Generali Group Consolidated Results as at 30 June 2022(1)

02 August 2022 - 07:31 price sensitive

Generali reports continued growth in the operating result. The net result was stable, excluding Russian impairments. Capital position remained extremely solid

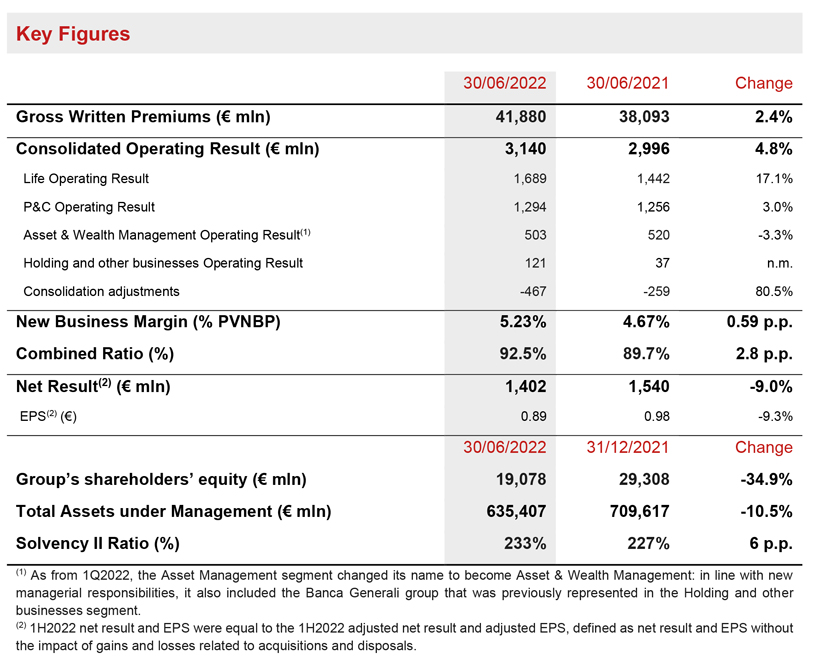

- Gross written premiums increased to € 41.9 billion (+2.4%), driven by strong growth in P&C (+8.5%), led by the non-motor line. Life premiums were stable (-0.5%). Life net inflows were resilient at € 6.2 billion, supported by growth in the protection and unit-linked lines, offsetting a reduction in the savings line, consistent with the repositioning of the Life business portfolio

- Operating result continued to rise, standing at € 3.1 billion (+4.8%), thanks to the positive performance of the Life, P&C and Holding and other businesses segments. The Combined Ratio was 92.5% (+2.8 p.p.). Excellent New Business Margin reached 5.23% (+0.59 p.p.)

- Net result was € 1,402 million (€ 1,540 million 1H2021). Excluding impairments on Russian investments, the net result would have been € 1,541 million

- Extremely solid capital position with the Solvency Ratio at 233% (227% FY2021), after accounting for the € 500 million share buyback

Generali Group CEO, Philippe Donnet, said: “Generali’s solid performance demonstrates that our focus on the implementation of the ‘Lifetime Partner 24: Driving Growth’ strategic plan is the right way to deliver sustainable growth and increase operating profitability. We have been able to achieve these results in an increasingly uncertain geopolitical and macroeconomic context while always keeping our customers and their needs as our top priority. In the months to come, we will continue to be fully committed to the execution of our three-year plan as we reinforce our Group's leadership as a global insurer and asset manager.”

EXECUTIVE SUMMARY

Milan - At a meeting chaired by Andrea Sironi, the Assicurazioni Generali Board of Directors approved the 2022 Consolidated Half-Year Financial Report of the Generali Group.

Gross written premiums rose to € 41,880 million (+2.4%), thanks to P&C segment growth.

Life net inflows were resilient at € 6,240 million. The decrease (-7.9%) was due to the savings line, consistent with the Group's strategy to reposition its Life business portfolio as well as specific in-force management actions. The protection (+7.0%) and unit-linked (+2.1%) lines grew.

Life technical provisions reached € 419.2 billion (-1.2% FY2021), the slight decrease reflected the performance of financial markets.

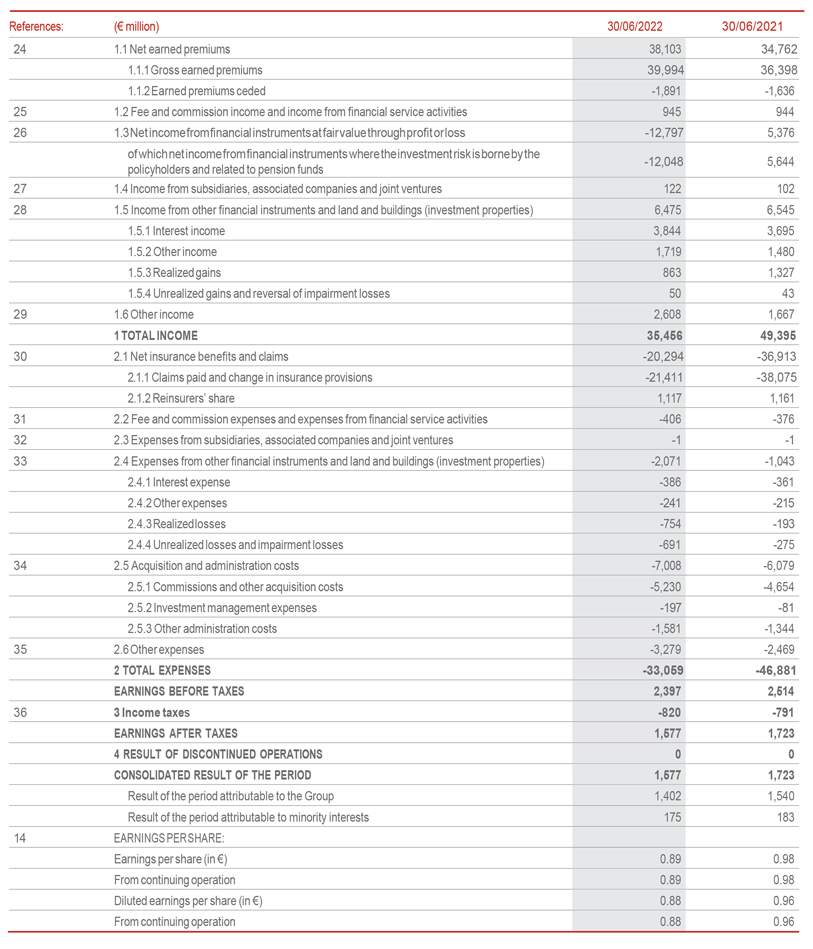

The operating result continued to rise, reaching € 3,140 million (+4.8%), benefiting from the positive development of the Life, P&C and Holding and other businesses segments.

The operating result of the Life segment grew strongly (+17.1%), reflecting excellent technical profitability, also confirmed by the New Business Margin at 5.23% (+0.59 p.p.).

The operating result of the P&C segment also increased (+3.0%). The Combined Ratio stood at 92.5% (+2.8 p.p.), reflecting the higher loss ratio and also the impact of hyperinflation in Argentina. Without considering this country, the Combined Ratio would have been 91.9% (89.4% 1H2021).

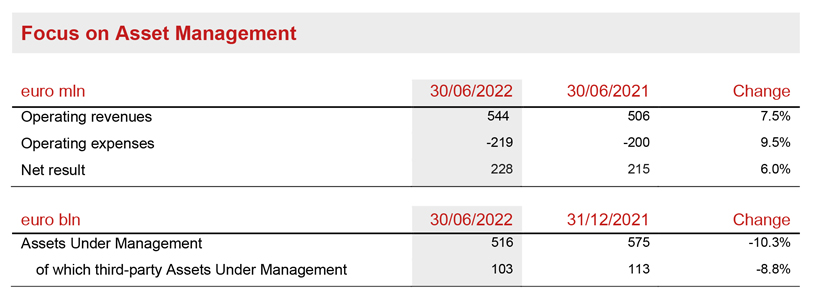

The operating result of the Asset & Wealth Management segment was € 503 million (-3.3%). This decrease was entirely due to lower performance fees at Banca Generali, linked to the movement of financial markets. The Asset Management operating result increased by 6.2%.

The operating result of the Holding and other businesses segment grew, benefitting mainly from the performance of the real estate business.

The non-operating result amounted to € -713 million (€ -496 million 1H2021). In particular, the non-operating investment result was € -168 million (€ 48 million 1H2021), mainly due to higher impairments on investments classified as available for sale, in particular Russian investments, and to lower net realised gains2.

The net result was € 1,402 million (€ 1,540 million 1H2021), impacted by impairments on Russian investments totalling € 138 million. € 97 million was due to fixed income securities held directly by the Group and € 41 million to the investment in Ingosstrakh. Excluding this impact, the net result would have been stable at € 1,541 million.

The Group's Total Assets Under Management were € 635.4 billion (-10.5% compared to FY2021), entirely reflecting the performance of financial markets, despite positive net inflows.

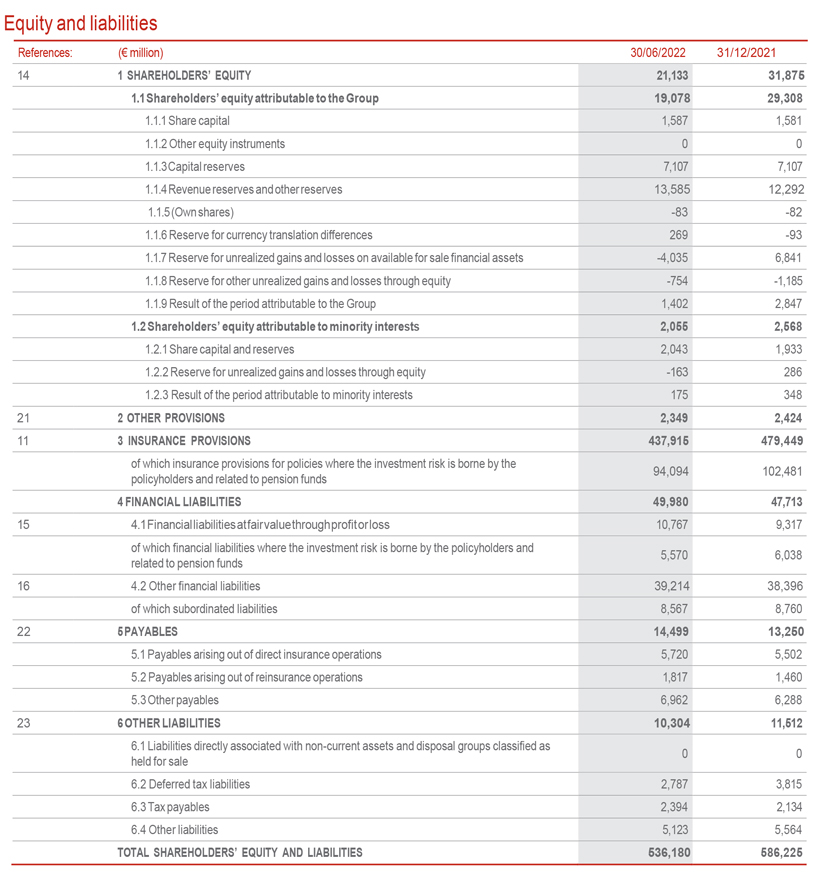

The Group’s shareholders' equity stood at € 19,078 million (-34.9% FY2021). The change was due to the € -10,876 million decrease in the available for sale reserves - mainly deriving from the rise in interest rates on government and corporate bonds - and to the € 1,691 million payment for the 2021 dividend.

The Group reported an extremely solid capital position, with the Solvency Ratio at 233% (227% FY2021).

LIFE SEGMENT

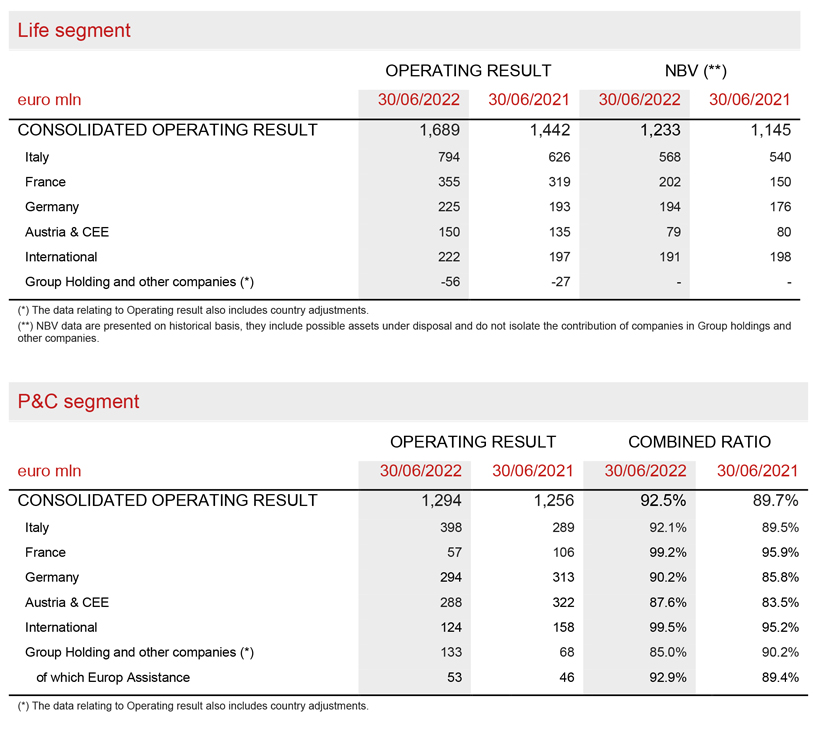

- Operating result grew strongly to reach € 1,689 million (+17.1%)

- Excellent New Business Margin at 5.23% (+0.59 p.p.)

- New Business Value (NBV) grew to € 1,233 million (+4.3%)

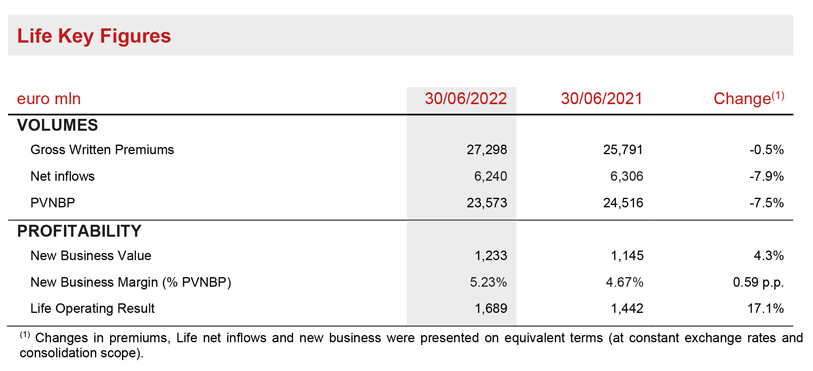

The gross written premiums in the Life Segment3 stood at € 27,298 million4 (-0.5%). The protection line rose (+4.9%) across almost all the main areas where the Group operates, and the unit-linked line increased by +3.3%, mainly in France and Germany. The savings line fell (-5.1%), mainly in Italy, France and Germany.

Net Life inflows were € 6,240 million5 (-7.9%). The decrease was due to the savings line, which stood at € -1,540 million (€ -496 million 1H2021), consistent with the Group's strategy to reposition its Life business portfolio and specific in-force management actions. There was positive growth in both the protection (+7.0%), primarily in Italy, France and ACEE, and the unit-linked line (+2.1%), especially in Germany and France.

New business (expressed in terms of PVNBP - present value of new business premiums) was € 23,573 million (-7.5%) due to the Group's strategy to reposition the Life business portfolio and the macroeconomic uncertainty in the second quarter. In terms of business lines, the positive growth of the unit-linked line (+3.8%), driven by France and Germany, mitigated the sharp reduction in the savings line (-16.2%), mainly in Italy, France and Germany and the protection line (-8.4%), in particular in China, Germany and Italy.

The New Business Margin on PVNBP significantly increased to 5.23% (+0.59 p.p.). The improvement in profitability reflected the rebalancing of the business mix towards the most profitable lines, the continuous improvement in the features of new products and the increase in interest rates.

The increase in profitability boosted the New Business Value (NBV) to reach € 1,233 million (+4.3%).

The operating result grew strongly to € 1,689 million (€ 1,442 million 1H2021). The technical margin - net of insurance expenses - improved, thanks to the more profitable business mix. The result from investments also improved, thanks to higher current income and intragroup dividends as well as lower provisions related to guarantees to policyholders in Switzerland.

P&C SEGMENT

- Premiums grew to € 14,582 million (+8.5%)

- Combined Ratio was 92.5% (+2.8 p.p.)

- Operating result rose to € 1,294 million (+3.0%)

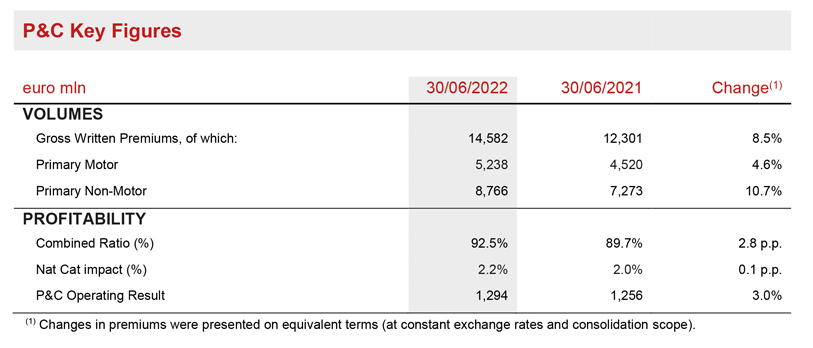

The gross written premiums in the P&C segment grew to € 14,582 million (+8.5%), thanks to the performance of both business lines6.

The non-motor line grew by 10.7%, with widespread growth across almost all the main areas where the Group operates. The motor line increased by 4.6%, particularly in Argentina (mainly as a result of inflationary adjustments), France and ACEE, which more than offset a contraction in Italy and Germany.

The premiums of Europ Assistance recovered strongly (+74.0%). In 2021, Europ Assistance was still impacted by the pandemic, especially in the travel line. The contribution from new partnerships was positive.

The Combined Ratio was 92.5% (+2.8 p.p.), mainly reflecting the higher loss ratio (+2.6 p.p.). The non- catastrophe current year loss ratio increased (+1.9 p.p.), due to both the performance of the motor line, which in the first part of 2021 still benefited from the effects of lockdown restrictions in some countries where the Group operates, and to higher large man-made claims (+0.2 p.p.). Natural catastrophe claims slightly increased (+0.1 p.p.), in the first six months of 2022 these claims reached € 271 million (€ 218 million 1H2021), including the storms that mainly impacted France, Germany and ACEE. The contribution from prior year development decreased to -2.6% (+0.7 p.p.).

The expense ratio increased to 28.7% (+0.2 p.p.), due to growth in administration costs (+0.3 p.p.). The growth in administration costs was entirely explained by the line-by-line consolidation of the Cattolica group, which has an expense ratio higher than the Group average.

There was also a particular effect on the Combined Ratio due to hyperinflation in Argentina. Without considering this country, the Combined Ratio would have been 91.9% (89.4% 1H2021).

The operating result was € 1,294 million (€ 1,256 million 1H2021). The decrease in the technical result (-15.5%) was more than offset by the improvement in the financial result (+45.1%), which benefitted from both higher current income and higher dividends from Banca Generali and private equity.

ASSET & WEALTH MANAGEMENT SEGMENT

- Asset Management operating result was € 325 million (+6.2%)

- Banca Generali group operating result was € 178 million (-17.0%) due to the reduction in performance fees

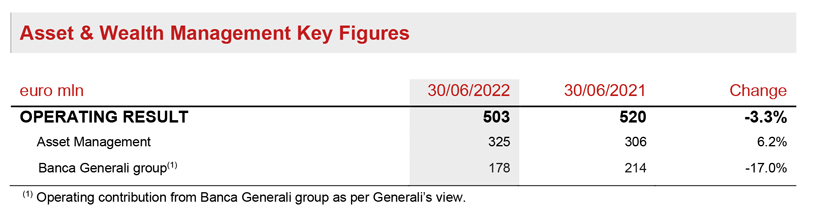

The operating result of the Asset & Wealth Management segment was € 503 million (-3.3%).

In particular, the operating result of Asset Management grew to € 325 million (+6.2%), supported by the growth of operating revenues (+7.5%) mainly from Asian companies and from higher non-recurring performance fees, booked in the first quarter.

The operating result of the Banca Generali group was € 178 million (-17.0%); the contraction reflected the movement of the financial markets in the first half of 2022, resulting in a sharp reduction in performance fees, from € 165 million at 1H2021 to € 16 million at 1H2022. Excluding the effect of performance fees and the provision of € 80 million in the first half of 2021 to protect customers, the operating result would have strongly increased. Total net inflows at Banca Generali in 1H2022 exceeded € 3 billion, confirming the strong development of volumes.

The total value of the Assets Under Management managed by the Asset Management companies was € 516.2 billion (-10.3% compared to FY2021). Third-party Assets Under Management managed by Asset Management companies stood at € 103.1 billion (-8.8% compared to FY2021). The decrease was entirely driven by the high level of volatility in the global equity markets and the rise in bond yields.

Despite this context, there were positive net inflows from third-party customers for € 2.1 billion.

HOLDING AND OTHER BUSINESSES SEGMENT

- Operating result grew to € 121 million

- Positive contribution from the real estate business

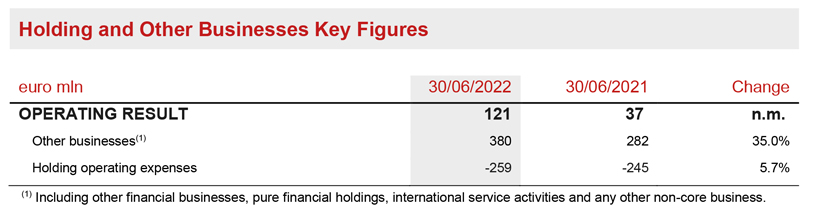

The operating result of the Holding and other businesses segment rose to € 121 million (€ 37 million 1H2021)7.

The contribution from other businesses was positive, mainly due to the improvement of the real estate business result - also thanks to some positive non-recurring effects in 2022 - which in 2021 was still negatively impacted by pandemic restrictions. Holding operating expenses increased by 5.7%, mainly due to the increase in costs related to personnel and projects for the implementation of new strategic initiatives.

BALANCE SHEET AND CAPITAL POSITION

- Extremely solid capital position with the Solvency Ratio at 233% (227% FY2021)

- Normalised capital generation stood at 2.0 billion

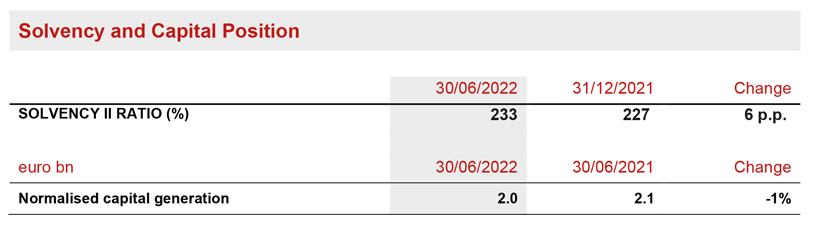

The Solvency Ratio stood at 233% (227% at FY2021). The increase of 6 p.p. was mainly driven by the solid contribution from normalised capital generation and by the positive market variances (where the rise in interest rates compensated the fall in equity markets, the widening of spreads and the rise in volatility and inflation). These positive effects have more than offset the negative impacts deriving from the regulatory changes in the first quarter, M&A transactions, the dividend provision for the period and the share buyback programme.

The normalised capital generation was confirmed at a very solid level at € 2.0 billion, mainly thanks to the further growth of the Life new business value and the robust contribution from the P&C segment.

OUTLOOK

In the first half of 2022, markets were dominated by three factors: the war in Ukraine, which also led to a substantial increase in energy and commodity prices; inflation and recession fears; and the tightening of monetary policies by central banks.

Consequently, the global insurance sector may be affected by uncertainty due to an economic slowdown, that may become recession, an increase in inflation and the risks of escalation following the Russian invasion of Ukraine, as well as to the spread of new variants of Coronavirus.

In this context, the Group confirms and continues with its strategy to rebalance the Life portfolio to further increase its profitability, with more efficient capital allocation, also as interest rates continue to rise. Simplification and innovation will continue to be key, with the introduction of a range of modular product solutions, designed for the specific requirements and new needs of customers, and marketed through the most suitable, efficient and modern distribution channels. In the P&C segment, the Group’s objective for the mature insurance markets in which it operates is to maximise profitable growth, above all in the non-motor line, and, in parallel, gain ground in high growth potential markets by expanding its presence and offer. Furthermore, in a context impacted by rising inflation and expected increases in claims management costs, the Group plans further pricing adjustments, in addition to those already undertaken. In the Asset & Wealth Management segment, on the one hand, Asset Management activities identified for the new plan will continue, with the aim of extending the product catalogue, in particular for real assets & private assets, and enhancing distribution competences; on the other hand, the Banca Generali group will be focused on the targets for size, profitability and shareholders’ remuneration defined in its strategic plan announced in February. With reference to the investment policy, the Group confirms an asset allocation aimed at ensuring consistency with liabilities to policyholders and consolidating current returns, as well as investments in private and real assets in order to contribute to portfolio diversification and return.

Despite an evolving macroeconomic scenario, thanks to the business actions taken to recover and maintain profitability and to the strategic initiatives launched, the Group confirms its commitment to pursue sustainable growth, enhance its earnings profile and lead innovation in order to achieve a compound annual growth rate in earnings per share8 between 6% and 8% in the period 2021-2024, to generate net holding cash flow9 exceeding € 8.5 billion in the period 2022-2024 and to distribute a cumulative dividend10 to shareholders for an amount between € 5.2 billion and € 5.6 billion in the period 2022-2024, with a ratchet policy on dividend per share.

***

SIGNIFICANT EVENTS AFTER 30 JUNE 2022

As of 1 July 2022, Europ Assistance withdrew from its operations in Russia.

Other significant events that occurred following the end of the period are available in the 2022 Consolidated Half- Year Financial Report. The Report also contains the Glossar

***

Q&A CONFERENCE CALL

The Group CEO, Philippe Donnet and Group CFO, Cristiano Borean, will host the Q&A session conference call for the consolidated results of the Generali Group as of 30 June 2022, which will be held on 2 August 2022, at 12.00 pm CEST.

To follow the conference call, in a listen only mode, please dial +39 02 802 09 27.

***

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

FURTHER INFORMATION BY SEGMENT

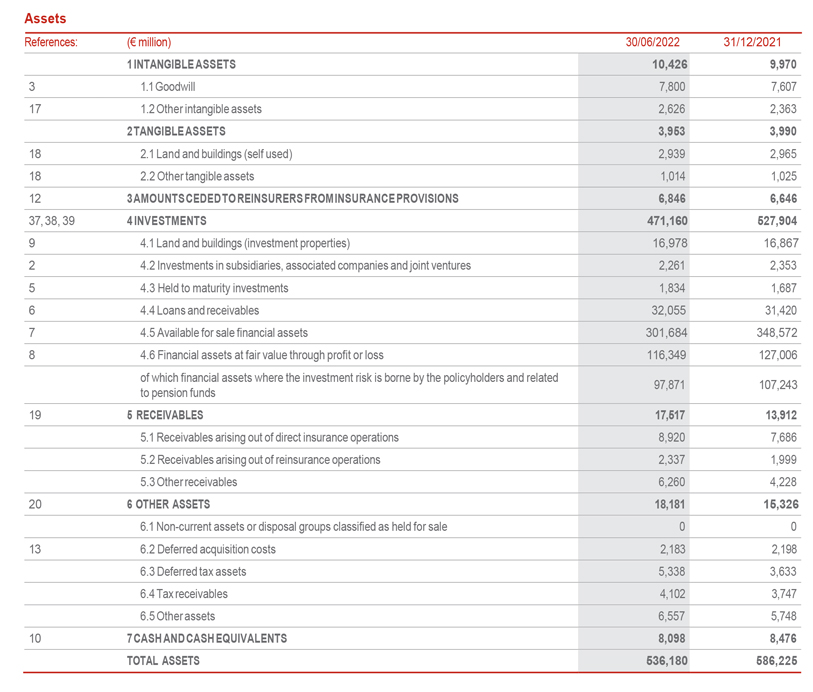

BALANCE SHEET11

INCOME STATEMENT

1Changes in premiums, Life net inflows and new business were presented on equivalent terms (at constant exchange rates and consolidation scope); as a result, the contribution of the Cattolica group was neutralised in the calculation for changes on equivalent terms. Changes in the operating result, general account investments and Life technical provisions excluded any assets under disposal or disposed of during the same period of comparison; as a result, they considered the contribution from the Cattolica group in percentage changes.

The amounts were rounded at the first decimal point and the amounts may not add up to the rounded total in all cases. The percentage presented can be affected by the rounding.

2The first half of 2021 benefited from the real estate transaction for Libeskind Tower in CityLife, Milan for € 67 million.

3Including premiums from investment contracts equal to € 790 million (€ 802 million 1H2021).

4The contribution of the Cattolica group was € 1,332 million.

5The contribution of the Cattolica group was € 275 million, almost entirely deriving from bancassurance agreements.

6Without considering the contribution of Argentina, a country impacted by a context of hyperinflation, the total premiums for the segment would have increased by 7.4%.

7As from 1Q2022, this segment excludes the contribution of the Banca Generali group, which is now included in the Asset & Wealth Management segment.

83 year CAGR; adjusted for impact of gains and losses related to acquisitions and disposals. Target based on current IFRS accounting standards.

9Net holding cash flow and dividend expressed in cash view.

10Subject to regulatory recommendations.

11With regard to the financial statements envisaged by law, note that the statutory audit on the data has not been completed. The Group will publish the final version of the Consolidated Half-Yearly Financial Report 2022 in accordance with prevailing law, also including the Independent Auditor’s Report.