Financial Information as of 31 March 2025 (1)

22 May 2025 - 07:00 price sensitive

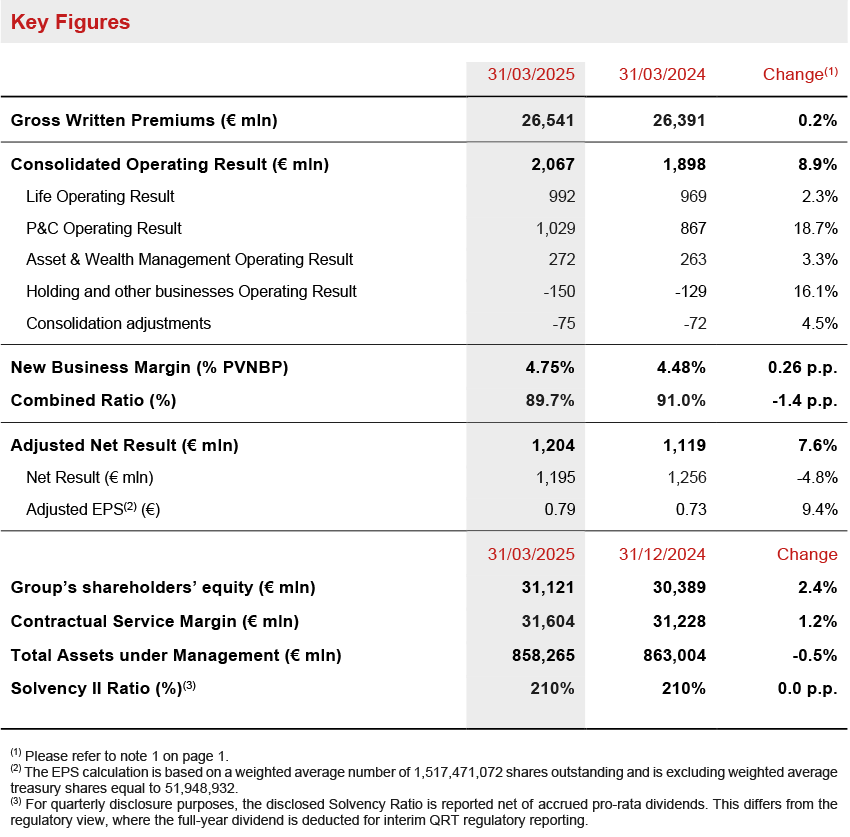

Generali reports strong growth in operating result thanks to all business segments. Solid capital position confirmed

- Gross written premiums reached € 26.5 billion (+0.2%), driven by the strong performance of P&C (+8.6%), especially in Non-Motor

- Life net inflows exceeded € 3.0 billion thanks to all business lines, particularly Protection & Health

- Combined Ratio improved substantially to 89.7% (-1.4 p.p.). The undiscounted Combined Ratio also continued its very positive development to 92.0% (-1.7 p.p.)

- Operating result grew significantly to € 2.1 billion (+8.9%), thanks to the contribution from all business segments, led by strong P&C performance

- Adjusted net result increased to € 1.2 billion (+7.6%). Adjusted EPS rose even more strongly to € 0.79 (+9.4%)

- Solid capital position confirmed, with Solvency Ratio at 210% (210% FY2024)

Generali Group CFO, Cristiano Borean, said: “In this first quarter, Generali achieved continued strong growth in both operating and adjusted net result, showing a very positive start to our new strategic plan ‘Lifetime Partner 27: Driving Excellence’ thanks to the contribution of all business segments. Our P&C business benefitted from healthy top-line growth, mainly driven by the Non-Motor line, as well as from a continued improvement in the Combined Ratio. The Life business recorded significant net inflows, with our preferred areas of Protection & Health and Hybrid & Unit-Linked both performing strongly. Asset & Wealth Management provided a solid contribution to the Group operating result, mainly supported by the consolidation of Conning Holdings Limited. Our diversified profit sources and solid capital position driven by excellent cash generation will allow the Group to successfully implement the new strategic plan and create value for all our stakeholders.”

Executive summary

Milan - At a meeting chaired by Andrea Sironi, the Assicurazioni Generali Board of Directors approved the Financial Information of the Generali Group at March 31st 20252.

The Group’s gross written premiums reached € 26.5 billion, thanks to a strong performance of P&C. Life net inflows recorded a robust growth, exceeding € 3.0 billion (+30.4%), primarily driven by Italy and Germany, with the former also showing a material improvement in terms of lapses.

The operating result grew significantly to € 2,067 million (+8.9%), driven by a strong performance of P&C and supported by positive contributions from all business segments.

The Life operating result grew to € 992 million (+2.3%). New Business Value (NBV) amounted to € 822 million (-4.0%), also reflecting the comparison with a particularly strong first quarter in 2024.

P&C operating result increased significantly to € 1,029 million (+18.7%), led by the very good performance of the undiscounted operating insurance service result, which was enabled by the robust top line expansion and the continued improvement in margins. The Combined Ratio improved to 89.7% (91.0% 1Q2024) reflecting positive developments of loss and expense ratios. The undiscounted Combined Ratio improved to 92.0% (93.7% at 1Q2024).

Asset & Wealth Management operating result grew to € 272 million (+3.3%), supported by the performance of Asset Management, also reflecting the consolidation of Conning Holdings Limited (“CHL”).

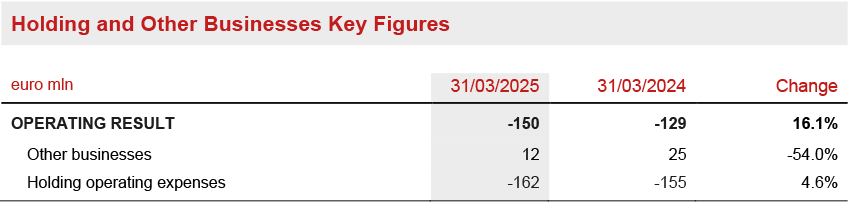

The operating result of Holding and Other Businesses was € -150 million (€ -129 million 1Q2024).

The Group adjusted net result increased by 7.6% to € 1,204 million (€ 1,119 million 1Q2024).

The net result amounted to € 1,195 million (€ 1,256 million 1Q2024) with the comparison to the prior year reflecting the strong non-operating investment result in 1Q2024, which also included a non-recurring capital gain (€ 58 million net of taxes) related to the disposal of TUA Assicurazioni.

The Group’s shareholders' equity increased to € 31.1 billion (€ 30.4 billion FY2024).

The Contractual Service Margin (CSM) grew to € 31.6 billion (€ 31.2 billion FY2024).

The Group's Total Assets Under Management were € 858.3 billion (€ 863.0 billion FY2024).

The Group confirmed its solid capital position, with the Solvency Ratio at 210% (210% FY2024), resulting from € 49.4 billion of Eligible Own Funds and € 23.5 billion of Solvency Capital Requirement. The sound contribution from normalised capital generation was strongly supported by both Life and P&C segments. The normalised capital generation also included the impact of the share buy-back for the Long-Term Incentive Plan (LTIP), that was almost entirely executed and accounted for in the first quarter. The market variances in the quarter were positive. The stable Solvency Ratio is due to negative regulatory changes, the dividend provision for the period and the minorities acquisition of the Chinese P&C insurance business.

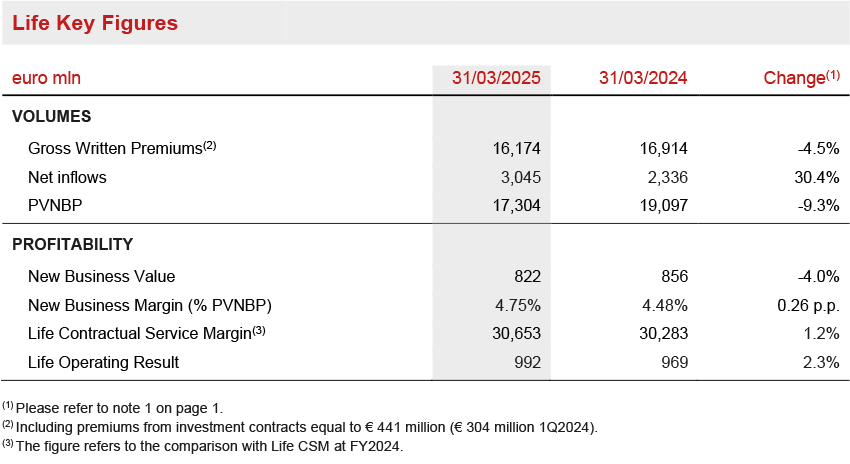

Life Segment

- Very strong net inflows at 3.0 billion (+30.4%)

- Life CSM grew to € 30.7 billion (+1.2%)

- Operating result increased to € 992 million (+2.3%)

Gross written premiums in Life decreased by 4.5% to € 16.2 billion. This development reflected a comparison with a particularly strong first quarter in 2024, during which targeted commercial actions were implemented to sustain net inflows in Italy and France and extraordinary new production was recorded in Asia. Protection & Health confirmed its solid growth trajectory (+10.5%), while Traditional Saving and Hybrid & Unit-linked decreased by 11.9% and 6.5% respectively, due to the aforementioned year-on-year comparison.

Life net inflows were very strong, reaching € 3,045 million (+30.4%), primarily driven by strong performances in Italy and Germany. All business segments contributed positively, with Protection & Health achieving € 1,371 million, Hybrid & Unit-Linked € 1,179 million and Traditional Saving € 495 million.

New business volumes (expressed in terms of present value of new business premiums - PVNBP) decreased to € 17.3 billion (-9.3%), primarily due to an exceptionally strong 1Q2024 which benefitted from some extraordinary effects, including exceptional production in China and very strong PVNBP of Saving and Hybrids in Italy to support net inflows in the traditional business.

New Business Value (NBV) amounted to € 822 million (-4.0%), reflecting the lower volumes, despite the increased profitability of new business production.

The New Business Margin on PVNBP (NBM) rose to 4.75% (+0.26 p.p.) mainly thanks to a favorable company and product mix, partially offset by the impact of lower interest rates. The 1Q2025 NBM includes the impact of the French Protection business, which has high volumes with lower profitability and is mostly sold in the first quarter of the year. Excluding the impact of this specific portfolio, the 1Q2025 NBM would be around 5.4%.

The Life Contractual Service Margin (Life CSM) increased to € 30.7 billion (€ 30.3 billion FY2024). The positive development was mainly driven by the contribution of the Life New Business CSM of € 802 million, which, coupled with the expected return of € 361 million, more than offset the Life CSM release of € 773 million.

The Life operating investment result was € 176 million (€ 227 million 1Q2024), reflecting in Argentina both significantly lower inflation and the reallocation of Life excess capital to P&C. The investment result of the quarter also saw a lower contribution from investment funds compared to 1Q2024, due to a timing difference in dividend distributions. The Life operating investment result was also affected by higher insurance finance expenses.

The Life CSM release and the Life operating investment result were the most relevant contributors to the Life operating result, which grew to € 992 million (€ 969 million 1Q2024).

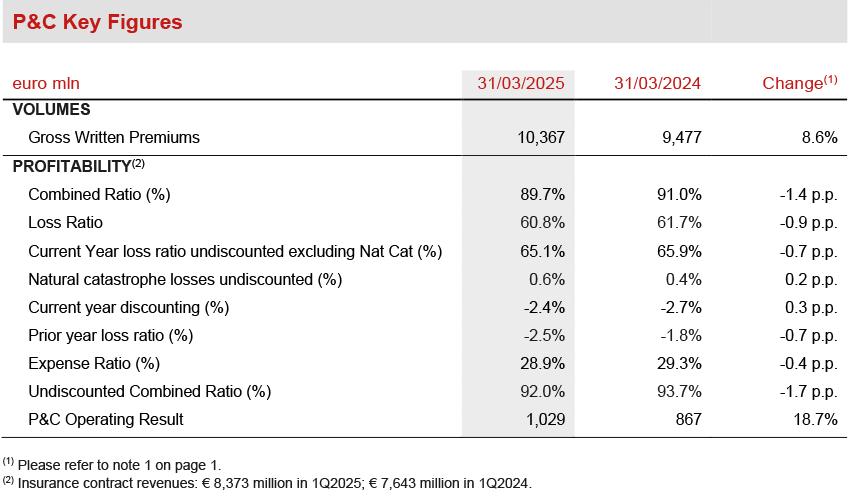

P&C Segment

- Premiums increased to € 10.4 billion (+8.6%)

- Combined Ratio improved substantially to 89.7% (-1.4 p.p.). The undiscounted Combined Ratio confirmed its very solid development to 92.0% (-1.7 p.p.)

- Operating result grew strongly to € 1,029 million (+18.7%)

P&C gross written premiums grew to € 10.4 billion (+8.6%), driven by the positive performance of both business lines. Non-motor increased by 8.9%, achieving widespread growth across the Group. Europ Assistance premiums grew by 16.0%, also thanks to a new partnership in Australia.

The Motor line rose by 7.2% across all the main areas, with particularly positive business dynamics in Germany, Italy, France, Austria and CEE. Excluding the contribution from Argentina, Motor line premiums increased by 5.0%.

The Combined Ratio improved to 89.7% (91.0% 1Q2024) thanks to the positive development of the loss ratio to 60.8% (-0.9 p.p.), notwithstanding a lower discounting benefit. The undiscounted combined ratio improved to 92.0% (93.7% 1Q2024). The undiscounted current year loss ratio (excluding Nat Cat) confirmed its positive development reaching 65.1% (65.9% 1Q2024). The expense ratio decreased to 28.9% (29.3% 1Q2024), thanks to the lower incidence of administrative costs.

The operating result increased strongly to € 1,029 million (+18.7%). The operating insurance service result grew to € 865 million (€ 685 million 1Q2024), thanks to both improved profitability and higher business volumes, despite a lower discounting effect of € 198 million (€ 205 million in 1Q2024). The undiscounted operating insurance service result grew strongly by 39% to € 667 million (€ 481 million 1Q2024).

The operating investment result was € 164 million (€ 182 million 1Q2024). This reflected a € 44 million decline in the operating investment income to € 351 million which more than compensated a reduction of € 26 million in the insurance finance expenses to € -187 million. The reduction in the operating investment income was entirely related to Argentina, due to the very significant decline in the local inflation rate. The operating investment income excluding Argentina was € 326 million (€ 297 million 1Q2024) reflecting higher volumes as well as reinvestment yields higher than the maturing coupons.

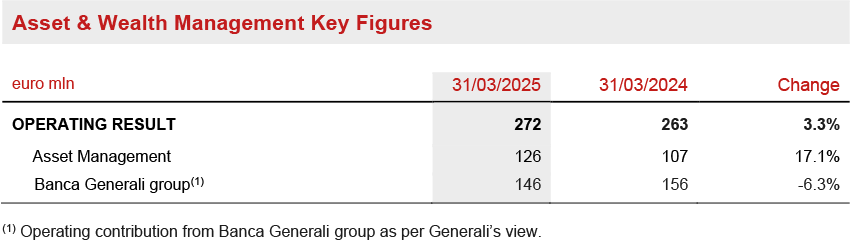

Asset & Wealth Management Segment

- Asset & Wealth Management operating result increased to € 272 million (+3.3%)

- Banca Generali group operating result at € 146 million (€ 156 million 1Q2024)

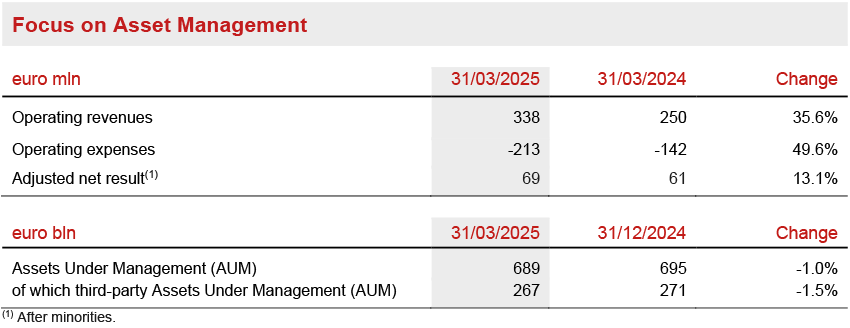

The operating result of Asset Management increased to € 126 million (+17.1%), reflecting a € 19 million contribution from CHL. Without CHL, the operating result would have been broadly stable year-on-year.

Operating revenues posted a positive development (+35.6%, or +1.1% excluding CHL) thanks to the contribution of CHL (€ 86 million) and the increase in recurring fees (+2.6% excluding CHL) driven by higher average AUM. Operating expenses rose to € 213 million (+49.6%), mainly due to CHL (€ 67 million). Excluding CHL the increase would have been +2.5%, primarily driven by higher compensation costs.

The operating result of the Banca Generali group was € 146 million (€ 156 million in 1Q2024) due to lower non-recurring performance fees from a record high € 54 million in 1Q2024 to € 34 million in 1Q2025. The result on the other hand highlighted a positive year-on-year contribution from both net interest income and net recurring fees, thanks to continuous diversification efforts and Intermonte’s integration. Total net inflows at Banca Generali in 1Q2025 were € 1.5 billion.

Asset Management adjusted net result rose to € 69 million (+13.1%). In addition to the operating trends mentioned above, the net result benefitted from lower taxes compared to 1Q2024.

AUM pertaining to the segment were € 689 billion at the end of 1Q2025, -1.0% compared to YE2024, due to a negative FX rate impact of approximately € 9 billion, offsetting positive net flows of € 3.8 billion during the quarter, of which € 2.4 billion were from third party clients. Third-party AUM managed by the Asset Management companies stood at € 267 billion, including € 156 billion from CHL.

Holding and other businesses Segment

- Operating result at € -150 million (€ -129 million 1Q2024)

The operating result of Holding and Other Businesses was € -150 million (€ -129 million 1Q2024). The contribution from Other businesses was € 12 million (€ 25 million 1Q2024), primarily affected by a one-off exit tax payment related to the closure of a foreign entity. Holding operating expenses increased to € -162 million, mainly reflecting higher personnel costs.

Outlook

The global economy is expected to grow between 2.5% and 3.0% in 2025, below the 3.2% growth rate recorded in 2024, due to a possible slowdown in the US and China amid trade uncertainties. The Euro area economy may still expand at a subdued pace, similar to 2024, with higher fiscal spending in Germany being gradually phased in. US tariffs may raise US inflation, while disinflationary forces prevail in the Euro area. This should allow the ECB to proceed with further rate cuts during the year. The Fed is unlikely to resume its easing cycle before the summer when the potential impact of tariffs on the US economy may start to materialise.

In this context, with the new Lifetime Partner 27: Driving Excellence strategic plan, which focuses on excellence in customer relationships, core capabilities and the Group operating model, the Group will accelerate profitable growth in Life by capitalising on its broad customer base and strong distribution footprint. In addition, the Group will improve technical proficiency to increase profitability and enhance effectiveness by scaling Group-wide assets across the value chain. Focus will remain on simplification and innovation, offering updated and integrated solutions to adapt to evolving customer needs throughout their lifetime.

In Life, primary focus areas include protection and health, as well as capital-light savings with the aim to create a wide range of insurance solutions adapted to different risk and investment profiles for the benefit of both the policyholder and the Group. For protection and health products, the Group aims to offer integrated end-to-end services and will also further upgrade customer experience and distribution. Hybrid and unit-linked offerings will continue to be a priority to address growing customer needs for financial security with the objective of becoming the go-to partner for retirement and savings.

In P&C, Generali's objective is to maximise profitable growth with a focus on the non-motor line, strengthening its position and offering especially in countries with high growth potential. The Group confirms and strengthens its adaptive approach towards tariff adjustments, also considering rising needs for insurance coverage on natural catastrophes. The non-motor offer will continue to be enhanced with additional modular solutions designed to meet specific customer needs, providing improved and innovative prevention, assistance and protection services, enabled by the latest digital tools.

With reference to the Group’s investment policy, it will continue to pursue an asset allocation strategy aimed at ensuring consistency with liabilities to policyholders and, where appropriate, at increasing current returns. Investments in private and real assets continue to be an important part of the Group’s strategy, following a prudent approach that considers the lower liquidity of these instruments. In the real estate sector, the Group is pursuing both geographical and sector diversification, closely monitoring and evaluating market opportunities as well as asset quality.

In Asset & Wealth Management, Asset Management will continue to expand the product offering, particularly in real assets and private assets, enhance distribution capabilities, and extend its presence in new markets, further supported by the acquisition of CHL, completed in 2024. In Wealth Management, the Banca Generali group will continue to focus on its targets of size, profitability and high shareholder remuneration.

The Group is committed to delivering – through the new Lifetime Partner 27: Driving Excellence plan – new ambitious 2025-2027 growth targets:

- strong earnings growth: 8-10% EPS CAGR

- solid cash generation: > €11 billion Cumulative Net Holding Cash Flow

- increasing dividend per share: > 10% DPS CAGR with ratchet policy

With a clear capital management framework with increased focus on shareholder returns:

- more than € 7 billion in cumulative dividends (2025-27)

- committed to at least €1.5 billion share buyback over the plan horizon

- € 500 million buyback, approved by the Annual Shareholder Meeting 2025 to be launched in 2025 after regulatory approval.

Significant events after March 31st 2025

On April 8th ‘Agorai Innovation Hub’ launched in Trieste: a unique ecosystem of basic and applied research leveraging advanced Data Science and Artificial Intelligence to improve the quality of human life.

On April 24th the 2025 Annual General Meeting approved the 2024 financial statements, appointed the new Board of Directors and approved the € 500 million share buyback3.

On April 28th the Board of Directors of Generali appointed the Chairman and CEO for the period 2025-2027 electing Andrea Sironi as Chairman and Philippe Donnet as Managing Director and Group CEO. On the same date, the Board of Directors acknowledged the communication made by Mediobanca – Banca di Credito Finanziario S.p.A. regarding a public exchange offer promoted on all the shares of Banca Generali S.p.A.

Other significant events that occurred after the end of the period are available on the website.

***

The glossary and the description of alternative performance indicators are available in the Group Annual Integrated report 2024.

Q&A conference call

The Group CFO, Cristiano Borean, the Group General Manager, Marco Sesana and the CEO Insurance, Giulio Terzariol, will host the Q&A session conference call for the results of the Generali Group at March 31st 2025, which will be held on May 22nd 2025, at 12.00 pm CEST.

To follow the conference call, in a listen only mode, please dial +39 02 8020927.

***

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

1 Changes in premiums, Life net inflows and new business are presented on equivalent terms (at constant exchange rates and consolidation scope). The amounts are rounded and may not add up to the rounded total in all cases. Also, the percentages presented can be affected by the rounding.

2 The Financial Information at March 31st 2025 is not an interim Financial Report according to the IAS 34 principle

3 Subject to regulatory approval.