Interim Financial Information as of 31 March 2017 - Press Release

11 May 2017 - 07:30 price sensitive

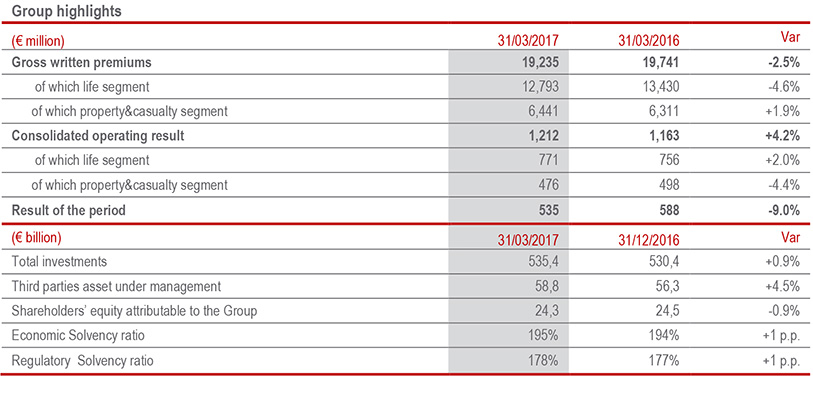

The first quarter results confirm the effectiveness of core business operations: operating performance is up significantly and net result is solid. Strategic profitability objective reached again

- Operating result exceeds €1.2bn (+4.2%). P&C performance remains solid and Life and Financial business improve further

- Combined Ratio at excellent level, 93.1% (+1.1 p.p.) despite increased catastrophe claims. Excellent Life profitability with strong growth of NBM at 37.8%

- Operating RoE rolling increased at 13.6% (+0.1 p.p.), again in line with the target (>13%)

- Premiums over €19.2bn (-2.5%): growth recorded in P&C business (+1.9%) and the disciplined approach to Life business continues (-4.6%)

- Net result confirmed solid at €0.5bn (-9%). The decrease is attributable to the lower non-operating investment result, mainly due to the continued policy to reduce realised gains, and to the stronger impact of taxation

- Solid capital position with Regulatory Solvency Ratio at 178% and Economic Solvency Ratio at 195%

The Group CFO of Generali, Luigi Lubelli, commented: “The first quarter’s results confirm the excellent performance in terms of the Group’s profitability and capital strength. In a scenario of persisting financial market volatility and low interest rates, and considering the absence of catastrophes during the previous year, Generali has continued its disciplined and effective approach to its core business. We have generated further value, which is reflected in excellent results and technical performance among the best in the industry, with operating RoE again in line with the target at 13.6%. Confirming the effectiveness of business operations in line with strategic objectives, the operating result increased due to the solid performance of the Property&Casualty business and improvement of the Life and Financial segments. The new business margin (NBM) continued to rise, reaching 37.8% and the combined ratio held to excellent levels, despite the stronger impact of natural catastrophes. In the Life segment, the trend in premiums and net cash inflows reflects the disciplined implementation of a more selective underwriting policy in the savings segment and the rebalancing in favour of products offering better risk-return terms. Premiums in the P&C segment, on the other hand, increased as a result of the good performance in both Motor and Non-Motor business”.

Milan. At a meeting chaired by Gabriele Galateri di Genola, the Assicurazioni Generali Board of Directors approved the interim financial information as of 31 March 2017.

Premiums and New Business

- Gross written premiums for the Group amounted to €19,235 million (-2.5%1). With reference to the lines of business, in the Life segment (-4.6%) there continues the more selective underwriting policy for savings products, dropping by -18.6%, especially in Italy, Germany and France, and the rebalancing in favour of products offering better risk-return terms, such as protection contracts (+9.3%) and unit-linked products (+26.2%), with excellent results in all the Group countries, particularly in Italy. Net cash inflows exceed €3.4 billion, with a decline of -24.1% that reflects the aforementioned pursuit of strategic objectives.

Property&Casualty was up by 1.9% as a result of the positive performance of both business segments. The Motor business was up by +3.5%, reflecting the growth in Germany (+3.4%), Central and Eastern European countries (+8.6%) and the Americas (+38.0%), which more than offset the persisting decline recorded in Italy (-5.3%), still affected by the reduction in the average premium. The Non-Motor (+1.3%) recorded an increase in the main Group countries, except Italy (-5.2%) following postponement of the renewal of certain corporate contracts to the second quarter of the year. - New production in terms of APE (Annual Premium Equivalent) amounted to €1,225 million (-2.2%), down slightly compared to the first quarter of 2016. The New Business Value (NBV) rose by 33.3%, amounting to € 463 million (€ 350 million 1Q16). The aforementioned Group actions targeting selective underwriting and rebalancing of the products results in a considerable improvement in the New Business Margin (37.8%; 27.8% 1Q16)2.

Economic performance

- The operating result rose to € 1,212 million (+4.2%), driven by the technical performance of the Life business and by the Holding and other businesses segment. In particular, the Life segment recorded an improved technical profitability and a decrease in expenses, whilst investment results slowed due to the lower realised gains and the persisting low level of interest rates.

The decline in the P&C operating result, which remains solid, was mainly due to the reduced technical result that reflects the impact of €55 million in natural catastrophe claims, absent the previous year.

The combined ratio confirmed its excellent levels (93.1%). Without considering the 1.1 p.p. impact of the catastrophe claims, the CoR would have achieved last year’s levels, as a result of the essential stability of current year non-catastrophe claims and the run-off results.

The higher operating result in the Holding and other activities segment is mainly due to the Financial segment which recorded the positive performance of Banca Generali and the containment of Holding operating expenses (-2.6%).

Group net result stands at € 535 million (-9.0%) and reflects3:

- the decrease in the non-operating result characterised by lower realised gains for approximately €100 million, particularly in the bonds and real estate segment, consistent with the Group strategy to preserve the future returns on investments. The non-operating result of investments also includes impairments recorded in the quarter for about €42 million attributable to Alitalia.

- the higher impact of taxation, which rose from 28.5% to 30.7%; the first quarter last year had benefited from the positive effect on taxes of previous years. - In the current context of low interest rates, the P&L return on investments amounted to 0.8% (0.9% 1Q16)4. In particular, current returns reached 0.7% (0.8% 1Q16) and the harvesting rate decreased mainly due to the lower contribution from realised gains mentioned previously.

In Life segment, the P&L return on investments moved from 0.9% to 0.8% while in the P&C business, it went from 0.8% to 0.6%.

Balance Sheet and Capital Position

- The Group shareholders’ equity stood at €24.3 billion. The 0.9% decrease mainly reflects the decline in the reserve for unrealised gains/losses on available for sale financial assets for €0.65 billion (-10%) following the slight increase in interest rates and government bond spreads affecting the value of bond investments.

- The Regulatory Solvency Ratio – which represents the regulatory view of the Group’s capital and is based on use of the internal model, solely for companies that have obtained the relevant approval from IVASS, and on the Standard Formula for other companies – stood at 178% (177% FY 2016; +1 p.p.). The normalised generation of capital essentially offset the aforementioned negative economic spread impact.

The Economic Solvency Ratio, which represents the economic view of the Group’s capital and is calculated by applying the internal model to the entire Group perimeter, stood at 195% (194% FY16; +1 p.p.).

The Manager in charge of preparing the company’s financial reports, Luigi Lubelli, declares, pursuant to paragraph 2 article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

For the significant events that occurred in the period and after 31 March 2017, please refer to the press releases downloadable from the web site www.generali.com.

On the basis of the information provided by the members of the Board of Statutory Auditors and of those available to the Company, the Board of Directors ascertained that professionalism, respectability and independence requirements laid down by law and applicable legislation were met by the members of the Board of Statutory Auditors and verified as well the absence of any grounds for incompatibility or disqualification. The Board of Directors also took note that the members of the Board of Statutory Auditors met the independence requirements laid down by the Corporate Governance Code, based on the information provided by the Board of Statutory Auditors.

The glossary and description of alternative performance indicators are available in the Group Annual Integrated Report and Consolidated Financial Statements 2016.

1 Changes in premiums, net cash inflows and Annual Premium Equivalent (APE) are presented in equivalent terms (at constant exchange rates and scope of consolidation).

2 From the first quarter of 2017, the New Business calculation method was updated to take into consideration the Solvency II rule on including future premiums and related projection performances (Contract Boundaries). The 1Q16 figures were consistently restated.

3 The following figures are after taxes and minorities.

4 The % return on investments in the income statement is not annualised.