Cov-ideologies

By Generali Investments’ Research Team

- The autumn looks more challenging, as the pandemic might put more pressure on the health systems, the recovery flattens out and political risks rise (“blue wave” at US elections? “Bare bone” Brexit deal?)

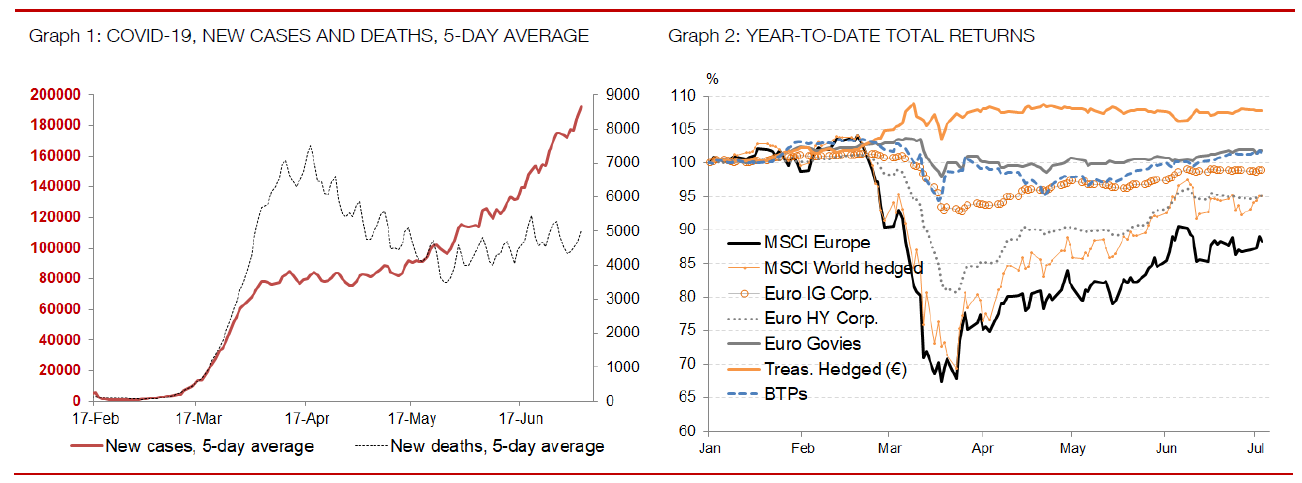

After the rescue. As we enter the 20H2, Covid-19 is still lurking around, and influencing our social and economic behaviours. The number of new daily cases globally is at a new high (Graph 1). Partly, this reflects more intensive testing. The latter now captures a broader and younger population. This also explains that the mortality rate (total numbers of Covid deaths / total cases) has declined from near 7% in late April to 4.7% in early July. The global number of daily deaths, off the peak and rather stable, is probably a more reliable barometer of the pandemic, if a lagging one. This relative stability, in a context of reopening economies, and formidable policy support since late March, explain that global risk assets recovered sharply in Q2 (Graph 2). Our pro-risk bias, abandoned in late February but restated in early April, has been rewarded, though in hindsight the rebound was sharper than expected.

Cov-ideologies. As the global economy reopens, the aftermath of the Global Covid Crisis (GCC) looks different from that of the Great Financial Crisis. This IIF Global Debt Monitor does a good job illustrating the contrast. Into the GFC, global (and particularly US) financial (bank) and household leverage had increased sharply. The post-crisis environment saw a permanent rise in the saving ratio and a regulatory tightening of the financial sector. Into the GCC, it is sovereign and (to a lesser ex-tent) non-financial corporate debt that had been rising fast – a trend that the pandemic has accelerated. We estimate that global public debt will increase by more than15pp of GDP in 2020.

The post-GCC will see financial repression reach a whole new level: policy makers will focus on keeping the debt path (government debt, with an eye also on corporate debt) sustainable, which will require low yields for longer. Central bank buying is definitely a major tool in the repression box. The GCC has seen the frontier between fiscal and monetary policy being blurred like never before; expect not just low policy rates for longer, but also QE for longer. Financial repression may play out in other ways, for instance a rise in taxation (greater income tax progressivity, wealth tax, corporate tax). The median global corporate tax rate has dropped from 40% in 1980 to about 20% today; reversing that trend will be easier said than done, without stronger international cooperation, but the heightened post-crisis focus on inequality will be a powerful driver. The demands for a stronger safety net will make it harder to cut public spending, hence governments may have to rely on higher taxes within fiscal consolidation programs. The post-GCC environment will see bigger States, following massive rescue intervention to limit the economic destruction; the bans on dividends are only the early signs on rising interventionism. Unfortunately, capital in the process may not always be allocated in the most efficient way, e.g. some businesses are being rescued when in fact some should be part of the creative destruction that contributes to economic efficiency. Repression will also continue to be shaped via regulations that channel savings into government bonds, e.g. European banks were recently offered a capital contribution holiday when facing a loss of value in their government bond holdings. Government interventionism is also likely to imply a further reversal of the globalisation that has dominated the past 40 years. A greater leverage of digitalisation and automation may only partially offset the negative impact on productivity.

We will dig deeper into ‘new behaviours’ (governments, households and corporations) in a very soon-to-be-released Investment White Paper: “Life after Covid: the LDI view”. Unfortunately, the trends described above will likely participate to a further erosion of potential GDP growth, which will complicate the absorption of the debt.

20H2, a half-year with two halves?

Just an illusion. Our view of a “swoosh” recovery implies that Developed Market GDP may not return to pre-crisis level before end-2021. But the reopening of the economies has seen a strong initial bounce in most regions. As businesses catch up with unfilled orders and pent-up consumer demand follows months of record saving, the illusion of a V-shape recovery will persist over summer. Only later will the second-round effects (fading benefits, impaired balance sheets a drag on capex, higher unemployment hurting consumer spending) vindicate our view of a “swoosh”.

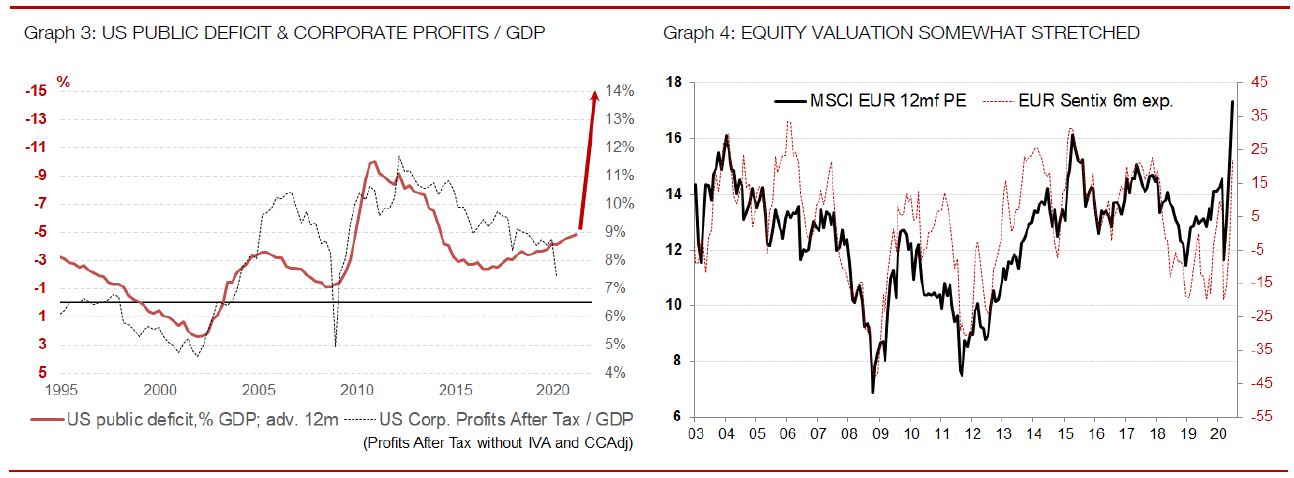

Summer joy… This V-shape illusion may well support investors’ appetite for risk over summer. While they progressively turned more daring over Q2, following massive de-risking in the dark days of late February and March, investors overall have remained cautious, both in terms of sentiment and positioning. Cash positions are still large; credit funds have seen strong inflows over the past three months, reversing sharp outflows through the crash, but equity funds haven’t. In surveys, investors also advertise a rather cautious view of the economy and markets. We suspect that FOMO (fear of missing out) and TINA (there is no alternative) will dominate the summer months. Governments will also deliver more support, e.g. we expect the German EU presidency to align views and deliver on the European Recovery Fund (ERF). The US Congress is also working on a bi-partisan infrastructure plan (1.0 to 1.5 trillion dollars, or 4-6% of GDP). The US public deficit is likely to flirt with 20% of GDP this year; usually rising budget deficits benefit corporate profits disproportionately: after-tax profits take a larger share of the GDP pie (Graph 3). And of course, central banks are still heavy buyers of assets, front-loading QE early in the recovery. This tends to stretch valuation of the risk-free assets, then the safest risky assets (IG Credit) and finally trickling down to most assets. Ride this wave over summer.

… but risks rising in the autumn. It is not all rosy. Offsetting forces are likely to grow over the autumn. First, the virus is still galloping, and we fear that the autumn conditions will make that much more challenging from a sanitary and public health capacity point of view. Governments will resist full lockdowns – the economy cannot afford it – but local ones may well mushroom. By the autumn, the initial economic bounce is also likely to flatten out, sending investors into a deeper introspection about the post-Covid environment. The political environment will also be more challenging, given the risk of a “blue wave” at the US elections: should Biden win and enjoy a majority in both chambers, investors may prepare for less economy-friendly policies (taxes, higher minimum wage, pressure on big tech, pharma and shale oil etc.). The UK and EU, preparing for the end of the transition period at the turn of the year, may also strike a “bare bone” deal that will do no favour to the economies on both sides of the Channel. And of course, by then, valuations may be even more stretched. By some measures, equities valuation is already looking quite impressive (Graph 4).

Retain but reduce positive risk bias in portfolios

Timing is everything. Of course we must be very humble when predicting such turn, which is always very tricky to time. We did relatively well is cutting positions (late Feb.) and cautiously re-risking (early April) but may not be so ’lucky’ next time. As such, we will enter the summer with a moderate pro-risk bias, looking forward to reduce risk further as some of the aforementioned risks materialise.

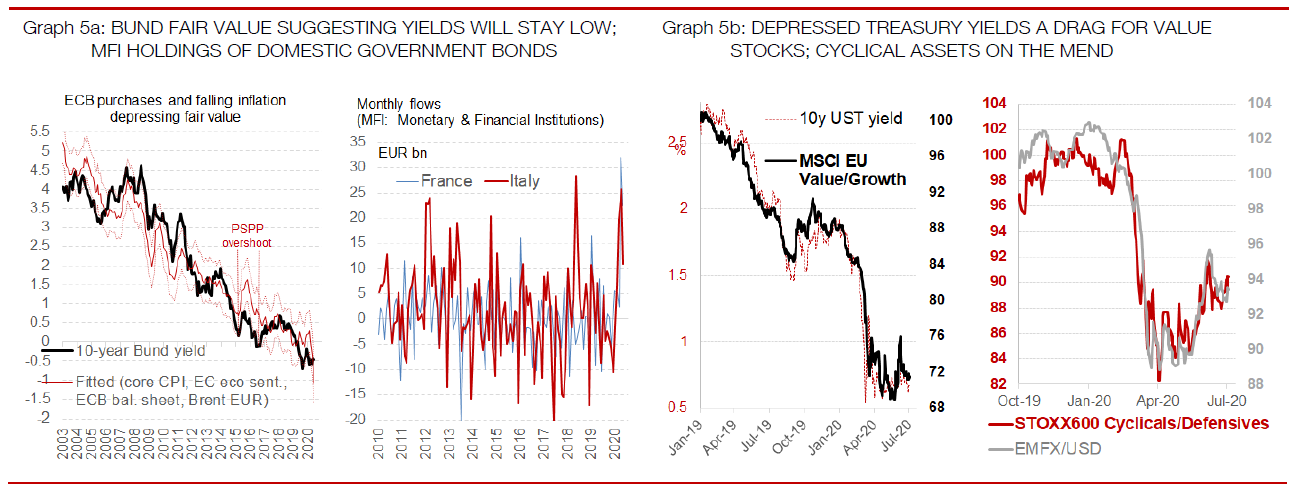

Long rates to stay low, despite pressure from recovery. While the summer illusion may contribute to a small in rise in government bond yields, we expect them to be stuck at very low levels. In fact inflation remains the largest driver of 10-year Bund yields, and the recent pullback in core HICP measures suggest yields will stay low; add the large ECB buying, and the fair value of the Bund has been pushed further down. By our measures, the Bund yield is currently not stretched at all (Graph 5a). In this context, we argue against short duration positions; LDI players, if any-thing, will be forced into closing residual shorts there. That said, we find that the 10-30y slope is currently trading below fair value, especially in EUR swaps (less so in cash government curves); upcoming issuance from the EC (2021 and beyond) could support a correction there. Despite a challenging debt path, expect the non-core sovereign complex to stay well supported over summer, and more so as 1/ the ERF is finalised and 2/ rating agencies show patience now that sovereign funding is be-ing facilitated. The banks have borrowed record amounts from the ECB at the super-cheap TLTRO (-1%), and this will initially foster the sovereign carry trade. Al-ready Italian and French banks have been heavy buyers of their domestic sovereign bonds (Graph 5b).

Investment Grade (IG) Credit still favoured, if less so. Three months ago, Credit was already our favourite pick; we had singled out EUR Investment Grade and EMBI (EM hard currency sovereign debt) as the cheapest credits from a historical point of views. Those two have outperformed on a beta-adjusted basis over the past three months, and do no longer stand out. Still, we continue to prefer IG credit, both in EUR and USD, as we focus on a cautious pro-risk bias. We take risk by going down the capital structure of safe companies (hybrids, AT1), rather than High Yield. We expect the peak in default to be lower in this cycle than in the GFC one, but defaults could be high for longer, and the recovery rates lower. In an adverse scenario we would expect the ECB to include Fallen Angels to the CSPP, so also prefer those to older High Yield issuers.

Equities: tactical positioning over summer favours Cyclicals rather than Value. We retain an overweight (OW) in equities, but a very small one indeed, following the sharp rebound of Q2. With bond yields stuck at depressing levels, the chances of the Value style making a come-back are rather low (Graph 6a). Cyclicals are a better tactical bet, as they could benefit from the V-shape illusion. Tactically, cyclical assets however could enjoy the ongoing pullback of the US dollar (Graph 6b), driven by extraordinary debt monetisation, dovish Fed signals (Yield Curve Control next?), better global economic data and rising local political risk. EM equities could particularly benefit from the USD pullback. Structurally, the lower-for-longer growth environment argues against a durable catch-up of cyclicals. The challenge instead will be to diversify the sourcing of the Growth factor, as technological progress reaches new shores (MedTech, CleanTech, FinTech etc.).