Interim Management Report as of 30 June 2018 – Press Release

01 August 2018 - 07:30 price sensitive

Successful execution of the strategic plan continues: increasing profit, over-achievement of the disposals target, strong capital position1

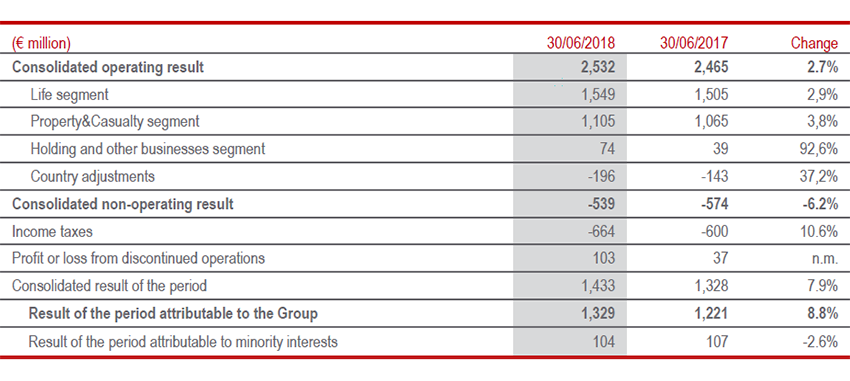

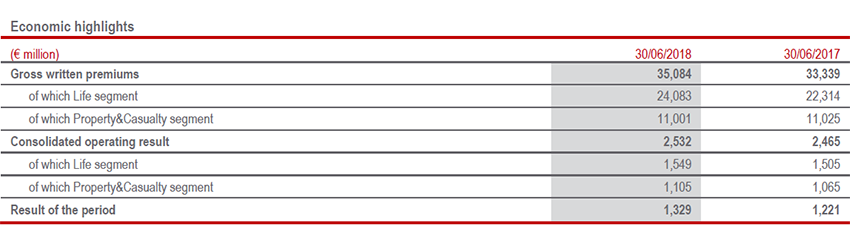

- Operating result increased to € 2.5 billion, up 2.7% thanks to improvements in all business segments

- Combined ratio at excellent levels (92%), despite the significant impact of natural catastrophes. Life new business profit margins increased to 4.5%

- Annualised operating RoE at 12.5%; the average figure for the period 2015-1H 2018, 13.4%, was in line with the strategic target (>13%)

- Net profit increased to € 1,329 million (+8.8%), also thanks to the positive non- operating performance and the gains from disposals closed during the period

- Premiums increased to € 35.1 billion (+6.5%) thanks to growth in both business segments. Net cash inflows stable at € 5.7 billion. Life technical reserves increased by 1.8% in the first six months

- Solid and resilient capital position, with the Regulatory Solvency Ratio at 201% and the Economic Solvency Ratio at 221%, despite the market volatility in the second quarter of the year

- Expected proceeds from agreed disposals carried out to optimise geographical presence exceeded € 1.5 billion (€ 1 billion target)

- Sale of the Life portfolio of Generali Leben, an innovative operation in line with the Group's strategic objective of rebalancing the portfolio, with a significant reduction in interest rate risk

Generali Group CEO, Philippe Donnet, declared: “The results for the first half of the year demonstrate Generali's capital resilience and the excellent technical and industrial performance within a context of global volatility. I would also like to highlight the disposals and geographical optimisation plan, with the target significantly exceeded at an early stage, and the recent sale of Generali Leben in Germany, an innovative transaction that will allow us to accelerate the achievement of our strategic objectives in the Life segment. The operating performance of P&C and Life business was also excellent, as were the activities of Investments, Asset & Wealth Management, results that confirm our ability to execute the strategic plan with discipline and determination. We have consequently achieved one of the highest half- year net profits ever."

Milan – At a meeting chaired by Gabriele Galateri di Genola, the Board of Directors of Assicurazioni Generali approved the consolidated results at 30 June 2018.

EXECUTIVE SUMMARY

The Generali Group's half-yearly results highlighted an excellent performance in terms of profitability and maintenance of a resilient capital position. Within a context of moderate economic growth in the Eurozone and financial markets volatility, especially in the second quarter, the Group continued with a disciplined and effective implementation of its 2016-2018 strategic plan.

In particular, during the first half of the year, disposal operations were announced with expected proceeds which, alongside past actions aimed at optimising geographical presence and improving operational efficiency and allocation of capital, reached a total of over € 1.5 billion, significantly higher than the initial € 1 billion target. An agreement was also signed for the sale of 89.9% of the German company Generali Leben.

The operating result grew by 2.7% to € 2,532 million (€ 2,465 million in 1H17) thanks to the positive development in all business segments. P&C operating performance increased, driven by the improvement in the technical result, reflected in the combined ratio which continued at excellent levels (92%). The Life operating result was also positive, thanks to the development of the technical margin. The Holding and other businesses segment also grew thanks, in particular, to the favourable development of Investments, Asset & Wealth Management activities, in line with the strategic plan. Holding operating expenses were stable.

Therefore, the Group maintained excellent operating profitability levels, measured through the annualised operating RoE, equal to 12.5%: this figure reflected the impact of the disposal transactions. The average operating RoE for the period 2015-1H2018 was 13.4% (strategic target >13%).

In terms of volumes, the Group's total premiums, amounting to € 35.1 billion, reflected the growth already observed in the first quarter of the year. The 6.5% increase was attributable to a positive performance in both business segments.

With reference to business lines, Life grew by 8.6%, mainly due to the development of savings and pension products (+9.1%), particularly in Italy as a result of actions on the existing portfolio which led to the renewal of collective policies for an amount of approximately € 1.2 billion. The performance of protection lines (+12.3%) was also positive in almost all the countries in which the Group operates, as was that of unit-linked products (+4.3%), especially in France. Group Life net cash inflows, at € 5.7 billion, continued at the same levels as last year, reflecting a strong acceleration in the second quarter.

Life technical reserves - excluding deferred liabilities towards policyholders - amounted to € 341,970 million, increasing by 1.8% at equivalent consolidation area; in particular, unit-linked reserves grew by 2.2%.

New business in terms of PVNBP (present value of new business premiums) amounted to € 21,431 million, down by 3.9% compared to the previous half-year. At line of business level, there was a decline in new business for savings and pension products (-7.1%), due to the contraction in Italy, Germany and Spain; a decrease was also recorded in protection products (-2.8%) due to a decline in Germany and France. Premiums for unit-linked products remained more or less stable (+ 0.1%). New business value (NBV) increased by 3.6% compared to the first six months of 2017 to € 965 million (€ 942 million in 1H17).

As a result, the profitability on PVNBP stood at 4.50% (4.11% in 1H17) with an equivalent consolidation area increase of 0.33 pps due to the better business mix, product rebalancing with consequent recalibration of financial guarantees, and improvement in the financial context compared to the first six months of 2017.

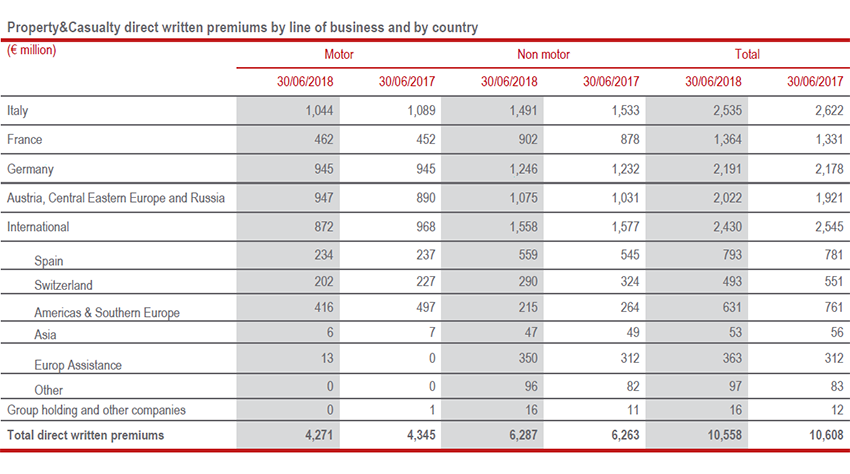

The growth observed in P&C premiums in the first quarter continued, increasing on a like-for-like basis by 2.1% to € 11 billion due to the development of both lines. The Motor line grew by 2.3%, particularly in ACEER2, and the Non-Motor line by 1.7%, with different trends in the various countries in which the Group operates.

The non-operating result improved to € -539 million, reflecting improved financial performance, thanks to lower impairments and higher realized gains, as well as lower interest on financial debt. In particular, the higher realized gains included € 113 million from the sale of the shareholding in Italo - Nuovo Trasporto Viaggiatori, monetising the investment in which the Group had been involved since its creation. The remaining realized gains were down compared to the previous period, especially as for the bond component, reflecting the planned policy of supporting future returns on investments, in the face of the current situation of financial market volatility.

The tax rate increased from 30.8% to 32.4%, mainly due to a number of extraordinary events occurred in Germany last year and in the United States in the first half of this year.

The result of discontinued operations3 was positive, which mainly included the profit of € 49 million on the disposal of the Irish business, as well as the results of other operations still in the disposal phase.

Taking into account the performance noted above, the result for the period attributable to the Group is € 1,329 million, showing an increase (+8.8%) over the € 1,221 million recorded in the 2017 half-year.

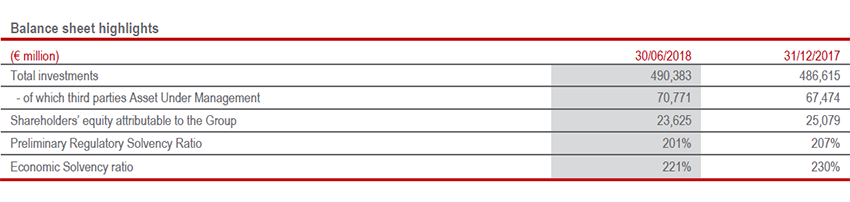

Shareholders’ equity attributable to the Group remained solid, amounting to € 23,625 million, down by 5.8% compared to € 25,079 million at 31 December 2017. The change was due to the result of the period attributable to the Group, amounting to € 1,329 million, more than offset by both the dividend payment totalling € 1,330 million and the reduction of € 1,339 million in the reserve for unrealised gains and losses on available for sale financial assets, deriving from the performance of bonds due to spread widening in the first part of the year.

Third party Assets Under Management posted an increase of 4.9%, mainly due to performance in China and Banca Generali.

The Preliminary Regulatory Solvency Ratio – which represents the regulatory view of the Group’s capital and is based on use of the internal model, solely for companies that have obtained the relevant approval from IVASS, and on the Standard Formula for other companies – stood at 201% (207% FY20174; -6 pps). The change was due to the financial markets at half-year, influenced by the BTP spread widening.

The Economic Solvency Ratio, which represents the economic view of the Group’s capital and is calculated by applying the internal model to the entire Group perimeter, stood at 221% (230% FY17; -9 pps).

Life segment: premiums, NBM and operating performance up, net cash inflows stable

- Life net cash inflows at € 5.7 bln, at the same levels as last year

- NBM improved to 4.5%

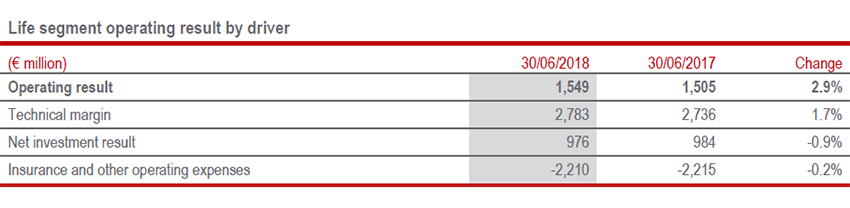

- Operating result up to € 1,549 mln (+2.9%)

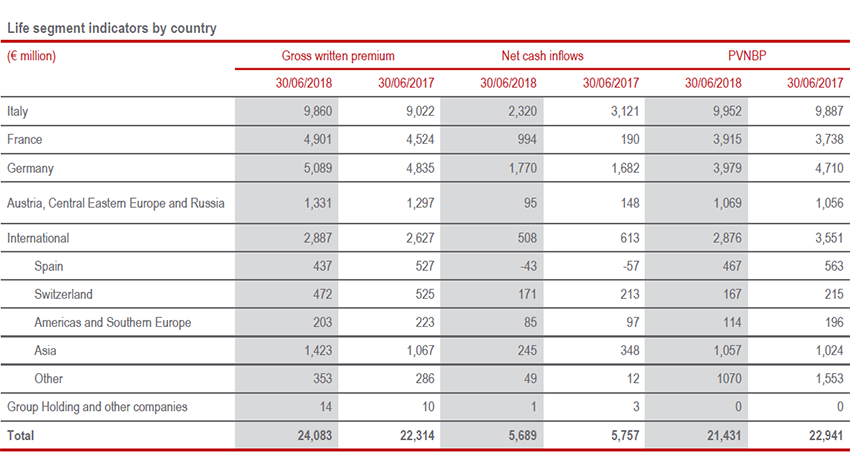

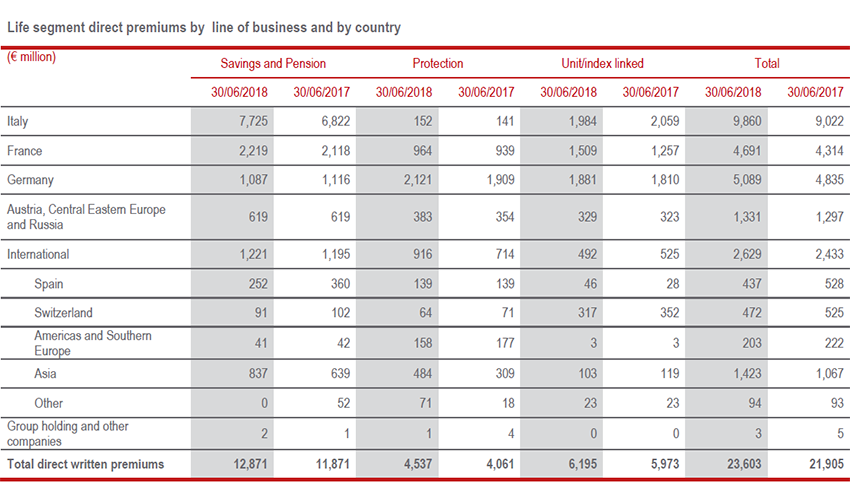

Life premiums5, at € 24,083 million, increased by 8.6% thanks to the development of all lines of business. In particular, savings and pension products rose by 9.1%, with a concentration in Italy, France and Asia. The performance of protection lines (+12.3%) was also positive in almost all the countries in which the Group operates, as was that of unit-linked products (+4.3%), especially in France.

With reference to the main countries where the Group operates, Italy recorded significant growth (+9.3%) driven by savings and pension products (+13.2%), essentially reflecting the actions taken to renew important collective policies. Excellent performance in France, where all business sectors contributed to growth (+8.3%), especially unit-linked (+20.1% thanks to commercial and customer selection policies aimed at developing this type of products) and, to a lesser extent, savings and pension products (+4.8%). Germany also performed well (+5.3%), thanks to protection policies (+11.2%) and unit-linked products (+4%). Premium income slightly rose in ACEER (+0.9%). International's 16.3% growth reflects the robust development seen in Asia (+40%), where growth was recorded in savings and pension products (+35.8%), especially in China, driven by the development of the bancassurance channel, as well as in the protection line (+65.9%), thanks to the development in China and Hong Kong, where the new company resumed production.

Life net cash inflows - premiums written net of claims and lapses - reached € 5.7 billion, essentially continuing at the same levels as last year (-0.2%), reflecting a strong acceleration in the second quarter, with different trends in the countries in which the Group operates. In particular, the positive performance in France, where last year there were particularly high outflows in conjunction with the French general elections, was offset by the decline recorded in Italy linked to the planned reduction in traditional non- hybrid gross inflows.

Life technical reserves - excluding deferred liabilities towards policyholders - amounted to € 341,970 million, increasing by 1.8% at equivalent consolidation area; in particular, unit-linked reserves grew by 2.2%.

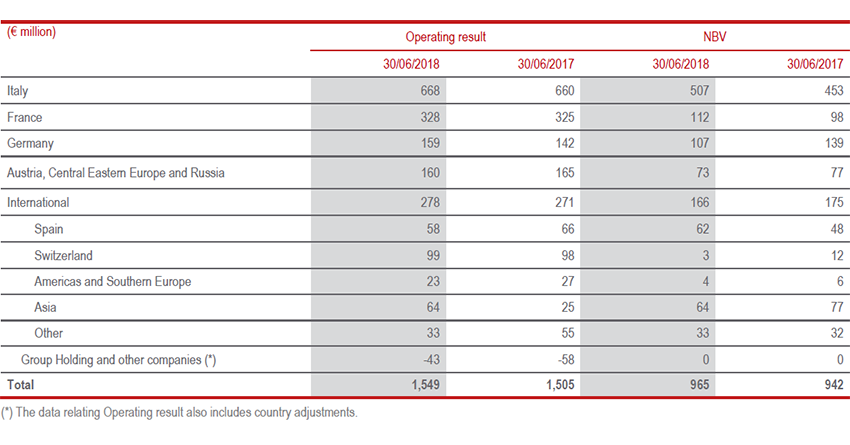

New business in terms of PVNBP (present value of new business premiums) amounted to € 21,431 million, down by 3.9% compared to the first half-year of 2017. At line of business level, there was a decline in savings and pension products (-7.1%), due to the contraction in Italy (-7.4%), Germany (- 25.2%) and Spain (-35.6%), only partially offset by France (+3.1%). There was also a fall in protection products (-2.8%), reflecting the decline in Germany (-12.9%) and France (-15.0%). Premiums for unit- linked products remained more or less stable (+ 0.1%). New business value (NBV) was € 965 million (€ 942 million in 1H17), up 3.6% compared to the first six months of 2017.

The profitability on PVNBP stood at 4.50% (4.11% in 1H17) with an increase of 0.33 pps due to the better business mix, product rebalancing with consequent recalibration of financial guarantees and improvement of financial assumptions compared to the first six months of 2017.

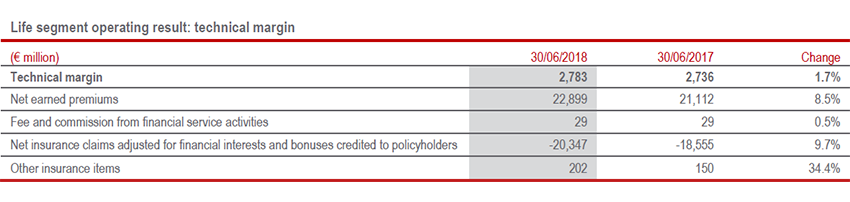

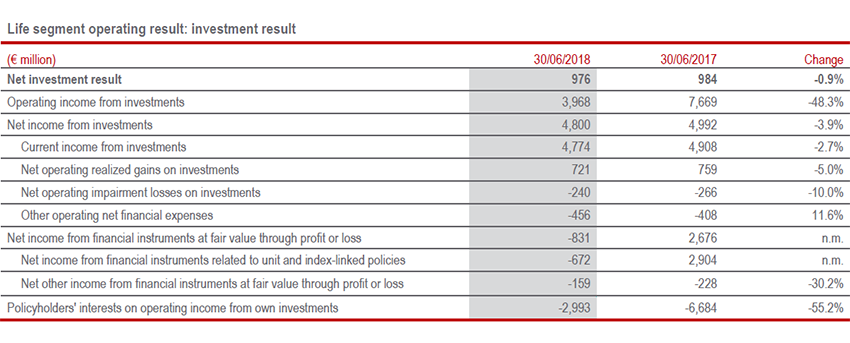

The operating result of the Life segment came to € 1,549 million (€ 1,505 million in 1H17). The 2.9% increase reflects the development of the technical margin, net of insurance operating expenses.

With reference to the main countries of operations, a solid contribution was made to the Group result by Italy, Germany and France. The operating result in Asia increased, also reflecting the reserve adjustment occurred last year, as a consequence of the Chinese regulations, not present at the current half-year.

The operating return on investments of the Life segment remained stable at 0.42%.

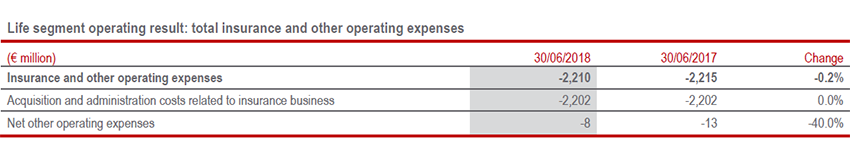

The expense ratio - the ratio of costs to earned premiums - decreased from 10.1% to 9.3% due to the improvement in the ratio in both acquisition (-0.6 pps) and administration (-0.2 pps) components, observed in almost all the countries in which the Group operates.

P&C segment: premiums and technical profitability up

- Premiums increased to € 11 bln (+2.1%), positive performance in both lines

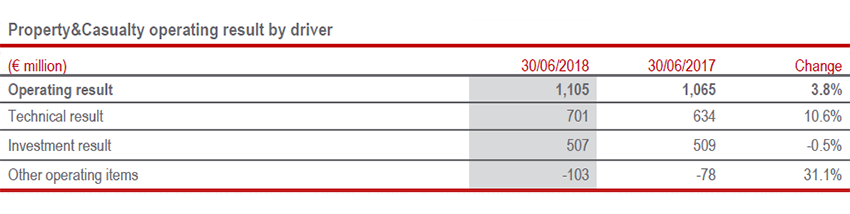

- Growth in the operating result to € 1,105 mln (+3.8%)

- Combined ratio improved at 92% (-0.8 pps)

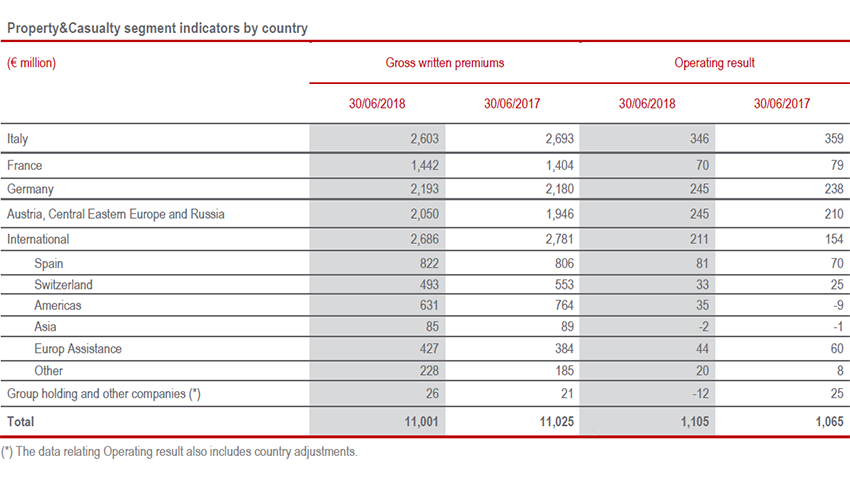

P&C premiums continued to grow as already observed in the first quarter, increasing on a like-for-like basis to € 11,001 million (+2.1%), thanks to the development of both lines of business. The Motor line grew by 2.3%, particularly in Central and Eastern Europe (+6.1%, mainly thanks to the pricing policies in the Czech Republic and the increase in car sales in Hungary), France (+2.1%, mainly due to the pricing policies applied) and Austria (+2.8%). Italy fell by 4.1% as a result of strict focus on profitability (the decline in the average premium slowed down, along with a contraction of the portfolio also due to portfolio pruning).

The Non-Motor line also performed well (+1.7%), with different trends in the various countries in which the Group operates. Central and Eastern European countries grew by 4.3%, mainly in the home business, Europe Assistance grew by 15.6% thanks to the development of travel insurance and roadside assistance in mature markets, and France grew by 2.7% thanks to pricing policies and commercial initiatives. The 2.7% decline in Italy reflected the decline in Global Corporate & Commercial lines following the actions developed to improve profitability.

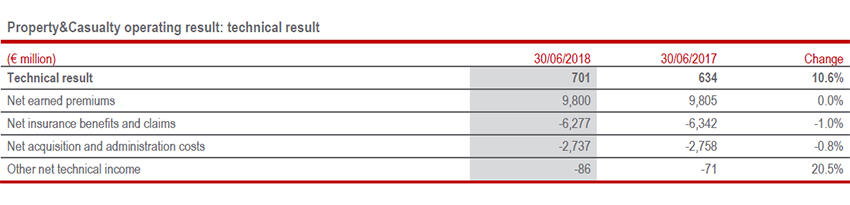

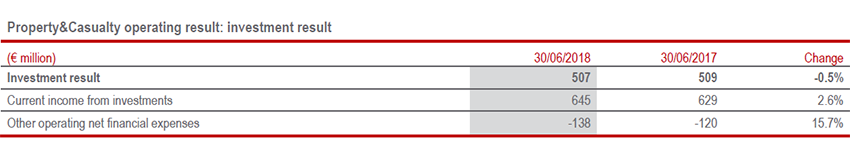

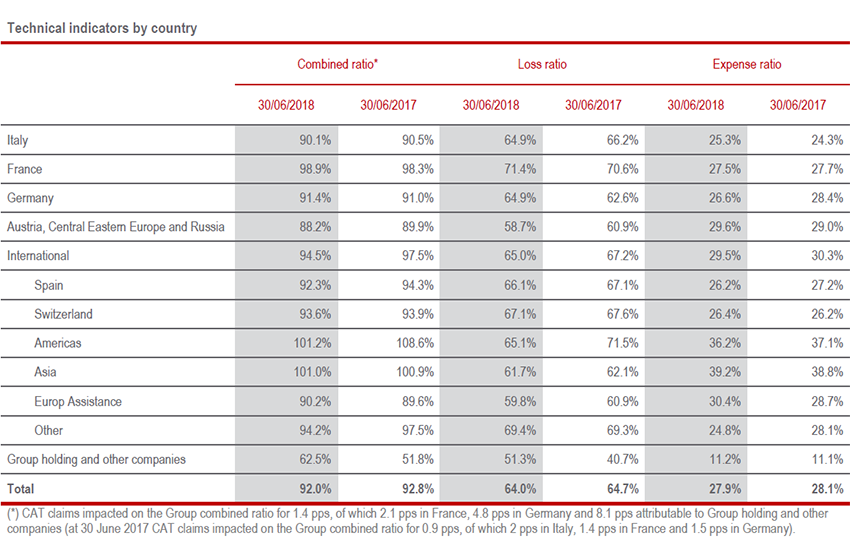

The operating result amounted to € 1,105 million (€ 1,065 million in 1H17). The development of the technical result reflected the improvement in the CoR, despite the fact that the half-year was affected by higher catastrophic claims for € 46 million. The contribution from the financial result was broadly stable, while the contribution from other operating items was reduced in the period, reflecting the reduction in the services margin and higher indirect taxes.

The combined ratio improved to 92% (-0.8 pps). The half-year just ended was affected by catastrophic events for a total of approximately € 139 million, which mainly affected Germany and France, as well as Holding reinsurance business, for an impact of 1.4 pps on the CoR (0.9 pps in the first half of the previous year). The current year loss ratio excluding natural catastrophes component improved by 0.9 pps, due to the evolution observed in the Motor line. The contribution of prior years loss ratio slightly increased to -4.8 pps (-4.6 pps in 1H17).

As regards the main countries of operation, Italy's combined ratio improved to 90.1% (-0.4 pps) thanks to the near absence of catastrophic claims, which had a 2 pps effect last year. The CoR of Germany continued at excellent levels (91.4%; +0.4 pps), including 4.8 pps for catastrophic claims for the storms that hit the country in January and June. The CoR of France (98.9%; +0.6 pps) was also impacted by 2.1 pps, deriving from catastrophic events during the half-year. The combined ratio of ACEER improved to 88.2%, reflecting the positive trend in the loss ratio excluding natural catastrophes component in the Motor line. The CoR of Americas and Southern Europe also improved to 101.2%: last year in Argentina there was an adjustment of the local reserve for some classes of claims following the inflationary dynamics observed during the period.

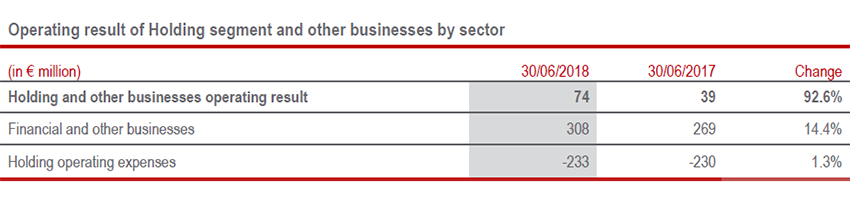

Holding and other businesses segment6

The operating result of the Holding and other businesses segment was € 74 million (€ 39 million in 1H17), thanks to the development of the operating result of the financial segment following the favourable development of Investments, Asset & Wealth Management activities.

Net holding operating costs totalled € -233 million (€ -230 million in 1H17), reflecting the decline in revenues from brand royalties and stable costs.

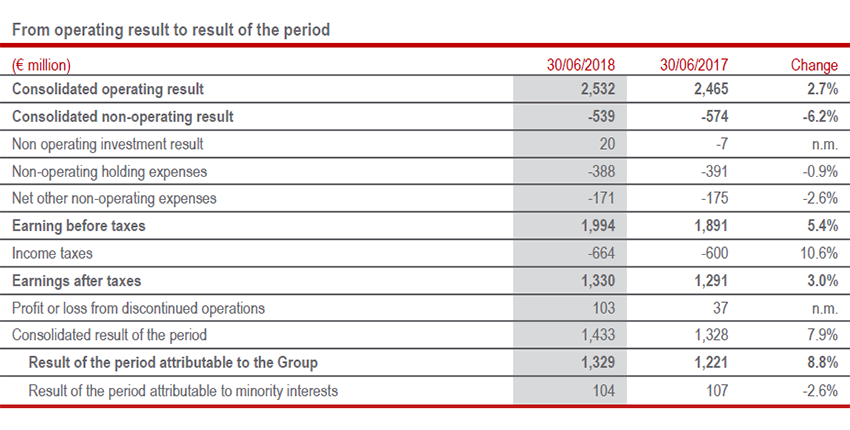

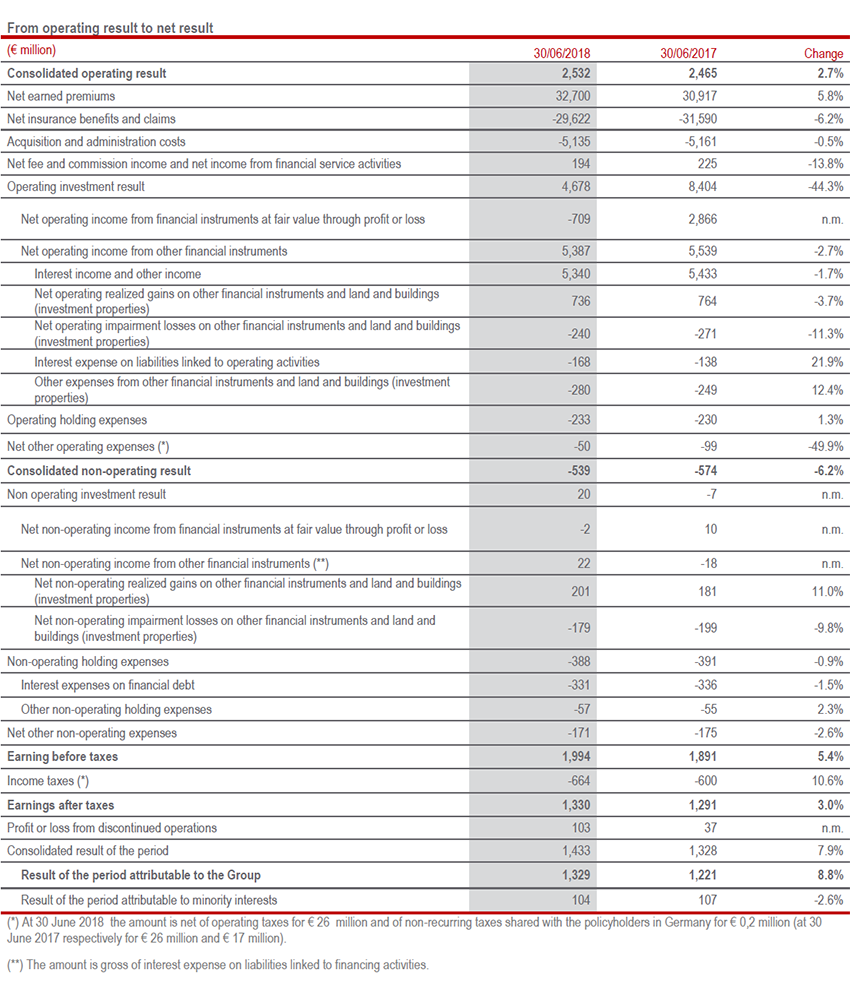

From operating result to Group net result

The non-operating result of the Group improved from € -574 million to € -539 million. This result reflects improved financial performance, thanks to lower impairments and higher realized gains, as well as lower interest on financial debt.

In particular, the non-operating investment result improved by € 27 million, due to lower impairments on financial investments, partially offset by greater realised gains compared to the previous year. In particular, the higher realized gains included € 113 million from the sale of the shareholding in Italo - Nuovo Trasporto Viaggiatori, monetising the investment in which the Group had been involved since its creation. Excluding this disposal, realised gains were lower than in the previous period.

Non-operating holding expenses went from € -391 million to € -388 million, reflecting the drop in interest on financial debt which went from € -336 million to € -331 million.

Finally, other net non-operating expenses went from € -175 million to € -171 million. This item mainly consisted of € -49 million for the amortisation of the value of acquired portfolios (€ -52 million in 1H17) and of € -68 million for the restructuring costs (up compared to € -53 million in 1H17, mainly in Germany). The change from the previous year in other net non-operating costs (€ +17 million) was mainly due to realized gains from the sale of assets in Panama.

The increase in the tax rate to 32.4% (30.8%) was mainly due to a number of extraordinary events occurred in Germany last year and in the United States in the first half of this year.

The result attributable to minority interests, amounting to € 104 million and corresponding to a minority rate of 7.2% (8.1% in 1H17), decreased when compared to € 107 million in the previous year due to the results of Banca Generali.

As a result of the performances commented on above, the result of the period attributable to the Group rose by 8.8% to € 1,329 million (€ 1,221 million in 1H17).

Group financial position

Shareholders' equity

Share capital and reserves attributable to the Group amounted to € 23,625 million at 30 June 2018, a decrease of 5.8% compared to € 25,079 million at 31 December 2017. The change was due to the result of the period attributable to the Group, amounting to € 1,329 million, more than offset by both the dividend payment totalling € 1,330 million and the reduction of € 1,339 million in the reserve for unrealised gains and losses on available for sale financial assets, deriving from the performance of bonds due to the cited spread widening in the first part of the year.

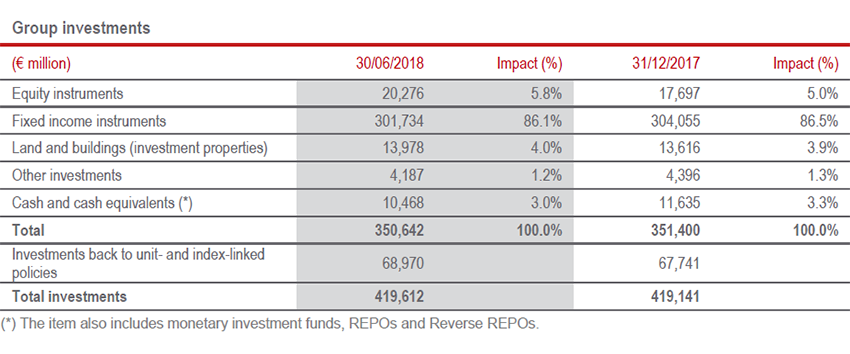

Investments

The Group’s total Assets Under Management recorded an increase of 0.8% at 30 June 2018, up to € 490.4 billion. In particular, total investments amounted to € 419.6 billion, while third party Assets Under Management came to € 70.8 billion.

Total investments, amounting to € 350.6 billion, essentially remained stable decreasing by 0.2%, mainly due to the reduction in corporate bonds against the increase in interest rates which more than offset net purchases in the period concentrated on government bonds and equity securities, as well as to the reduction in cash and cash equivalents.

Investment properties and other investments essentially remained stable.

As for the investment strategy, for fixed-income investments it aims to optimise the risk-return profile of portfolios, guaranteeing adequate profitability to policyholders and a satisfactory return on capital.

Gradual diversification through alternative investments continued, offering attractive returns with a low overall risk profile.

With reference to equity exposure, given the expectation of a still high market volatility, our preference for ‘controlled volatility’ strategies with protection in the event of a decrease was reaffirmed.

New investments in the real estate sector continued to be mainly oriented towards the European market.

KEY HALF-YEARLY FACTS AND SIGNIFICANT EVENTS AFTER 30 JUNE 2018

February

The Net Promoter Score - NPS program of Generali was recognized as the world’s best one by Medallia during the Experience Europe 2017 event held in London. The program enables to listen to client feedback in real time and act on that feedback in order to resolve issues and improve services. It covers retail and corporate customers as well as distributors.

Generali completed the sale of its entire shareholding in Generali Nederland N.V. (and its subsidiaries) but it remains active in the Netherlands through its Global Business Lines, namely Generali Employee Benefits, Generali Global Corporate & Commercial, Europ Assistance and Generali Global Health continuing to provide insurance services to its international customers.

During the Board of Directors’ meeting on 21 February, Generali approved its climate change strategy including actions in its core activities, i.e. investments and underwriting.

March

Generali Global Infrastructure (GGI) was launched, a cornerstone of the Group’s multi-boutique asset management strategy. It is a platform that employs internal know-how as well as creating partnerships as to invest in infrastructure debt across a wide geographical and sectorial investment scope and develop a range of products and solutions for investors. The investment selection approach is rigorous both from a credit quality and ESG (Environmental, Social, and Governance) factors perspective.

April

Generali completed the sale of its operations both in Panama and Colombia, countries where it is still present through its Global Business Lines, or more specifically, Generali Employee Benefits, Generali Global Corporate & Commercial, Generali Global Health and Europ Assistance.

Generali entered into a binding agreement to sell its entire stake in Generali Belgium; however, the Group remains present in Belgium through its Global Business Lines, continuing to provide insurance and assistance solutions. The transaction is subject to regulatory approvals and is expected to be finalized during the second half of 2018.

On 19 April, the Shareholders’ Meeting of Assicurazioni Generali approved the 2017 financial statements, the remuneration policy, the 2018 Group Long Term Incentive Plan (LTIP) and the amendments to the Articles of Association. It also approved the proposal to delegate the Board of Directors to increase the share capital with free issues and in one or several transactions, for the purposes of the 2018 LTI.

For the first time, Generali transmitted via streaming the initial speeches, thus confirming its focus on digital development and technology integration into the business.

In execution of the 2015 Long Term Incentive Plan the share capital of Assicurazioni Generali increased to € 1,565,165,364.

May

Generali successfully pushed forward its presence in the Central Eastern European countries acquiring full control of both Adriatic Slovenica, zavarovalna družba, a Slovenian company providing a full suite of P&C, health, life and pension products, and Concordia Capital SA e Concordia Polska TUW, Polish Life and P&C companies respectively. The transactions are subject to the approvals by regulatory bodies and competition authorities.

Generali renewed its revolving credit facilities, initially signed in 2013 and last renewed in 2015, increasing their overall amount and adopting innovative sustainable and green features: their cost is linked both to targets on green investments and to progress made on sustainability initiatives.

June

Generali CEE Holding B.V. and UniCredit signed a cooperation agreement for the distribution of insurance solutions in Central and Eastern Europe.

Generali completed the sale of its entire shareholding in Generali PanEurope, remaining active in Ireland through its Global Business Lines.

Generali signed an agreement with Future Group to increase its stake in its insurance ventures in India to 49%. Through this transaction it will accelerate the leverage of the far-reaching distribution network of Future Group to offer insurance protection solutions in the Indian market with a focus on digital. The transaction is subject to regulatory approval and customary closing conditions and is expected to close during the second half of 2018.

July

Generali agreed to sell 89.9% of Generali Leben and signed the transaction with Viridium Gruppe, establishing a broader industrial partnership in the German insurance market. The transaction is subject to the approval by the German Federal Financial Supervisory Authority (BaFin) and to the clearance by the competent German antitrust authorities.

Generali entered into a share purchase agreement with Life Company Consolidation Group (LCCG) to sell its entire shareholding in Generali Worldwide Insurance Company Limited, that has its headquarters in Guernsey and specialises in offering Life-insurance-based wealth management and employee benefit solutions to a global audience, and in Generali Link, an Irish company providing shared services in fund and policy administration. The transactions are subject to the approval by the relevant competition and regulatory authorities and are expected to be finalized by the first quarter 2019.

OUTLOOK

Within a context of moderate economic growth in the Eurozone and increased volatility in the second quarter, the Group will continue to implement its strategic plan for the period 2016-2018. The new strategic plan for the three-year period 2019-2021 is expected to be launched at the end of the year.

The Group will continue to rebalance the portfolio in the Life segment with the goal of optimising its profitability and allowing capital to be allocated more efficiently through the simplification and innovation of the range of product solutions.

Despite the strong competitive pressure, premium income in the P&C segment is expected to rise, maintaining the focus on technical excellence in the Group.

The initiatives described above will allow to continue along the path towards achieving the objectives set out in the 2016-2018 strategic plan.

The Manager in charge of preparing the company’s financial reports, Luigi Lubelli, declares, pursuant to paragraph 2 article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

CORPORATE EVENT

The new strategic plan for the three-year period 2019-2021 will be presented to the market at the Group’s 2018 Investor Day on 21 November in Milan.

ADDITIONAL INFORMATION

For further information please refer to the Condensed Consolidated Half-Yearly Financial Statements of the Generali Group.

LIST OF ANNEXES

Group highlights

1) Group highlights

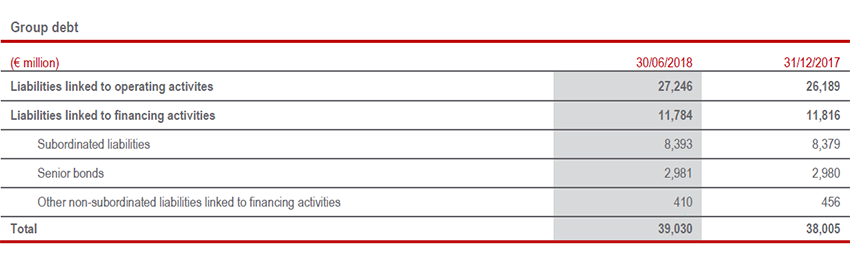

Debt

2) Debt

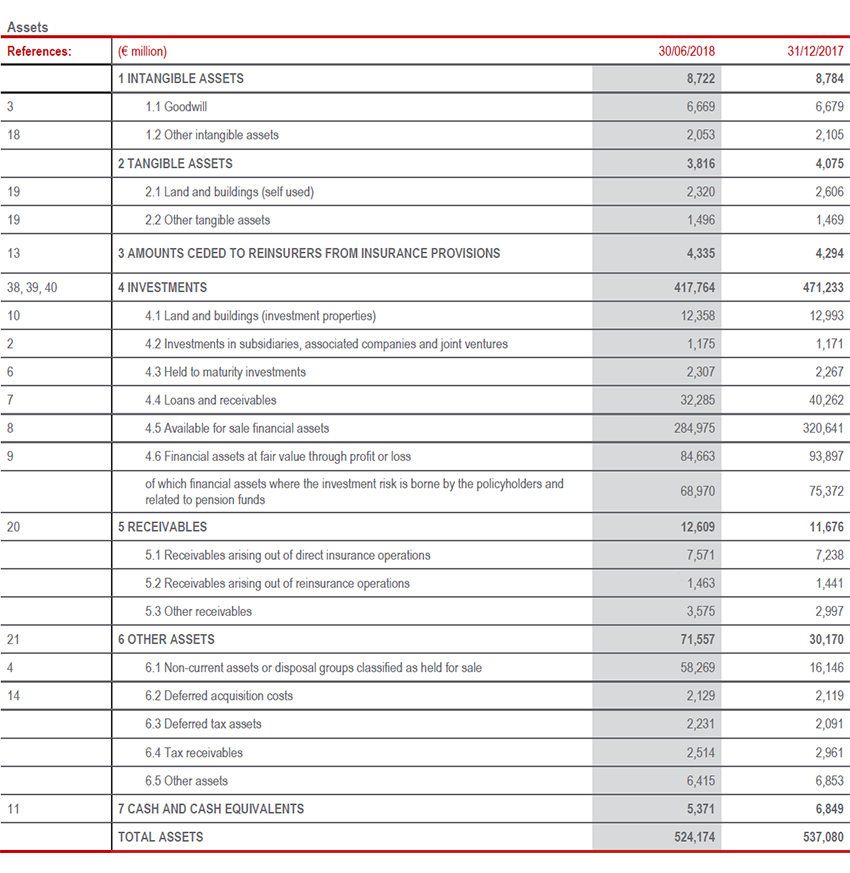

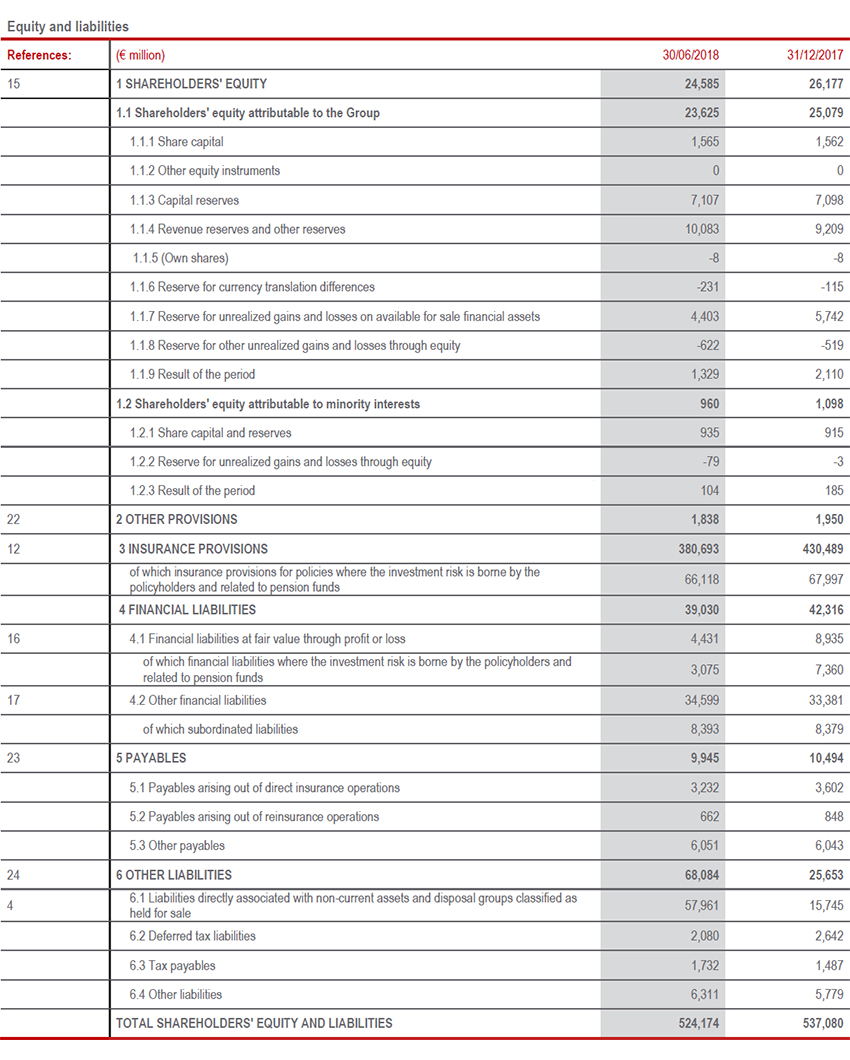

Balance sheet

3) Balance sheet

From operating result to Group result

4) From operating result to Group result

Additional key data by segment

5) Additional key data by segment

Life segment

Operating result

Other information on the Life segment

Property&Casualty segment

Operating result

Other information on the Propery&Casualty segment

Information on significant transactions with related parties

6) Information on significant transactions with related parties

With reference to transactions with related parties, in accordance with the provisions of paragraph 18 of the Procedures relating to transactions with related parties approved by the Board of Directors in 2010 and subsequent updates, it should be noted that:

(i) no significant transactions were concluded during the reporting period and

(ii) no transactions with related parties having a material effect on the financial position or results of the Group were concluded.

Further details on related party transactions can be found in the relevant section of the Condensed Consolidated Half-Yearly Financial Statements.

1 Changes in premiums, net cash inflows and PVNBP (present value of new business premiums) are presented in equivalent terms (at equivalent exchange rates and consolidated scope). Changes in operating results, own investments and Life technical reserves exclude entities sold during the comparative period.

2 ACEER refers to the regional structure known as Austria, Central and Eastern European Countries & Russia.

3 With reference to the disposals of the Belgian, Guernsey and Generali Leben (German) business, pending the issue of the necessary regulatory authorisations, these assets were classified as disposal groups held for sale, in application of IFRS 5. As a result, these investments were not excluded from consolidation, but total assets, liabilities and earnings after taxes were recognised separately in the specific financial statement items. Profit or loss from discontinued operations also included the realised gain on the disposal of the Irish business. Similarly, the comparative data was restated (2017 data also included Dutch and Irish operations whose sales were completed in February and June 2018, respectively). The disposal of the operations in Panama and Colombia led to realized gains, classified in the non-operating result. They were not deemed as relevant compared to the Group dimension and then not included in the non-current assets or disposal groups classified as held for sale. Further information is reported in the Note.

4 The ratio represents an update with respect to the figure communicated on 15 March 2018 (208%), consistent with the information disclosed to the Supervisory Authority in accordance with the timing provided by the Solvency II regulations and published on 30 June 2017 in the 2017 Report on the solvency and financial position of the Generali Group.

5 Premiums from investment contracts amounted to € 708.4 million (€ 800.7 million in 1H17).

6 The Holding and other businesses segment includes the activities carried out by the Group companies in the financial advisory and asset management sectors (financial segment), the costs incurred from the management, coordination and financing of the business, and other activities that the Group considers ancillary to its core insurance business.