Policy fireworks

By Vincent Chaigneau, Head of Research, Generali Investments

New coronavirus cases soon plateauing, as contagion slows. The total number of confirmed coronavirus cases, now above 1.6 million globally, is currently rising at less than 6% per day, down from about 9% a week ago and 12% two weeks ago. A continuation of this trend would imply that the number of new cases per day is about to reach a plateau, just above 85k. Of course this is still far too much to stop the social distancing effort and rebuild the old web of global interconnections. So confinement continues for now, though some countries such as Denmark and Austria are starting to relax local restrictions very progressively.

Financial soothing. Global financial markets are showing clear signs of soothing. The S&P500, which on 23 March was down 34% from peak, has now halved those losses (down 17.6% from peak). The past week saw a further stabilisation in fund flows: at the global level equity funds are seeing inflows again; even Investment Grade Credit funds saw minor inflows last week, following record redemptions over the five previous weeks. Prime Money Market funds have also stopped bleeding.

The Fed’s new facility to assist the commercial paper (CP) market will launch only on April 14, but 3-month CP (index) spreads to Treasury Bills have already halved to less than 100bp. Financial volatility has continued to pull back across equities, rates and credit markets. Not everything is back to normal of course, e.g. inter-banking rate spreads still signal tensions in money markets. Cash credit spreads have only started to retrace from the sharp widening seen in the five weeks to 24 March; that process is being slowed down by the surge in primary market activity, itself another sign of healing (issuers coming back to the market).

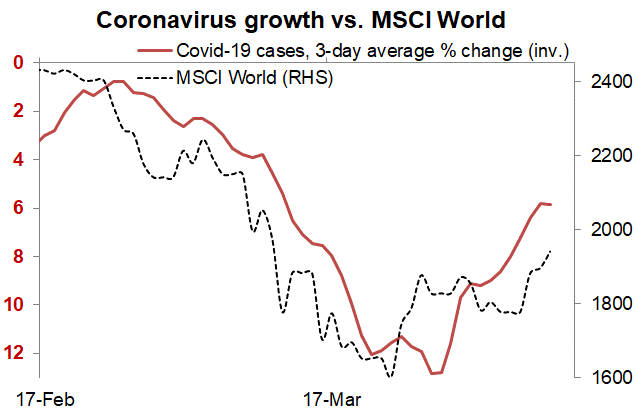

Policy fireworks. The better tone in financial market primarily reflects positive news about the slower pace of viral contagion. As the chart below shows, there has been a link between that pace and the performance of global equities. Going forward we do not expect that link to stay as strong: the damage to growth, corporate earnings and dividends is such that the equity rally should soon run out of steam. That said, if equities have managed to turn around so quickly and forcefully that is also thanks to the impressive policy response. The recent normalisation of financial markets has not stopped central banks from delivering more bazookas. The three most spectacular announcements of the past week come as follow:

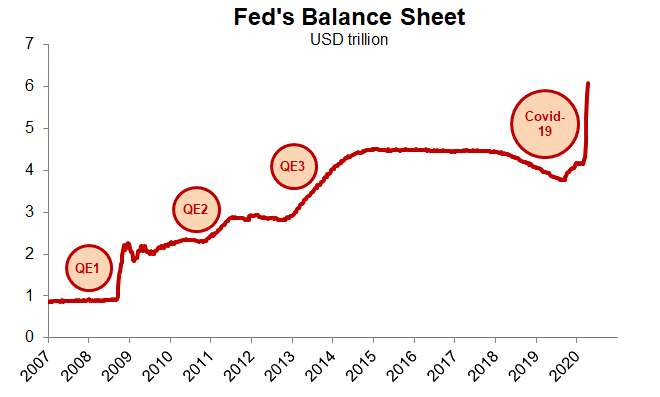

1. The Fed announced it would expand the scope of the Primary and Secondary Corporate Credit Facility (SMCCF), as well as the Term Asset-Backed Securities (ABS) Loan Facility. It also announced four new programs to provide credit to small and medium size businesses and state/local governments. Remarkably, the Fed can now buy Fallen Angels, i.e. corporate bonds that have recently been downgraded from Investment Grade to High Yield. It can also buy High Yield ETF. Altogether, the Fed’s new and expanded programmes will provide up to $2.3 trillion in loans – more than 10% of GDP. This is huge, yet the Fed is only partially leveraging on the $454bn pool of guarantees that the Treasury department made available (via the Exchange Stabilization Fund) through its fiscal plans (and that can be leveraged up to ten times by the Fed). After this week’s announcement, the Fed has used up ‘just’ 40% of that pool. The Fed's balance sheet grew to a record $6.1tn this week. As the chart below shows, the recent balance sheet expansion is dwarfing all previous Quantitative Easing (QE) programmes.

2. The Bank of England said it would directly finance extra government spending. In other words, the government will get part of its spending directly funded via an expansion of its bank account at the BoE, without bothering about tapping the gilt market. Such direct monetary financing of government will be “temporary and short-term”, yet is the most extraordinary example of monetary financing. The frontier between monetary and fiscal policy has been removed, at least temporarily.

3. Even the ECB relaxed its standards further, by reducing the haircuts applied on its loans and accepting weaker credit as collateral, namely Greek debt (rated High Yield, or Speculative).

Those policy efforts clearly aim at preventing or limiting defaults and bankruptcies, in order to contain the destruction that the social-distancing measures may cause. We know that, as GDP falls through crises, it then fails to return to its previous path. Hence the immense effort to limit the immediate damage. Now is not a time to think about ‘creative destruction’; the efforts to save businesses will inevitably lead to some misallocation of capital, which in time will hurt potential growth. But this is still deem preferable to accepting a permanent destruction of capital via bankruptcies.

Europe agrees on a rescue package, but the devil is in the details. European finance ministers agreed on a €540bn package, including a joint employment insurance fund (€100 billion), a European Investment Bank initiative supplying up to €200 billion euros to companies, and credit lines of as much as €240 billion (about 2% of GDP) from the European Stability Mechanism ESM). This will help but is still very short of joint issuance. As of 1 July 2013 the ESM enjoys preferred creditor status similar (but junior) to the IMF. So any loan from the ESM may end up subordinating holders of national government debt. Arguably, finance ministers also agreed to work on a temporary €500 billion fund that would help kick-start the economic recovery; presumably this may be funded via joint issuance? But this remains vague and will only be discussed within the next six months.

Notwithstanding the underwhelming European solidarity effort, the policy response continues to support market stability. While we expect the equity rally to run out of steam into late spring, our preference for safe credit remains strong. With the Fed now dipping a toe in the High Yield market, even riskier credits may continue to recover.