Shares and shareholders. The geography of share capital

Shares and shareholders. The geography of share capital

The Trieste that favoured the establishment of Generali in 1831 contained the seeds of novelty. A modern city in urban, economic, and social terms, it was the product of the economic strategy of an empire that wanted to have a single port for trade to and from overseas. The privileges linked to the free port status granted by Charles VI in 1719 and especially the Edict of Toleration of 1781, which granted religious immigrant communities freedom of worship, had brought traders, capital, and workers from northern Europe, the other territories of the Empire, and the Levant, into the regional capital.

Like the city, the company had a cosmopolitan soul: entrepreneurs of different languages, ethnicities, and religions signed the deed of foundation in Trieste. Northern Italy, Veneto in particular, was well represented, as were the territories belonging to the area of Austrian influence: the majority were Trieste shareholders, expressing the economic and financial interests tied to Central Europe.

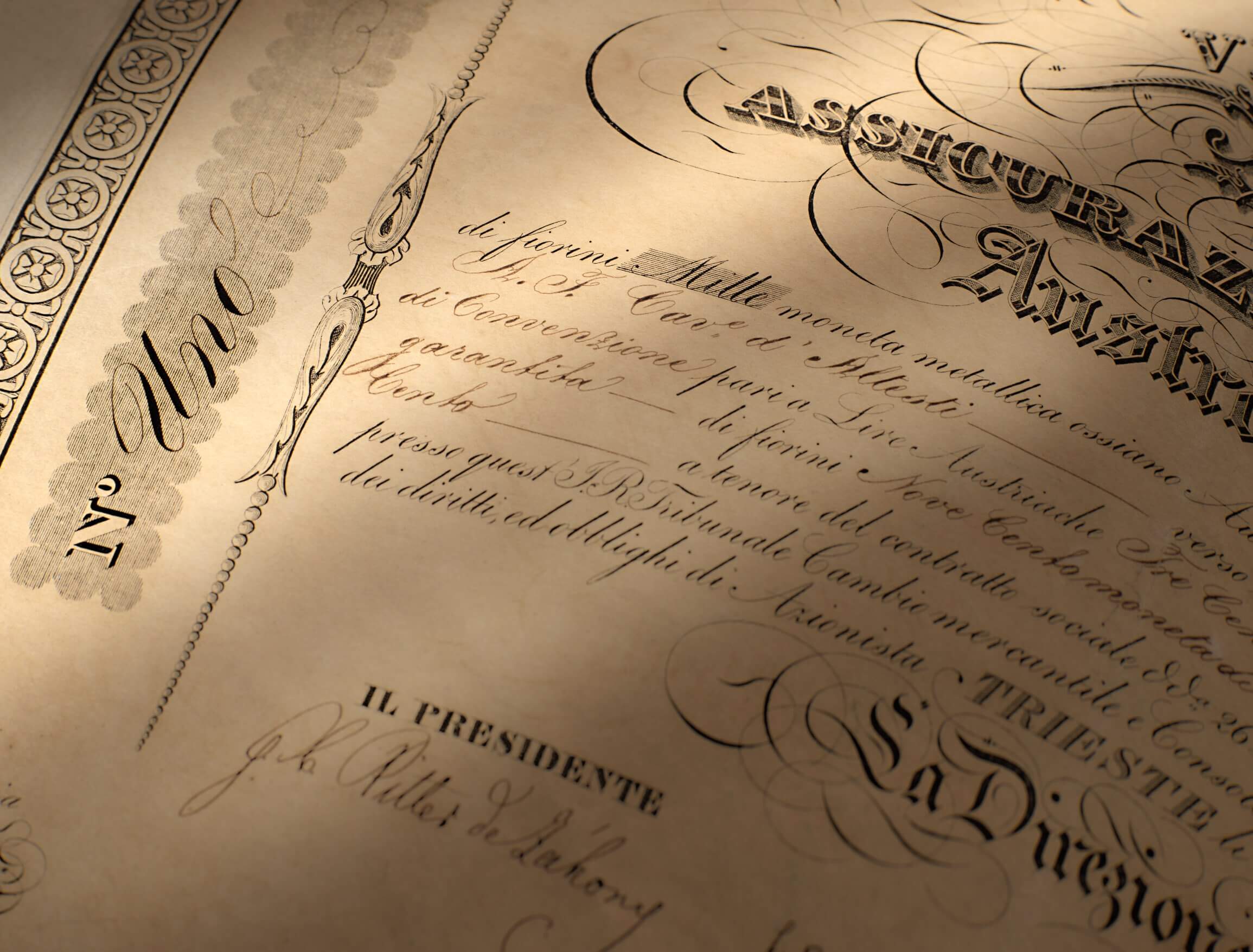

Share Certificate no. 1 of Assicurazioni Generali Austro-Italiche (Trieste, June 30, 1832)

Assicurazioni Generali Historical Archive

ph. Massimo Gardone

Generali originated from an association of commercial and banking houses, and aimed from the beginning to target those markets that were within the scope of the interests of its own signatories, highly experienced businessmen with specific spheres of knowledge. Such a base, so oriented towards openness, required a modern corporate structure able to promote it.

At that time, especially in the Italian peninsula, the decision-making and organisational apparatus of companies was vertical. The mostly widely used system was limited partnership, establishing a hierarchy among the partners. Giuseppe Lazzaro Morpurgo opted for a different model for Generali: a company with extensive corporate bases, adopting the typology of the joint stock company.

What seems common today was relatively new at the time. Indeed, joint stock companies had only been recognised by the Civil Code of the Habsburg Empire in 1816. The innovation was first implemented in the insurance field in Vienna, with the foundation, as a joint stock company, of Erste Österreichische Brandversicherungs-Gesellschaft in 1824, and in 1825 of Compagnia di Milano in Lombardy. In the Italian ‘boot’, particularly, examples could be counted on the fingers of one hand at least until the mid-nineteenth century. For Generali, however, it was the ideal choice, not only because it was in tune with the company’s founding principles, but because it would bring out the best from the resource represented by the shareholders themselves.

Directories, share registers and transfer registers enable us to reconstruct the composition and geography of the shareholders. Generali’s first shareholders were industrious characters: insurers, owners of trading houses or members of traditional merchant families. Besides Trieste, the cities featuring most on the lists were Venice, Padua, Verona and Ferrara, Vienna and Ljubljana. They were followed by Milan, Genoa, Piacenza, Florence, Naples, Reggio, Catania and Messina; Kronberg, Graz, Bolzano, Gorizia, Pordenone, Fiume (now Rijeka), Karlovac, Szeged, Pest and Prague, centres roughly corresponding to the first agencies. Among those elected to the most important company positions, were leading figures at European level (such as Ritter de Záhony, Giovanni Battista de Rosmini, Pasquale Revoltella and Morpurgo himself) in contact with the most powerful banking and financial circuits of the time.

The large share capital of two million Austrian florins (about 2.5% of the Habsburg Empire’s trade balance, consisting of 2,000 shares of 1,000 florins each), ten times more than the average budget of the companies on the market at the time, and the adoption of the legal form of the joint stock company brought enormous benefits; not only because they enabled more experienced members to intervene directly in the management of the company, making the most of its international vocation; but also because they permitted the company to face turbulence in the sector with adequate capitalisation and, at the same time, serve as a link between policyholders and local investors, who saw profit sharing as a fairly safe way to invest the revenue of their commercial enterprises.

The shares, for their nominal value of 1,000 florins each (corresponding to approximately €22,000 today) represented a considerable investment. Above all, the modern form of joint stock company allowed investors to participate in the life of the company by casting their vote at the general meeting in proportion to their share of the capital. Those who owned from one to five shares were entitled to one vote (founders only needed to have one), six to ten shares entitled them to two votes, and eleven or more shares to three votes. Shareholders could represent no more than fifteen votes each, including their own.

The founders’ shares were identified with numbers from 1 to 1,000 and had to be signed by all the top management of the company. In addition, the privileges granted to the founding shareholders were attached to the shares and therefore transferable to any subsequent purchaser. Share number one was registered to Andrea Francesco Altesti, a Generali board member in 1832-1833 and a skilled merchant, for many years at the service of the Russian diplomacy at the time of Catherine the Great and Alexander I. On the back of the share, kept in the Generali Historic Archives, the transfer is registered to Pasquale Revoltella, promoter of the Suez Canal and a prominent figure in both Trieste and Generali.

The modern nature of the project, i.e. a company with extensive corporate bases and a large share capital, did not delay in yielding positive results. In the first year of business, Generali made a net profit of over 17,000 florins.

In April 1832, 1,239 shares were reached (544 shares were represented in Generali’s constituent assembly) and the number increased daily.

In 1856, a few years after its foundation, the share capital went from two million to four million Austrian florins (split into 4,000 shares), increasing to 5.25 million Austrian florins in 1880 (split into 5,000 shares of 1,050 florins of nominal value), and it passed six million at the beginning of the twentieth century.

There were two innovative aspects to the foundation of Generali: the corporate legal model (the joint stock company, which made it easier to raise the vast amount of capital needed for such a wide-ranging business and which involved the division of capital between a large number of shareholders, not subject to the majority of a single group) and the business model (“full risk” insurance, extended to multiple branches, not only to sea and land transport as was the custom of the time, including life insurance. Hence the choice of the name Assicurazioni Generali Austro-Italiche).