Insurance for Companies: managing business risk through insurance and ESG strategies

Every company, regardless of size or production type, needs to properly manage the uncertainty and risks of business activities, which involve a continual series of assumptions about the future.

Understanding business risk and uncertainty

Every business operates in a landscape shaped by uncertainty. These risks fall into two main categories:

- Business risk: strategic uncertainties such as market demand, competition, and consumer behavior. These are typically not insurable, as they stem from internal decisions and market dynamics.

- Insurable risk: tangible, measurable events - like natural disasters, accidents, or theft - that can be covered through tailored insurance policies.

Understanding this distinction is essential for building a resilient risk management strategy.

Commercial and industrial risk scenarios

Modern companies face a wide range of operational risks:

Asset-related risks

- Damage to production facilities (e.g. fire, explosion, natural disasters)

- Loss or damage of goods in transit

- Non-recovery of receivables

- Construction risks in large-scale infrastructure projects

People-related risks

- Workplace injuries and travel-related incidents

- Pension and healthcare liabilities for employees and their families

These risks require both insurance coverage and proactive mitigation strategies.

Strategic risk management and loss prevention

Effective risk management is not just about reacting to incidents - it’s about anticipating them. This includes:

- Identifying and assessing threats across business units

- Designing mitigation strategies and ensuring insurance alignment

- Preparing for catastrophic events like pandemics or cyberattacks

Key tools:

- Scenario modeling and stress testing

- Business continuity planning

- Crisis communication protocols

These practices help companies maintain operational resilience and protect long-term value.

Generali’s Global Business Activities

To meet the needs of medium and large businesses, Generali has developed its Global Business Activities:

- Generali CARE Hub

- Global Corporate & Commercial (GC&C)

- ARTE Generali

- Generali Global Pension (GGP)

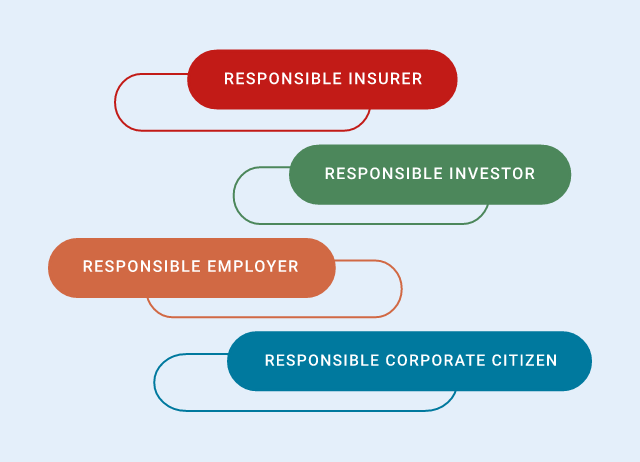

The Group integrates environmental, social, and governance (ESG) factors into its Property & Casualty (P&C) underwriting process to support both financial performance and positive social impact. Before underwriting new business or partnering with intermediaries, a viability assessment is conducted at the Group Legal Entity or Business Unit level. This includes evaluating ESG-related risks and opportunities for clients and brokers.

The Responsible Underwriting Group Guideline defines a unified framework for P&C underwriting across the Group. Its goal is to promote responsible conduct and reduce exposure to clients whose practices conflict with Generali’s sustainability principles, as outlined in the Group Charter of Sustainability Commitments.

Generali’s commitment to small and medium enterprises

Amid global financial fluctuation, geopolitical tensions, and rapid technological change, small and medium-sized enterprises (SMEs) continue to face significant daily challenges. Against this backdrop, Generali remains convinced of the benefits that the sustainable transition can offer to all these companies. That’s why the Group is deeply committed to supporting SMEs on this journey - especially through public-private partnerships and its collaboration with the United Nations Development Programme (UNDP).

SME EnterPRIZE

SME EnterPRIZE is the initiative launched by Generali in 2021, marking the Group’s 190th anniversary, to promote a culture of sustainability among European SMEs.

The SME EnterPRIZE project was created to:

- support SMEs in their sustainable transition, consistent with the European ambition to develop a greener and more inclusive economy;

- stimulate public debate on the importance of sustainability for SMEs, promoting further research on the subject;

- highlight significant examples of responsible business, recognising entrepreneurs that can become an inspirational model for others to follow.

Building MSME resilience in Asia with UNDP

As part of their multi-year partnership, Generali and UNDP have joined forces to support micro, small and medium enterprises (MSMEs) and promote their resilience against climate change as well as other natural hazards, with a special focus on the Asian region.