Interim Financial Information as of 30 September 2017 - Press Release (1)

09 November 2017 - 07:31

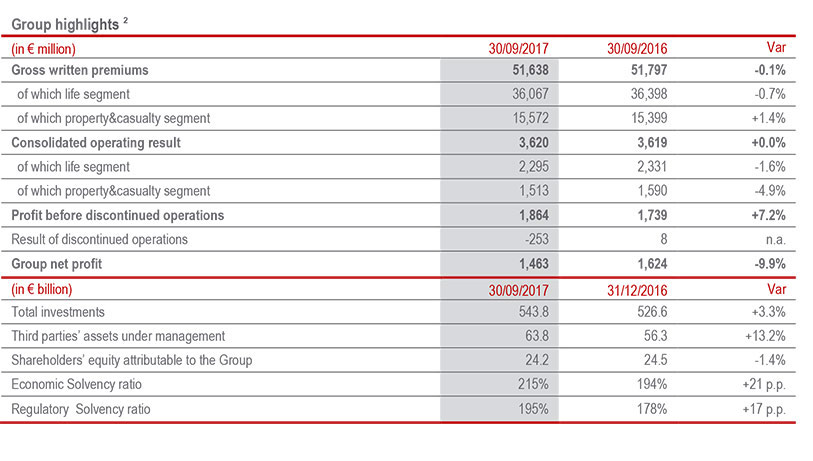

Stable operating result at € 3.6 bln confirming Operating RoE in line with target. Strong capital position. Profit before result of discontinued operations increases by 7.2%

- Operating result stable at € 3.6 bln. Performance remains solid in Life and P&C businesses, despite the increase of € 70 mln in natural catastrophe claims. Improved performance in Holding and other businesses

- Excellent Combined Ratio at 93% (+0.7 p.p.). Strong profitability in Life new production with New Business Margin up significantly to 4.2% (+1.6 p.p.)

- Annualised Operating RoE at 13.2% (-0.4 p.p.) in line with the target (>13%)

- Premiums stable at over € 51.6 bln, improving in P&C business (+1.4%). Life net cash inflows of more than € 8.2 bln remain at best-in-class levels

- Profit before Dutch business disposal grows to € 1.9 bln (+7.2%).

Group net profit, including € -253 mln from the disposal of Dutch assets, stands at € 1.5 bln - Capital position further improved with Regulatory Solvency Ratio at 195% and Economic Solvency Ratio at 215%

Generali Group CFO, Luigi Lubelli, commented: “The nine-month results confirm our strong performance. Our business continues to grow thanks to the consistent execution of our strategy which has resulted in the increase in P&C premiums, especially in the Motor sector; strong Life net cash inflows exceeding € 8.2 billion, among the best of European peers, driven by Unit-linked and Protection products; as well as a significant increase of more than 13% in third-party assets under management. Continued focus on technical excellence is shown by the outstanding combined ratio, despite the increase in natural catastrophe claims, and by the notable growth of the Life new business margin. Cost reduction, lower impairments and the decrease in the cost of our financial debt further contributed to our performance in the period. Net profit before discontinued operations grew by 7.2% and underlines the solid level of our current underlying profitability.”

Mogliano Veneto (TV). At a meeting chaired by Gabriele Galateri di Genola, the Assicurazioni Generali Board of Directors approved the interim financial information as of 30 September 2017.

Premiums and New Business

- Total Group premiums, amounting to € 51,638 million, are stable on a like-for-like basis with respect to the previous year, thanks to the growth recorded in the third quarter. With reference to the business lines, the Life segment registered a recovery with respect to the half-year period, despite registering a slight decrease in the 9-month period (-0.7%). This derived from the continued application of a more selective Savings products underwriting policy, whose issuance fell by 13.5%, especially in Italy, Germany and France. Due to the policy of rebalancing in favour of products offering better risk-return terms, Protection products (+6.6%) and Unit-linked products (+27.3%) instead recorded an increase, with excellent growth in all countries in which the Group operates, Italy in particular. Net cash inflows surpass € 8.2 billion; the decrease of 18.9% reflects the aforementioned pursuit of the strategic objectives of concentrating sales on products with high profit margins.

P&C Premiums rose by 1.4%, thanks to the positive performance in both sectors. The Motor segment grew by 3.2% thanks to the growth in Germany (+4%), in the Central-Eastern European countries (+4.6%), Spain (+4.6%) and Americas (+31.3%); Italy saw a drop of 4.6% due to the fall in average premiums and the portfolio. Non-Motor premiums in the segment also increased (+0.7%), where France and Germany recorded essentially stable performances, while Italy fell by 5.1% mainly due to the drop in income in the Global Corporate & Commercial lines. - Present value of new business premiums (PVNBP) amounted to € 32,138 million (-1.5%). The new business value (NBV) stood at € 1,341 million (€ 863 million 9M16), recording a major improvement (+56.7%) compared to 9-month period of 2016.

The aforementioned Group actions targeted at selective underwriting and product rebalancing boosted the PVNBP3 margin to 4.2% (2.6% 9M16), marking an remarkable increase of 1.6 p.p. also as a result of an economic scenario which has shown a slight recovery with respect to the 9-month period of 2016.

Economic performance

- Operating result stable at € 3,620 million. The decrease in the Life segment reflects the technical performance net of insurance and other operating expenses. The P&C operating result posted a decrease of 4.9% and includes natural catastrophe claims for around € 260 million, such as the recent US hurricanes in August and September and the storms that hit central Europe in July and August. Excluding the impact of natural catastrophe claims in both years under comparison, the P&C operating result would essentially be in line with the 9-month period of 2016. The combined ratio stands at excellent levels (93%: +0.7 p.p. over the 9M16), despite the impact of catastrophic claims for 1.8 p.p. (1.3 p.p. 9M16); the prior years development remains positive. The expense ratio is up, owing to the commercial efforts targeted at developing the Non-Motor segment. Lastly, a positive performance was registered in the Holding and other businesses segment, thanks in particular to the excellent performance of Banca Generali and the significant reduction in operating costs (-10.7%).

- The Group net profit stands at € 1,463 million (-9.9%) and reflects4:

- the improvement in the investment result of non-operating result, in particular owing to lower net impairment losses, and lower interest expenses on financial debt;

- the higher impact of taxation, which rose from 30.7% to 31.6%. Last year, the tax rate had benefitted from higher exempt income;

- the result of discontinued operations of € -253 million which includes the impairment of Dutch operations plus the profit for the period deriving from said activities. - The P&L return on investments stands at 2.5% (2.6% in 9M16), mainly due to the impact of the persistently low interest rates on current return, equal to 2.3% (2.4% in 9M16).

Balance Sheet and Capital Position

- Group shareholders’ equity is confirmed as solid at € 24,209 million (€ 24,545 million as at 31 December 2016). The change of -1.4% was due to the result of the period attributable to the Group, amounting to € 1,463 million, which essentially absorbed the payment of the dividend totalling € 1,249 million and the reduction of € 313 million in the reserve for unrealised gains and losses on available for sale financial assets.

- Third parties' assets under management recorded an increase of 13,2%, mainly thanks to the excellent performance of Banca Generali.

- The Preliminary Regulatory Solvency Ratio – which represents the regulatory view of the Group’s capital and is based on use of the internal model, solely for companies that have obtained the relevant approval from IVASS, and on the Standard Formula for other companies – stood at 195% (178% FY16; +17 p.p.).

The Economic Solvency Ratio, which represents the economic view of the Group’s capital and is calculated by applying the internal model to the entire Group perimeter, stood at 215% (194% FY16; +21 p.p.).

The remarkable increase is due to normalised generation of capital, net of the accrued dividend for the current year, and the positive trend of financial markets.

For the significant events that occurred in the period and after 30 September 2017, please refer to the press releases that can be downloaded from the site www.generali.com. In particular, it should be noted that, following the announced phase of industrial transformation to strengthen the operating performance in Germany, the associated restructuring costs at the determination phase will be posted by the end of the year, with a net impact in the region of € 80 million.

The Manager in charge of preparing the company’s financial reports, Luigi Lubelli, declares, pursuant to paragraph 2 article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

The glossary and description of alternative performance indicators are available in the Group Annual Integrated Report and Consolidated Financial Statements 2016.

1 The changes in premiums, life net cash inflows and PVNBP (current value of premiums of new products) are on a like- for-like basis (with exchange rates and scope of consolidation being the same). The changes in the operating results and own investments exclude the entities under disposal in the comparative period.

2 With reference to the disinvestment in Dutch operations, pending the issuing of the necessary regulatory authorizations, in application of IFRS 5, as of 30 September 2017, the Dutch companies in the transfer phase are classified as assets held for sale. Consequently, these investments were not excluded from consolidation, but both total assets and liabilities and the economic result, net of taxes, were booked separately to the specific items of the financial statements. Likewise, the comparative data were reclassified.

3 This performance indicator is calculated as the ratio New Business Value (NBV)/Present Value of New Business Premiums (PVNBP, that replaces the performance indicator APE). The technical margin calculated considering APEs would increase up to 41.1%.

4 The following figures are after taxes and minorities.