Exit strategy goes live

By Vincent Chaigneau, Head of Research, Generali Investments

- Now is a key moment in the Covid-19 crisis, as the lockdowns end. Countries that have opened up early have not seen any significant relapse. But the number of new cases globally has picked up, and selected US States are easing up restrictions too early.

- V-shaped recovery? Non-sense. Vs are symmetrical… output, employment and earnings will not return to pre-crisis levels in just two quarters (not even by end 2021).

- The US employment report highlights that low-paid jobs have been hit badly. Inequality will be another major post-Covid theme.

- We are not losing sleep on the near-term fallout of the German Constitutional Court’s ruling, but it still has implications for the markets.

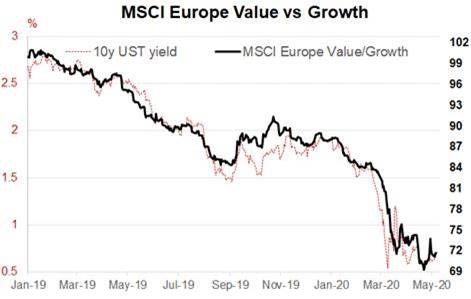

A major sanitary test. Out! Finally the western governments are freeing up people from the lockdown. Well, it is going to be a cautious exit strategy, given the fear of a second wave. The reproduction rate (R0) has dropped, but globally the number of daily new cases is not falling; in fact over the past five days new cases globally have averaged 89k per day, an upside break of the range seen since early April (Chart 1): the virus is far from being totally suppressed.

Chart 1

US and Europe continue to contribute for 25-30k new cases per day each, while countries like Russia and Brazil still suffer dynamic contagion. Even Germany, indisputably a pandemic outperformer in Europe, is creating an “emergency brake” that will reintroduce the lockdown in places that see more than 1 new case per 2000 people over a week.

Stores larger than 800 square meters will stay closed for now. Other European countries are generally taking an even more cautious approach. Some US States are taking a rather risky approach, by easing up the lockdown even though they have not met the pre-conditions. Now is a key moment in the Covid-19 crisis. Any sustained rebound in the reproduction rate would be a major hit to confidence and the economy.

Another wave in the autumn or next year is also possible, but by then hopefully medical breakthroughs (first a drug, and much later a vaccine) would make the problem less acute. So the risks appear front loaded indeed. So far so good: countries that have opened up early, such as Austria, Demark or Switzerland, have not suffered a major relapse. Still, the much-needed social distancing measures mean that the coming weeks and months will not be life as we knew it.

Lessons from China. The exit strategy in China also included severe social distancing, with effects on most segments of the social fabric, to name a few: a much lower reliance on public transportation; employee rotations to reduce density in the workplaces; a smaller number of students per class etc. This is reflected in the high-frequency economic data: the service sector is generally recovering, with notable exceptions such as hospitality, catering, and transportation - all suffering from social distancing. The manufacturing sector is also hampered by weak global demand, which has kept exports depressed. That drag will fade as the western world reopens, but this process will be only progressive and partial. In the meantime Chinese industrial inventories are now at the highest level in five years.

China is also exposed, in the longer run, to the regionalisation and diversification of the supply chains – likely a major post-Covid theme. In the worst case scenario China, and the world economy, face the destructive return of the trade war. “China may or may not keep the trade deal; Next week we can report on whether China is fulfilling its obligations under the deal,” Trump said. We are not looking for a new round of mutual retaliations just now, though. Vibes from Lighthizer’s office were positive on Friday. “Both sides agreed that good progress is being made… In spite of the current global health emergency, both countries fully expect to meet their obligations under the agreement in a timely manner.”

V-shaped recovery? Non-sense. The debate about the shape of the recovery is important, but the alphabet discussion a bit confusing. Some say that the Chinese PMIs, or predicted path for yoy GDP growth suggest it will be a V-shaped recovery again. But it is not what a V-recovery is: output, employment and corporate earnings quickly returning to the pre-crisis level. That will not happen in this cycle.

A V is symmetrical, and there is zero chance that those variables will recover as fast as they have crashed. The speed of the shock is unprecedented. Second-round effects are also inevitable. Pent-up demand may support consumer spending initially (another lesson from China is that digital businesses will win), but rising unemployment and precautionary savings will be significant headwinds. Most corporations will exit the crisis with a much weaker balance sheet. This will lead to cost cutting, such as delaying capex and hiring.

US employment: eye-catching headline, fascinating details. A staggering 20.5Mln jobs were lost in April. The unemployment rate soared from 4.4% to 14.7%. The latter would be much higher still if 8 million people had not vanished from the labour statistics over the past two months (people who were in a job or looking for one and are now too discouraged).

On a more positive side, 72% of the lost jobs in April were categorized as temporary layoffs; the share of unemployed people on temporary layoff soared from 26.5% to 78.3%. The risk is that these become permanent, hence the urgency to reopen the economy.

Remarkably, average weekly earnings were reported up 4.7% mom and 7.9% yoy! This is purely a composition effect, as mostly low-paid workers (hospitality, leisure, retail etc.) were laid off. Inequality will be another major post-Covid theme: a lot of low-paid workers have been either laid off or forced to keep doing the job despite the sanitary risks (supermarkets, nurses etc.).

The European Commission (EC) has just released its “Spring forecasts: a deep and uneven recession”. They see a 7.7% drop in the euro area (EA) GDP this year, followed by a 6.3% recovery in 2021. Our numbers are slightly lower (Market Perspectives: Limping out of the lockdown) but both profiles imply that by end 2021 EA GDP will still be well below the pre-crisis level. In other words the recovery will not be V-shaped. The EC sees a big hole (output gap) between actual and potential GDP, at 7.3% this year and 2.6% next. This will cause disinflation, and lead to more ECB actions. The EC also sees the Eurozone public deficit at 8.5% of GDP in 2020, and -3.5% in 2021. This would send the Eurozone debt-to-GDP ratio up from 86.0% to 102.7% in 2020, and 98.8% in 2021. The peaks in Greece and Italy will raise eyebrows, at respectively 196.4% and 158.9%.

German constitutional court throws a curved ball. This was the surprise of the week. The court “clearly ruled” that QE isn’t monetary financing: the PSPP program complies with the German constitution. But it also said that it lacked some "proportionality check". In other words the ECB must explain, within three months, why it needs to buy government bonds and what the detailed impact on various sectors of the economy may be. Without this, the Bundesbank would have end PSPP participation. Such outcome – which would gravely question the stability of the Eurozone – appears highly unlikely. Indeed the ECB will have no trouble proving that QE was and remains necessary as it seeks to fulfil its inflation mandate. For that matter the ECB, which is independent, will probably not even bother to reply; let the Bundesbank and German Finance Ministry deal with those internal matters. Yet the ruling still is bad news:

1. The ruling applied to PSPP, i.e. the old Public Sector Purchase Programme, not the new Pandemic one (PEPP). The Court ruled that PSPP was acceptable because it included a 33% issue and issuer limit. But that limit was removed in the new PEPP. The risk of a new legal and more threatening legal challenge is high, and could constraint the ECB in the future.

2. Such tight oversight also makes it less likely that the ECB would break the “ultimate taboo” in the future, i.e. to stop distributing sovereign purchases in proportion to the national contribution to ECB capital. It also slightly reduces the chance that the ECB would be buying corporate fallen angels (the ECB staff is currently investigating the pros and cons of doing so).

3. The decision has wider implications for the European Union, as it is testing the relationship between the EU Court of Justice (ECJ) and national courts. The Karlsruhe court ruled that the ECJ ruling was “objectively arbitrary” and “methodologically no longer justifiable.” This opens the door to other national courts in the future rejecting the ECJ rulings.

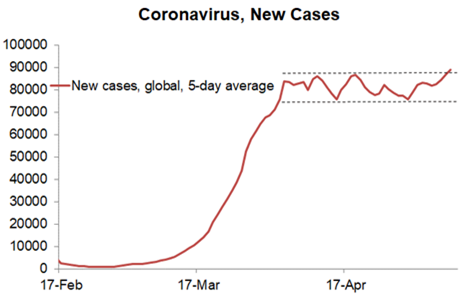

è In all, we are not losing sleep on the near-term fallout, but the news still has implications for the markets. Doubts about the ECB’s role as the ultimate gate keeper of the euro area stability are fundamentally negative for the euro currency. By potentially constraining the ECB’s ability to cap government bonds spreads and to ensure cheap funding for as long as needed, the ruling reminds that rating transition is as much a risk for Sovereigns as for Corporates (Moody’s was supposed to review the rating of Italy and Greece on 8 May but postponed the reports). Chart 2 shows that following a strong comeback in late March, BTP spreads have started to widen again – much in contrast to IG corporate spreads. Within the corporate space, the lower confidence about the ECB venturing into fallen angels limits the potential for BB-BBB spread compression (which indeed stalled in mid-April).

Chart 2

There is a silver lining: hopefully the checks on the ECB will lead government to address the flaws of the European construction. As the German Finance Minister himself put it, the ruling “shows the need to further deepen and intensify European cooperation.” For too long, too much weight has been on the sole shoulders of the ECB. On Friday EA Finance Ministers agreed on the details of the ESM role in the €500bn emergency plan. National governments will have access to cheap funds worth up to 2% of GDP, without any of the conditionality required before. More critically, EA governments are still discussing the European Recovery Fund, where the key question is whether it will deliver grants (fiscal transfers) or loans.

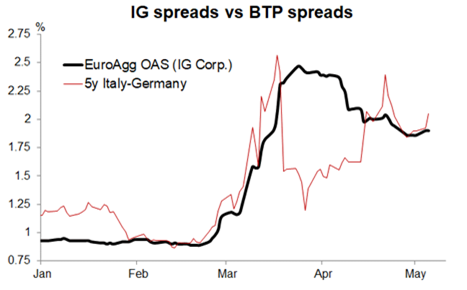

Investment views. Since late March (quarterly Investment Views: Sudden stop, permanent scars) we have positioned towards longer long-term rates, tighter IG credit spreads and a cautious reweighting of equities, mostly through defensive sectors. Those views hold, though potential in all three is now much smaller. Stocks have come back stronger and quicker than we expected, but the rally has stalled over the past three weeks. And the last two charts confirm that the rally was very defensive: cyclical assets have lagged. Slowness in the social normalisation and the risks attached to it, the troubling economic, inflation, earnings and ratings news suggests it is too early to embrace high-beta risk exposure.