Generali announces non-binding indicative results of the buyback of three series of subordinated notes with first call dates in 2022

23 September 2019 - 09:45

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION TO ANY PERSON LOCATED OR RESIDENT IN THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES AND THE DISTRICT OF COLUMBIA OR TO ANY U.S. PERSON (AS DEFINED IN REGULATION S OF THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED) OR IN OR INTO OR TO ANY PERSON LOCATED AND RESIDENT IN ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THE TENDER OFFER MEMORANDUM.

Trieste –Assicurazioni Generali S.p.A. (Generali or the Offeror) announces today the nonbinding, indicative results of the cash buyback offer, launched on 16 September 2019, on three series of subordinated notes with first call dates in 2022 described below.

The buyback offer expired on Friday 20th September 2019 at 5.00 p.m. (CEST).

DETAILS OF THE NON-BINDING INDICATIVE RESULTS

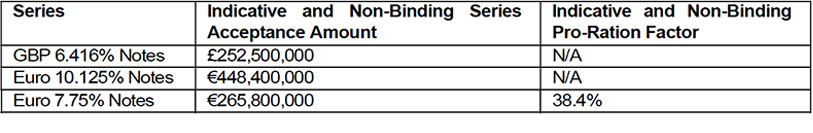

As at the Invitation Expiration, the Offeror has received valid tenders for purchase of: (i) £252,500,000 in aggregate nominal amount of the GBP 6.416% Notes; (ii) €448,400,000 in aggregate nominal amount of the Euro 10.125% Notes; and (iii) €780,000,000 in aggregate nominal amount of the Euro 7.75% Notes.

Subject to confirmation by the Offeror (in its sole and absolute discretion) in its announcement of final results, the Offeror expects that each Series Acceptance Amount will be set approximately as follows:

Final pricing for each Series of Notes will take place at or around 2.00 p.m. (CEST) today. As soon as practicable following the Pricing Time on the Pricing Date, the Offeror will announce whether it will accept valid tenders of Notes of each Series and, if so, the Final Acceptance Amount, each Reference Benchmark Rate, each Purchase Yield, the FX Rate (in respect of the GBP 6.416% Notes), the Purchase Price for each Series of Notes, each Series Acceptance Amount and Pro-Ration Factor(s), if any.

The purchase by the Offeror of any Notes pursuant to the Invitation is conditional upon the successful completion (in the sole determination of the Offeror) of the New Notes Offering on terms satisfactory to the Offeror (in its sole discretion) (the New Issue Condition).

The indicative Pro-Ration Factors set out above have been determined based on a New Notes issuance size of €750,000,000 in aggregate principal amount. The final size of the New Notes Offering together with the other pricing details will however depend on the final execution of the New Notes Offering which will determine the definitive results of the Invitation to be announced by the Offeror following pricing of the New Notes.

The Settlement Date of the Invitation is expected to be 1 October 2019. On settlement, subject to satisfaction or waiver of the New Issue Condition, the Offeror will pay to Holders whose Offers have been accepted the Purchase Price Consideration and Accrued Interest Amount in respect of the Notes accepted for purchase by the Offeror.

The Invitation was made on the terms and subject to the conditions set out in the memorandum dated 16 September 2019 (the Tender Offer Memorandum). Capitalised terms used in this announcement but not defined have the meanings given to them in the Tender Offer Memorandum.

Structuring Advisers and Dealer Managers of the Invitation

Deutsche Bank AG, London Branch

Winchester House

1 Great Winchester Street

London EC2N 2DB

United Kingdom

Attention: Liability Management Group

Tel: +44 20 7545 8011

Merrill Lynch International

2 King Edward Street

London EC1A 1HQ

United Kingdom

Attention: Liability Management Group

Email: DG.LM_EMEA@baml.com

Tel: +44 207 996 5420

Dealer Managers

Banco Bilbao Vizcaya Argentaria S.A.

44th Floor, One Canada Square

London E14 5AA

United Kingdom

Attention: Liability Management Group

Tel: +44 (0)20 7648 7516

Email: liabilitymanagement@bbva.com

Crédit Agricole Corporate and Investment Bank

12 place des Etats-Unis

CS 70052

92 547 Montrouge Cedex

France

Tel: +44 (0) 207 214 5903

E-mail: liability.management@ca-cib.com

Attention: Liability Management

J.P. Morgan Securities plc

25 Bank Street

Canary Wharf

London E14 5JP

United Kingdom

Tel: +44 207 134 2468

Attention: Liability Management

Email: emea_lm@jpmorgan.com

Mediobanca – Banca di Credito Finanziario S.p.A.

Piazzetta Enrico Cuccia, 1

20121 Milan

Italy

Tel: +39 028829984

Attention: Liability Management FIG

Email: Liability_Management_FIG@mediobanca.com

Morgan Stanley & Co. International plc

Canary Wharf

London E14 4QA

United Kingdom

Tel: +44 (0)20 7677 5040

Attention: Liability Management Group

Email: liabilitymanagementeurope@morganstanley.com

Société Générale

SG House

41 Tower Hill

London EC3N 4SG

United Kingdom

Tel: +44 20 7676 7579

Attention: Liability Management

Email: liability.management@sgcib.com

Tender Agent

Lucid Issuer Services Limited

Tankerton Works

12 Argyle Walk

London WC1H 8HA

United Kingdom

Attention: Thomas Choquet / Arlind Bytyqi

Email: generali@lucid-is.com

Tel: +44 (0) 20 7704 0880

DISCLAIMER This announcement must be read in conjunction with the Tender Offer Memorandum. This announcement and the Tender Offer Memorandum contain important information which should be read carefully before any decision is made with respect to the Invitation. If you are in any doubt as to the contents of this announcement or the Tender Offer Memorandum or the action you should take, you are recommended to seek your own financial and legal advice, including as to any tax consequences, immediately from your stockbroker, bank manager, solicitor, accountant or other independent financial or legal adviser. Any individual or company whose Notes are held on its behalf by a broker, dealer, bank, custodian, trust company or other nominee or intermediary must contact such entity if it wishes to offer Notes for sale pursuant to the Invitation. None of the Dealer Managers, the Tender Agent or the Offeror makes any recommendation as to whether Holders should offer Notes for sale pursuant to the Invitation.

Any investment decision to purchase any New Notes should be made solely on the basis of the information contained in the base prospectus relating to the €15,000,000,000 Euro Medium Term Note Programme of the Offeror dated 4 June 2019, as supplemented by the supplement dated 13 September 2019 (the Base Prospectus) and the final terms to be prepared in connection with the issue and listing of the New Notes (the Final Terms), which will include the final terms of the New Notes. Subject to compliance with all applicable securities laws and regulations, the Base Prospectus and the Final Terms will be available from the joint lead managers of the issue of the New Notes on request.

OFFER AND DISTRIBUTION RESTRICTIONS

Neither this announcement nor the Tender Offer Memorandum constitute an invitation to participate in the Invitation in any jurisdiction in which, or to any person to or from whom, it is unlawful to make such invitation or for there to be such participation under applicable securities laws or otherwise. The distribution of this announcement and the Tender Offer Memorandum in certain jurisdictions (in particular, the United States, Italy, the United Kingdom, France and Belgium) may be restricted by law. Persons into whose possession this announcement or the Tender Offer Memorandum comes are required by each of Dealer Managers, the Offeror and the Tender Agent to inform themselves about, and to observe, any such restrictions.

No action has been or will be taken in any jurisdiction in relation to the New Notes that would permit a public offering of securities.

United States

The Invitation is not being made, and will not be made, directly or indirectly in or into, or by use of the mail of, or by any means or instrumentality of interstate or foreign commerce of, or of any facilities of a national securities exchange of, the United States. This includes, but is not limited to, facsimile transmission, electronic mail, telex, telephone, the internet and other forms of electronic communication. The Notes may not be tendered in the Invitation by any such use, means, instrumentality or facility from or within the United States or by persons located or resident in the United States, as defined in Regulation S of the United States Securities Act of 1933, as amended. Accordingly, copies of this announcement, the Tender Offer Memorandum and any other documents or materials relating to the Invitation are not being, and must not be, directly or indirectly mailed or otherwise transmitted, distributed or forwarded (including, without limitation, by custodians, nominees or trustees) in or into the United States or to any persons located or resident in the United States. Any purported tender of Notes resulting directly or indirectly from a violation of these restrictions will be invalid, and any purported tender of Notes made by a person located or resident in the United States or from within the United States or from any agent, fiduciary or other intermediary acting on a non-discretionary basis for a principal giving instructions from within the United States will be invalid and will not be accepted.

Each Holder participating in the Invitation will represent that it is not located in the United States and is not participating in the Invitation from the United States, or that it is acting on a non-discretionary basis for a principal located outside the United States that is not giving an order to participate in the Invitation from the United States. For the purposes of this and the above paragraphs, United States means United States of America, its territories and possessions (including Puerto Rico, the U.S. Virgin Islands, Guam, America Samoa, Wake Island and the Northern Mariana Islands), any state of the United States of America and the District of Columbia.

Italy

Neither this announcement, the Tender Offer Memorandum nor any other documents or material relating to the Invitation have been or will be submitted to the clearance procedure of the Commissione Nazionale per le Società e la Borsa (CONSOB), pursuant to applicable Italian laws and regulations.

In Italy, the Invitation on each Series of Notes is being carried out as an exempted offer pursuant to article 101-bis, paragraph 3-bis, of Legislative Decree No. 58 of 24 February 1998, as amended (the Financial Services Act) and article 35-bis, paragraph 4 of CONSOB Regulation No. 11971 of 14 May 1999, as amended.

Holders or beneficial owners of the Notes can tender their Notes for purchase through authorised persons (such as investment firms, banks or financial intermediaries permitted to conduct such activities in the Republic of Italy in accordance with the Financial Services Act, CONSOB Regulation No. 16190 of 29 October 2007, as amended from time to time, and Legislative Decree No. 385 of September 1, 1993, as amended) and in compliance with applicable laws and regulations or with requirements imposed by CONSOB or any other Italian authority.

Each intermediary must comply with the applicable laws and regulations concerning information duties vis-à-vis its clients in connection with the Notes or this announcement or the Tender Offer Memorandum.

United Kingdom

The communication of this announcement, the Tender Offer Memorandum and any other documents or materials relating to the Invitation is not being made and such documents and/or materials have not been approved by an authorised person for the purposes of section 21 of the Financial Services and Markets Act 2000. Accordingly, such documents and/or materials are not being distributed to, and must not be passed on to, the general public in the United Kingdom. The communication of such documents and/or materials as a financial promotion is only being made to those persons in the United Kingdom falling within the definition of investment professionals (as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the Financial Promotion Order) or persons who are within Article 43 of the Financial Promotion Order or any other persons to whom it may otherwise lawfully be made under the Financial Promotion Order.

France

The Invitation is not being made, directly or indirectly, to the public in the Republic of France (France). Neither this announcement, the Tender Offer Memorandum nor any other document or material relating to the Invitation has been or shall be distributed to the public in France and only (a) providers of investment services relating to portfolio management for the account of third parties (personnes fournissant le service d'investissement de gestion de portefeuille pour compte de tiers) and/or (b) qualified investors (investisseurs qualifiés) other than individuals, in each case acting on their own account and all as defined in, and in accordance with, Articles L.411-1, L.411-2 and D.411-1 to D.411-3 of the French Code Monétaire et Financier are eligible to participate in the Invitation. This announcement and the Tender Offer Memorandum have not been approved by, and will not be submitted for clearance to, the Autorité des Marchés Financiers.

Belgium

Neither this announcement, the Tender Offer Memorandum nor any other documents or materials relating to the Invitation have been, or will be, submitted for approval or recognition to the Financial Services and Markets Authority (Autorité des Services et Marches Financiers / Autoreit Financiele diensten en markten) and, accordingly, the Invitation may not be made in Belgium by way of a public offering, as defined in Articles 3, §1, 1° and 6 of the Belgian law of 1 April 2007 on public takeover bids as amended or replaced from time to time (the Belgian Takeover Law). Accordingly, the Invitation may not be advertised, and the Invitation will not be extended, and neither this announcement, the Tender Offer Memorandum nor any other documents or materials relating to the Invitation (including any memorandum, information circular, brochure or any similar documents) has been or shall be distributed or made available, directly or indirectly, to any person in Belgium other than (i) ”“qualified investors” in the sense of Article 10 of the Belgian Law of 16 June 2006 on the public offer of placement instruments and the admission to trading of placement instruments on regulated markets (as amended from time to time), acting on their own account or (ii) in any circumstances set out in Article 6, §4 of the Belgian Takeover Law. Insofar as Belgium is concerned, this announcement and the Tender Offer Memorandum have been issued only for the personal use of the above qualified investors and exclusively for the purpose of the Invitation. Accordingly, the information contained in this announcement and the Tender Offer Memorandum may not be used for any other purpose or disclosed to any other person in Belgium.

General

This announcement and the Tender Offer Memorandum do not constitute an offer to sell or buy or the solicitation of an offer to sell or buy the Notes, and Offers of Notes pursuant to the Invitation will not be accepted from Holders in any circumstances in which such offer or solicitation is unlawful. In those jurisdictions where the securities, blue sky or other laws require a Invitation to be made by a licensed broker or dealer and any of the Dealer Managers or any of their respective affiliates is such a licensed broker or dealer in any such jurisdiction, the Invitation shall be deemed to be made on behalf of the Offeror by such Dealer Manager or affiliate (as the case may be) in such jurisdiction.