09 September 2021

A stony path to normality

Generali Investments’ Market Perspectives

Author: Thomas Hempell, Head of Macro & Market Research, Generali Investments

- Toppish data, rising Covid worries and China’s regulatory clampdown are weighing on the outlook.

- Yet the recovery will not run off the rails and policymakers will tread cautiously in removing accommodation.

- Low real yields and solid expansion still leave risky assets with legs, while rates will creep higher only sluggishly.

- We maintain a prudent pro-risk bias, but acknowledge a higher risk of setbacks in the more mature phase of the cycle.

A challenging summer is drawing to a close, with extreme weather (wildfires, floodings, typhoons) giving a whiff of what climate change may mean longer term. Cyclical indicators have peaked and global data surprises dived, as the Covid delta variant and resurgent infections poured cold water on hopes of a quick return to normal. China severely extended its clampdown on tech companies. Yet global financial markets have taken the news in a stride. Global equity markets have advanced further, testing new highs (MSCI World +2.5% in August as of 30/8), while Credit markets extended their resilience. This has further benefitted our maintained pro-risk stance.

The path towards a post-pandemic normality will indeed prove stony. Vaccinations in the US and (and increasingly Europe) are running into the speed limit of reluctant demand. Rising cases in Israel and scientific research suggest that the efficacy of jabs may fade more quickly; vaccinated people still seem to carry a high virus load, making herd immunity an increasingly distant dream.

Yet while resurgent Covid worries will retard the global recovery, they will unlikely derail it. Mobility tracker still recover in most advanced economies. Vaccines’ protection against hospitalization and death is still supported by studies. And with the majority of people in most advanced economies vaccinated and vaccines available for elder children too, governments will not risk a fall back into harmful lockdowns. Booster shots are increasingly rolled out to vulnerable groups addressing fading protection.

Meanwhile, policy support will be withdrawn only very gradually. The fiscal impulse in the US will wane over the coming quarters, but chances have risen that Congress ultimately agrees on a bipartisan U$1 tr infrastructure package and an (amended version of) Biden’s U$3.5 tr new budget package. The Fed eyes to start tapering its QE programme in Q4. But Chair Powell also stressed in his Jackson Hole intervention that the bar for raising rates will be distinctively higher. The ECB may delay any tapering decision of its PEPP programme to Q4 or even next year.

Risk assets still with legs, yields creeping higher

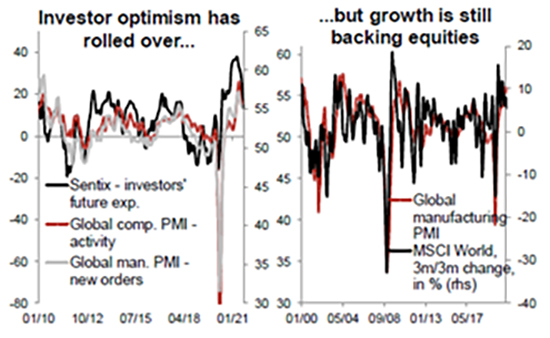

Toppish growth indicators and the more mature phase of the cycle may well herald higher volatility and more frequent setbacks among risky assets. But with investors having already cooled their exuberant optimism and the global expansion still strong (see charts), we maintain a pro-risk bias in our tactical recommendations.

Corporate earnings upgrades are still reassuring. Fallen real yields (back below-1% at 10 y for the US) underpin equity valuations, with equity risk premia still looking favourable. Credit is set to extend its resilience shown throughout the year. While spreads are already tight, a persistent search for yield, easing default rates and ongoing policy support from the ECB’s bond purchases are boding well. We are growing more cautious about the more risky HY segments, though, especially in the US market amid looming Fed tapering and a pick-up in M&A activity.

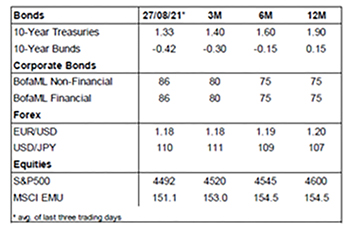

Core yields are geared to the upside amid above-potential growth and lingering US inflation worries. Yet the looming conflict in Congress about lifting the reinstated debt ceiling may require the Treasury to further draw on its accounts at the Fed instead of bond issuance. Any sharper increase in yields may also prove self-defeating given the higher fragility of the recovery, debt sustainability concerns and potential larger impacts on risk sentiment and financial conditions. We thus prefer only a moderate short position in fixed income duration.