28 February 2018

A fully connected insurance

From the Internet of Things to the Internet of Everything?

The Internet of Things is set to have an impact also on the insurance sector. Data analysis will focus on individual clients’ lifestyles and risk prevention but also in the assessment of the likelihood of payouts.

In 2020 the traditional devices for connecting to the internet, such as PCs, smartphones and tablets, will represent just one third of all connected objects. The remaining two thirds will be made up of a diverse world that includes connected cars, wearable devices, thermostats, smart homes, smart offices and shops, production lines or entire logistical production chains at smart factories, smart cities and roads. There is already talk of a shift from the Internet of Things to the Internet of Everything. Such a transformation will naturally involve also the insurance industry, which is destined to experience perhaps the most radical disruption that it has even known.

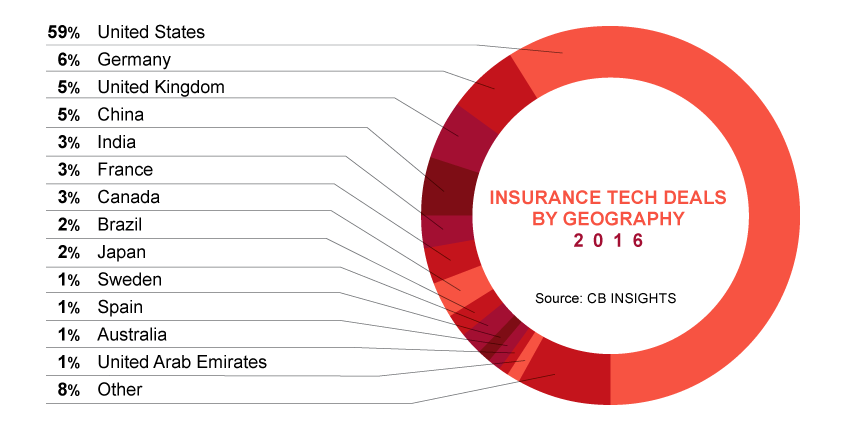

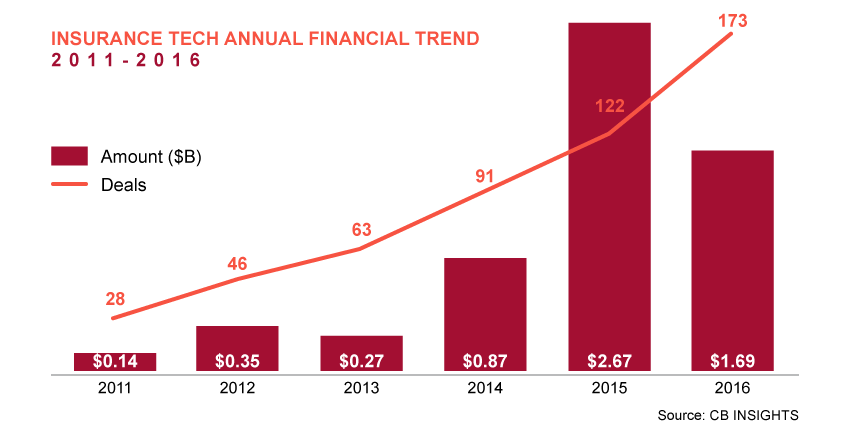

Massive growth in the number of deals being made with insurance tech startups is a sign of the dynamism in this particular sector, above all in the United States. Nevertheless, as Insurance Journal reported, investments in InsurTech actually fell in 2016 by 47 per cent following years of intense growth and after a record year in 2015 with 46.7 billion dollars of investments. For some years now traditional companies have been starting to look to the world of InsurTech startups with a view to Open Innovation, an approach that sees them work together with these fledgling companies, financing their work with their own funds or with venture capital or even purchasing them outright.

For example, the Generali Group has introduced a home insurance policy involving smart home technology provided by Nest Labs, a Google-Alphabet group company, to further protect the homes of the company’s clients. Then there is the partnership developed in Germany, where Generali has an interesting offer for the clients of CosmosDirekt, the country’s leading direct insurer. Furthermore, Generali Italia has recently launched a campaign called “CallForGrowth” in order to create new partnerships with innovative startups from the sector.

For insurance companies, digitalization offers a double opportunity. On one hand the technology can enable a change of approach towards customers, adapting services to their requirements and lifestyles far more accurately than ever before. On the other, companies can optimise their business models by investing more in prevention. Only the business of companies capable of focussing on their customers’ requirements will manage to be sustainable in the medium to long term. In 2020 the generation of millennials is estimated to have a spending power of around 24 billion dollars and they are sure to demand rapid, digital and personalized services.

Recent research by the consultancy multinational Accenture polled the opinions of 32,715 insurance industry customers in 18 markets. What emerged is that the new consumers have become more open to the possibilities offered by the big players in the IT market. The Internet of Things is destined to play an enormous role: 64% of respondents would like to receive alerts about routes with higher accident rates in real time whilst they are driving and 30% claimed to be open to considering insurance policies offered by nonconventional providers, such as Google, Amazon or supermarket chains. The price remains one of the key factors concerning customers’ choices (50%). The number of consumers that prefer to use online channels to obtain information about insurance products or services has increased significantly over the last three years, passing from 54% in 2013 to 68% in 2016.

Analysis by Oxbow Partners, British advisory firm for the insurance industry, put a slight brake on expectations with its evaluations of eleven areas of InsurTech in terms of the hype concerning each technology compared with its genuine impact. For the time being the impact is still to be felt from the majority of technologies considered trends in the insurance sector. For example, the impact of driverless cars is nil due to the fact that they are not yet commercially available. It is likely we will have to wait a substantial time before we see a widespread adoption of this technology, also because of a series of regulatory and ethical problems that remain unresolved. Companies are advised to focus in the short term on the business opportunities offered by connected cars, while they are also urged to begin to prepare the strategies to adopt in the future because autonomous vehicles will change the very concept of car ownership. Oxbow is sceptical also about Blockchain and peer-to-peer (P2P) policies.

With the IoT the challenge for the sector will be to take advantage of the data that digitalization makes available in order to use it in relation to the lifestyles of individual clients. The data analysis will improve predictive models through which insurance companies calculate the possibility for requests for payouts and, consequently, will determine the price of the products offered.

According to a report by Deloitte, the trend towards usage-based insurance models will reduce the risk for companies, cutting the volume of claims and offering opportunities for the development of micro-insurance in real time in order to intercept the changing demand. Micro-policies based on effective usage are revealing themselves to be, for Burnmark, also a system to guarantee insurance cover in low-income social areas because they can be made available at accessible prices. In general one of the most interesting developments in InsurTech is the possibility to stipulate policies specifically relating to the actual number of kilometres travelled or hours spent behind the wheel. Telematics, sensors, wearables and other devices that enable the IoT will continue to develop and these represent drivers for the introduction of new types of policy, including those for home and health insurance.

Once again the customer is at the centre of every policy.