian GAAP consolidated net profit from 2001 to 2003; IAS-FRS consolidated net profit from 2004.

* Amount corresponding to the dividend in kind, equivalent to 1/25 of the share, according to the official price of 21 May 2009 (dividend payment date). The dividend per unit, cash + 1/25 of the share, amounts to 0.78 euro per share.

** Percentage increase in the amount distributed in cash for 2008.

*** Data regarding the distribution actually carried out in 2020 and related to the first tranche of the resolved dividend, amounting to € 0.50 per share and to the second tranche, amounting to € 0.46 per share, paid out in 2021.

**** Data regarding only the amount related to the ordinary profit pay-out carried out in 2021 and amounting to € 1.01. The amount related to the second tranche, of € 0.46, has been included in data related to the 2019 fiscal year.

Dividend history

|

Year of |

Date of |

Dividend |

Number of |

Total |

| 2025 | 21.05.25 | Euro 1.43 | 1,549,784,923 | 2,171,879,795.80 |

| 2024 | 22.05.24 | Euro 1.28 | 1,569,160,198 | 1,987,267,765.76 |

| 2023 | 24.05.23 | Euro 1.16 | 1,559,281,461 | 1,789,502,077.80 |

| 2022 | 25.05.22 | Euro 1.07 | 1,586,593,803 | 1,697,655,369.21 |

| 2021 | 26.05.21 | Euro 1.01 | 1,581,069,241 | 1,596,879,933.41 |

| 20.10.21*** | Euro 0.46*** | 1,581,069,241*** | 727,291,850.86*** | |

| 2020 | 20.05.20 | Euro 0.50 | 1,576,052,047 | 788,026,023.5 |

| Not distributed | Euro 0.46 | 1,576,052,047 | 724,983,941.62 | |

| 2019 | 22.05.19 | Euro 0.90 | 1,569,600,895 | 1,412,640,805.5 |

|

2018 |

23.05.18 |

Euro 0.85 |

1,565,165,364 |

1,330,390,559.40 |

|

2017 |

24.05.17 |

Euro 0.80 |

1,561,808,262 |

1,249,446,609.60 |

|

2016 |

25.05.16 |

Euro 0.72 |

1,559,883,538 |

1,123,116,147.36 |

|

2015 |

20.05.15 |

Euro 0.60 |

1,556,873,283 |

934,123,969.80 |

|

2014 |

22.05.14 |

Euro 0.45 |

1,556,873,283 |

700,592,977.35 |

|

2013 |

23.05.13 |

Euro 0.20 |

1,556,873,283 |

311,374,656.60 |

|

2012 |

24.05.12 |

Euro 0.20 |

1,556,873,283 |

311,374,656.60 |

|

2011 |

26.05.11 |

Euro 0.45 |

1,556,873,283 |

700,592,977.35 |

|

2010 |

27.05.10 |

Euro 0.35 |

1,556,873,283 |

544,905,649.05 |

|

2009 |

21.05.09 |

Euro 0.15** |

1,410,113,747 |

211,517,062.05 |

|

2008 |

22.05.08 |

Euro 0.90 |

1,410,015,363 |

1,269,013,826.70 |

|

2007 |

24.05.07 |

Euro 0.75 |

1,278,285,370 |

958,714,027.50 |

|

2006 |

25.05.06 |

Euro 0.54 |

1,275,899,543 |

688,985,753.22 |

|

2005 |

26.05.05 |

Euro 0.43 |

1,275,587,018 |

548,502,417.74 |

|

2004 |

27.05.04 |

Euro 0.33 |

1,275,587,018 |

420,943,715.90 |

|

2003 |

22.05.03 |

Euro 0.28 |

1,275,284,781 |

357,079,738.68 |

|

2002 |

23.05.02 |

Euro 0.28 |

1,274,863,625 |

356,961,815.00 |

|

2001 |

24.05.01 |

ITL 500 |

1,252,991,340 |

626,495,670,000 |

|

2000 |

25.05.00 |

ITL 460 |

1,252,943,669 |

576,354,087,740 |

|

1999 |

31.05.99 |

ITL 425 |

1,025,847,404 |

435,985,146,700 |

|

1998 |

20.07.98 |

ITL 385 |

1,025,811,890 |

394,937,577,650 |

|

1997 |

21.07.97 |

ITL 375 |

881,704,686 |

330,639,257,250 |

|

1996 |

22.07.96 |

ITL 375 |

801,522,393 |

300,570,897,375 |

|

1995 |

17.07.95 |

ITL 360 |

801,474,647 |

288,530,872,920 |

|

1994 |

18.07.94 |

ITL 360 |

728,577,146 |

262,287,772,560 |

|

1993 |

16.07.93 |

ITL 350 |

728,511,075 |

254,978,876,250 |

|

1992 |

16.07.92 |

ITL 335.33 |

728,511,061 |

244,291,614,100 |

|

1991 |

17.07.91 |

ITL 349.48 |

582,802,343 |

203,677,762,800 |

|

1990 |

16.07.90 |

ITL 350 |

529,816,112 |

185,435,639,200 |

|

1989 |

17.07.89 |

ITL 330 |

529,790,000 |

174,830,700,000 |

|

1988 |

18.07.88 |

ITL 600 |

208,472,862 |

125,083,717,200 |

|

1987 |

16.07.87 |

ITL 600 |

173,028,100 |

103,816,860,000 |

|

1986 |

17.07.86 |

ITL 600 |

123,092,718 |

73,855,630,800 |

|

1985 |

16.07.85 |

ITL 500 |

122,594,079 |

61,297,039,500 |

|

1984 |

17.07.84 |

ITL 325 |

122,098,100 |

39,681,882,500 |

|

1983 |

19.07.83 |

ITL 1,100 |

30,524,525 |

33,576,977,500 |

|

1982 |

16.07.82 |

ITL 1,100 |

24,419,620 |

26,869,582,000 |

|

1981 |

08.07.81 |

ITL 950 |

24,419,620 |

23,198,639,000 |

|

1980 |

21.07.80 |

ITL 750 |

24,419,620 |

18,314,715,000 |

|

1979 |

19.07.79 |

ITL 700 |

19,278,648 |

13,495,053,600 |

|

1978 |

19.07.78 |

ITL 600 |

16,457,544 |

9,874,526,400 |

|

1977 |

20.07.77 |

ITL 550 |

13,714,624 |

7,543,043,200 |

|

1976 |

19.07.76 |

ITL 500 |

13,714,624 |

6,857,312,000 |

|

1975 |

21.07.75 |

ITL 500 |

8,944,320 |

4,472,160,000 |

|

1974 |

09.07.74 |

ITL 500 |

8,944,320 |

4,472,160,000 |

|

1973 |

19.07.73 |

ITL 500 |

7,453,600 |

3,726,800,000 |

|

1972 |

19.07.72 |

ITL 450 |

7,453,600 |

3,354,120,000 |

|

1971 |

19.07.71 |

ITL 450 |

7,453,600 |

3,354,120,000 |

|

1970 |

08.06.70 |

ITL 550 |

5,324,000 |

2,928,200,000 |

|

1969 |

18.06.69 |

ITL 550 |

4,840,000 |

2,662,000,000 |

|

1968 |

19.06.68 |

ITL 1,000 |

2,420,000 |

2,420,000,000 |

|

1967 |

19.07.67 |

ITL 900 |

2,420,000 |

2,178,000,000 |

|

1966 |

08.08.66 |

ITL 850 |

2,420,000 |

2,057,000,000 |

|

1965 |

20.07.65 |

ITL 850 |

2,420,000 |

2,057,000,000 |

|

1964 |

21.07.64 |

ITL 850 |

2,420,000 |

2,057,000,000 |

|

1963 |

29.07.63 |

ITL 850 |

2,420,000 |

2,057,000,000 |

|

1962 |

22.06.62 |

ITL 850 |

2,200,000 |

1,870,000,000 |

|

1961 |

03.07.61 |

ITL 750 |

2,200,000 |

1,650,000,000 |

|

1960 |

04.07.60 |

ITL 700 |

2,000,000 |

1,400,000,000 |

|

1959 |

06.07.59 |

ITL 650 |

2,000,000 |

1,300,000,000 |

|

1958 |

07.07.58 |

ITL 600 |

2,000,000 |

1,200,000,000 |

|

1957 |

03.07.57 |

ITL 550 |

2,000,000 |

1,100,000,000 |

|

1956 |

02.07.56 |

ITL 500 |

2,000,000 |

1,000,000,000 |

|

1955 |

04.07.55 |

ITL 400 |

2,000,000 |

800,000,000 |

|

1954 |

08.07.54 |

ITL 350 |

2,000,000 |

700,000,000 |

|

1953 |

08.07.53 |

ITL 300 |

2,000,000 |

600,000,000 |

|

1952 |

07.07.52 |

ITL 250 |

2,000,000 |

500,000,000 |

|

1951 |

02.07.51 |

ITL 200 |

2,000,000 |

400,000,000 |

|

1950 |

06.07.50 |

ITL 160 |

2,000,000 |

320,000,000 |

|

1949 |

06.07.49 |

ITL 120 |

1,600,000 |

168,000,000 |

|

1948 |

22.07.48 |

ITL 60 |

1,200,000 |

72,000,000 |

|

1947 |

30.04.47 |

ITL 35 |

600,000 |

21,000,000 |

|

1946 |

11.02.46 |

ITL 31.5 |

600,000 |

18,900,000 |

|

1945 |

- |

ITL 31.5 |

600,000 |

18,900,000 |

|

1944 |

giu-44 |

ITL 35 |

600,000 |

21,000,000 |

|

1943 |

giu-43 |

ITL 35 |

600,000 |

21,000,000 |

|

1942 |

giu-42 |

ITL 35 |

600,000 |

21,000,000 |

|

1941 |

mag-41 |

ITL 35 |

600,000 |

21,000,000 |

|

1940 |

mag-40 |

ITL 35 |

600,000 |

21,000,000 |

|

1939 |

mag-39 |

ITL 175 |

120,000 |

21,000,000 |

|

1938 |

Apr-38 |

ITL 175 |

120,000 |

21,000,000 |

|

1937 |

Apr-37 |

ITL 175 |

120,000 |

21,000,000 |

|

1936 |

Apr-36 |

ITL 175 |

120,000 |

21,000,000 |

|

1935 |

Apr-35 |

ITL 175 |

120,000 |

21,000,000 |

|

1934 |

Apr-34 |

ITL 175 |

120,000 |

21,000,000 |

|

1933 |

Apr-33 |

ITL 175 |

120,000 |

21,000,000 |

|

1932 |

Apr-32 |

ITL 175 |

120,000 |

21,000,000 |

|

1931 |

Apr-31 |

ITL 175 |

120,000 |

21,000,000 |

|

1930 |

Apr-30 |

ITL 175 |

120,000 |

21,000,000 |

|

1929 |

Apr-29 |

ITL 175 |

120,000 |

21,000,000 |

|

1928 |

Apr-28 |

ITL 150 |

120,000 |

15,000,000 |

|

1927 |

Apr-27 |

ITL 150 |

120,000 |

15,000,000 |

|

1926 |

Apr-26 |

ITL 150 |

120,000 |

15,000,000 |

|

1925 |

mag-25 |

ITL 150 |

80,000 |

12,000,000 |

|

1924 |

mag-24 |

ITL 125 |

80,000 |

10,000,000 |

|

1923 |

giu-23 |

ITL 750 |

6,300 |

4,275,000 |

|

1922 |

giu-22 |

ITL 680 |

6,300 |

4,284,000 |

|

1921 |

lug-21 |

ITL 640 |

6,300 |

4,032,000 |

|

1920 |

- |

ITL 600 |

6,300 |

3,780,000 |

|

1919 |

- |

ITL 600 |

6,300 |

3,780,000 |

|

1918 |

- |

ITL 600 |

6,300 |

3,780,000 |

|

1917 |

- |

ITL 600 |

6,300 |

3,780,000 |

|

1916 |

- |

ITL 400 |

6,300 |

2,520,000 |

|

1915 |

Apr-15 |

gold Franc pieces 500 |

6,300 |

3,150,000 |

|

1914 |

Mar-14 |

gold Franc pieces 720 |

6,300 |

4,536,000 |

|

1913 |

Mar-13 |

gold Franc pieces 720 |

6,300 |

4,536,000 |

|

1912 |

Apr-12 |

gold Franc pieces 700 |

6,300 |

4,410,000 |

|

1911 |

Apr-11 |

gold Franc pieces 700 |

6,000 |

4,200,000 |

|

1910 |

Mar-10 |

gold Franc pieces 600 |

6,000 |

3,600,000 |

|

1909 |

Mar-09 |

gold Franc pieces 600 |

6,000 |

3,600,000 |

|

1908 |

Mar-08 |

gold Franc pieces 600 |

6,000 |

3,600,000 |

|

1907 |

Mar-07 |

gold Franc pieces 540 |

6,000 |

3,240,000 |

|

1906 |

Mar-06 |

gold Franc pieces 420 |

5,000 |

2,100,000 |

|

1905 |

Mar-05 |

gold Franc pieces 400 |

5,000 |

2,000,000 |

|

1904 |

Mar-04 |

gold Franc pieces 400 |

5,000 |

2,000,000 |

|

1903 |

Mar-03 |

gold Franc pieces 390 |

5,000 |

1,950,000 |

|

1902 |

Mar-02 |

gold Franc pieces 380 |

5,000 |

1,900,000 |

|

1901 |

Apr-01 |

gold Franc pieces 360 |

5,000 |

1,800,000 |

|

1900 |

Apr-00 |

gold Franc pieces 360 |

5,000 |

1,800,000 |

|

1899 |

- |

gold Franc pieces 360 |

5,000 |

1,800,000 |

|

1898 |

- |

gold Franc pieces 360 |

5,000 |

1,800,000 |

|

1897 |

- |

gold Franc pieces 360 |

5,000 |

1,800,000 |

|

1896 |

- |

gold Franc pieces 340 |

5,000 |

1,700,000 |

|

1895 |

- |

gold Franc pieces 300 |

5,000 |

1,500,000 |

|

1894 |

- |

gold Franc pieces 300 |

5,000 |

1,500,000 |

|

1893 |

- |

gold Franc pieces 300 |

5,000 |

1,500,000 |

|

1892 |

- |

gold Franc pieces 300 |

5,000 |

1,500,000 |

|

1891 |

- |

gold Franc pieces 300 |

5,000 |

1,500,000 |

|

1890 |

- |

gold Franc pieces 255 |

5,000 |

1,275,000 |

|

1889 |

- |

gold Franc pieces 255 |

5,000 |

1,275,000 |

|

1888 |

- |

gold Franc pieces 265 |

5,000 |

1,325,000 |

|

1887 |

- |

gold Franc pieces 300 |

5,000 |

1,500,000 |

|

1886 |

- |

gold Franc pieces 310 |

5,000 |

1,550,000 |

|

1885 |

- |

gold Franc pieces 300 |

5,000 |

1,500,000 |

|

1884 |

- |

gold Franc pieces 220 |

5,000 |

1,100,000 |

|

1883 |

- |

gold Franc pieces 255 |

5,000 |

1,275,000 |

|

1882 |

- |

gold Franc pieces 270 |

5,000 |

1,350,000 |

|

1881 |

- |

gold Franc pieces 180 |

5,000 |

900,000 |

|

1880 |

- |

gold Franc pieces 170 |

5,000 |

680,000 |

|

1879 |

- |

gold Franc pieces 153.75 |

4,000 |

615,000 |

|

1878 |

- |

gold Franc pieces 125.05 |

4,000 |

500,200 |

|

1877 |

- |

gold Franc pieces 173.75 |

4,000 |

615,000 |

|

1876 |

- |

gold Franc pieces 153.75 |

4,000 |

615,000 |

|

1875 |

- |

gold Franc pieces 190 |

4,000 |

760,000 |

|

1874 |

- |

gold Franc pieces 180 |

4,000 |

720,000 |

|

1873 |

- |

gold Franc pieces 200 |

4,000 |

800,000 |

|

1872 |

- |

gold Franc pieces 187.5 |

4,000 |

750,000 |

|

1871 |

- |

gold Franc pieces 150 |

4,000 |

600,000 |

|

1870 |

- |

gold Franc pieces 150 |

4,000 |

600,000 |

|

1869 |

- |

gold Franc pieces 125 |

4,000 |

500,000 |

|

1868 |

- |

gold Franc pieces 73.5 |

4,000 |

294,000 |

|

1867 |

- |

gold Franc pieces 73.5 |

4,000 |

294,000 |

|

1866 |

- |

gold Franc pieces 73.5 |

4,000 |

294,000 |

|

1865 |

- |

gold Franc pieces 126 |

4,000 |

504,000 |

|

1864 |

- |

gold Franc pieces 73.5 |

4,000 |

294,000 |

|

1863 |

- |

gold Franc pieces 73.5 |

4,000 |

294,000 |

* As from 2000, the relevant coupon detachment date will be three days before the payment date. Starting from 2015, the relevant coupon detachment date will be two days before the payment date.

** The dividend per unit includes Euro 0.15 per share in cash and the free allotment of one Assicurazioni Generali ordinary share for every 25 shares held. The dividend in kind corresponds to 1/25 of the share and is equal to 0.63 euro according to the official price of 21 May 2009 (Euro 15.869). For tax purposes, the “normal value” of each allotted share is equal to Euro 15.724 and is made by the arithmetic mean of the share prices between 18 April and 18 May 2009 (coupon detachment date) on the days when the regulated market was open.

*** The distribution of this second tranche has been subject to the verification by the Board of Directors of the absence of impeding supervisory provisions or recommendations in force at that time.On 1 October 2021, the Assicurazioni Generali Board of Directors verified the actual absence, as at that date, of impeding supervisory provisions or recommendations regarding the payment of the second tranche of the dividend.