Generali annuncia i risultati indicativi non vincolanti relativi al riacquisto di tre serie di titoli subordinati con prima data di call nel 2022

23 settembre 2019 - 09:45

IL PRESENTE COMUNICATO NON È DESTINATO ALLA DIFFUSIONE, PUBBLICAZIONE O DISTRIBUZIONE AD ALCUNA PERSONA CHE SI TROVI O SIA RESIDENTE NEGLI STATI UNITI D’AMERICA, NEI SUOI TERRITORI O POSSEDIMENTI, IN QUALUNQUE STATO DEGLI STATI UNITI D’AMERICA E NEL DISTRICT OF COLUMBIA O A QUALSIASI U.S. PERSON (COME DEFINITA NEL REGULATION S OF THE UNITED STATES SECURITIES ACT DEL 1933, COME MODIFICATO) OVVERO A QUALSIASI PERSONA CHE SI TROVI O SIA RESIDENTE IN OGNI ALTRA GIURISDIZIONE IN CUI DISTRIBUIRE IL TENDER OFFER MEMORANDUM È CONTRARIO ALLE LEGGI E AI REGOLAMENTI APPLICABILI

Trieste – Assicurazioni Generali S.p.A. (Generali o l’Offerente) annuncia in data odierna i risultati indicativi non vincolanti dell’offerta di riacquisto per cassa, promossa in data 16 settembre 2019, su tre serie di titoli subordinati con prima data di call nel 2022, come di seguito descritta.

L’offerta di riacquisto è scaduta venerdì 20 settembre 2019 alle ore 17.00 (CEST).

DETTAGLI DEI RISULTATI INDICATIVI NON VINCOLANTI

Alla Scadenza dell’Invito, l’Offerente ha ricevuto offerte valide per il riacquisto di: (i) nel caso di “GBP 495.000.000 Fixed/Floating Rate Perpetual Subordinated Notes” (ISIN: XS0283627908) (Titoli GBP 6,416%) un importo nominale complessivo pari a £252.500.000; (ii) nel caso di “€750.000.000 Fixed/Floating Rate Notes due July 2042” (ISIN: XS0802638642) (Titoli Euro 10,125%) un importo nominale complessivo pari a € 448.400.000; e (iii) nel caso di “€1.250.000.000 Fixed/Floating Rate Notes due December 2042” (ISIN: XS0863907522) (Titoli Euro 7,75%) un importo nominale complessivo pari a € 780.000.000.

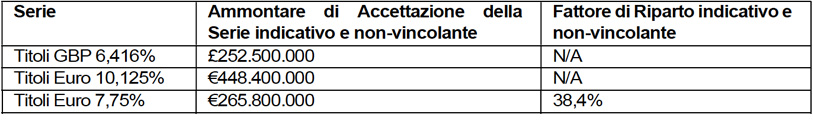

Con riserva di conferma da parte dell’Offerente (a sua insindacabile e assoluta discrezione) all’interno del proprio comunicato che annuncia i risultati finali, l’Offerente prevede che i rispettivi Ammontari di Accettazione della Serie (Series Acceptance Amount) siano fissati approssimativamente come segue:

La definizione del prezzo finale per ciascuna Serie di Titoli avverrrà alle (o intorno alle) 14.00 (CEST) (Ora del Pricing) della giornata odierna (Data del Pricing). Non appena ragionevolmente possibile successivamente all’Ora del Pricing nella Data di Pricing, l’Offerente annuncerà se accetterà valide offerte di Titoli di ogni Serie e, in questo caso, l’Ammontare Finale di Accettazione (Final Acceptance Amount), ogni Tasso Benchmark di riferimento (Benchmark Reference Rate), ogni Purchase Yield, il FX Rate (in caso di Titoli GBP 6,416%), il Prezzo di Acquisto per ogni Serie di Titoli (Purchase Price), ogni Ammontare di Accettazione della Serie (Series Acceptance Amount) e, se applicabili, Fattore di Riparto(i) (Pro-Ration Factor).

Il riacquisto da parte dell’Offerente di qualsivoglia Titolo ai sensi dell’Invito è condizionato al buon esito (ad insindacabile giudizio dell’Offerente) dell’Offerta di Nuovi Titoli (New Notes Offering) nei termini ritenuti soddisfacenti per l’Offerente (a sua esclusiva discrezione) (la Condizione di Nuova Emissione, New Issue Condition).

I Fattori di Riparto indicativi sopra menzionati sono stati determinati sulla base di un ammontare nominale aggregato pari a Euro 750.000.000 di Nuovi Titoli. L’ammontare finale dell’Offerta di Nuovi Titoli congiuntamente agli altri dettagli relativi al pricing saranno tuttavia dipendenti dall’esecuzione finale dell’Offerta dei Nuovi Titoli che determinerà i risultati definitivi dell’Invito e saranno annunciati dall’Offerente a seguito del pricing dei Nuovi Titoli.

La Data di Regolamento dell’Invito è prevista il 1° ottobre 2019. In sede di regolamento, che è condizionato al buon esito ovvero alla rinuncia della Condizione di Nuova Emissione, l’Offerente pagherà, a quei Portatori le cui Offerte sono state accettate, il Corrispettivo di Acquisto nonché il Rateo Interessi in relazione ai Titoli accettati in riacquisto dall’Offerente.

L’Invito è stato effettuato secondo i termini e le condizioni previste nel memorandum datato 16 settembre 2019 (il Tender Offer Memorandum). I termini aventi l’iniziale in lettera maiuscola utilizzati nel presente comunicato, ma che non sono stati definiti, avranno il significato attribuito ai termini corrispondenti (in inglese) nel Tender Offer Memorandum.

Structuring Advisers e Dealer Managers dell’Invito

Deutsche Bank AG, London Branch

Winchester House

1 Great Winchester Street

London EC2N 2DB

United Kingdom

All’attenzione di: Liability Management Group

Tel: +44 20 7545 8011

Merrill Lynch International

2 King Edward Street

London EC1A 1HQ

United Kingdom

All’attenzione di: Liability Management Group

Email: DG.LM_EMEA@baml.com

Tel: +44 207 996 5420

Dealer Managers

Banco Bilbao Vizcaya Argentaria S.A.

44th Floor, One Canada Square

London E14 5AA United Kingdom

All’attenzione di: Liability Management Group

Tel: +44 (0)20 7648 7516

Email: liabilitymanagement@bbva.com

Crédit Agricole Corporate and Investment Bank

12 place des Etats-Unis

CS 70052

92 547 Montrouge Cedex

France

Tel: +44 (0) 207 214 5903

E-mail: liability.management@ca-cib.com

All’attenzione di: Liability Management

J.P. Morgan Securities plc

25 Bank Street

Canary Wharf

London E14 5JP

United Kingdom

Tel: +44 207 134 2468

All’attenzione di: Liability Management

Email: emea_lm@jpmorgan.com

Mediobanca – Banca di Credito Finanziario S.p.A.

Piazzetta Enrico Cuccia, 1

20121 Milan

Italy

Tel: +39 028829984

Attention: Liability Management FIG

Email: Liability_Management_FIG@mediobanca.com

Morgan Stanley & Co. International plc

Canary Wharf

London E14 4QA

United Kingdom

Tel: +44 (0)20 7677 5040

Attention: Liability Management Group

Email: liabilitymanagementeurope@morganstanley.com

Société Générale

SG House

41 Tower Hill

London EC3N 4SG

United Kingdom

Tel: +44 20 7676 7579

Attention: Liability Management

Email: liability.management@sgcib.com

Tender Agent

Lucid Issuer Services Limited

Tankerton Works

12 Argyle Walk

London WC1H 8HA

United Kingdom Attentioni: Thomas Choquet / Arlind Bytyqi

Email: generali@lucid-is.com

Tel: +44 (0) 20 7704 0880

DISCLAIMER Il presente comunicato deve essere letto congiuntamente al Tender Offer Memorandum. Il presente comunicato e il Tender Offer Memorandum contengono importanti informazioni che dovrebbero essere lette attentamente prima dell’assunzione di qualsiasi decisione in merito all’Invito. L'investitore che abbia qualsiasi dubbio in merito al contenuto del presente comunicato o del Tender Offer Memorandum o in relazione alle decisioni da assumere, è invitato a ottenere proprie consulenze finanziarie o legali, anche in merito a qualsiasi conseguenza fiscale, immediatamente presso il proprio stock broker, bank manager, legale, contabile o altri consulenti finanziari o legali indipendenti. Ciascuna persona fisica o giuridica i cui i Titoli siano depositati presso un intermediario finanziario, una banca, un custode, un trust o un qualsiasi altro soggetto terzo o intermediario deve contattare tale soggetto se intende offrire i Titoli in vendita ai sensi dell’Invito. Né i Dealer Manager, né il Tender Agent, né l’Offerente hanno espresso alcuna raccomandazione in merito all'offerta in vendita dei Titoli da parte dei Portatori ai sensi dell’Invito.

Qualsiasi decisione di investimento relativa all’acquisto dei Nuovi Titoli dovrebbe essere effettuata esclusivamente sulla base delle informazioni contenute nel prospetto di base relativo al €15.000.000.000 Euro Medium Term Note Programme dell’Offerente datato 4 Giugno 2019, come supplementato dal supplemento datato 13 settembre 2019 (il Prospetto di Base) e nelle condizioni definitive che saranno predisposte in relazione all’emissione e quotazione dei Nuovi Titoli (le Condizioni Definitive), che includeranno le condizioni definitive dei Nuovi Titoli. Nel rispetto della normativa applicabile, il Prospetto di Base e le Condizioni Definitive saranno disponibili su richiesta dai joint lead managers dell’emissione dei Nuovi Titoli.

OFFER AND DISTRIBUTION RESTRICTIONS

Neither this announcement nor the Tender Offer Memorandum constitute an invitation to participate in the Invitation in any jurisdiction in which, or to any person to or from whom, it is unlawful to make such invitation or for there to be such participation under applicable securities laws or otherwise. The distribution of this announcement and the Tender Offer Memorandum in certain jurisdictions (in particular, the United States, Italy, the United Kingdom, France and Belgium) may be restricted by law. Persons into whose possession this announcement or the Tender Offer Memorandum comes are required by each of Dealer Managers, the Offeror and the Tender Agent to inform themselves about, and to observe, any such restrictions.

No action has been or will be taken in any jurisdiction in relation to the New Notes that would permit a public offering of securities.

United States

The Invitation is not being made, and will not be made, directly or indirectly in or into, or by use of the mail of, or by any means or instrumentality of interstate or foreign commerce of, or of any facilities of a national securities exchange of, the United States. This includes, but is not limited to, facsimile transmission, electronic mail, telex, telephone, the internet and other forms of electronic communication. The Notes may not be tendered in the Invitation by any such use, means, instrumentality or facility from or within the United States or by persons located or resident in the United States, as defined in Regulation S of the United States Securities Act of 1933, as amended. Accordingly, copies of this announcement, the Tender Offer Memorandum and any other documents or materials relating to the Invitation are not being, and must not be, directly or indirectly mailed or otherwise transmitted, distributed or forwarded (including, without limitation, by custodians, nominees or trustees) in or into the United States or to any persons located or resident in the United States. Any purported tender of Notes resulting directly or indirectly from a violation of these restrictions will be invalid, and any purported tender of Notes made by a person located or resident in the United States or from within the United States or from any agent, fiduciary or other intermediary acting on a non-discretionary basis for a principal giving instructions from within the United States will be invalid and will not be accepted.

Each Holder participating in the Invitation will represent that it is not located in the United States and is not participating in the Invitation from the United States, or that it is acting on a non-discretionary basis for a principal located outside the United States that is not giving an order to participate in the Invitation from the United States. For the purposes of this and the above paragraphs, United States means United States of America, its territories and possessions (including Puerto Rico, the U.S. Virgin Islands, Guam, America Samoa, Wake Island and the Northern Mariana Islands), any state of the United States of America and the District of Columbia.

Italy

Neither this announcement, the Tender Offer Memorandum nor any other documents or material relating to the Invitation have been or will be submitted to the clearance procedure of the Commissione Nazionale per le Società e la Borsa (CONSOB), pursuant to applicable Italian laws and regulations.

In Italy, the Invitation on each Series of Notes is being carried out as an exempted offer pursuant to article 101-bis, paragraph 3-bis, of Legislative Decree No. 58 of 24 February 1998, as amended (the Financial Services Act) and article 35-bis, paragraph 4 of CONSOB Regulation No. 11971 of 14 May 1999, as amended.

Holders or beneficial owners of the Notes can tender their Notes for purchase through authorised persons (such as investment firms, banks or financial intermediaries permitted to conduct such activities in the Republic of Italy in accordance with the Financial Services Act, CONSOB Regulation No. 16190 of 29 October 2007, as amended from time to time, and Legislative Decree No. 385 of September 1, 1993, as amended) and in compliance with applicable laws and regulations or with requirements imposed by CONSOB or any other Italian authority.

Each intermediary must comply with the applicable laws and regulations concerning information duties vis-à-vis its clients in connection with the Notes or this announcement or the Tender Offer Memorandum.

United Kingdom

The communication of this announcement, the Tender Offer Memorandum and any other documents or materials relating to the Invitation is not being made and such documents and/or materials have not been approved by an authorised person for the purposes of section 21 of the Financial Services and Markets Act 2000. Accordingly, such documents and/or materials are not being distributed to, and must not be passed on to, the general public in the United Kingdom. The communication of such documents and/or materials as a financial promotion is only being made to those persons in the United Kingdom falling within the definition of investment professionals (as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the Financial Promotion Order) or persons who are within Article 43 of the Financial Promotion Order or any other persons to whom it may otherwise lawfully be made under the Financial Promotion Order.

France

The Invitation is not being made, directly or indirectly, to the public in the Republic of France (France). Neither this announcement, the Tender Offer Memorandum nor any other document or material relating to the Invitation has been or shall be distributed to the public in France and only (a) providers of investment services relating to portfolio management for the account of third parties (personnes fournissant le service d'investissement de gestion de portefeuille pour compte de tiers) and/or (b) qualified investors (investisseurs qualifiés) other than individuals, in each case acting on their own account and all as defined in, and in accordance with, Articles L.411-1, L.411-2 and D.411-1 to D.411-3 of the French Code Monétaire et Financier are eligible to participate in the Invitation. This announcement and the Tender Offer Memorandum have not been approved by, and will not be submitted for clearance to, the Autorité des Marchés Financiers.

Belgium

Neither this announcement, the Tender Offer Memorandum nor any other documents or materials relating to the Invitation have been, or will be, submitted for approval or recognition to the Financial Services and Markets Authority (Autorité des Services et Marches Financiers / Autoreit Financiele diensten en markten) and, accordingly, the Invitation may not be made in Belgium by way of a public offering, as defined in Articles 3, §1, 1° and 6 of the Belgian law of 1 April 2007 on public takeover bids as amended or replaced from time to time (the Belgian Takeover Law). Accordingly, the Invitation may not be advertised, and the Invitation will not be extended, and neither this announcement, the Tender Offer Memorandum nor any other documents or materials relating to the Invitation (including any memorandum, information circular, brochure or any similar documents) has been or shall be distributed or made available, directly or indirectly, to any person in Belgium other than (i) ”“qualified investors” in the sense of Article 10 of the Belgian Law of 16 June 2006 on the public offer of placement instruments and the admission to trading of placement instruments on regulated markets (as amended from time to time), acting on their own account or (ii) in any circumstances set out in Article 6, §4 of the Belgian Takeover Law. Insofar as Belgium is concerned, this announcement and the Tender Offer Memorandum have been issued only for the personal use of the above qualified investors and exclusively for the purpose of the Invitation. Accordingly, the information contained in this announcement and the Tender Offer Memorandum may not be used for any other purpose or disclosed to any other person in Belgium.

General

This announcement and the Tender Offer Memorandum do not constitute an offer to sell or buy or the solicitation of an offer to sell or buy the Notes, and Offers of Notes pursuant to the Invitation will not be accepted from Holders in any circumstances in which such offer or solicitation is unlawful. In those jurisdictions where the securities, blue sky or other laws require a Invitation to be made by a licensed broker or dealer and any of the Dealer Managers or any of their respective affiliates is such a licensed broker or dealer in any such jurisdiction, the Invitation shall be deemed to be made on behalf of the Offeror by such Dealer Manager or affiliate (as the case may be) in such jurisdiction.