Generali Group Consolidated Results as at 30 June 2025 (1)

06 August 2025 - 13:27 price sensitive

Generali achieves strong start to its “Lifetime Partner 27: Driving Excellence” plan driven by P&C, Life and Asset Management

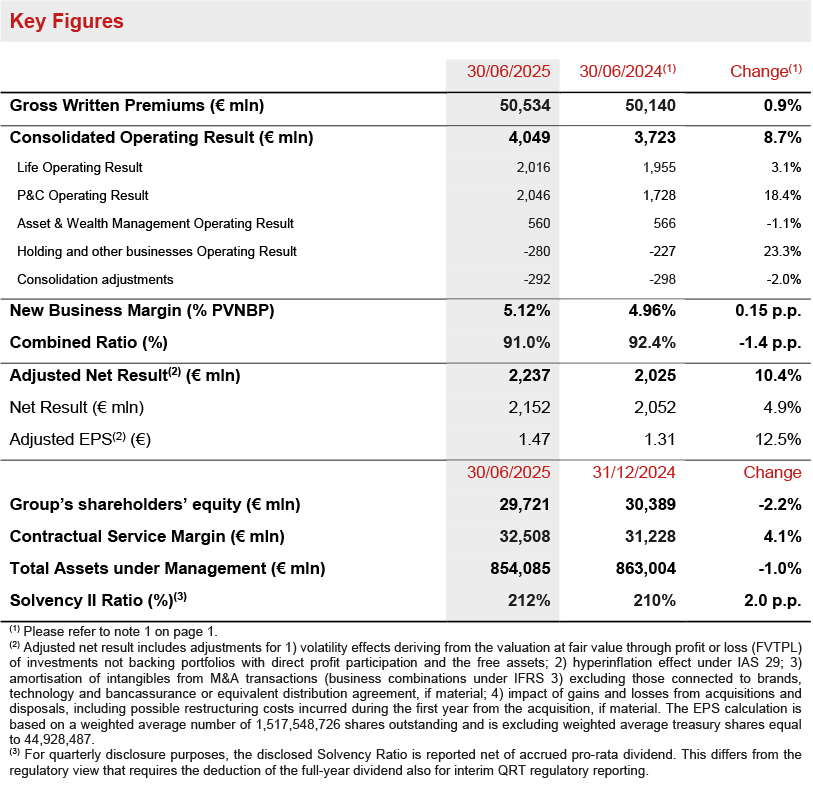

- Gross written premiums reached € 50.5 billion (+0.9%), mainly driven by growth in P&C (+7.6%)

- Life net inflows were positive at € 6.3 billion thanks to all business lines, particularly protection & health and hybrid & unit-linked

- Combined Ratio improved significantly to 91.0% (-1.4 p.p.); undiscounted Combined Ratio continued its positive development to 93.1% (-1.8 p.p.)

- Strong growth in operating result to € 4.0 billion (+8.7%), driven by P&C, Life and Asset Management

- Adjusted net result grew to € 2.2 billion (+10.4%) thanks to the Group’s excellent operating performance; adjusted EPS rose to € 1.47 (+12.5%)

- Solid capital position, with Solvency Ratio rising to 212% (210% FY2024), thanks to healthy normalised capital generation and embedding the launch of the € 500 million buy-back programme

Generali Group CEO, Philippe Donnet, said: “Our excellent half-year results confirm a very strong start to the Group’s ‘Lifetime Partner 27: Driving Excellence’ strategic plan with positive performance across our Insurance business and global Asset Management platform. In Insurance, P&C grew substantially in all our main geographies driven by our focus on maximising profitable growth and Life net inflows continued their growth trajectory driven by our preferred business lines. Our Asset Management platform also recorded a solid performance supported by the contribution of Conning. We achieved these very positive results thanks to the efforts of all our colleagues and distribution networks. We will build on this momentum, pursuing excellence in being a Lifetime Partner to our customers, in our core capabilities and in the Group operations. We remain fully focused on the Group’s clear priorities under our strategic plan and will continue delivering value for the benefit of all our stakeholders.”

Executive Summary

Milan – At a meeting chaired by Andrea Sironi, the Generali Board of Directors approved the 2025 Consolidated Half-Year Financial Report of the Generali Group.

Gross written premiums rose to € 50.5 billion (+0.9%), mainly driven by growth in P&C.

Life net inflows were positive, exceeding € 6.3 billion thanks to all business lines, particularly protection & health, hybrid & unit-linked.

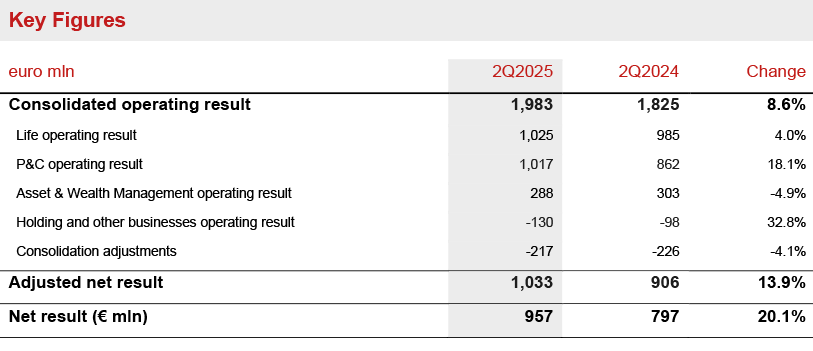

The operating result grew strongly to € 4,049 million (+8.7%), thanks to the positive performance of P&C, Life and Asset Management, in line with the strategic priorities of the “Lifetime Partner 27: Driving Excellence” plan.

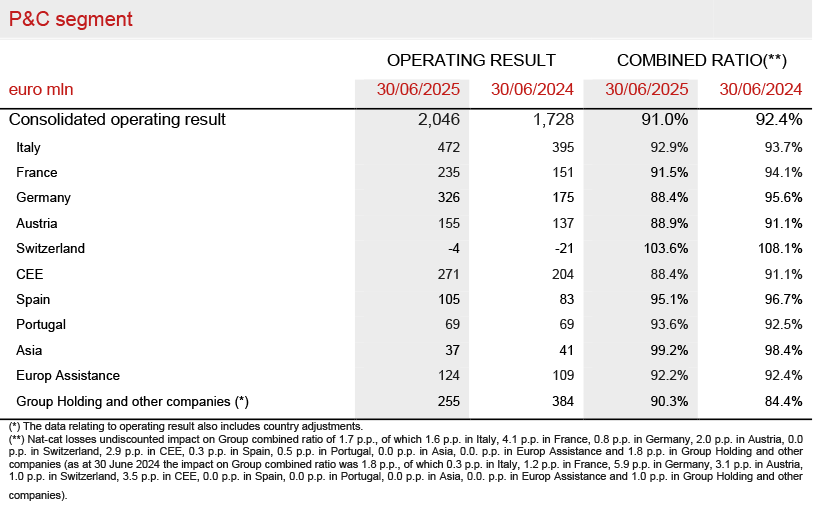

The P&C operating result increased significantly to € 2,046 million (+18.4%) with the Combined Ratio at 91.0% (-1.4 p.p.) mainly reflecting the positive effects of an improved undiscounted current year attritional loss ratio.

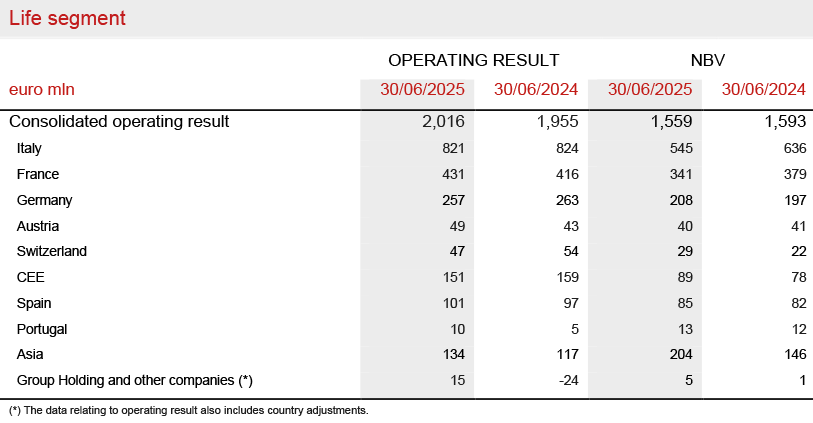

The Life operating result grew to € 2,016 million (+3.1%) while the New Business Value amounted to € 1,559 million (-2.0%).

The Asset & Wealth Management operating result stood at € 560 million (-1.1%) sustained by the solid performance of Asset Management (+11.7%) supported by the contribution of Conning Holdings Limited (CHL).

The Holding and other businesses operating result was € -280 million (€ -227 million 1H2024).

The adjusted net result2 increased strongly to € 2,237 million (+10.4%) thanks to the Group’s excellent operating performance. The net result grew to € 2,152 million (+4.9%).

Adjusted EPS rose to € 1.47, with a 12.5% increase compared to 1H2024.

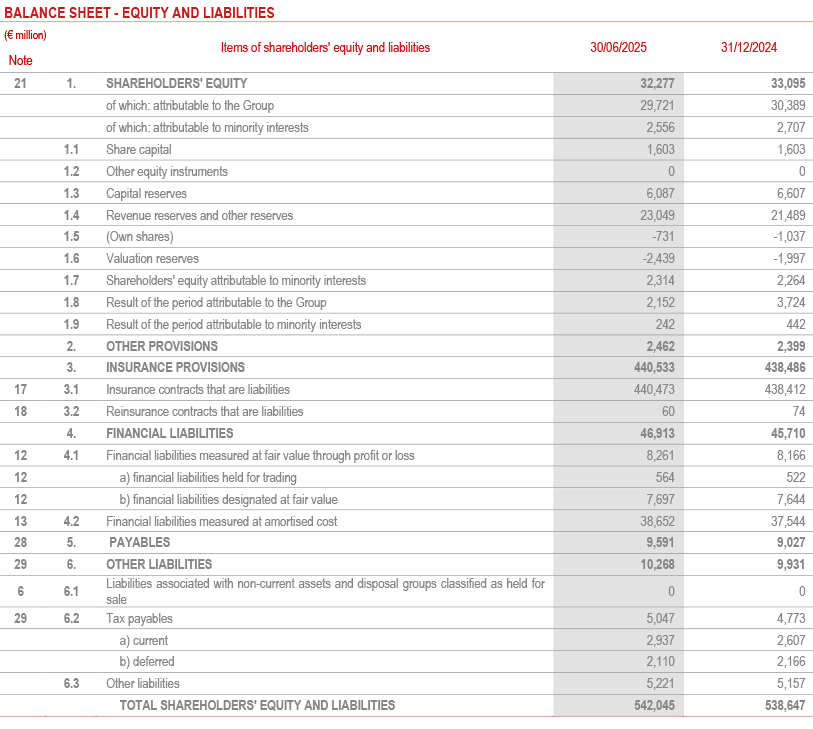

The Group’s shareholders' equity was € 29.7 billion (-2.2%), reflecting the net result for the period, the 2024 dividend payment and the share buyback related to the Long-Term Incentive Plan implemented during 1H 2025.

The Contractual Service Margin (CSM) rose to € 32.5 billion (€ 31.2 billion FY2024).

The Group’s Total Assets Under Management (AUM) were € 854.1 billion (-1.0% compared to FY2024).

The Group confirms its solid capital position, with the Solvency Ratio rising to 212% (210% FY2024) thanks to healthy normalised capital generation and embedding the launch of the € 500 million buy-back programme.

Life Segment

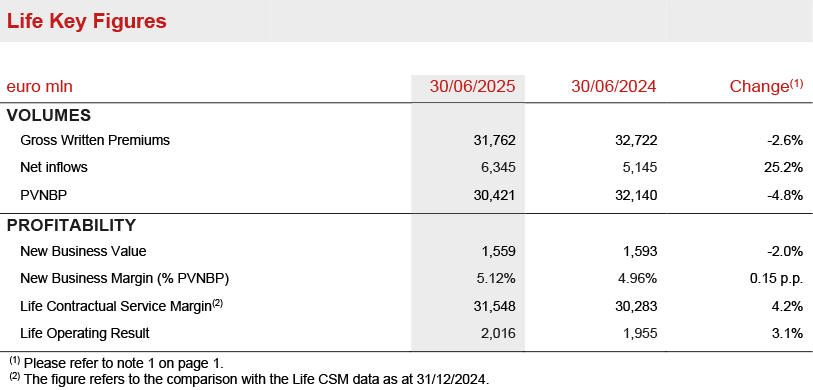

- Life net inflows were very positive at € 6.3 billion (+25.2%)

- Operating result rose to € 2.0 billion (+3.1%)

- New Business Margin was 5.12% (+0.15 p.p.)

Life gross written premiums3 were € 31,762 million (-2.6%). Protection & health continued its solid growth trajectory (+8.5%) in all main countries. Traditional saving recorded a stable performance (+0.7%) while hybrid & unit-linked (-9.0%) was affected by the comparison with a particularly strong first half in 2024, during which targeted commercial actions were implemented to sustain net inflows in Italy and France.

Life Net inflows increased significantly to € 6,345 million (+25.2%) driven by growth in traditional saving, which reached € 1,050 million, led by Asia, Italy and Germany. Protection & health grew to € 2,644 million thanks to the solid performance in Asia and Italy. Meanwhile hybrid & unit-linked net inflows were € 2,651 million.

New business volumes (expressed in terms of present value of new business premiums - PVNBP) amounted to € 30.4 billion (-4.8%), reflecting the comparison with the extraordinarily high volumes achieved in 1H2024, which included the very high production in China, particularly in 1Q2024, strong production in Italy and very positive market momentum in France.

New Business Value (NBV) amounted to € 1,559 million (-2.0%), reflecting the lower volumes despite higher profitability. The New Business Margin on PVNBP (NBM) stood at 5.12% (+0.15 p.p.).

The Life Contractual Service Margin (Life CSM) increased to € 31.5 billion (€ 30.3 billion FY2024). The positive development was mainly driven by the contribution of the Life New Business CSM of € 1,501 million, which, coupled with the expected return of € 721 million, more than offset the Life CSM release of € 1,569 million. The latter also represented the main driver (around 78%) of the operating result, which increased to € 2,016 million (€ 1,955 million 1H2024).

P&C Segment

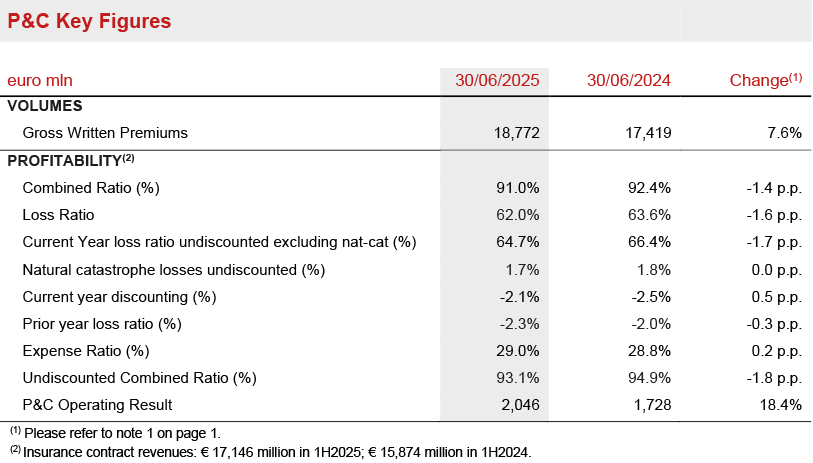

- Premiums increased to € 18.8 billion (+7.6%)

- Combined Ratio improved substantially to 91.0% (-1.4 p.p.). Undiscounted Combined Ratio continued its positive development to 93.1% (-1.8 p.p.)

- Operating result grew strongly to € 2.0 billion (+18.4%)

P&C gross written premiums grew to € 18.8 billion (+7.6%) thanks to the performance of both business lines. Non-motor improved strongly (+7.6%), achieving widespread growth across all main areas in which the Group operates.

The motor line rose by 7.3% with particularly positive performances recorded in Germany, Italy and CEE. Excluding the contribution from Argentina, motor line premiums increased by 5.2%.

Europ Assistance premiums increased by 13.9% driven mainly by the US travel business, by France and new partnerships.

The Combined Ratio improved substantially to 91.0% (92.4% 1H2024) mainly reflecting the positive development of the undiscounted current year attritional loss ratio, notwithstanding a lower discounting benefit. The undiscounted combined ratio continued its positive development to 93.1% (94.9% 1H2024). The undiscounted current year loss ratio (excluding nat-cat) improved to 64.7% (66.4% 1H2024). The expense ratio increased slightly to 29.0% (28.8% 1H2024), reflecting higher acquisition costs.

The operating result grew strongly to € 2,046 million (€ 1,728 million 1H2024). The operating insurance service result increased to € 1,536 million (€ 1,204 million 1H2024).

The operating investment result was € 510 million (€ 525 million 1H2024). The reduction in the operating investment income was entirely related to Argentina, due to the very significant decline in the local inflation rate. The operating investment income excluding Argentina was € 810 million (€ 767 million 1H2024) reflecting higher volumes as well as reinvestment yields higher than the maturing coupons.

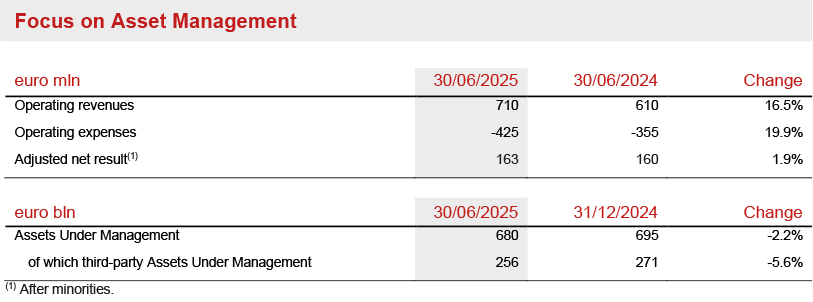

Asset & Wealth Management Segment

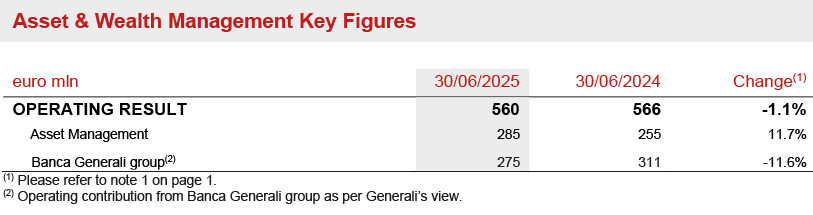

- Asset & Wealth Management operating result was € 560 million (-1.1%)

- Asset Management operating result rose to € 285 million (+11.7%)

- Banca Generali group operating result was € 275 million (-11.6%)

The Asset Management operating result recorded solid growth to € 285 million (+11.7%) also thanks to the contribution of CHL.

Operating revenues improved to € 710 million (+16.5%) thanks to the contribution of CHL, higher average AUM compared to 1H2024 and slightly higher margins. Operating expenses (+19.9%) reflected the consolidation of CHL and increased personnel costs; excluding CHL, the increase would have been 2.6%.

The operating result of the Banca Generali group was € 275 million (-11.6%) due to lower non-recurring performance fees amounting to € 42 million (€ 94 million 1H2024). Total net inflows at Banca Generali in 1H2025 were € 3.0 billion.

The Asset Management adjusted net result rose to € 163 million (+1.9%) also due to higher costs related to integration, M&A and other non-operating items.

The AUM pertaining to the Asset Management companies were € 680 billion (-2.2% FY2024) entirely due to FX effects, in particular the euro-dollar impact. Third-party AUM stood at € 256 billion, including € 145 billion relating to CHL. Net flows from external clients amounted to € 3.6 billion.

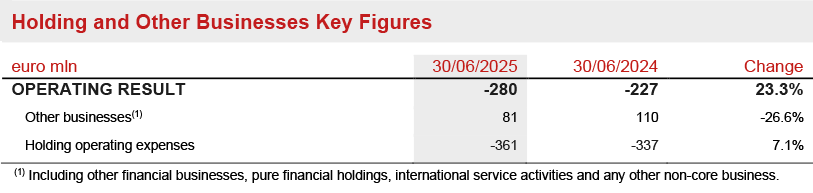

Holding and Other Businesses Segment

- Operating result stood at € -280 million

The Holding and other businesses operating result was € -280 million (€ -227 million 1H2024).

The operating result of Other businesses decreased to € 81 million (€ 110 million 1H2024), primarily affected by a one-off exit tax payment related to the closure of a foreign entity and lower intragroup dividends. Operating expenses grew by 7.1% mainly reflecting higher project costs related to strategic initiatives.

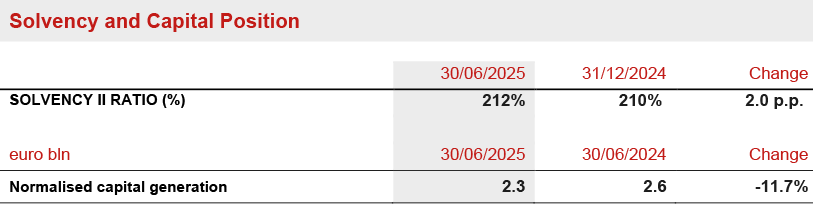

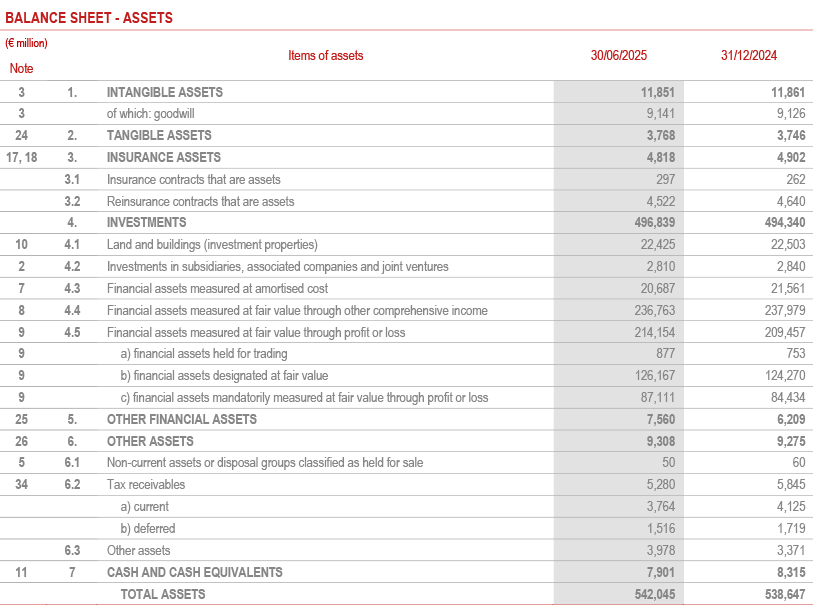

Balance Sheet and Capital Position

- Solid capital position with the Solvency Ratio at 212% (210% FY2024)

- Continued healthy normalised capital generation at € 2.3 billion

The Group confirms a solid capital position with a Solvency Ratio at 212% (210% FY2024). The increase reflected the sound contribution of normalised capital generation (+9 p.p.) and the impact of economic variances (+4 p.p., mostly attributable to European government bond spreads tightening, the growth of the listed equity market and the moderate increase in interest rates in the Euro area). These factors more than offset the impact from regulatory changes (-2 p.p.), non-economic variances (-3 p.p., mainly following the planned strategic asset allocation optimisation, entailing an increased weight of investments with a higher SCR absorption), M&A operations (-1 p.p.) and capital movements (-5 p.p., stemming from the impact of the dividend for the period and the share buy-back programme, net of the subordinated debt issuance completed in the second quarter).

The normalised capital generation, which includes the full impact from the share buy-back for the Long-Term Incentive Plan (LTIP), remained healthy at € 2.3 billion (€ 2.6 billion 1H2024), supported by Life, P&C and Financials.

Outlook

The global economy has been resilient so far in 2025 but is expected to decelerate this autumn as the adverse effects of the trade disputes emerge. Political uncertainty has started to ease, also thanks to the trade agreement reached in July between the European Union and the United States, making a recession less likely. Economic activity in the Euro area is expected to remain subdued in the near term, but to pick up again by the end of the year. The ECB rate cut cycle is now well advanced while the Fed has more room to cut despite an expected inflation spike due to tariffs.

In this context, with the Lifetime Partner 27: Driving Excellence strategic plan launched in January 2025, which focuses on excellence in customer relationships, core capabilities and the Group operating model, Generali will accelerate profitable growth in Life by capitalising on its broad customer base and strong distribution footprint. In addition, the Group will improve technical proficiency to increase profitability and enhance effectiveness by scaling Group-wide assets across the value chain. Focus will remain on simplification and innovation, offering updated and integrated solutions to adapt to evolving customer needs throughout their lifetime. Primary focus areas include protection and health, as well as capital-light savings with the aim to provide a wide range of insurance solutions adapted to different risk and investment profiles for the benefit of both the policyholders and the Group. For protection and health products, the Group aims to offer integrated end-to-end services and become the preferred health partner to all customers. Hybrid & unit-linked offerings will continue to be a priority to address growing customer needs for financial security with the objective of becoming the go-to partner for retirement and savings.

In P&C, Generali's objective is to maximise profitable growth with a focus on the non-motor lines, strengthening its position and offering especially in countries with high growth potential and in under-penetrated segments. The Group confirms and strengthens its adaptive and disciplined approach towards tariff adjustments, also considering rising needs for insurance coverage on natural catastrophes. The non-motor offer will continue to be enhanced with additional modular solutions designed to meet specific customer needs, providing improved and innovative prevention, assistance and protection services, enabled by the latest digital tools.

With reference to the Group’s investment policy, it will continue to pursue an asset allocation strategy aimed at ensuring consistency with liabilities to policyholders and, where appropriate, at increasing current returns. Investments in private assets and real assets continue to be an important part of the Group’s strategy, following a prudent approach that considers the lower liquidity of these instruments. In the real estate sector, the Group is pursuing both geographical and sector diversification, closely monitoring and evaluating market opportunities as well as asset quality.

In Asset & Wealth Management, Asset Management will continue to expand the product offering, particularly in real assets and private assets, enhance distribution capabilities, and extend its presence in new markets, further supported by the acquisition of CHL, completed in 2024. In the Wealth Management sector, the Banca Generali group will continue to focus on its objectives of growth in size and profitability, reaffirming its commitment to the generous remuneration of its shareholders. On 28 April 2025, Banca Generali became the subject of a voluntary exchange offer launched by Mediobanca, which is currently undergoing the appropriate evaluations by the Generali Board of Directors and its relevant bodies.

The Group is committed to delivering - through the “Lifetime Partner 27: Driving Excellence plan” - ambitious 2025-2027 growth targets:

- strong earnings growth: 8-10% EPS CAGR4;

- solid cash generation: > € 11 billion Cumulative Net Holding Cash Flow5;

- increasing dividend per share6: > 10% DPS CAGR7 with ratchet policy;

with a clear capital management framework with increased focus on shareholder returns:

- more than € 7 billion in cumulative dividends8 (2025-2027);

- committed to at least € 1.5 billion share buyback9 over the plan horizon;

- € 500 million buyback that is going to be executed starting 7 August 2025 and will be completed during 2H2025.

Significant Events After 30 June 2025

Significant events that occurred following the end of the period will be available in the Half-Yearly Consolidated Financial Report 2025.

The Report also contains the description of the alternative performance indicators and the Glossary.

***

Q&A Conference Call

The Group CEO, Philippe Donnet, the Group CFO, Cristiano Borean, the Group General Manager, Marco Sesana and CEO Insurance, Giulio Terzariol, will host the Q&A session conference call for the consolidated results of the Generali Group as of 30 June 2025, which will be held on 6 August 2025, at 16.00 pm CEST.

To follow the conference call, in a listen only mode, please dial +39 02 8020927.

***

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

Generali 2Q2025 Results

Further Information by Segment

Balance Sheet

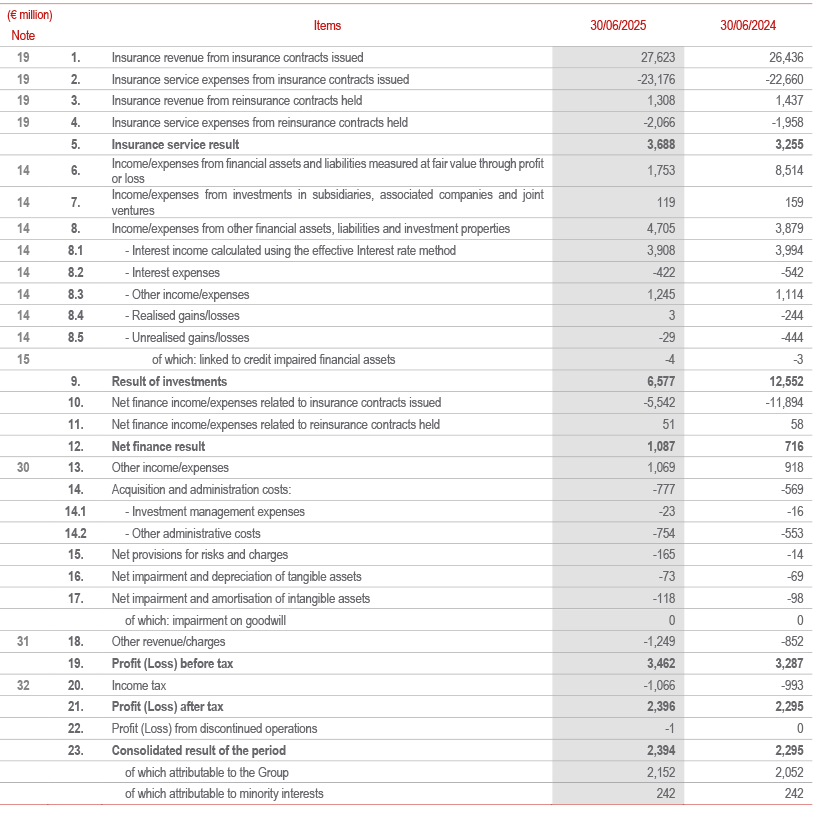

Income Statement

1 Changes in premiums, Life net inflows and new business are on a like-for-like basis (i.e., at constant exchange rates and scope of consolidation). Changes in total AUM, Solvency Ratio, shareholders’ equity, CSM and Life CSM are calculated with reference to the corresponding figures at the end of the previous year.

2 For definition of the adjusted net result, please refer to note 2 on page 2.

3 Including premiums from investment contracts equal to € 824 million (€ 817 million 1H2024).

4 3-year CAGR based on the Group’s adjusted net result.

5 Expressed on cash basis.

6 Subject to all relevant approvals.

7 3-year CAGR with 2024 baseline at € 1.28 per share.

8 Subject to all relevant approvals.

9 Subject to all relevant approvals.