04 July 2019

Letters from Bruxelles

Pensions expenditure

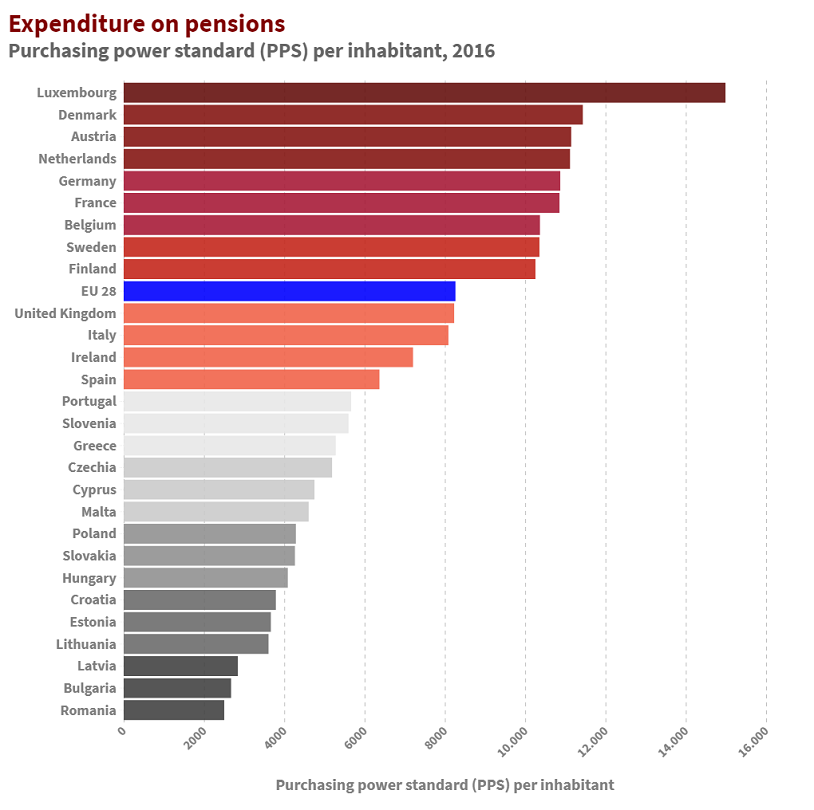

Ageing in good health also means growing old with a dignified existence, guaranteed by adequate pension cover. In 2016, the expenditure for all types of social protection in EU-28 accounted for 19.1% of GDP with pensions alone reaching 10.2%. Pension provision and healthcare represented over two thirds (67.3%) of this spending. In 2015, expenditure for old age pensions was on average €14,288 per beneficiary in the EU.

In EU-28 the per capital spending in 2015 was an average of 8,229 PPS (this estimate includes 2014 figures for Poland). PPS (Purchasing Power Standards) are indicators calculated by Eurostat with the aim of eliminating differences between purchasing powers among the different EU member states. These countries have different pricing levels for goods and services, and therefore the PPS are calculated to ensure the comparability of prices of goods and services in the various EU countries. The highest per capita spending was recorded in Luxembourg (14,988 PPS), around six times higher than the lowest recorded (Romania with 2,504 PPS).

Source: EUROSTAT

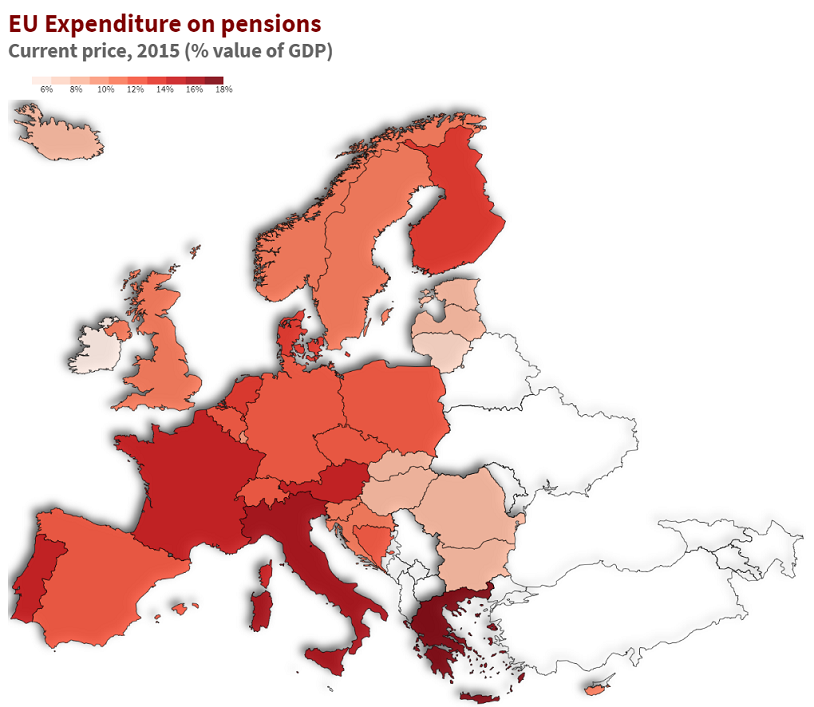

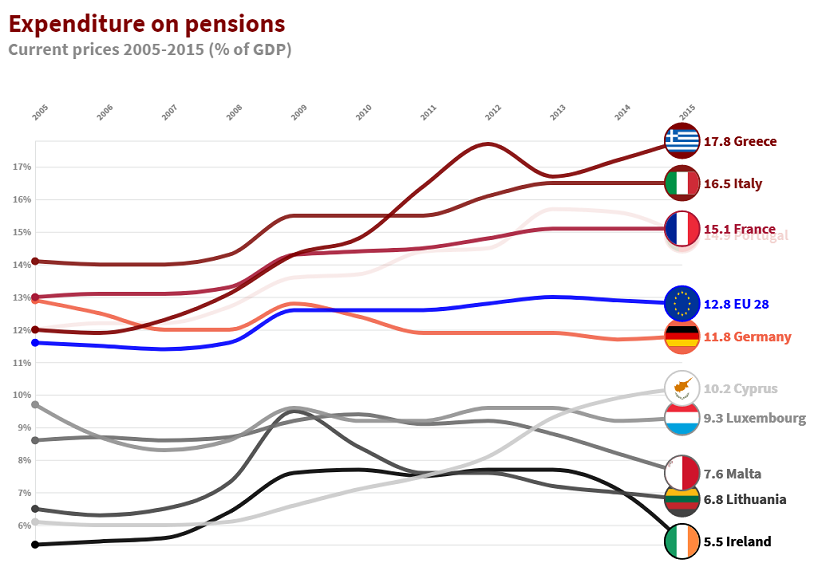

EU-28 pensions expenditure in 2015 amounted to 12.8% of GDP (2014 figures for Poland). Among the EU member states, the percentage of pensions expenditure was particularly high in France (15.1%), and in many southern EU countries such as Portugal (14.9%), Italy (16.5%) and Greece (17.8%). At the opposite extreme, 6.8%-8.0% were recorded in the three Baltic member states, in Malta, and Ireland was even lower (5.5%).

Source: EUROSTAT

Source: EUROSTAT

https://public.flourish.studio/visualisation/339958/

Pension expenditure per beneficiary varies according to the type of pension involved. In 2015, the aggregate expenditure per beneficiary on old age pensions was estimated at €14.3 thousand in EU-28 (2014 figures for Poland). A slightly higher than average expenditure was recorded for old age pensions claimed early (€14.1 thousand per beneficiary) or for early retirement (due to reduced working capacity), with average expenditure of €13.9 thousand per beneficiary. Expenditure on part-pensions, in the meantime, averaged only €2.9 thousand per beneficiary, much lower than for any other form of pension as the beneficiaries of this type of pension also receive income from employment. In 2016, pensions expenditure per beneficiary in old age pensions (the most common type) varied among EU member states from €1.8 million in Bulgaria to €26.6 million in Luxembourg. In PPS terms, the average expenditure per beneficiary reached the peak of 19.9 thousand PPS in Austria, higher than Luxembourg (19.7 thousand PPS), whilst the lowest level was recorded in Bulgaria (4.3 thousand PPS).

Given this situation, through the Social Protection Committee, in 2017 the European Commission issued a report centred on adequacy and sustainability (sustainability referring to the physical and financial balance between assets and liabilities in pension schemes) of pensions in the EU. The Commission wrote that, in order to be sustainable in the long term, public pension schemes have to be able to absorb the effects of population ageing without destabilising the finances of member states. In this respect, recently in there have been years when this sustainability saw an improvement: six member states (Belgium, Luxembourg, Germany, Malta, Slovakia and Slovenia) were able to significantly increase their public pension expenditure, whilst in others (Denmark, France, Italy, Latvia and Croatia) there was a decline which “could imply significant risks for future adequacy of incomes in old age”. The Committee’s report concludes that in “in Member States where public pension costs are reducing, the expansion of private pensions would be expected to cover a large part of the possible gaps in adequacy” and that in any event “efforts to promote the development of cost-effective vehicles for complementary retirement savings would need to be stepped up in several of these countries” (EU - European Semester Thematic Factsheet - Adequacy and sustainability of pensions, Brussels, 31/10/2017).