Financial Information as of 30 September 2022(1)

10 November 2022 - 07:30 price sensitive

Generali results maintain growth momentum. Extremely solid capital position

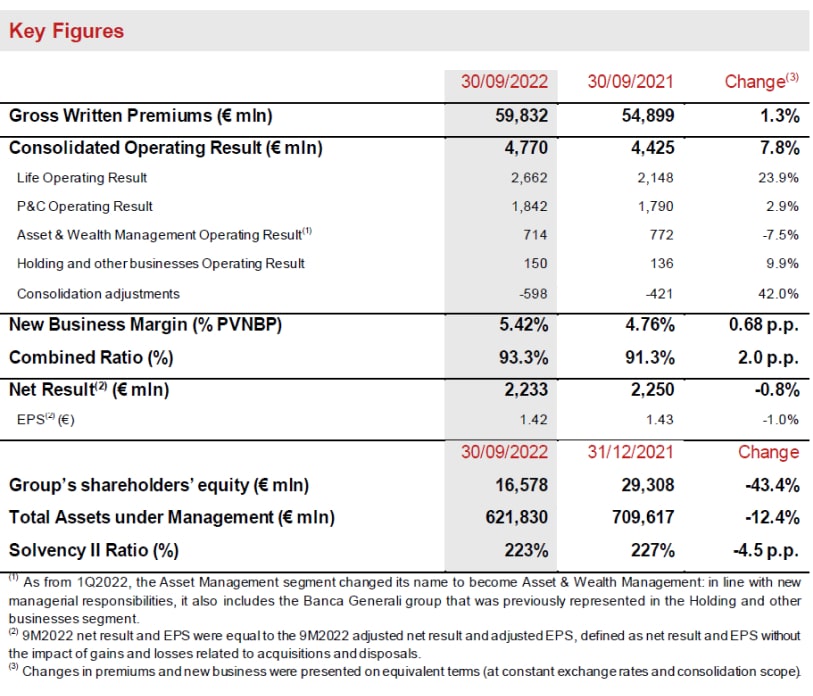

- Gross written premiums increased to € 59.8 billion (+1.3%), driven by growth in P&C (+10.3%), led by the non-motor line. Life premiums contracted (-2.9%). Life net inflows were € 7.7 billion, driven by the unit-linked and protection lines, consistent with the strategy to reposition the Life business portfolio

- Operating result continued to rise to € 4.8 billion (+7.8%), thanks to the positive performance of the Life and P&C segments. The Combined Ratio was 93.3% (+2 p.p.). New Business Margin was excellent and reached 5.42% (+0.68 p.p.)

- Net result was stable at € 2,233 million (-0.8%). Excluding impacts from Russian investments, the net result would have grown to € 2,374 million (+5.5%)

- Extremely solid capital position with the Solvency Ratio at 223% (227% FY2021)

Generali Group CFO, Cristiano Borean, said: “The results of the first nine months reflect the solidity of our Group built on the foundations of our strategy to focus on the most profitable business lines and our diversified sources of earnings. This allows us to continue to generate value despite the macroeconomic environment. Generali is successfully achieving sustainable growth and continuously increasing its operating result, reflecting the effective implementation of our 'Lifetime Partner24: Driving Growth' strategic plan.”

EXECUTIVE SUMMARY

Milan - At a meeting chaired by Andrea Sironi, the Assicurazioni Generali Board of Directors approved the Financial Information at 30 September 20222 of the Generali Group.

Gross written premiums rose to € 59,832 million (+1.3%), thanks to continued growth in the P&C segment.

Life net inflows were € 7,667 million (-25.3%). The drop was mainly attributed to the savings line, consistent with the Group's strategy to reposition its Life business portfolio as well as specific in-force management actions. The unit-linked line also decreased, reflecting the increased macroeconomic uncertainty. The protection line achieved robust growth.

Life technical provisions amounted to € 418.5 billion (-1.4% compared to FY2021), reflecting the performance of financial markets.

The operating result continued to rise, reaching € 4,770 million (+7.8%), thanks to the positive development of the Life and P&C segments.

The operating result of the Life segment (+23.9%) and the New Business Margin (+0.68 p.p.) grew further, benefitting from rising interest rates.

The operating result of the P&C segment also increased (+2.9%). The Combined Ratio stood at 93.3% (+2.0 p.p.) due to a higher loss ratio, which was also impacted by the acceleration of hyperinflation in Argentina. Excluding this country, the Combined Ratio would have been 92.5% (91.1% 9M2021).

The operating result of the Asset & Wealth Management segment was € 714 million (-7.5%). The change was entirely due to lower performance fees at Banca Generali, linked to the movement of financial markets. Asset Management achieved an operating result of € 459 million (+1.7%).

The operating result of the Holding and other businesses segment grew (+9.9%), benefitting mainly from the performance of real estate.

The non-operating result stood at € -1,064 million (€ -731 million 9M2021). Specifically, the non-operating investment result was € -245 million (€ 137 million 9M2021), mostly due to higher impairments on investments classified as available for sale, in particular Russian investments, and to lower net realised gains3.

The tax rate was 32.9% (32.7% 9M2021).

The net result stood at € 2,233 million (€ 2,250 million 9M2021), affected by the impacts from Russian investments amounting to € 141 million for the first nine months of 2022. The impairment on the stake in Ingosstrakh was € 48 million while € 93 million was due to fixed income securities held directly by the Group4. Excluding this impact, the net result would have grown to € 2,374 million (+5.5%).

The Group's Total Assets Under Management were € 621.8 billion (-12.4% compared to FY2021), mostly reflecting the rise in interest rates onfixed income securities.

The Group’s shareholders' equity stood at € 16,578 million (-43.4% compared to FY2021). The change was mainly due to the € -14,063 million decrease in the available for sale reserves - mostly deriving from the rise in interest rates and corporate spreads.

The Group maintained its extremely solid capital position, with the Solvency Ratio at 223% (227% FY2021). The contraction of 4.5 p.p. was mainly driven by the impacts stemming from M&A transactions, the regulatory changes in the first quarter as well as the dividend provision for the period and the share buyback programme. These impacts were only partly offset by the solid contribution from normalised capital generation and by the positive market variances (where the rise in interest rates more than offset the fall in equity markets, the widening of BTP spreads and the rise in volatility and inflation).

LIFE SEGMENT

- Operating result grew strongly to reach € 2,662 million (+23.9%)

- Excellent New Business Margin at 5.42% (+0.68 p.p.)

- New Business Value (NBV) amounted to € 1,733 million (+0.6%)

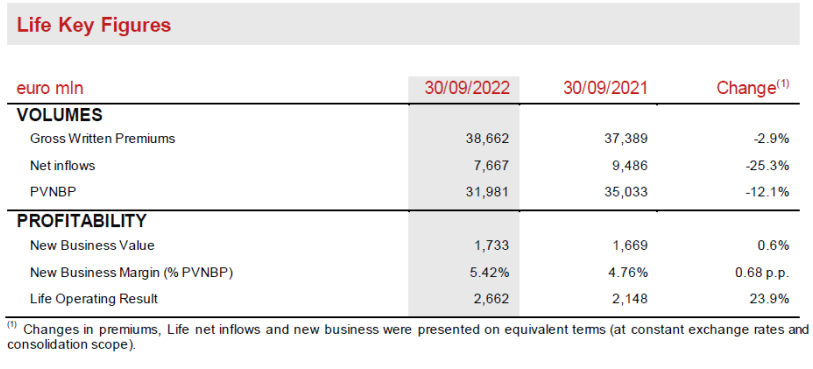

The gross written premiums in the Life Segment5 amounted to € 38,662 million6 (-2.9%). The savings and pension line decreased (-8.3%), mainly in Italy, France and Germany, while the unit-linked line remained almost stable (-1.4%), mostly as a result of the slowdown observed in the third quarter in Italy and France. The protection line maintained its positive momentum (+5.0%) across almost all the main areas where the Group operates.

Net Life inflows stood at € 7,667 million7 (-25.3%). The savings line recorded net inflows of € -3,026 million (€ -476 million 9M2021). It reflected the Group's strategy to repositionits Life business portfolio, ongoing in- force management actions, mostly in Italy, and lower premiums, mainly in Italy, France and Germany. The Group’s surrender rate was stable during the first nine months of 2022. The unit-linked line amounted to € 6,609 million (-7.0%). The protection line grew to € 4,084 million (+9.8%) across almost all the main areas where the Group operates.

The new business production (expressed in terms of PVNBP - present value of new business premiums) stood at € 31,981 million (-12.1%), reflecting macroeconomic uncertainty, which primarily impacted activities in Italy, Germany and France. This was mainly recorded in the savings line (-20.1%) and, to a lesser extent, protection (-11.5%), whilst in the unit-linked line, production contracted only marginally (-2.7%).

Thanks to the Group’s strategy of rebalancing the business mix towards the most profitable lines of business and to the significant increase in interest rates, the New Business Margin on PVNBP rose to 5.42% (+0.68 p.p.), showing an improvement across all lines.

Thanks to this increase, the Group more than offset the decrease in volumes, with the New Business Value (NBV) rising to € 1,733 million (+0.6%).

The operating result grew strongly to € 2,662 million (€ 2,148 million 9M2021). The technical margin - net of insurance expenses - improved, thanks to the more profitable business mix. The net investment result also increased, with current income and the reserving dynamics benefitting from rising interest rates.

P&C SEGMENT

- Premiums grew to € 21,170 million (+10.3%)

- Combined Ratio was 93.3% (+2.0 p.p.)

- Operating result rose to € 1,842 million (+2.9%)

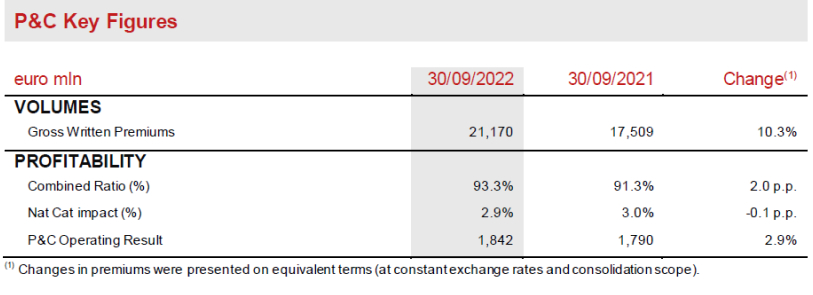

The gross written premiums in the P&C segment grew to € 21,170 million (+10.3%), thanks to the performance of both business lines.

The non-motor line continued to rise (+12.8%) across almost all the main areas where the Group operates, with accelerated growth in the third quarter. The motor line increased by 6.1%, particularly in Argentina (mainly as a result of inflationary adjustments), France and ACEE, the performance of which more than offset the performance in Italy, Switzerland and Germany.

The premiums of Europ Assistance recovered strongly (+93.4%), also thanks to the contribution from new partnerships. In 2021, Europ Assistance was still impacted by the pandemic, especially in the travel line.

Excluding the contribution from Argentina, a country impacted by a context of hyperinflation, the total premiums of the segment would have increased by 8.7%, with the non-motor line rising by 12.6% and the motor line by 1.7%.

The Combined Ratio increased by 2.0 p.p. to 93.3% (92.5% excluding Argentina). This resulted from a higher loss ratio (+1.7 p.p.) and a higher expense ratio (+0.3 p.p.).

The non-catastrophe current year loss ratio rose by 0.7 p.p., on one hand, due to a higher attritional component8 (+0.4 p.p.; +0.1 p.p. excluding Argentina) mainly because of the performance of the motor line, which in the first part of 2021 still benefitted from the effects of lockdown restrictions, and, on the other hand, due to higher large man-made claims (+0.3 p.p.). The natural catastrophe loss ratio slightly decreased (-0.1 p.p.): in the first nine months of 2022, natural catastrophe claims reached € 560 million (€ 486 million 9M2021), including hailstorms in France and floods in Italy. The contribution from prior year development decreased to -3.1% (+1.1 p.p.).

The expense ratio increased to 28.1% (+0.3 p.p.), due to growth in administration costs (+0.4 p.p.) attributed to the line-by-line consolidation of the Cattolica group.

The operating result stood at € 1,842 million (€ 1,790 million 9M2021). The decrease in the technical result (-9.4%), reflecting the development of the Combined Ratio, was more than offset by the improvement in the investment result (+28.6%), which benefitted from increased current income and larger dividends from Banca Generali and private equity.

ASSET & WEALTH MANAGEMENT SEGMENT

- Asset Management operating result was € 459 million (+1.7%)

- Banca Generali group operating result was € 254 million (-20.5%) due to the reduction in performance fees

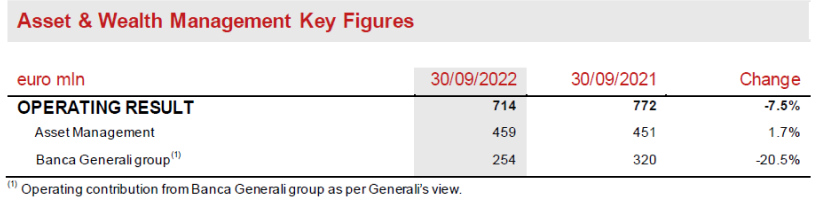

The operating result of the Asset & Wealth Management segment stood at € 714 million (-7.5%).

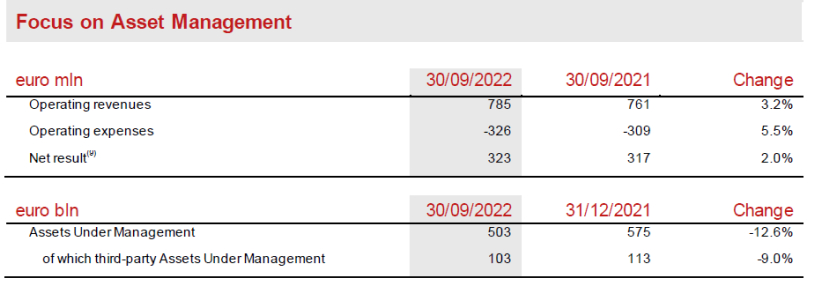

The operating result of Asset Management activities grew to € 459 million (+1.7%), supported by the growth in operating revenues (+3.2%) mainly from Asian companies and from higher non-recurring performance fees, booked in the first quarter.

The operating result of the Banca Generali group was € 254 million (-20.5%); the contraction reflected the movement of the financial markets in the first nine months of 2022, resulting in a significant impact on performance fees, from € 196 million at 9M2021 to € 18 million at 9M2022. Excluding the effect of performance fees and the provision of € 80 million at HY2021 to protect customers, the operating result would have significantly increased. Total net inflows at Banca Generali in 9M2022 exceeded € 4 billion, confirming the strong development of volumes in the complex market environment.

The net result9 of the Asset Management segment rose to € 323 million (+2.0%).

The total value of the Assets Under Management managed by the Asset Management companies was € 502.8 billion (-12.6% compared to FY2021). Third-party Assets Under Management managed by the Asset Management companies stood at € 102.7 billion (-9.0% compared to FY2021). The change was entirely driven by the high level of volatility in the global equity markets and the rise in bond yields. The net inflows from third-party customers grew to € 3.3 billion.

HOLDING AND OTHER BUSINESSES SEGMENT

- Operating result grew to € 150 million (+9.9%)

- Positive contribution from the real estate business

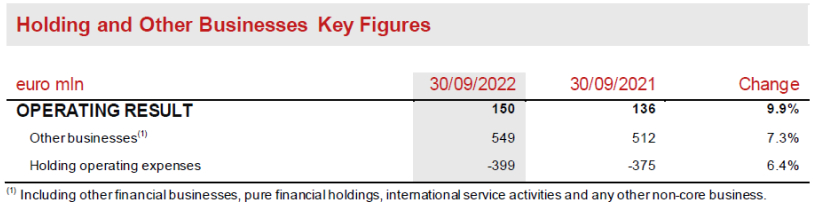

The operating result of the Holding and other businesses segment reached € 150 million (€ 136 million 9M2021)10.

The contribution from Other businesses was positive, mainly due to the improvement in the real estate result, benefitting from some positive non-recurring effects in 2022 and the comparison base in 2021 which was still impacted by pandemic restrictions. Holding operating expenses increased by 6.4%, mainly due to the increase in costs related to personnel and projects.

OUTLOOK

In the first nine months of 2022, financial markets were dominated by three factors: the war in Ukraine, which led to a substantial increase in energy and commodity prices; inflation and recession fears; and the tightening of monetary policies by central banks.

The effects of the macroeconomic context mentioned above may impact the global insurance sector, in particular growth in the Life segment.

The financial results for the period demonstrate the positive effects of the Group’s strategy. Generali confirms it will continue to rebalance its Life portfolio to further increase its profitability, with more efficient capital allocation. Simplification and innovation will continue to be key, with the introduction of a range of modular product solutions, designed for the specific requirements and new needs of customers, and marketed through the most suitable, efficient and advanced distribution channels. In the P&C segment, the Group’s objective for the mature insurance markets in which it operates is to maximise profitable growth, primarily in the non-motor line, and to continue to gain further ground in high growth potential markets by expanding its presence and offer. Given the current context of rising inflation and expected increases in claims management costs, the Group plans further pricing adjustments, in addition to those already undertaken. In the Asset & Wealth Management segment, Asset Management activities identified in the Group’s strategic plan will continue to be implemented, with the aim of extending the product catalogue, in particular for real assets & private assets, and enhancing distribution competences. On the Wealth Management side, the Banca Generali group will be focused on the delivery of its targets for size, profitability and shareholders’ remuneration defined in its strategic plan announced in February.

For the investment policy, the Group confirms its approach to an asset allocation aimed at ensuring consistency with liabilities to policyholders and consolidating current returns, as well as investments in private and real assets in order to contribute to portfolio diversification and return.

The strategic initiatives and business actions implemented since the past years ensure the Group is well positioned to achieve its targets. Despite an evolving macro-economic scenario, Generali confirms its commitment to pursue sustainable growth, enhance its earnings profile and lead innovation in order to achieve a compound annual growth rate in earnings per share11 between 6% and 8% in the period 2021-2024, to generate net holding cash flow12 exceeding € 8.5 billion in the period 2022-2024 and to distribute a cumulative dividend13 to shareholders for an amount between € 5.2 billion and € 5.6 billion in the period 2022-2024, with a ratchet policy on dividend per share.

SIGNIFICANT EVENTS AFTER 30 SEPTEMBER 2022

On 27 October, Generali announced that it will exercise the early redemption option (call date 12 December 2022) in respect of all outstanding subordinated notes due in December 2042.

On 7 November, Generali reached a long-term agreement, with renewable five-year exclusivity periods, for the distribution of Life and P&C policies. The partnership is reinforced by the acquisition of a stake in Banco CTT by Generali, through a € 25 million reserved capital increase. Generali will become a shareholder of the institution with an approximate 8.71% stake.

This transaction will be completed after approval by the relevant regulators.

Other significant events that occurred after the end of the period are available on the website.

***

The glossary and the description of alternative performance indicators are available in the Annual Integrated Report and Consolidated Financial Statements 2021.

***

Q&A CONFERENCE CALL

The Group CFO, Cristiano Borean, and the Group General Manager, Marco Sesana, will host the Q&A session conference call for the results of the Generali Group at 30 September 2022, which will be held on 10 November 2022, at 12.00 pm CET.

To follow the conference call, in a listen only mode, please dial +39 02 802 09 27.

***

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

1Changes in premiums, Life net inflows and new business were presented on equivalent terms (at constant exchange rates and consolidation scope). Changes in the operating result, general account investments and Life technical provisions excluded any assets under disposal or disposed of during the same period of comparison.

The amounts were rounded at the first decimal point and the amounts may not add up to the rounded total in all cases. The percentage presented can be affected by the rounding.

2The Financial Information at 30 September 2022 is not an Interim Financial Report according to the IAS 34 principle.

39M2021 benefitted from the real estate transaction for Libeskind Tower in CityLife in Milan for € 67 million and from the Saint Gobain Tower transaction in Paris for € 80 million.

4Regarding the Group’s exposure in Russia, following impairments in 9M2022, the stake in Ingosstrakh and fixed income instruments held directly by the Group amounted to € 165 million (€ 384 million FY2021) and to € 25 million (€ 188 million FY2021), respectively. The Group also had Russian and Ukrainian indirect investments of € 24 million (€ 111 million FY2021) and unit-linked investments of € 19 million (€ 117 million FY2021).

5Including premiums from investment contracts equal to € 1,162 million (€ 1,106 million 9M2021).

6The contribution of the Cattolica group was € 1,802 million.

7The contribution of the Cattolica group was € 297 million, almost entirely deriving from bancassurance agreements.

8It is the component of the non-catastrophe current year loss ratio without the impact from man-made claims.

9Afterminorities.

10As from 1Q2022, this segment excludes the contribution from the Banca Generali group, which is now included in the Asset & Wealth Management segment.

113 year CAGR; adjusted for impact of gains and losses related to acquisitions and disposals. Target based on current IFRS accounting standards.

12Net holding cash flow and dividend expressed in cash view.

13Subject to regulatory recommendations.