The Modern Monetary Theory: From Theory to Practice

By Vincent Chaigneau, Head of Research, Generali Investments

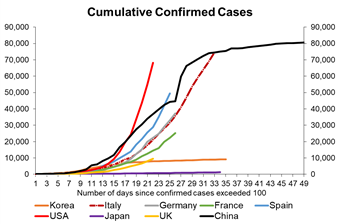

Virus still spreading. First, the sanitary situation: still worrying. The total numbers of recorded Covid-19 cases is now over half a million, and the number of deaths close to 25k. Contagion from east to west continues, with the US now the center of attention: the country has more reported cases than China. The total number of cases (world) has grown at an average daily pace of 13% in the week to 26 March, 5 points faster than the previous week. One bit of positive news, however: confinement measures seem to be working, with the number of cases in Italy now growing at less than 8% per day, down from about 15% just a week ago. Worryingly, social distancing in the US does not seem as severe as in Italy. New clusters may also appear in regions where restrictions are progressively relaxed.

Economy suffers sudden stop. In the meantime the western economies are suffering a ‘sudden stop’. US jobless claims surged like never before in the week ended 21 March, to nearly 3.3 million. The Eurozone Services PMI dropped from 52.6 to 28.4 in March, by very far the lowest ever. The Bank of England warned of a ‘very sharp economic downturn’. There is hope of a strong bounce in the second half of the year, but this is conditional to the virus receding, and policy makers stopping second-round effects such as defaults and bankruptcies. Even if supply normalizes through summer, demand will be slower to recover (many companies not in position to spend on capex, wealth effect hurting consumer demand etc.).

Financial panic recedes as policy makers get bold and creative. The mood in financial markets has improved substantially over the past few days. To a large extent this owes to extremely bold US policy action. Over the past week the Fed expanded its Quantitative Easing (QE) to short-term municipal bonds and private assets (corporate bonds and Asset Backed Securities, $300bn). It then made the QE program ‘unlimited (initially $700bn). Meanwhile Congress approved a USD 2 trillion fiscal plan - nearly 10% of national GDP! The pack funds business bailout, help to SMEs, income support, unemployment benefits and medical funding. Crucially, the bailout program includes guarantees that can leveraged ten times by the Fed!

Europe? ECB still the only game in town. European leaders failed on Thursday to agree on any mutualisation of the crisis costs. Finance ministers are given the task to find a solution within two weeks. Fortunately the ECB continues to keep the European house. On Thursday it made its temporary pandemic emergency purchase program (€750bn) ever more credible by formally removing self-imposed limits to its public debt purchases.

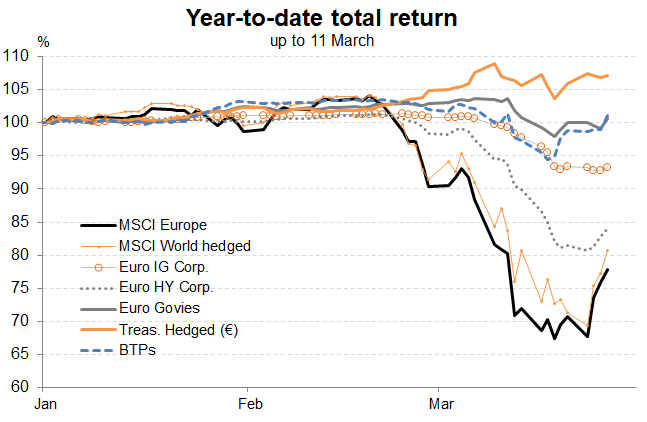

How to position? Last week we listed a number of missing policy actions that we thought could be true circuit breakers. Policy makers have mostly raised to the task. End of the financial crisis? It would be bold to claim that the worst is behind us (famous last words). The recent pullback in volatility is welcomed, and usually a precondition to better market trends. Yet we remain wary that awful economic data in the coming weeks, as well as new Covid-19 clusters, may keep investors nervous. Our bias for equities is positive over 3 and 12 months, but for now we still prefer defensive plays such as large cap., Pharma, Households, Utilities, Food & Beverages, and Telecommunications. We recommend an overweight in Investment Grade (IG) Credit (while staying cautious on High Yield). We also see value in long-dated core and semi-core EUR and US government bonds, following the technical dislocation seen around mid-March.

The day after. The coronavirus crisis will settle – eventually – but the world will not return to its previous state. The Modern Monetary Theory (MMT) argues that governments should use fiscal policy to achieve full employment, while central banks create the money required to fund government purchases. The Global Covid Crisis (GCC) has seen MMT go from theory to practice, particularly so in the United States. Central banks used to be the lenders of last resort for commercial banks; amazingly, they now also play that role directly for the non-financial sector. Will such monetary debasement eventually create inflation? That remains to be seen; over the coming quarters, supply will recover faster than demand, keeping inflation subdued. But adding inflation-linked bonds to a diversified portfolio makes sense. The US dollar is exposed to such debasement policy, while Gold stands to benefit.