Financial Information as of 31 March 2020 – Press Release (1)

21 May 2020 - 07:30 price sensitive

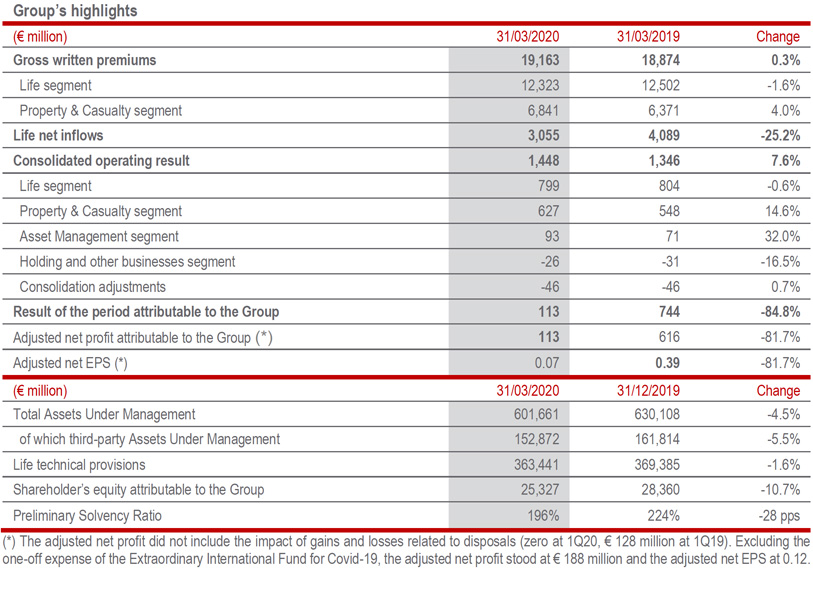

Solid profitability of the business confirmed with the operating result increasing to € 1,448 million (+7.6%). The capital position remained solid. Net profit affected by impairments on investments

- The operating result amounted to € 1,448 million thanks to the contribution from the P&C and Asset Management segments, that also included the recent acquisitions, as well as from the Holding and other businesses segment. P&C technical profitability improved, with the combined ratio at 89.5% (-2.0 pps); the profitability of new Life business remained high at 4.04% (-0.35 pps); revenues from Asset Management continued to increase;

- Total gross written premiums stood at € 19.2 billion (+0.3%), with a positive development from the P&C segment (+4.0%). In the Life segment, net inflows amounted to € 3.1 billion (-25.2%) and technical provisions stood at € 363.4 billion (-1.6%), due to the current financial markets performance;

- Solid Group’s capital position with a Preliminary Solvency Ratio at 196%;

- The Group’s net profit stood at € 113 million (€ 744 million at 1Q19) and was affected by € 655 million in net impairments on investments, due to the impact of Covid-19 on financial markets, and the contribution of € 100 million2 allocated by the Group to the Extraordinary International Fund for the pandemic emergency. There was no contribution from disposals compared to a gain of € 128 million in the first quarter of 2019.

Generali Group CFO, Cristiano Borean, commented: “In one of the most difficult and uncertain periods in recent decades, with the Covid-19 emergency and its consequent strong macroeconomic and financial impact, our business model has ensured the Group’s operating continuity and has allowed us to maintain our role as Life-time Partner to our customers. This is also the result of the ever increasing digitalisation of our processes and products, a multi-channel distribution network that leverages a global agent network, and international diversification. The first three months of the year showed a good operating performance and confirmed the Group’s solid capital position. Net profit was affected by impairments due to the current financial markets performance as result of the global pandemic.”

Turin - At a meeting chaired by Gabriele Galateri di Genola, the Board of Directors of Assicurazioni Generali approved the Financial Information at 31 March 20203.

Premiums, New Business and Volumes

- The Group’s gross written premiums showed a slight increase compared to the previous year (+0.3%), reaching € 19,163 million, thanks to the growth in the P&C segment which offset the decline in the Life segment. The 1.6% decrease in Life premiums reflected a decline in savings and pension products (-13.2%) posted mainly in Italy, France and Asia. The growth in unit-linked products was significant (+20.9%) across the markets in which the Group operates, particularly in France and Italy. The development of the protection business was positive (+0.7%). The combined effect of the decrease in premiums and increase in payments, particularly surrenders, led to a decline in net inflows which stood at € 3.1 billion (-25.2%), especially in Italy, France and Asia. P&C premiums increased (+4.0%) thanks to the positive trend of both business lines. There was a 1.7% increase in the motor line, mainly thanks to growth in Austria, CEE and Russia (ACEER), France as well as the Americas and Southern Europe. The non-motor line also grew (+5.3%), reflecting the positive trends observed across the Group’s various areas of operations, particularly in Italy, ACEER, France, Spain and in the branches abroad.

- New business in terms of PVNBP (present value of new business premiums) stood at € 10,996 million, up 2.4%. The increase was due to the growth in unit-linked products (+18.6%) and protection products (+13.8%), which offset the decline in traditional savings and pension products. Despite the less favourable financial assumptions, the new business margin on PVNBP stood at 4.04%, showing a slight decrease (-0.35 pps) due to a more favourable business mix, continuous improvement in the features of new products and further recalibration of financial guarantees. As a result, the New Business Value (NBV) was € 444 million (-5.9%).

- Total4 third-party Assets Under Management decreased to € 152,872 million (-5.5%), reflecting current financial market conditions as well as the outflows from certain portfolios recorded in the first quarter.

- Life technical provisions decreased to € 363,441 million (-1.6%), reflecting in particular the decline in the unit-linked component (-11.1%) resulting from the performance of the financial markets in the reporting period.

Economic Performance

- The operating result reached € 1,448 million, up 7.6%.

The P&C operating result increased (+14.6%), driven by the technical performance, which more than offset the decline in the investment result, and by the positive contribution from the recent acquisition of Seguradoras Unidas in Portugal (€ 34 million). The combined ratio improved to 89.5%, -2.0 pps compared to 1Q19, driven by the improvement in the non-catastrophe current year loss ratio posted in both business lines, especially in the motor line. The expense ratio also improved, particularly the administration cost ratio. Natural catastrophe claims in the first quarter amounted to approximately € 93 million, equal to 1.7 pps on the combined ratio (0.9 pps 1Q19).

The Life operating result was stable (-0.6%), with a good performance of the technical margin, net of insurance operating expenses, being offset by the decline in the net investment result due to the negative impact of financial markets in the reporting period.

The operating result of the Asset Management segment grew (+32%), mainly thanks to an increase in operating revenues which amounted to € 195 million and, compared to the first quarter last year, benefited from the consolidation of the revenues from the new boutiques. The operating result of this segment would have increased by 24.0% at constant scope.

The operating result of the Holding and other businesses segment also improved thanks to the better result coming from Banca Generali. - The Group’s net profit stood at € 113 million (€ 744 million 1Q19). The decrease mainly reflected:

- € 655 million in operating and non-operating significant impairments on available for sale financial assets, following the application of accounting standard rules5, which resulted from the impact of the Covid-19 pandemic on financial markets. These impairments, mainly non-deductible, led to a higher tax rate, which rose from 30.6% to 61.2%;

- the non-operating expense amounting to € 1006 million from the establishment of the Extraordinary International Fund launched by the Group to assist in the Covid-19 emergency;

- the lower result from discontinued operations, zero in 2020, which was € 123 million in the first quarter of last year.

The adjusted net profit stood at € 113 million, compared to € 616 million at 1Q19. Excluding the one-off expense of the Extraordinary International Fund for Covid-19, the adjusted net profit stood at € 188 million. - The net profit of the Asset Management segment grew to € 66 million (+26.5%). It would have increased by 20.5% at constant scope.

- The P&L return on investments was 0.09% (0.75% 1Q19), reflecting lower current income and impairments.

Balance Sheet and Capital Position

- The Group shareholders’ equity was € 25,327 million (€ 28,360 million FY19). The decrease of 10.7% was mainly due to the decline in the reserve for unrealized gains and losses on available for sale financial assets reflecting the value of bonds and IFUs.

- The Preliminary Solvency Ratio - which represents the regulatory view of the Group’s capital and is based on the use of the internal model, solely for companies that have obtained the related approval from IVASS, and on the standard formula for other companies - stood at 196% (224% at FY19; -28 pps).

The solid normalised capital generation, net of the accrued dividend (calculated on a pro rata basis compared to the dividend of the previous year), only partially offset negative market variances due to the Covid-19 pandemic (-23 pps) and the effects (-7.4 pps aggregated) of the regulatory changes (EIOPA change on the Ultimate Forward Rate and the treatment of the IRP business in France) and of the closing of the Seguradoras Unidas and AdvanceCare acquisition in Portugal.

The unprecedented Covid-19 pandemic has a significant impact on the macroeconomic environment worldwide, both at present and into the near future. At the current time it is too early to measure the overall effect on the global insurance sector. The Generali Group, thanks to its business mix and diversification, expects its operating result to be resilient in 2020, albeit with a likely decrease compared to 2019.

From an operational standpoint, the macroeconomic consequences of Covid-19 will affect the Group’s top- line evolution, particularly in travel insurance. The recurring financial revenues (from dividends, rental income and fee income) will also be adversely impacted.

With regards to claims experience, it is as of yet difficult to provide precise guidance on the impact of Covid- 19. Overall, Generali can rely on a favourable business mix and robust standard policy terms.

Generali is working to significantly reduce costs in order to mitigate the impact of the foreseen reduction in revenues.

At the same time, in line with its ambition to be Life-time Partner and with its commitment to sustainability, the Group is proud to implement a series of measures to support its employees, clients, distributors and communities. While these measures will have an impact on our cost base and results in the short term, the wellbeing and security of our stakeholders are an investment in our future together.

Awaiting greater clarity on the global economic situation, Generali estimates that the financial markets’ weakness and the consequences of the outbreak will adversely impact its 2020 net result, mostly due to impairments.

Initiatives for the Covid-19 emergency

On 12 March, the Board of Directors of Generali established an Extraordinary International Fund of € 100 million to assist in the Covid-19 emergency and to support economic recovery efforts in the countries where the Group operates. The Fund also benefited from contributions from the Group’s employees. It helped with the health emergency in Italy according to the priorities agreed with the Italian National Health System and the Italian Civil Protection as well as with initiatives for customers, SMEs and their employees across the markets in which the Group operates.

In addition, the members of the Group Management Committee and other managers with strategic responsibilities decided voluntarily to reduce their fixed compensation by 20% starting in April 2020 and until year end, further increasing the Fund.

For further significant events that occurred during and after the period ended 31 March 2020, please refer to the press releases available at www.generali.com.

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

On the basis of the information provided by the members of the Board of Statutory Auditors and of that available to the Company, the Board of Directors ascertained that professionalism, respectability and independence requirements laid down by law and applicable legislation are met by each member of the Board of Statutory Auditors and verified as well as the absence of any grounds for incompatibility or disqualification. The Board of Directors also took note, on the basis of the information provided by the Board of Statutory Auditors, that the the members of such corporate body meet the independence requirements laid down by the Corporate Governance Code.

The glossary and the description of alternative performance measures are available in the 2019 Annual Integrated Report and Consolidated Financial Statements of the Group.

1Changes in premiums, Life net inflows and PVNBP (present value of new business premiums) were presented in equivalent terms (at constant exchange rates and consolidation scope). Changes in the operating result, own investments and Life technical provisions excluded assets disposed of during the same period of comparison.

2This amount, after taxes, was € 75 million.

3The Financial Information at 31 March 2020 is not an Interim Financial Report according to the IAS 34 principle.

4Including also assets managed by Banca Generali and pension funds.

5The Financial Information at 31 March 2020 is not an Interim Financial Report according to the IAS 34 principle. Therefore, these impairments do not reflect a permanent change in the carrying value of these investments, which will be determined on 30 June, based on the asset values at that time.

6This amount, after taxes, was € 75 million.