13 April 2017

Energy disruption

Risks and opportunities of a greener future

Risks and opportunities of a greener future

Clean energy has overtaken coal in terms of installed capacity and it is on its way to becoming cheaper than conventional sources. But The Economist warns: be careful of the consequences on employment. The incentives bubble might well burst.

Sparks, Nevada. Not far from this American town of 60 thousand inhabitants the energy colossus Tesla is building its Gigafactory, a plant for the construction of lithium-ion batteries. Spread over a vast area (photo), equal in size to one hundred football pitches, the factory will be powered by solar energy. The Gigafactory should be fully operative by 2018 and is expected to provide jobs to 20 thousand people.

The aim of Tesla’s founder, Elon Musk, is that the Gigafactory alone will be able to meet the global demand for electric car batteries. The production of these vehicles looks set to grow and estimates predict that in the second half of this century at least half a million will be built each year. Tesla, as is well known, was founded precisely to supply this market, which can still be described as a niche sector. According to a recent report, news of which spread immediately around the world, Musk is even considering incorporating solar panels into the roofs of Tesla cars.

Lately, there has been much talk also about the scientific research carried out at the Chalmers University of Technology in Gothenburg, in Sweden. Researchers have managed to store solar energy in a liquid, creating a system of energy storage that is neither expensive nor polluting. Furthermore, the stored energy can be utilized when it is needed.

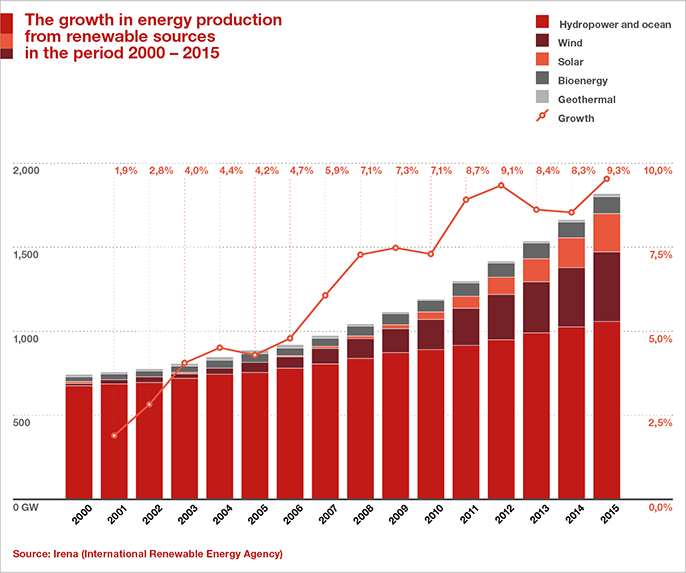

The fact that production of the automobile, a mass production good by definition, appears to be tending increasingly towards ecological sustainability and that energy storage is evolving in this way provides confirmation of the revolutionary changes that the world of energy is set to experience in the coming years. On the top of that, it should not be forgotten that on a global level clean energy has now overtaken coal in terms of installed capacity. Furthermore, renewables have achieved grid parity in terms of costs, a fact that has also been pointed out by a study by Lloyd’s Register.

This latter development is crucial as it means that producing energy from renewable sources, an activity that has been driven so far by ethical motivations, has become much more cost effective: the production of renewable energy is now at least as cheap as oil, coal and gas and perhaps cheaper. We can expect, therefore, that the production of renewables is set to take off and this will entail new requirements from an insurance point of view. Photovoltaic is seen as the sector with the greatest potential.

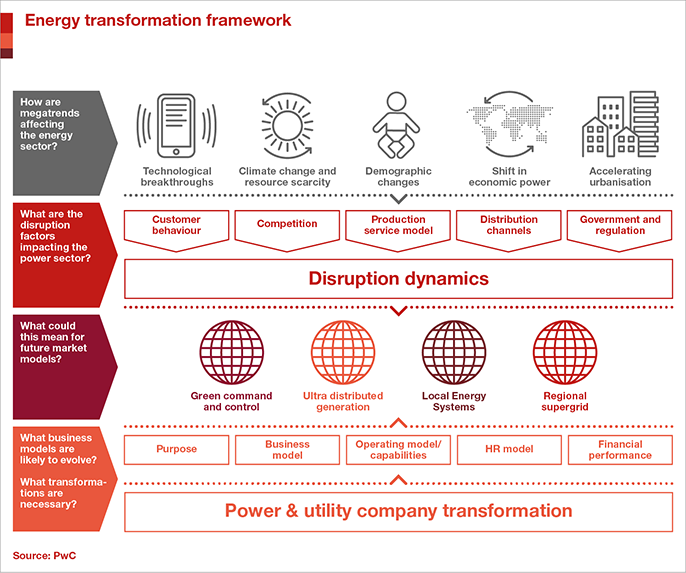

A revolution cannot gather momentum alone, however. Consultancy giant PwC in its report The Forces of Transformation has identified five factors that will provide the lifeblood for this metamorphosis. The first of these is technology, which will reshape the dominant concept of centralized distribution that has changed little since its conception at the time of Edison

Technological breakthroughs such as artificial intelligence, the Internet of Things and new storage capacities will make distribution increasingly fragmented and interactive. In other words, users will be able to become self-sufficient, hooking into the main network only when their needs demand. For example, Nissan in collaboration with Eaton has developed the project xStorage, transforming an electric car battery into a platform for the management and storage of energy for domestic purposes. A battery of this type would allow those with photovoltaic panels installed on the roofs of their homes to store energy and use it as they prefer, either avoiding using energy from the centralized grid or choosing when to use it. Energy will be increasingly available on demand.

The second factor identified by PwC is global warming, which will make the process of the transition to renewables increasingly urgent. The Oil & Gas sector is responsible for two thirds of greenhouse gas present in the atmosphere. The third, fourth and fifth factors (demographic changes, geopolitical changes, urbanization) are all closely related to one another. In short, the global population is set to grow. It is logical, then, to suppose that the energy market should adapt to these radical changes.

Everything revolves around the energy transition. The more renewables are able to increase their share on a global scale, the more these changes will impact on our daily lives. Although the direction ahead seems evident, the timeframes involved are less clear. On this point The Economist raised an important issue in an article at the end of February: an accelerated transition could damage the non-renewable sources and the related jobs. Precisely for this reason it would be wise to avoid racing ahead too fast.

“Green energy has a ‘dirty’ secret,” wrote the British weekly. “The more it is deployed, the more it lowers the price of power from any source. That makes it hard to manage the transition to a carbon-free future, […] Policymakers are already seeing this inconvenient truth as a reason to put the brakes on renewable energy. In parts of Europe and China, investment in renewables is slowing as subsidies are cut back.”

The issue of subsidies is important because in many countries the emphasis on renewables has been due more to the strong support from the public rather than effective demand from the market. Fortune has mentioned the case of Germany and its Energiewende, the country’s energy revolution. On one hand, the emergence of an ecological awareness in the country resulted in a strong consensus between civil society and political decision makers, leading the latter to define a pathway to promote renewables. This policy has led to excellent results and has positioned Germany as the leader of a global movement. On the other hand, the German approach has been driven by a policy of incentives for renewables that has created a bubble in the market, while also weighing heavily on the electricity bills of the country’s citizens, some of whom have begun to grumble.

For further information visit the section about how Generali works towards an eco-efficient energy consumption.