State-aid framework under Covid: what impact on credit markets?

By Generali Investments’ Research Team

Containing economic destruction

The amount of support granted to the private sector by public authorities is unprecedented. Policy makers are doing their utmost to preserve economic activity, trying to preserve employment and strategic activities. To do so they had to revise the state-aid rules. This, we think, has mostly positive consequences for creditors.

Bail-out during the GFC fuelled populism

Through the great financial crisis (GFC), taxpayers had to bail-out companies with creditors ending up largely un-scathed. Indeed even sub-ordinated creditors of banks that requested public support weren’t touched, even though the higher yield received on such securities was supposed to reflect a higher level of risk. But as we found out then, banks are too big to fail and the probability of a large bank going bankrupt is near zero, as governments would intervene beforehand.

Populists rightly complained about taxpayers absorbing the losses while the gains remained privatised. Hence, in an attempt to build a fairer system, bail-in mechanisms have been put into place by financial regulators and the European Commission (EC) via the competition framework both for financial and non-financial companies.

Regulatory efforts mostly targeted the financial sector: instruments like Additional Tier 1 (AT1) have been created for banks to absorb losses in a going concern way, i.e. before the bank reaches the point of non-viability. Also under the rules of competition governed by the Directorate-General (DG) for Competition of the EC, both financial and non-financial companies have gradually become subject to the burden-sharing principle, meaning that shareholders, subordinated creditors and possibly senior creditors must absorb losses before governments can decide to grant state-aids to support a company in difficulty.

A Covid-19 New bail-in framework

The Covid crisis had reshuffled the cards. Economic preservation is now the name of the game for public authorities in Europe. The ECB is taking its share with an unprecedented level of corporate bonds purchases of non-financial companies (CSPP, PEPP), coupled with very attractive liquidity measures for banks (TLTROs, PELTROs). But the EU Commission has also taken action to preserve the continuity of economic activity during and after the COVID-19 outbreak, allowing member states to use the fiscal leeway to help their respective business sectors. Indeed the main fiscal response to the Coronavirus will come from Member States' national budgets, and the EU State aid rules have been amended to enable Member States to take swift and effective action to support citizens and companies, in particular SMEs.

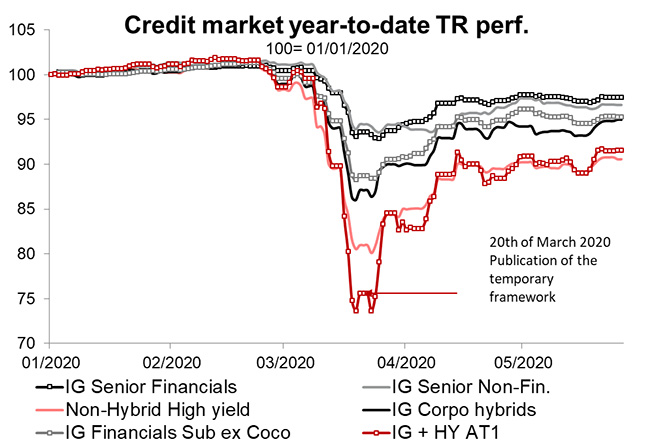

On 19 March 2020, the Commission adopted the Communication on the Temporary Framework for State Aid measures to support the economy in the current COVID-19 outbreak (TF COVID-19) which has been amended twice already (on 3 April 2020 and 8 May 2020).

The support to the economy can take various forms, such as wage subsidies, suspension of payments of corporate and value-added taxes or social contributions. Besides, Member States can grant financial support directly to consumers, for example for cancelled services or tickets that are not reimbursed by the operators. Also, EU State aid rules enable Member States to help companies cope with liquidity shortages and needing urgent rescue aid.

For longer-term aids, the second amendment to the temporary framework is also introducing, beyond the usual capital injection, the possibility for Member States to support their industries via subordinated loans, the latter being seen as less competition-distortive than the former by the DG Comp.

Banks are well protected by the Covid framework

The first version of the temporary framework has offered a very strong support for banks as it clearly states that the burden-sharing principle is suspended provided the losses are related to Covid-19.As banks capital positions are much stronger compared to their pre-GFC crises, we do not see immediate candidates for state support application within the banking sector. This is even more the case since the ECB has strongly encouraged banks to suspend their dividend distribution. We see this as a mitigant to the mild deterioration of capital position attributable to a higher cost of risk triggered by a sharp expected increase of non-performing loans in the context of Covid.

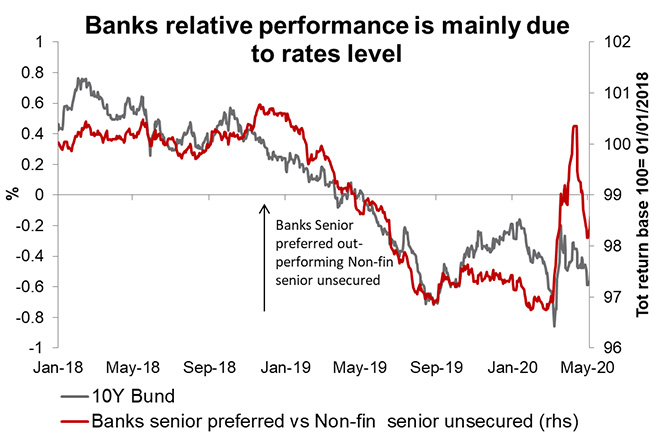

Hence, overall we have seen great attention paid by public authorities to banks, and a clear preference has been made to creditors over shareholders. The suspension of the burden-sharing principles for subordinated creditors is a relief for bank creditors. If the new state-aid rules are undeniably positive for subordinated bonds (Tier2 and AT1) even senior preferred bonds have largely benefitted from the new framework.

Looking ahead, we are rather confident on AT1 coupons given the encouraging tone of regulators that do not seem to have any plan to ask for a global coupons skip. As Andrea Enria Chair of the European Central Bank’s Supervisory Board said recently: “restrictions on payments of these instruments will be automatically triggered only if banks hit certain capital levels set out in the legislation – but as of today, banks still have significant buffers to use before reaching that point.”.

Non-financials remain more exposed

However, the second amendment to the temporary framework is making clear that, unlike in the financial sector, may-pay coupons and dividends will have to be suspended until the state-aid has been fully repaid in the non-financial sector. However we don’t expect corporate hybrids to suffer from this news for the following reasons:

- First, the question of the competition distortion between the financial and the non-financial sector may arise. Hence we can’t rule out that the EC may align the treatment of the coupon on non-financials to the one of financials.

- Second, to be eligible for state aid, the company should be in such financial distress that it could not survive without it. We see a limited number of corporate bond issuers currently matching this definition at this point of the crisis.

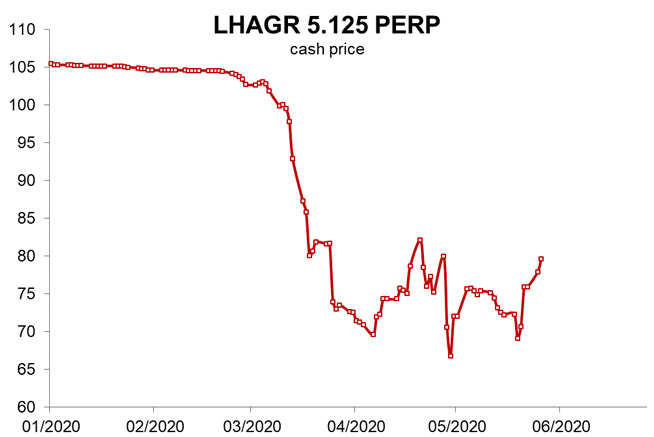

Seniority of “debt” state-aid vis a vis corporate hybrids is not clarified in the temporary framework. Some issuers that will request state-support in the near future have already subordinated debt outstanding. And in the case where the aid would be granted in the form of subordinated debt, the temporary framework is silent regarding the payment rank of the “public hybrid” vis a vis the subordinated debt previously sold to private investors. Lufthansa’s rescue package is the first example of such a situation. The plan has not yet been approved by Brussels, but from the preliminary communication of the company, we understand that part of the aid granted by the German government to the airline company, will be done in the form of subordinated debt convertible into equity. The company is so far reluctant to make any comment on the hybrid situation, which is likely to be a bone of contention with Brussels; despite the Article 77 theoretically pointing to a coupon suspension, the “private corporate hybrid” of Lufthansa has been rising on the news of the agreement between the company and the German state.

Strategic companies can still be helped outside the temporary framework

Strategic issuers that receive a capital injection or subordinated loan from their respective states State at market price or an investment pari passu with private shareholders will not necessarily qualify as State aid. Therefore, it implies that the subordinated bonds of these issuers will not be affected by State aid-related risks (burden sharing, coupon deferral). Interestingly there is no definition of strategic. EDF is among the companies that can be considered at risk from a state support standpoint, but despite all the issues the company is facing it is far from being near default. Consequently, should EDF receive a subordinated loan (purely theoretical at this point), we expect it to fall under this category of strategic issuers support, not implying any forced coupon deferral.

Conclusion: Corporate hybrids can live with article 77 for now

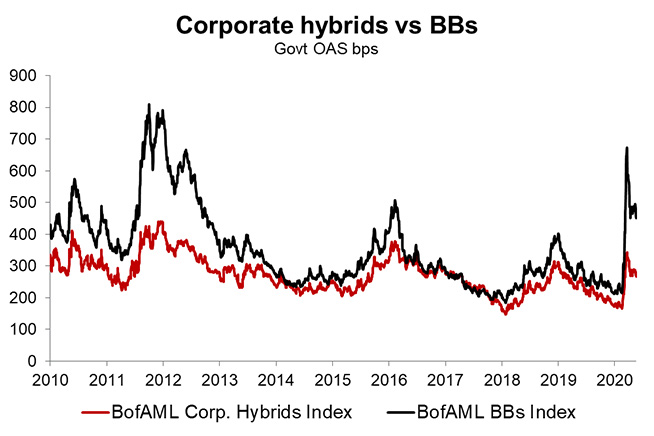

We see several reasons for not turning negative on corporate hybrids despite the threat on the coupon for companies that will be helped.

- Hybrid issuers are mostly IG rated, hence very few companies are matching the “near-default” criteria: the airlines are probably the only ones at this stage.

- A significant share of hybrid issuers are strategic as the universe is mostly made of Telcos and Utilities.

In all, we can say that the Covid-19 related framework has been a support for credit markets in general and banks in particular. AT1 and Tier 2 are perceived as less risky now, which is improving banks funding profile, allowing them to access the market for subordinated issuances. The most vulnerable segment would be in our view corporate hybrids, but assuming the impacted companies will be limited to the airline sector, it is not altering our positive stance on the asset class: we continue to like the defensive composition bias of the universe (Utilities, Telcos). We continue to see extension risk as limited and it remains almost immune to default risk (unlike high yield) since most issuers are rated investment grade.