10 March 2021

Reflation boon and bane

Generali Investments’ Market Perspectives

Autori: Thomas Hempell / Vincent Chaigneau

- While acknowledging stretched investor positions and residual risks from Covid-19 mutations, we expect a strong economic rebound in the spring to keep financial conditions underpinned.

- An intensifying US inflation debate, however, poses risks for fixed income. Equities should prove resilient, but the recent pick-up in real yields deserves to be watched. It is more toxic for highly valued risk assets, incl. Growth stocks.

- Overall, we maintain a moderate pro-risk tilt in our portfolios, with potential equity setbacks providing buying opportunities into a broader ‘spring reopening’.

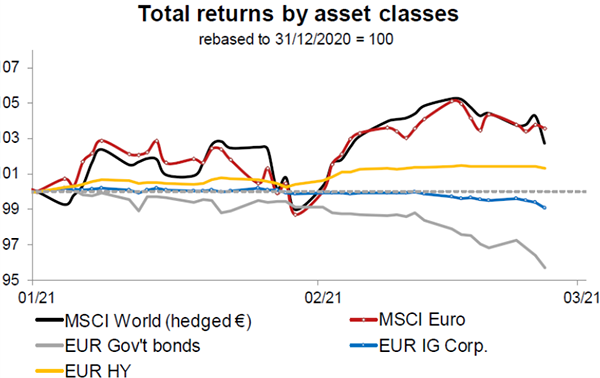

An accelerated global reflation trade and solid Q4 earnings propelled equities to fresh highs by mid-February. The sharp rise in global yields through February has started to shake lofty valuations, but our maintained pro-risk tilt has paid off, with Govies underperforming other assets.

Looking ahead, the fortune of global economies and markets still hinges on the control of the Covid-19 pandemic. New infections and deaths have been falling sharply since January, but in many instances only amid renewed lockdowns. Fortunately, their economic harm has proven much milder than in spring, as we have learnt how to cope with restrictions. Front-runners in the vaccine race (Israel, UK) are reporting promising results.

Fast vaccination is the surest way to economic reopening. EU is lagging the UK and US, but accelerated production and improved logistics may still allow for inoculating the most vulnerable people and front-line healthcare workers by May. Encouragingly, evidence thus far suggests that vaccines still cover new variants, if less effectively. Faster mutations may require vaccine adjustments and booster shots, but the central scenario sees a boom in to summer.

Intensifying inflation debate

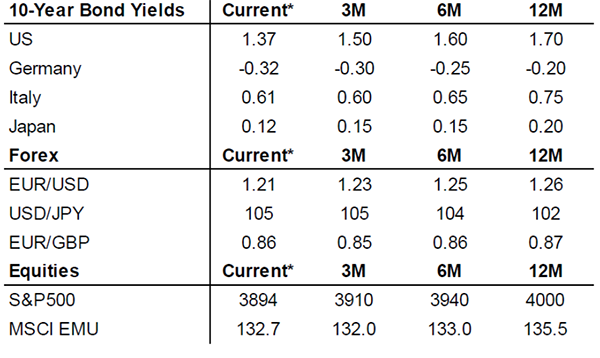

Meanwhile, the already vivid inflation debate will intensify. The US administration is set to deliver another fiscal package whose size may be quite close to President Biden’s plan (we assume US$ 1.6 tr). This will greatly amplify the economic rebound and coincide with a sharp increase in annual inflation rates in spring (mostly in the US, but also EA) on statistical effects from last year’s collapse in prices for oil and other temporary items. The Fed will continue to flag the temporary nature of the looming inflation spike, while employment is still almost 10 m short of pre-crisis levels. But amid a powerful cyclical rebound, markets may question the dovish Fed commitments, fuelling speculation about the tapering of its U$120bn bond purchases and the timing of rates hikes.

As long as the rise in yield remains orderly, as we expect, this will cap but not derail the overall friendly risk environment. Risks are rising, however. First, negative convexity hedging may cause a yield overshoot. Second, the whole investor community is not prepared for a significant rise in yields, following a secular decline; broader hedging could hurt. Third, the early move in yields was driven by inflation breakevens, but real yields have picked up of late –a more toxic development for risk assets. A larger move there is unlikely before we get closer to tapering, but the recent ‘stress’ is a nearly warning of possibly chaotic developments this autumn.

For now, we retain a pro-risk bias, if only because Govies are least attractive. While we acknowledge pro-risk positioning among investors and frothy valuations, we note that the recent rise in real yields (+40 bps in 10y TIPS) has been small compared to the 2013 taper tantrum (+150 bps). We are also less concerned about a sell-off in EUR fixed income. True reflation is much more distant in the EA, and the ECB will lean against the rise in real yields via QE.

The new Italian government intends to complement Recovery Fund spending with reforms (legal system, public administration), keeping risk premia low. Credit spreads are tight but contained default rates and persistent ECB support help. We more carefully watch EM exposure on headwinds from higher US yields. The short-term USD outlook is more balanced as US yields rise faster, but the global cyclical upswing supports a bearish bias.

Discover our Market Perspectives in the dedicated section.