Our business model

Our diversified business model, based on Life, P&C and Asset Management, stands out from that of competitors thanks to strengths such as: a clear strategy, the focus on technical excellence, a strong and multi-channel distribution network, the solid capital position, innovation and the ability to offer solutions to customers according to the lifetime partner approach.

Generali is one of the largest global insurance and asset management providers. With almost 87 thousand employees worldwide, an extensive network of agents and a large customer base, it plays a leadership role in Europe and has an increasingly significant presence in Asia and the Americas.

The diversified business model, based on Life, Property and Casualty (P&C) and Asset & Wealth Management, is characterized by a clear strategy, the focus on technical excellence, a strong multi-channel distribution network, the solid capital position, innovation and the ability to offer solutions to customers that meet the changing needs of the market.

The Group develops simple, integrated, customized and competitive Life and P&C insurance solutions targeted at both retail customers, small and medium enterprises (SMEs) and corporate customer: the offer ranges from savings, individual and family protection policies, unit-linked policies for investment purposes, as well as motor third-party liability (MTPL), home, accident and health policies, to sophisticated coverage for commercial and industrial risks and tailored plans for multinational companies. Among the products offered, there are also insurance solutions which, according to an internal classification, include, more than others, environmental and/or social components that contribute to creating shared value for all stakeholders and for which the Group has set a specific target.

Generali expands its offer to asset management solutions addressed to institutional (such as pension funds and foundations) and retail third-party customers.

The Group distributes its products and services using a multi-channel strategy, relying on new technologies, through a global network of agents, financial advisors, brokers, bancassurance and direct channels, that allow customers to obtain information on alternative products, compare options, acquire the preferred product and rely on an excellent quality service and after-sales experience.

The premiums received from insurance contracts are responsibly invested in high-quality assets, with a particular attention to their environmental and social impact. In addition to insurance activities, the Group’s business model also includes investment activities, including commercial relationships with the companies in which the premiums are invested. Finally, the Group’s supply chain is mainly characterized by data and service providers linked to the core business, as well as a smaller number of suppliers of goods and support services. Suppliers considered fundamental or essential are subject to a specific control framework to guarantee service continuity, also in line with industry regulations.

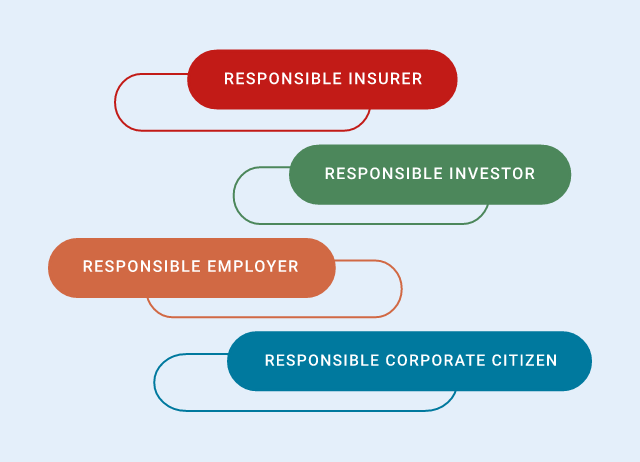

Formally introduced in 2004, sustainability has been embedded in Generali Group’s activities for decades: it is integrated into the business model and corporate processes, with the aim of achieving a social, environmental and good governance impact on stakeholders, towards sustainable transformation.