Performance by segment

Life Segment: 2024 results (1)

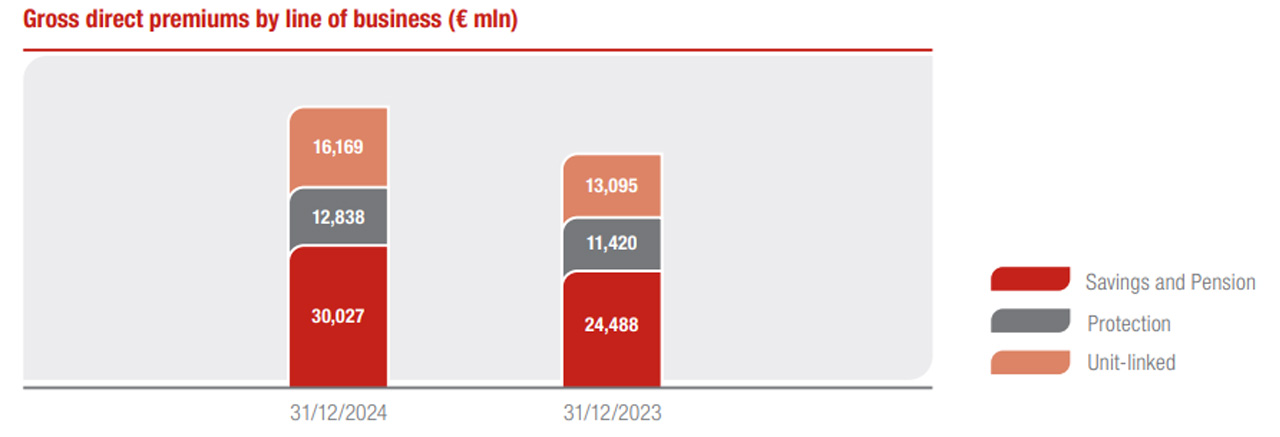

Life premiums (2) were € 61,434 million (+19.2% on equivalent terms) thanks to contribution of all the business lines. Savings and pension line (+23.3%) grew especially in Italy (+21.5%), France (+65.3%) and Asia (+30.5%). Protection line (+9.7%), grew in almost all the countries in which the Group operates, while the improvement in the unit-linked line (+23.2%) is concentrated in particular in Italy (+42.5%), France (+23.1%) and Germany (+11.2%).

Net inflows - premiums collected, net of claims and surrenders - were € 9,674 million. Net inflows of the protection line rose to € 5,206 million (€ 4,552 million at 31 December 2023), thanks to the development in Italy, France and Asia. Net inflows of the unit-linked line improved to € 5,772 million (€ 4,357 million at 31 December 2023), thanks to the performance of Italy and France. The net outflows of the savings and pension line amounted to € -1,303 million (€ -10,222 million at 31 December 2023) also as a consequence of the commercial actions implemented from 2023.

Life operating result stood at € 3,982 million (€ 3,735 million at 31 December 2023). The operating insurance services result improved, from € 2,901 million at 31 December 2023 to € 3,039 million, as well as the operating investment result, from € 833 million at 31 December 2023 to € 943 million.

From 2023 to 2024, the PVNBP experienced a significant increase (+28.8%), reaching € 51.8 billion. This growth, primarily supported by a strong production in Italy, France and Asia, was further emphasized by the IFRS 17 accounting treatment for the NB recognition of French protection business (3). Neutralizing this effect, i.e. allocating the new business, also in 2023, to the time when the insurance coverage started, the total Group PVNBP increase would have been +23.2%.

(1) Changes in premiums, Life net inflows and new business were presented on equivalent terms. Changes in the operating result, general account investments and Life technical provisions excluded any assets under disposal or disposed of during the same period of comparison. The amounts were rounded and may not add up to the rounded total in all cases. The percentages presented can be affected by the rounding.

(2) Including premiums from investment contracts equal to € 1,566 million (€ 1,383 million at 31 December 2023).

(3) French collective protection business underwritten in 4Q2023 with coverage starting in 2024 was deemed to be profitable and hence, according to IFRS17 contract recognition requirements, was recognized entirely in 1Q2024. The majority of business underwritten in 4Q2022 with coverage starting in 2023, being considered onerous, was instead recognized earlier in 4Q2022.

P&C segment: 2024 results

P&C premiums stood at € 33,756 million (+7.7% on equivalent terms) thanks to the positive performance of both business lines.

The combined ratio was 94.0% (94.0% at 31 December 2023) with a higher loss ratio at 65.2% (+0.3 p.p.), compensated by a lower expense ratio at 28.8% (-0.3 p.p.).

The operating result of the P&C segment amounted to € 3,052 million (€ 2,902 million at 31 December 2023). The operating result benefitted from the increase of the operating insurance services result, from € 1,807 million to € 1,976 million, partly offset by the reduction of the operating investment result amounting to € 1,076 million (€ 1,095 million at 31 December 2023).

Asset management segment: 2024 results

Asset & Wealth Management segment, in addition to including the activities of the Banca Generali group, is also related to Asset Management companies that provide products and services both for the insurance companies of the Generali Group and for third-party customers.

The operating result of the Asset & Wealth Management segment stood at € 1,176 million (+22.6%).

In particular, the Asset Management result stood at € 616 million (+18.3%) including € 70 million from Conning Holdings Limited (CHL), excluding CHL the increase in the operating result would have been 4.8%.

The operating result of Banca Generali group stood at € 560 million (+27.6%) thanks to the positive contribution of the net interest margin, the continuous diversification of fee income sources and the positive development of financial markets that contributes to higher performance fees.

Banca Generali group net inflows for 2024 amounted to € 6.6 billion, up by 14% compared to the previous year.