07 May 2021

Grand Reopening

Generali Investments’ Market Perspectives

- Amid the global economic rebound from the pandemic and rising US inflation concerns, upside pressures on yields will persist. The PEPP acceleration has not stopped the yield ascent, and the ECB faces a difficult June meeting; so does the Bund.

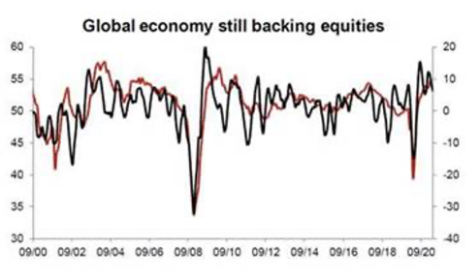

- The Fed’s patience may stoke inflation fears, but keep real yields in check-they matter most for risky assets. Vaccination progress, large excess savings / liquidity and surging earnings keep us long risk assets (Equities, Credit) for now, and underweight in longer-dated Government bonds.

- Discretionary positioning and equity fund inflows, however, have become stretched in parts. As the summer boom supports exuberance and vols recede, start thinking about cheap heading.

Authors: Thomas Hempell, Head of Macro & Market Research, Generali Investments; Vincent Chaigneau, Head of Research, Generali Investments

The global economy is enjoying a grand reopening. Rising infections still burden large parts of Europe and Ems (India, Brazil). Yet the vaccine champions are leading the way. The US is enjoying a strong rebound, with the boost from re-opening sectors seconded by strong fiscal packages and persistent Fed support. Evidence from the UK and Israel shows that effective vaccination campaigns allow for fast normalization of significant parts of the economy. Risks from mutations persist, but much improved vaccine supply will help the EU to catch up over the spring and summer.

Fiscal policy: what to expect, and what are the impacts?

Fiscal policy in the euro area will by far fall short of the US stimulus. But various governments are expanding their fiscal plans for this year, adding to the Recovery and Resilience Facility, whose disbursement should start in H2 after it cleared a hurdle at the German Constitutional Court.

Upside pressures on yields are unlikely to abate in this setting. In the US, the fiscal impulse and temporarily high inflation prints (mostly on statistical base effects from last year’s price slump) will keep inflation concerns high. In Europe, the pending grand reopening will encourage investors to diversify excess savings out of low-yielding safe government bonds into more juicy (and risky) alternatives.

Central banks want to delay discussions about tapering asset purchases. In the US, the Fed’s patience may keep real yields low for longer, but fan inflation concerns in the process. Meanwhile the ECB faces a tricky June meeting as the PEPP acceleration in Q2 has not stopped 10-year Bund yields from reaching new post-Covid highs. Assuming the hawks will stop an increase in the PEPP envelope, investors may well test the ECB’s resolve.

A too rapid bounce in yields is still a threat for risky assets, alongside lofty valuations, surging equity inflows over the past six months and stretched positions in selected segments. Equities have already extended their 2021 rally into double-digit territory, benefitting our pro-risk stance.

Yet there are good reasons to believe that the further rise in yields can be controlled and well digested. In the US, TIPS already discount a high degree of inflation worries with option markets pricing a 30% probability of a >3% inflation overshoot over five years. Excessive inflation remains are mote threat in Europe where significant output gaps still keep reflation the major task for the ECB.

Arguably the Fed and ECB will need to start considering the future of their asset purchase programs in summer. Nevertheless, they still have ammunition to counter a disorderly rise in real yields (which matter most for risky assets) via increased QE, strengthened forward guidance, duration extension or (unlikely) outright yield curve control.

Maintaining a pro- risk bias

We keep a pro-risk bias in our portfolios, with a moderate overweight in Equities and a more sizeable one in Credit. We continue to prefer Cyclical and Value stocks over Growth and Defensive ones. In Credit, we see particular value in financial papers and in HY, as the economic upswing will improve leverage metrics while default rates are already peaking.

We keep an underweight in core European Govies on poor carry and rising yields (with the risks tilted towards an overshoot of our yield forecasts). We like European inflation linkers, which still appear cheap into the recovery. The USD has already pared most of its initial Q2 bounce, and is headed for further headwinds amid a recovering global economy.