Relative attractiveness of Emerging Markets has improved

By Generali Investments’ Research Team

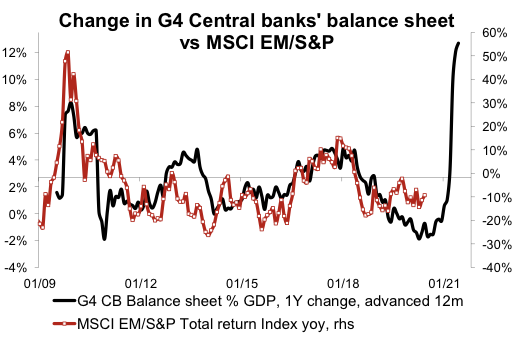

Since the start of Coronavirus crisis (end of January 2020), the MSCI Emerging Markets (EM) index has lost 12%, underperforming the MSCI World by 3.1 pp. Global policy interventions at the end of March 2020 triggered stock markets' reversal. Emerging markets’ equities recovered some of the losses by an unprecedented rally (+32.5%), having benefitted from falling yields (-320 bps), Emerging markets’ hard-currency government bond spreads (-230 bps) and a weaker trade-weighted US dollar (-4.2%). The massive fiscal and monetary policy response (more in advanced economies) is supporting a rather spectacular expansion of equity multiples globally. Such policy trend will linger in the next months, at least.

In term of multiples, Emerging markets are trading at a slight premium of 4% vs historical average but the cyclically-adjusted PE (price-earnings ratio) is one standard deviation below average. The momentum of the Emerging markets’ spread gap relative to US High Yield shows relative attractiveness of Emerging markets’ PEs vs US ones. That said, the Emerging markets are set to also benefit from improved financial conditions. In the mid- to longer term a moderately weakening US dollar and relatively low valuations will provide tailwinds.

Among the risks are stabilizing US dollar short term, US-China frictions, a pandemic worsening in some Emerging markets (Brazil, India, Mexico etc.) and a generally lower monetary and fiscal support compared to developed markets.