02 February 2021

US Q4 2020 earnings season starts better than Q3 one

Expect good earnings momentum to linger, supporting positive total returns this year

Author: Michele Morganti, Senior Equity Strategist, Generali Investments

The Q4 reporting season has just started. For the US, expectations are for a yearly earnings growth of -7.8% after -6.5% in Q3: a positive yearly growth will start to be visible from Q1 2021 (+16.7%). After 64 firms reported, results look quite solid vs expectations, both for earnings and sales.

Surprises are largely and broadly positive especially for earnings (27%). They are better than Q3 ones (16%) and the last 9 quarters’ average (10%). In particular, financials, industrials, discretionary and tech, did better than the sector average. Sales surprise is lower but still positive at 3.3% and better than in Q3 (2.8%) and the last 2 years (1.2%).

This bodes well for our expectations of increasing earnings momentum, which is at the core of our total return targets given that market multiples (PE) have little scope to increase further from current already elevated levels, albeit justified by policy support, low yields, earnings trough and lower political uncertainty.

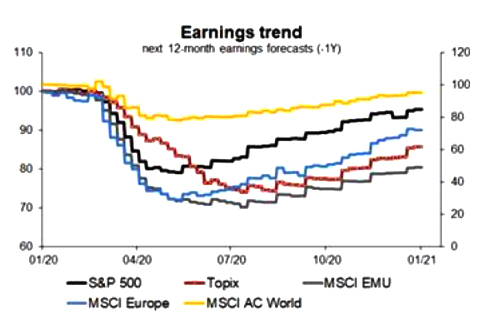

2021 earnings growth: Our macro-based models back a 2021 earnings growth of +42% for EMU and +17% for the US. EU Q4 2020 expectations have been in particular weak (not rebounding yet), incorporating the worsening of Covid new cases and delays to vaccine deliveries. Q1 2021 expectations could also deteriorate but not significantly, as macro surprises are still lying around cyclical highs, and global GDP is having a positive momentum.

EMU earnings should recover to 2019 levels in H2 2022 (24 months would be the norm according to past recoveries after recessions but this time the policy support makes the difference), while those for the US at the end of 2021 (a more resilient index).

A lower US weight in energy and financials and a higher one in tech explains a faster recovery in US earnings.

Year 2022 should see an earnings growth of around +10% for both.

Our US estimates have upside risks as world earnings revisions linger at the top of the cycle and Biden’s victory can provide higher GDP growth in 2021.

Democrats’ majority at the senate and the next fiscal stimulus under discussion could be at least worth an additional 1.6% GDP growth in 2021 and an earnings growth of 6%, finally bringing our target towards 4,100 (net of a negative impact from higher 10-year rates by the end of the year of nearly 20 bps).

A better US earnings revision should benefit indirectly also other international firms in EMU or Japan (export volumes, global firms’ confidence). The upside pressure on US yields, instead, will bode well for a continuing rotation into Value and to a lesser extent Cyclicals (they have already outperformed Defensives appreciably), especially outside the US, where valuations are cheaper (EMU, Japan and EM equity indices).

Overall we continue to see total returns in the range of 5-9% in 12 months (US 5%, EMU 6.8% and EM 9%).