Limping out of the lockdown

By Vincent Chaigneau, Head of Research, Generali Investments

More countries are now discussing the exit strategy, i.e. how to progressively ease the lockdown measures. This must be a prudent process, given the risk of a new contagion wave. In Germany for instance, the basic reproduction rate (R0) temporarily picked up from 0.7 to 1.0 (one infected person on average transmitting to one person); Germans have been advised to stay at home as much as possible.

Everywhere the return to normal is planned very cautiously, e.g. in France, where the lockdown officially ends on 11 May, the government has advised companies to keep employees at home until the 1st of June if that is possible.

One key objective is to maintain strict social distancing, e.g. avoid jamming the public transportation system.

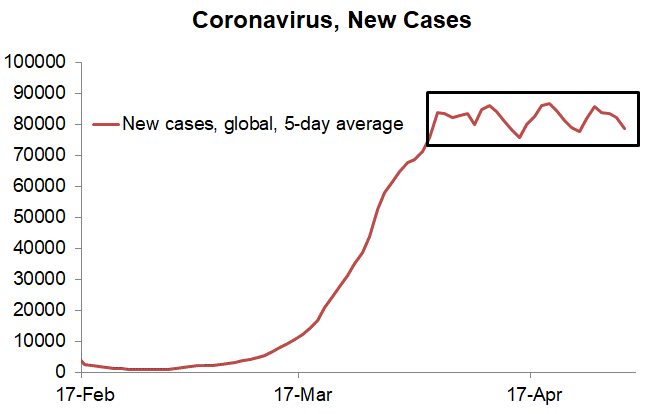

Globally the total number of confirmed cases has been growing at about 2.5% per day in the final days of April, the slowest pace since end February. That pace has dropped to just 1% in countries like Italy and France; this is good news, yet the decline to zero is asymptotic – in plain English, painfully slow. And the number of new daily cases globally has only just dropped below 80k – it isn’t yet clear that we are on the other side of the plateau.

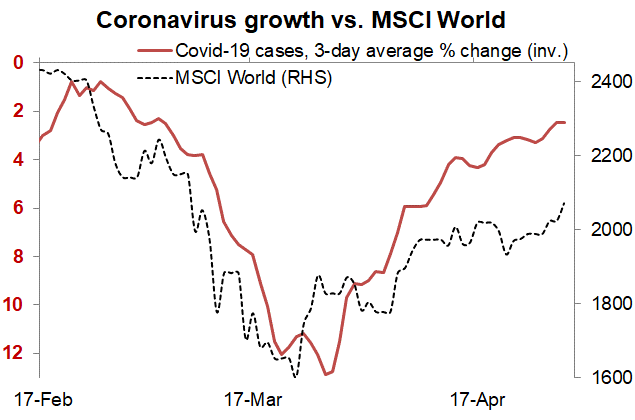

Hopes of a medical breakthrough. Global markets are taking comfort from the slower pace of contagion. From peak to bottom (March 23) it took less than five weeks for European equities to lose 35%; just a bit more than five weeks later, that drawdown has been reduce to ‘just’ 20%.

Even better, in the US the S&P drawdown has been cut from 34% to just 13%. The positive stance also partly reflects hopes of medical breakthrough. The first rigorous clinical trial of Remdesivir (Gilead Sciences) has delivered encouraging results, with the drug accelerating the recovery of hospitalized patients. The effects on the rate of death were only marginal, though. Finding a vaccine will be slower, but the Trump administration is planning a program to drastically cut the time it takes for it to be developed (a strategy that is not without sanitary risk, though).

Sudden economic stop, poor corporate earnings. The economic news of course is dire. The US GDP dropped at an annual pace of 4.8% in Q1, and this is only a fraction of the Q2 collapse in the making. In France, where the lockdown started earlier than in the US, the GDP was reported down 5.8% in Q1 (-21% annualised!) – the worst number since the series was initiated after WWII. Q2 will be worst still. The contraction has already impacted corporate earnings. We are in the heart of the earnings season, with one third of US and European companies having reported already. Earnings growth is currently around -16% yoy in the US, and close to -20% in Europe. Again, it is the Q2 season that will be the hardest.

Protecting the lending channels. Markets for now are looking beyond the immediate damage on the economy and earnings, and more so as policy support keeps coming. In another temporary easing of the rules governing state support, the European Commission (EC) is willing to allow Member States to inject subordinated debt into troubled companies. This support will not require the usual burden-sharing effort that bailouts usually imply for subordinated investors.

The European Commission also proposed a Banking Package aimed at facilitating bank lending. The pack offers flexibility on IFRS9 implementation, with provisioning being phased in over an additional two years. Banks are being offered more flexibility in the way they assess loan risk and provisioning.

The leverage ratio is being relaxed. Capital charges are reduces for loans to SME (Small and medium-sized enterprises) and infrastructure projects. Clearly, the EC continues to see banks as having a critical role in keeping businesses and the economy afloat. On 30 April the ECB also launched new initiatives, creating in particular a Pandemic Emergency Longer-Term Refinancing Operations (PELTROs), which essentially will act as a liquidity backstop for banks (at -25bp through the refi rate, currently at 0%).

Crucially, it also eased the TLTRO III conditions further, with banks now allowed to borrow at up to 50bp through the deposit rate, i.e. -1.0%. This should support lending margins, making it more appealing for the banks to lend, particularly so in the light of the aforementioned regulatory easing. This is good policy coordination. We see further ECB easing in the coming months more likely than not, e.g. an expansion of the size and scope of the Pandemic Emergency Purchase Programme.

Italy downgrade. While S&P confirmed the rating of Italy on 24 April (BBB, outlook still negative), Fitch surprised investors by cutting the country’s rating by one notch to BBB-, negative outlook. The review was due only in July, but the exceptional size of the economic and fiscal shock led to an early review.

Fitch expects the public debt to GDP ratio to increase by around 20pp this year, to 156% - a reasonable assumption. The ratio is then expected to “only stabilise at this very high level over the medium term, underlining debt sustainability risks.”

The stable Outlook largely relies on the ECB’s support, as bond purchases will “ease refinancing risks by keeping borrowing costs at very low levels at least over the near term.”

We agree. As we have argued repeatedly, the governments’ joint effort to mutualise risk has been underwhelming so far, leaving the ECB in charge of ensuring the stability of the Eurozone house. The ultimate and hugely controversial taboo would be for the ECB to reconsider the capital key distribution of its asset purchases; this is not around the corner, but something that may be considered in last resort, should EU governments fail to act.

To be clear, the sovereign rating pressure will inevitably rise, and not just in Italy. Already on February 21, before the pandemic crisis, Moody’s had cut its outlook for France (Aa2) to Neutral. On April 3, Fitch reduced the outlook on Belgium’s AA- rating to Negative. In April both S&P and Fitch also lowered the outlook on Portugal’s BBB rating to Stable. The pandemic crisis will push debt ratios to much higher levels everywhere, and rating agencies will be most severe with countries that struggle to restore the fiscal path without jeopardizing the recovery – a fine balancing act. The stability of the funding sources, institutional strength and political stability are also key factors of consideration for sovereign ratings.

Conclusion. Our recommendation to cautiously re-risk portfolios has paid off over the past month, with defensive and growth stocks leading the charge. We note an encouraging development over the past week, with cyclical stocks taking the lead instead. The top five performing sectors of the STOXX600 index in the final week of April (all up between 5% and 10%) have been Travel & Leisure, Banks, Auto & Parts, Insurance and Industrial Goods & Services – all sectors that were in the bottom half in terms of the size of the drawdown from the February peak. This suggests investors are starting to “bottom fish” as the worst part of the crisis is behind us. A swallow does not make a spring, and we keep our preference for defensive sectors and stocks for now and, more importantly, for safe Credit – the latter being the main beneficiary of the strong policy response. This call is being rewarded, with EUR IG spreads narrowing further to 185bp (Bloomberg Euro Aggregate), down from a peak at 247bp on 24 March. Instead the (riskier) High Yield index has seen spreads plateauing around 650bp over the past couple of weeks. Interestingly, the moderate risk rally is not putting upward pressure on risk-free yields, e.g. 10-year Bund yields (-0.50%) have eased by 30bp from their 19 March peak, which vindicates our preference for a small long duration position.

Please find more details in the monthly Market Perspectives, “Limping out of the lockdown”.