Financial Information as of 30 September 2021(1)

11 November 2021 - 07:32 price sensitive

Generali confirms that it is fully on track to successfully complete the ‘Generali 2021’ strategic plan. Excellent profitability, with strong growth in premiums, operating and net results. Extremely solid capital position

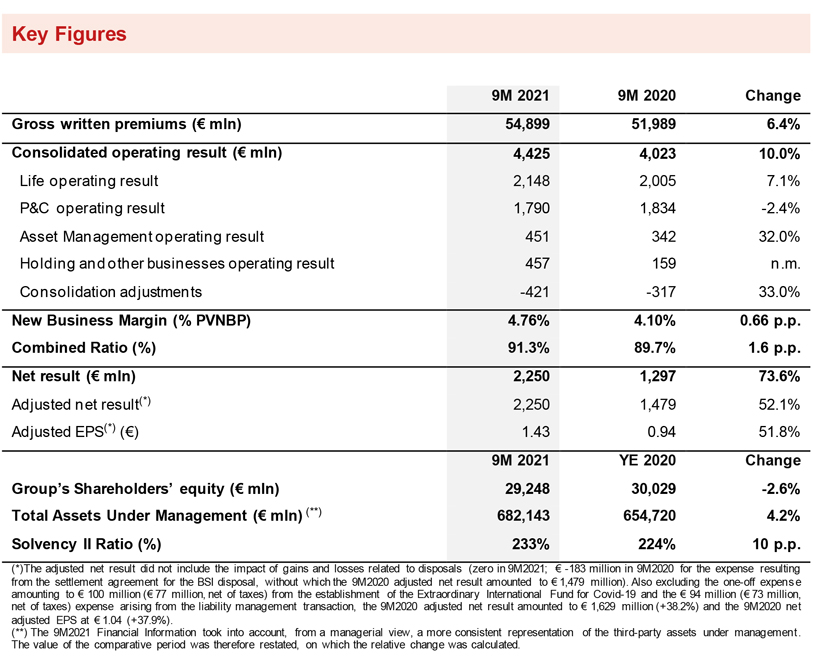

- Strong increase in the operating result to € 4.4 billion (+10%), thanks to the positive performance of the Life, Asset Management and Holding and other businesses segments. Resilient contribution from the P&C segment, despite the higher impact of natural catastrophe claims

- Gross written premiums increased to € 54.9 billion (+6.4%), supported by both the Life segment (+6.5%) and the P&C segment (+6.2%). Life net inflows grew to € 9.5 billion (+3%), entirely focusedon the unit-linked and protection lines. The Combined Ratio was 91.3% (+1.6 p.p.) and the New Business Margin was excellent at 4.76% (+0.66 p.p.)

- Net result rose by 74% to reach € 2,250 million (€ 1,297 million 9M2020)2

- Solvency Ratio was extremely solid at 233% (224% FY2020)

Generali Group CFO Cristiano Borean commented: "The results for the first nine months confirm the Group's excellent performance, technical profitability and solid trends across all businesses with one of the highest Solvency Ratios in the sector. Life net inflows, entirely focused on the unit-linked and protection lines of business, continue to rise, while the P&C segment remains resilient, despite the higher impact of natural catastrophe claims. The results of the Asset Management segment continue to grow, also thanks to our multi-boutique strategy. These results, which are fully in line with the successful completion of the ‘Generali 2021’ strategic plan, represent a solid foundation for the new three-year plan we will present to the market on 15 December."

EXECUTIVE SUMMARY

Milan - At a meeting chaired by Gabriele Galateri di Genola, the Board of Directors of Assicurazioni Generali approved the Financial Information at 30 September 20213.

The Group's operating result stood at € 4,425 million (+10%), benefiting from the positive performance of the Life, Asset Management and the Holding and other businesses segments. The P&C segment made a resilient contribution, despite the higher impact of natural catastrophe claims.

The Life segment continued to deliver excellent technical profitability, with the New Business Margin at 4.76% (4.10% 9M2020). The Combined Ratio stood at 91.3% (+1.6 p.p.).

The operating result of the Asset Management segment rose to € 451 million (+32%), mainly boosted by the growth in operating revenues, also thanks to the overall rise in assets under management. The operating result of the Holding and other businesses segment continued to grow, thanks to the results of Banca Generali and the significant contribution of private equity.

The Group's non-operating result amounted to € -731 million (€ -1,360 million 9M2020). The significant improvement was mainly thanks to the lower impairments on available for sale investments - which were particularly affected in 2020 by the impact of the pandemic on financial markets - and the increase in realised gains, driven by real estate, especially € 67 million for the Libeskind Tower transaction in CityLife, Milan and € 80 million for the Saint Gobain’s Tower transaction in Paris. The 9M2020 non-operating result was mainly impacted by the € 93 million impairment on goodwill related to the Life business in Switzerland, by the € 94 million expense arising from the liability management transaction and by the € 100 million one-off expense for the Extraordinary International Fund for Covid-19. The impact of interest expenses on financial debt improved, as a result of the debt optimisation strategy.

The net result increased by 74% to reach € 2,250 million (€ 1,297 million 9M2020), thanks to the increase in the operating result and to the non-operating performance, mentioned above.

The Group's gross written premiums amounted to € 54,899 million, increasing by 6.4%4, thanks to the growth in both the Life and P&C segments. Life net inflows grew to € 9.5 billion (+3%4), entirely due to the trend in the unit-linked and protection lines of business. Life technical provisions were € 397.5 billion (+3.3% compared to 31 December 2020; +4.5% excluding the effect from the deconsolidation of a pension fund in central and eastern European countries).

The Group's Total Assets Under Management rose to € 682.1 billion, up 4.2% compared to year-end 20205.

The Group's shareholders' equity was € 29,248 million (-2.6% compared to 31 December 2020). The change was due to a € 1,067 million decrease in the AFS reserves, deriving mainly from the performance of government bonds, and due to the deduction of the entire dividend approved for a total of € 2,315 million, of which € 1,591 million related to the 2020 dividend, paid on 26 May 20216.

The Group confirmed its excellent capital position with the Solvency Ratio at 233% (224% FY2020). The increase of 10 p.p. was mainly driven by the solid contribution of the normalised capital generation, net of the dividend for the period calculated on a pro rata basis compared to the dividend of the previous year7, and by market variances, favoured by the recovery of interest rates, the narrowing of spreads on Italian and other European government bonds and the upswing in the equity market.

LIFE SEGMENT

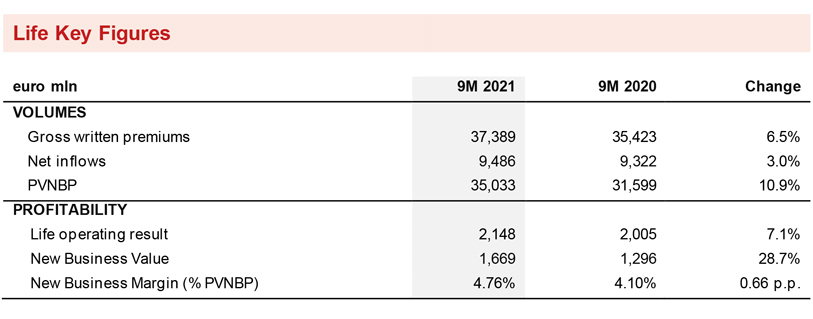

- Life net inf lows were up to € 9.5 billion (+3%)

- The New Business Margin was excellent at 4.76% (+0.66 p.p.); the New Business Value (NBV) rose to € 1,669 million (+28.7%)

- The operating result was € 2,148 million (+7.1%)

Life net inflows stood at € 9.5 billion (+3%; +23% excluding the collective pension fund in Italy mentioned above) thanks to the increase in the unit-linked line (+18%), driven above all by the development in France, and in the protection line (+8.9%), by virtue of the trends observed in France and Asia. In line with the Group’s strategy, net inflows were entirely focused on the unit-linked and protection lines, whereas net inflows of the savings and pension line amounted to € -476 million (€ 619 million 9M2020).

Gross written premiums amounted to € 37,389 million, increasing by 6.5% (+11.3% excluding the cited fund). The unit-linked line grew significantly (+17.5%), particularly in France and, to a lesser extent, in Germany. Improvements were also seen in the protection line (+5.4%), mainly in Asia and Italy, and the savings and pension line (+2.2%), above all in France and Asia.

New business (expressed in terms of PVNBP - present value of new business premiums) stood at € 35,033 million, up 10.9% compared to the first nine months of 2020, which had been impacted by the pandemic, but sustained by the premiums from the collective pension fund in Italy. Excluding this fund, new business would have risen by 20.7%. The increase mainly reflected the excellent growth in unit-linked products (+13.9%, +48.7% excluding the cited fund), especially in Italy and France, and the solid growth in protection products (+18.8%), thanks to a significant contribution from Germany. The growth in traditional savings products was more contained, but still positive (+5.2%).

Despite less favourable financial assumptions, the New Business Margin on PVNBP came to 4.76% (4.10% 9M2020), posting an increase of 0.66 p.p. (+0.46 p.p. excluding the cited fund), thanks to the rebalancing of the business mix towards more profitable lines of business and the continuous improvement in the features of new products.

The positive trends in production and profitability boosted the New Business Value (NBV) to € 1,669 million, a significant improvement compared to the first nine months of 2020 (+28.7%, +33.5% excluding the cited fund).

The operating result rose to € 2,148 million (€ 2,005 million 9M2020). The net investment result improved compared to the first nine months of 2020, which had been impacted by the negative performance of financial markets and the acceleration of provisions for guarantees to policyholders in Switzerland.

The technical margin was up (+7.1%), thanks to the growth in unit-linked and protection products. Insurance expenses increased in the acquisition component (+9.5%). The technical margin, net of insurance expenses, was stable.

The technical margin was estimated8 to be impacted by € -93 million as a result of the Covid-19 pandemic, in particular for higher claims in the protection line, mainly in ACEER, the Parent Company and Americas and Southern Europe.

P&C SEGMENT

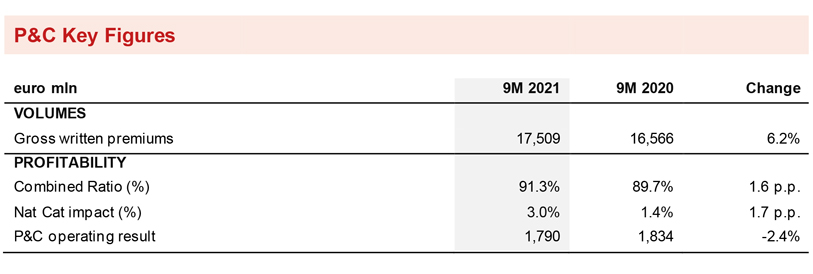

- Premiums rose to € 17,509 million (+6.2%)

- The Combined Ratio stood at 91.3% (+1.6 p.p.)

- The operating result was resilient at € 1,790 million (-2.4%)

Gross written premiums in the P&C segment amounted to € 17,509 million (+6.2%), boosted by the performance of both lines of business, where widespread growth was observed in almost all of the Group's main areas of operation.

The motor line rose by 4.8%, particularly in ACEER, Argentina (also following adjustments for inflation), France and Italy. The performance of the non-motor line also improved (+6.2%), above all in Italy and France.

The premiums of Europ Assistance, which were impacted by the pandemic in 2020, especially the travel business, continued to rise (+10.7%).

The operating result of the P&C segment confirmed its excellent contribution, and stood at € 1,790 million (-2.4%). The fall in the technical result (-12.9%), which reflected the trend of the Combined Ratio, was partly offset by the improvement in the investment result (+13.3%), which also benefited from higher dividend income from private equity.

The Combined Ratio was 91.3% (+1.6 p.p.). The worsening was mainly due to the rise in the natural catastrophe loss ratio (+1.7 p.p.) throughout all of the Group's areas of operation. More specifically, natural catastrophe claims totalled € 486 million (€ 213 million 9M2020), including claims for storms that hit Spain in January and continental Europe in the summer, as well as floods that mainly affected Germany in July. The non-catastrophe current year loss ratio rose slightly, mostly in the motor line, compared to the first nine months of 2020, which had benefitted from the lockdown effects, and it was partly offset by a lower impact from large man-made claims. The contribution from prior years grew, standing at -4.2% (-1 p.p.). The expense ratio increased to 27.8% (+0.3 p.p.), showing a rise in the acquisition costs component (+0.4 p.p.), which mainly reflected the trend in the motor line, as a result of the growth in higher commission coverage, particularly in Italy, and of the increase in expenses resulting from the development and support of business in ACEER.

The Group estimated9 its Combined Ratio excluding Covid-19 impacts to be 92.8%.

ASSET MANAGEMENT SEGMENT

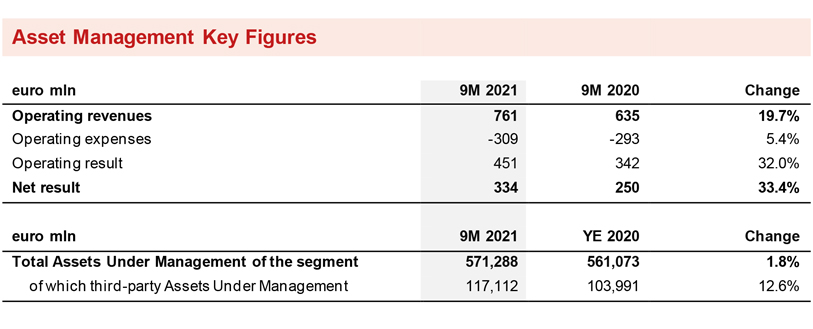

- The operating result of the segment rose to € 451 million (+32%), reflecting the growth in revenues

- The net result of the segment was € 334 million (+33.4%)

The operating result of the Asset Management segment reached € 451 million (+32%), mainly boosted by the operating revenues, which rose to € 761 million (+19.7%), also thanks to the overall increase in assets under management.

The net result of the Asset Management segment stood at € 334 million (+33.4%).

The value of Assets Under Management of the segment was € 571.3 billion (+1.8%).

Mainly thanks to the positive contribution of net inflows, third-party Assets Under Management of the segment rose from € 104 billion at year-end 2020 to € 117.1 billion, of which € 7.8 billion derived from the agreements entered into with Cattolica Assicurazioni in 202010.

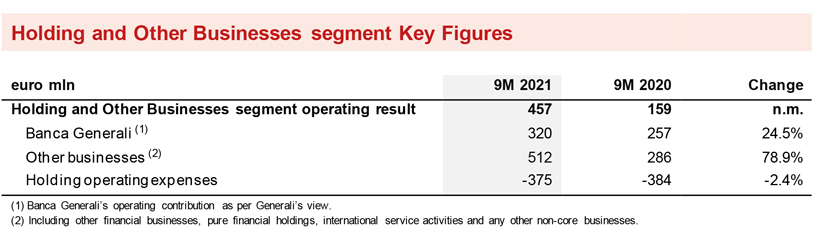

HOLDING AND OTHER BUSINESSES SEGMENT

- The operating result increased to € 457 million

- Banca Generali’s result rose by 24,5%

- Significant contribution of private equity

The operating result of the Holding and other businesses segment reached € 457 million (€ 159 million 9M2020). In particular, Banca Generali’s result rose to € 320 million (+24.5%), also thanks to the development of performance fees, which was partly offset by the provision of € 80 million11 in the second quarter, in order to protect customers.

Other businesses in the segment also provided a positive contribution, entirely driven by the results of private equity.

Holding operating expenses amounted to € -375 million (-2.4%), reflecting the reduction in expenses especially in the Parent Company and Asset & Wealth Management.

OUTLOOK

Even though there continues to be uncertainty as to the development of further variants of Covid-19, the current scenario, thanks to extensive vaccinations, foresees a recovery of the global economy, sustained by expansive monetary and fiscal policies, although this support is expected to gradually slow down. The global insurance sector, both Life and P&C, will benefit from the positive macroeconomic scenario.

In this context, the Group confirms and continues with its strategy to rebalance the Life portfolio to further increase its profitability and with a more efficient capital allocation. In the P&C segment, Generali’s objective in the mature insurance markets in which the Group operates is to maintain the positive trend of premiums accompanied by excellent profitability, despite the higher impact of natural catastrophe claims, and, at the same time, to gain ground in high potential markets, by expanding its presence and offer.

With regard to the Asset Management segment, actions will continue in 2021 to develop expansion into private equity and real assets, where Generali can leverage its capacity and commitment to sustaining the economic recovery, which will be accompanied by an extension of the product catalogue in terms of high convictions and multi-asset products for customers and partners, and of distribution capacity.

By leveraging all of these initiatives and in light of the results achieved in the first nine months of 2021, the Group confirms its target of annual compound growth in 2018-2021 of earnings per share of between 6% and 8%. In addition, the 2021 RoE is expected to be higher than 11.5%. The cumulative dividend target for 2019-2021 of between € 4.5 and € 5 billion has been achieved with the recent second tranche payment of the 2019 dividend.

SIGNIFICANT EVENTS AFTER 30 SEPTEMBER 2021

The Board of Directors of Assicurazioni Generali verified - as anticipated at the Annual General Meeting held on 29 April 2021 - the actual absence, as at 1 October 2021, of impeding supervisory provisions or recommendations regarding the payment of the second tranche of the 2019 dividend, which has been paid as from 20 October 2021. The shares have been traded ex-dividend as from18 October 2021, with the date of entitlement to receive the dividend on 19 October 2021.

Concerning the public voluntary tender offer on all the ordinary shares of Società Cattolica di Assicurazione, completed on 5 November 2021, Assicurazioni Generali holdsa 84.475% stake of the issuer's share capital12.

The successful completion of this tender offer is fully aligned with the ‘Generali 2021’ strategy, and reaffirms the Group’s rigorous and disciplined approach to M&A. The transaction will allow Generali to continue to diversify its business, notably within the P&C segment, to confirm the Group’s commitment to deliver profitable growth and create value for customers, consistent with Generali’s Lifetime Partner ambition.

***

The glossary and the description of alternative performance indicators are available in the Annual Integrated Report and Consolidated Financial Statements 2020.

***

Q&A CONFERENCE CALL

The Group CFO, Cristiano Borean, will participate to the Q&A session conference call for the Financial Information at 30 September 2021, which will take place on 11 November 2021 at 12:00 CET.

To follow the conference call, in a listen only mode, please dial +39 02 802 09 27.

***

On 15 December 2021, the Group CEO and the management team will meet the financial community during the digital Investor Day to illustrate the new strategic plan for the three-year period 2022-2024.

***

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

1 Changes in premiums, Life net inflows and new business were presented in equivalent terms (at constant exchange rates and consolidation scope). Changes in the operating result, own investments and Life technical provisions excluded any assets under disposal or disposed of during the same period of comparison.

2 The adjusted net result - defined as the net result without the impact of gains and losses related to disposals -was equal to the net result of the period, since the latter was not impacted by gains and losses related to disposals The 9M2020 adjusted net result amounted to € 1,479 million, which neutralised € 183 million resulting from the settlement agreement for the BSI disposal. In addition, excluding the one-off expense amounting to € 100 million (€ 77 million, net of taxes) from the establishment of the Extraordinary International Fund for Covid-19 and the € 94 million (€ 73 million, net of taxes) expense arising from the liability management transaction, the 9M2020 adjusted net result amounted to € 1,629 million.

3 The Financial Information at 30 September 2021 is not an Interim Financial Report according to the IAS 34 principle.

4 In June 2020, in Italy Generali was awarded the management mandate for two investment segments of Cometa, the National Supplementary Pension Fund for employees in the engineering, system installation and similar industries and for employees in the gold and silver industries. Excluding the effect of the aforementioned pension fund, total premiums would have increased by 9.6%. In the Life segment, premiums would have increased by 11.3% and net inflows by 23%.

5 The 9M2021 Financial Information took into account, from a managerial view, a more consistent representation of the third-party assets under management. The value of the comparative period was therefore restated, on which the relative change was calculated.

6 See ‘Significant events after 30 September 2021’ as for the payment of the second tranche of the 2019 dividend, equal to € 0.46.

7 The 2020 dividend per share amounted to € 1.01.

8 For more information on the methods used to determine the quantitative impacts, see the section ‘Disclosure on the quantitative impacts of Covid-19 on the Group’ in the Annual Integrated Report and Consolidated Financial Statements 2020.

9 For more information on the methods used to determine the quantitative impacts, see the section ‘Disclosure on the quantitative impacts of Covid-19 on the Group in the Annual Integrated Report and Consolidated Financial Statements 2020.

10 For more details on the public tender offer forCattolica Assicurazioni, see ‘Significant events after 30 September 2021’.

11 This amount, net of taxes and minorities, was equal to € 28 million.

12 Further details are available on the Group’s website.