Financial Information as of 31 March 2019 – Press Release (1)

16 May 2019 - 07:30 price sensitive

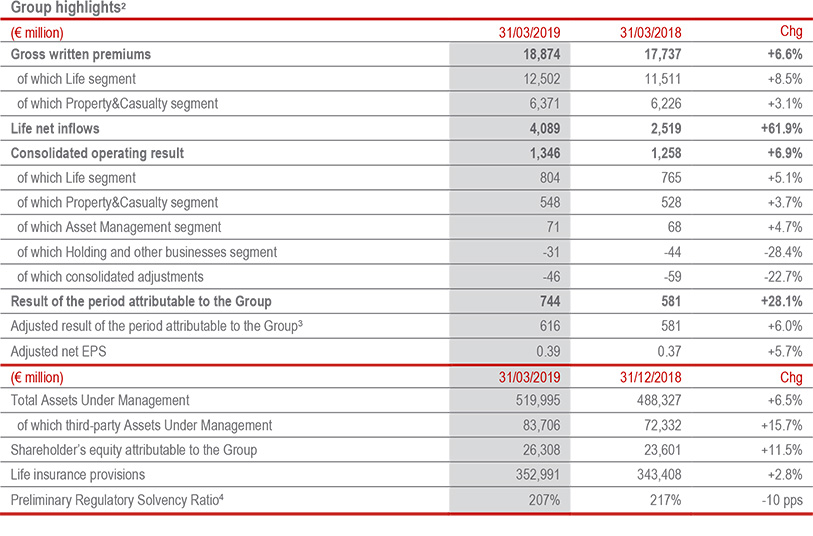

Increase in profit to € 744 million (+28.1%) and growth in operating result to € 1.3 billion (+6.9%). Solid capital position

- Group net profit at € 744 million, up 28.1% in part reflecting the result from disposals. Adjusted net profit increased to € 616 million (+6%) in line with the targets of the new strategic plan

- Operating result growth of 6.9% to € 1.3 billion thanks to the contribution of all Group business segments

- Technical profitability remained at excellent levels with the combined ratio at 91.5% (+0.1 pps) and the Life New Business Margin at 4.37% (-0.29 pps)

- Excellent Life net inflows at more than € 4 billion (+61.9%). Life technical reserves increased to € 353 billion (+2.8%). Total gross written premiums at € 18.9 billion, an increase of 6.6% thanks to the development of both business segments. In particular, P&C (+3.1%) growing in all the main countries in which the Group operates

- Solid Group capital position with a Preliminary Regulatory Solvency Ratio of 207%. The decrease from year-end 2018 was largely due to the expected implementation of regulatory changes

Generali Group CFO, Cristiano Borean, commented: “The first quarter results confirm excellent performance in terms of the Group’s profitability and its solid capital position. Volumes continue to grow, as shown by the increase in Life net inflows, Assets Under Management and total premiums. The focus on value generation is evidenced by continuing excellent levels of the combined ratio and New Business Margin. The net result, even without taking into account the positive contribution of disposals, demonstrates strong growth. These results show that the implementation of the Generali 2021 strategy, announced in November 2018, has gotten off to an excellent start.”

Milan. At a meeting chaired by Francesco Gaetano Caltagirone, the Board of Directors of Assicurazioni Generali approved the Financial Information at 31 March 2019.

Premiums and New Business

- The Group's gross written premiums showed 6.6% growth compared to the previous year, reaching € 18,874 million as a result of positive trends in both business segments.

In the Life segment, net inflows were at excellent levels, exceeding € 4 billion. The significant growth (+61.9%) was mainly driven by development in Asia and France, benefiting from the combined effect of lower surrenders and the growth in premium volumes, as well as in Italy, mainly due to the growth in premiums.

Premiums showed an 8.5% increase resulting from the growth in savings (+18.4%, thanks in particular to developments in Italy, China and France) and protection (+6.5%, confirming the widespread growth in the countries in which the Group operates). The drop in unit-linked premiums (-12%) mainly reflected the performance in Italy and France, as a result of the market effects of the latter part of last year.

P&C premiums also increased (+3.1%) thanks to the positive performance of both business lines. There was a 2.7% increase in the motor line, mainly due to growth in Austria, CEE and Russia (ACEER), as well as in Argentina following inflation driven rate adjustments. In Italy, premiums started to grow again (+1.7%). In the non-motor line, growth (+3.6%) was widespread in all the areas in which the Group operates, with noteworthy growth in ACEER, Germany, Spain and Europ Assistance. - New business in terms of PVNBP (present value of new business premiums) stood at € 10,922 million, up 4.6%. The increase was due to the growth in savings products (+14.6%) and protection products (+13.3%).

The New Business Margin in terms of the PVNBP stood at 4.37%: the decrease of 0.29 pps was mainly due to the different business mix between the countries and between the different product lines.

Due to these movements, the New Business Value (NBV) was € 478 million, slightly down on the first three months of 2018 (-1.9%). - There was an increase in Life technical reserves to € 353 billion (+2.8%), reflecting the excellent level of net inflows as well as the increase in the unit-linked component following the performance of the financial markets.

- Third-party Assets Under Management posted an increase of 15.7%, mainly due to the performance of Banca Generali and in China and also thanks to the contribution of Belgian assets which are still managed by the Group in line with the sales agreements.

Economic Performance

- The operating result stood at € 1,346 million, up 6.9% as a result of the positive contribution of all business segments of the Group.

The Life operating result (+5.1%) improved due to further growth in the technical margin. The higher acquisition costs, incurred above all in Germany and France to support the growth in premiums, were almost entirely offset by the growth in the net investment result, reflecting positive market performance.

Operating result was up 3.7% in the P&C segment thanks to the positive contribution of all its components. The combined ratio remained at excellent levels (91.5%; +0.1 pps compared to 1Q18). Improvement in the loss ratio, due in part to a lower impact of natural catastrophe claims, was offset by the increase in the expense ratio, which reflected the growth in acquisition costs, mainly related to the performance of the non-motor line. The incidence of administration expenses was stable.

The Asset Management segment operating result was up 4.7%.

Lastly, the operating result of the Holding and other businesses segment was positive, thanks in particular to the Banca Generali result due to higher performance fees. - The Group net profit stood at € 744 million, up 28.1%. In addition to the improvement in the operating result mentioned above, this mainly reflected5:

- the decrease in the non-operating investment result, in particular due to higher net impairments, mainly on investment funds, and to lower realized gains in the quarter;

- the lower impact of taxes; the effective tax rate went from 34.1% to 30.6%, mainly due to both the decrease in regional taxes (IRAP) in Italy and the increase in deductible costs in China;

- the higher result from discontinued operations, which overall amounted to € 123 million, including € 128 million gains from the disposal of the business in Belgium as well as the net result for the quarter for Generali Leben (Germany), whose disposal was finalised on 30 April. - Net profit of the Asset Management segment was up to € 52 million (+24%).

- The P&L return on investments stood at 0.8%6 (0.7% in 1Q18), a slight increase thanks to a higher current return and greater gains on foreign currencies, which more than offset the increase in net impairments.

Balance Sheet and Capital Position

- The Group shareholders’ equity stood at € 26,308 million (€ 23,601 million at 31 December 2018), up 11.5% due to the result for the period attributable to the Group and the increase in the reserve for unrealized gains and losses on available-for-sale financial assets, following the positive performance of the equity markets and lowering of interest rates.

- The Preliminary Regulatory Solvency Ratio - which represents the regulatory view of the Group’s capital and is based on the use of the internal model, solely for companies that have obtained the related approval from the IVASS, and on the standard formula for other companies - stood at 207% (217% FY18).

The change from year-end 2018 was largely attributable to the expected implementation of regulatory changes (-7 pps as a sum of the EIOPA changes on the Ultimate Forward Rate and reference portfolio as well as the treatment of the IRP business in France). The contribution of the normalised capital generation in the period was strong, and almost entirely offset negative market and capital variances (including the acquisitions finalised in the quarter and partial repayment of the subordinated debt).

For significant events that occurred during and after the period ended 31 March 2019, please refer to the press releases available for download at www.generali.com.

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

The glossary and the description of alternative performance measures are available in the 2018 Annual Integrated Report and Consolidated Financial Statements of the Group.

1 Changes in premiums, Life net inflows and PVNBP (present value of new business premiums) were presented in equivalent terms (at constant exchange rates and consolidation scope). Changes in operating result, general investments and Life technical reserves excluded entities sold during the comparative period.

2 With reference to the disposals of German business finalised on 30 April, in accordance with IFRS 5 these assets were classified as disposal groups held for sale. As a result, these investments were not excluded from consolidation, but total assets, liabilities and profit after tax were recognised separately in the specific financial statement items. Similarly, the comparative data were restated (which for 1Q18 include the Dutch, Irish and Belgian businesses - all already in IFRS 5 - and Guernsey business, not yet in IFRS 5 in 1Q18, whose disposals were finalised in February 2018, June 2018 and January 2019, respectively).

3 Adjusted for the impact of gains and losses from disposals.

4 The ratio at 31/12/2018 was updated compared to that released at 14 March 2019 (216%) in line with the ratio in the 2018 Solvency and Financial Condition Report of the Generali Group. The latter will be published at 3 June 2019 in accordance with the timing set by Solvency II regulation.

5 The following figures were shown net of taxes and minority interests.

6 The return was not annualized.