ONE MONTH FOR THE HISTORY BOOKS

By Vincent Chaigneau, Head of Research, Generali Investments

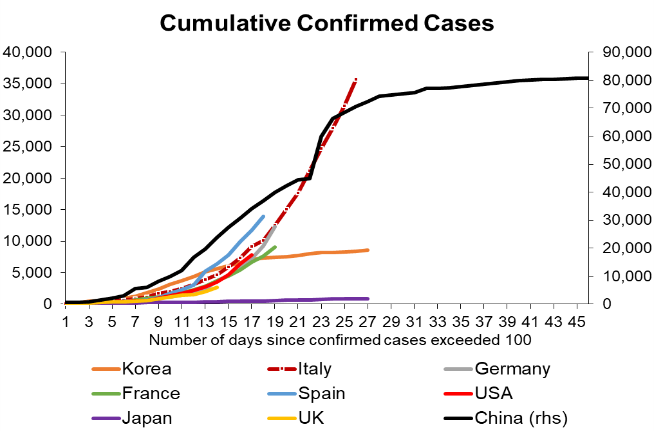

One month for the history books. Global equities (MSCI World) have lost 30% since the 19th of February, as the Chinese sanitary crisis morphed into a Global Covid Crisis (GCC). This is the fastest sell-off ever. The drawdown has cut $24 trillion from the global equity market capitalisation – more than the annual US GDP! Investors are scared and praying that the contagion of the coronavirus will slow. But for now the pandemic crisis is still worsening: in the 7 days to 19 March, the total numbers of cases, now 235k, has increased at an average 9% per day. This is double the pace recorded in the week ended 12 March. The number of deaths (over 10k) has increased at a daily pace of 11%, again more than double that of the previous week. The pace of contagion is starting to slow in Italy, at now about +15% per day over the past week, vs. more than 20% a week earlier. But this is not enough yet for the Covid curve to flatten out as it did in China (see chart). We estimate that France is one week behind Italy, the US about 20 days and the UK in between (hard to day given the under-testing there). The latter is a particular matter of concern, since the ‘herd immunity’ strategy adopted initially will make it harder the control the pandemic.

Global recession: the question is no longer if, but how long. The economic impact is hard to measure, but doubtless severe. The first numbers from China indicate a ‘sudden stop’ of the economy, which will imply a terrible Q1 growth number. The western world will suffer a deep contraction in Q2, as the social distancing measures cause a sharp fall in activity such as leisure, restaurants, travelling etc. Global growth forecasts for 2020 are melting like snow in the sun. We see it in the region of +0.5% this year, but the risks are still skewed to the downside; the longer the confinement measures, the larger the shock. For sure, global GDP growth will be the weakest since at least the Great Financial Crisis (marginally negative in 2009, and at -3.3% for the advanced economies). The world is usually seen in recession when global growth falls below 2.5%. But this recession will likely be like no other: the dual supply and demand shocks will imply a severe fall in H1, hopefully followed by a strong recovery on H2.

Policy makers are throwing the kitchen sink. The policy response, both at the sanitary and economic levels, is a testimony to the severity of the shock and the fear of chain effects. Governments are in a catch-22: let the virus spread, and the sanitary impact would be catastrophic (see this study from the Imperial College, a wake-up call to the UK government). Impose severe confinement measure, and the economic shock will be large. To offset the latter, policy makers are throwing the kitchen sink. We do not have the space here to list all the measures; we’ve had 42 central bank rate cuts over the past six weeks! The Fed cut rates by 150bp (50+100) to nearly 0%, announced $700bn of QE and reopened a number of liquidity facilities – including over the past week the Commercial Paper Funding Facility (CPFF) and the Money Market Mutual Fund Liquidity Facility (MMMFLF). The ECB announced a Pandemic Emergency Purchase Program (PEPP) of €750bn for this year, including all assets under the current APP (public sector and corporate bonds) plus non-financial commercial papers and Greek bonds. This comes on top of the current APP (€20bn/month) plus the €120bn envelope already announced at the March meeting - which means the ECB will easily be buying more than €100bn bonds per month this year – more than ever before – and probably substantially more in the coming months (front loading). The ECB also said it would review “self-imposed” limits if necessary, e.g. the 33% issuer and issue limit.

The fiscal policy response is also set to be gigantic, possibly bigger than in 2009. In all, the fiscal stimulus is likely to approach two percent of world GDP. The US is in the lead, with a $1+ trillion plan (yet to be agreed), or about 5% of GDP. China’s details are being worked out, but the numbers will be large. The European fiscal impulse is smaller, but complemented by a massive amount of guarantees (e.g. €300bn in France, or 12% of GDP).

What else can be done? The policy actions over the past week are close to what we consider circuit breakers, but not completely there yet. Central banks are splashing the markets with liquidity, but if the banks lack confidence, they will not lend. Hence the vast program of government guarantees is very much welcome. The top priority is to avoid that, as the economy suffers a sudden stop, companies (especially SMEs) fail to access liquidity. The liquidity crisis could morph into a solvency crisis (defaults), and more so in a very leveraged corporate world. The policy response effectively blurs the line between fiscal and monetary policy: governments spend, central banks print money and fund the public and private borrowing needs. Call it QE eternity. But the missing parts are two-fold.

- While the ECB offers long-term funding to the non-financial private sector, the Fed isn’t: it is still not buying corporate bonds. Doing so would likely require a change in the Federal Reserve Act, or at least guarantees from the Treasury Department against losses (government already backing the funding facilities for Money Market Funds and Commercial Papers). Because credit markets are at the core of this crisis, we would see such move as a true circuit breaker.

- In Europe, the fiscal initiatives are mostly national. This raises the risk of reviving the old feedback loop between the states and the banks in countries that have limited fiscal room, such as Italy. A true mutualisation of risk could happen for instance through the European Stability Mechanism (ESM).

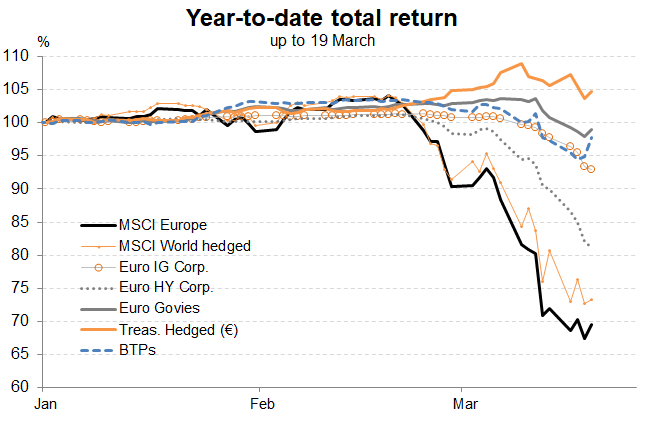

Flows and markets: capitulation. The past week has seen $20bn of outflows from equity funds globally, the fourth negative week in a row. Worse still, the week has also seen a record $109bn outflows from fixed income funds. Inflows towards cash was close to $100bn as savers rushed to liquidity and safety (surging flows in particular into Government-only Money Market Funds, vs outflows from prime MMF). Our main concerns is credit, where negative total return will cause more outflows, causing forced selling. Another area of concern is the break in correlations, e.g. risk-free bonds selling off despite the clear aversion for risk. The 10-year Bund yield has risen from -85bp to -25bp over the past two weeks. This partially reflects concerns about upcoming bond supply and rising public debt, but also forced selling from investors facing client redemption and margin calls or in need of capital gains to offset impairments. Those dislocations will offer opportunities for long-term investors, and the decisive policy actions of the past week are a step in the right direction. More can be done to reduce the risk of deeper market dislocations while the number of coronavirus cases continues to accelerate over the coming weeks. This crisis is like no other; once the virus contagion fades, the unprecedented stimulus that is in the pipe may cause a sharp market reversal indeed.