01 October 2021

German elections: fragmented parliament to complicate government formation and reforms

Generali Investments’ Market Commentary

Author: Thomas Hempell, Generali Investments Head of Macro & Market Research

- German federal elections on Sunday resulted in a narrow lead of the Social Democrat SPD over a plummeting CDU/CSU of the outgoing chancellor Merkel. Yet both top candidates, finance minister Olaf Scholz of the SPD and Armin Laschet of the CDU/CSU, have claimed a mandate to lead a new government.

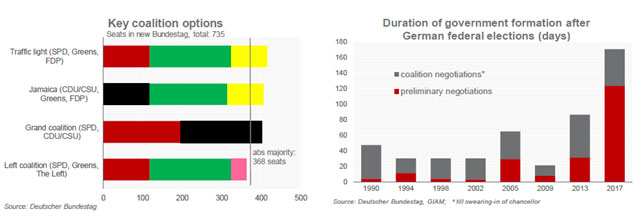

- With a renewal of the ‘grand coalition’ off the table for now, any new government would include the soaring Greens and the steady liberal FDP. The poor faring of the Left erased the option of a left-wing coalition with the SPD and the Greens.

- Government formation in the fragmented new parliament is set to prove difficult and will likely drag at least until year-end. The most likely outcome may be a ‘traffic light’ coalition headed by SPD candidate Scholz with the Greens and FDP – but it is a tight call. Divergent positions in many policy fields (including on taxes and debt) may neutralize most of the bolder reform ambitions promoted by each of the parties.

- With the question of government formation still wide open, the instant market response has been muted, with EUR and yields little changed. Yet the voters’ exclusion of the far Left from any new government and losses amid the eurosceptic AfD may have added to this morning’s equity gains and the outperforming German DAX.

The German Social Democrat Party (SPD) secured a narrow victory over the centre-right CDU/CSU in German federal elections on Sunday. With finance minister Olaf Scholz as their candidate for chancellor, the SPD obtained 25.7% of the votes, gaining 5.2pp vs. 2017 elections. By contrasts, the CDU/CSU under joint candidate Armin Laschet plummeted by 8.9pp to 24.1%, their worst result at the national level on record. The Greens posted the strongest gains vs. 2017 (+5.8% pp) to 14.8% but stayed at the lower range of recent polls. The liberal FDP secured 11.5% (+0.7pp), while the extreme right AfD lost 2.3pp to 10.3%. The far Left missed the 5% threshold at 4.9% but will still be part of parliament thanks to three direct mandates they have won. Yet their poor faring has erased any scope for a left-wing government comprising SPD, Greens, and the Left.

Protracted negotiations ahead

Government formation will prove more difficult and may turn out more protracted than ever. CDU/CSU and SPD would have enough seats to continue their current government, but party and public support for this alliance has clearly waned. This implies that any new chancellor will need to include at least three parties in the new more fragmented parliament. A minority government cannot be ruled out but is unprecedented in Germany and would only be a last option if multiple coalition talks fail.

The German constitution does not foresee an official mandate by the President to any of the candidates to form a government (he only proposes a person to the Bundestag for voting once he is confident enough that he or she has managed to secure a majority). This means that parties are free to design talks and coalition negotiations. Until a new government is sworn in, the old one under chancellor Merkel will remain in office as caretaker.

Forging a three-party coalition will take weeks and more likely several months. Coalitions in Germany are discussed in reference to the party colours. Back in 2017, ‘Jamaica’ coalition talks between CDU/CSU (black), FDP (yellow) and Greens dragged on for weeks before failing, giving way to renewing the currently governing ‘grand coalition’ of CDU/CSU and SPD. This time, with the parliament actually more fragmented, negotiations may be even more cumbersome. By German constitution, the current government will remain in office as caretaker government until a new chancellor is sworn in.

‘Traffic light’ coalition the more likely outcome – but it’s a tight call

Amid various options, the marginally most likely one would be a SPD-led ‘traffic-light’ alliance (SPD, Greens, FDP). The SPD is faring first, gained new votes, and Olaf Scholz is enjoying the highest popularity among the three main candidates. SPD and Greens pursue overlapping policy aims in key areas (higher minimum wage, more fiscal spending, rent regulation and openness to an EU fiscal reform). Yet the pro-business and pro-market FDP is at logger-heads with many of these positions, prioritizing tax cuts and investment incentives to businesses instead. The Greens pursue steeper carbon price increases and tighter regulation to fight climate change. Resolving the areas of discontent will likely result in many weeks of preliminary talks and negotiations, which may still fail.

The German debt brake will not be amended either (it would need a two-thirds majority anyway), with the Liberals fiercely opposed. All three parties are pro-European and push for deeper integration. Yet significant progress on European most controversial matters is neither likely. While Mr. Scholz and the Greens are open to flexibility regarding the EU fiscal rules and a European deposit insurance scheme, the FDP will curb any deeper concessions in this area. Mr. Lindner of the FDP may insist on the post as finance minister in a traffic-light alliance.

There may still be some more noteworthy efforts in addressing climate change, digitalisation, and infrastructure. Off-balance vehicles may allow for some boost in green and digital infrastructure spending without violating the debt brake while the FDP will insist on tax incentives for private investments. The Greens may well succeed on a significant increase in CO2 prices not covered by EU regulation, with most of the proceeds reimbursed to households as transfers.

Yet if things play out smoothly, a traffic light coalition may be agreed on by end of the year. Yesterday night, the heads of FDP and the Greens already mulled starting bilateral talks first to sort out the most controversial areas, before involving the SPD or CDU/CSU. Many opposed ideas between FDP and Greens leave the scope for deeper reforms limited, however. Note also that any three-party coalition will lack the majority in the upper house (Bundesrat) needed in almost all tax issues (where states and municipalities are involved). Only one state is governed by a ‘model’ coalition respectively (traffic-light alliance in Rhine-land-Palatinate, ‘Jamaica’ in Schleswig Holstein). Agreements will thus require a lot of arm-twisting and back-door politics not only in parliament but also with the heads of states represented in the upper house.

‘Jamaica’ chances undermined by CDU/CSU plunge and Laschet’s low popularity

The FDP itself is clearly leaning more strongly towards a ‘Jamaica’ coalition headed by the CDU/CSU. Indeed, Armin Laschet, who currently leads a coalition with the FDP in Germany’s largest state of North Rhine-Westphalia, has claimed the mandate for government formation too. He will also engage in talks with the FDP and Greens and his political future may even hinge on the success of such efforts. Yet with the conservatives having suffered steep losses and Armin Laschet lacking popularity even within his own party, the Greens may consider this option only if ‘traffic light’ talks fail, and they still see a scope for a deal on disputed topics with the Liberals.

If three-party talks fail, pressure to continue the current grand coalition may build. Yet there is very strong opposition in both parties against this option, also amid concerns that joint governing has boosted votes for opposition parties. Both CDU/CSU and SPD may have been blurring their appeal to core voters on many compromises over the past years. A minority government (e.g. red-green) is very unlikely, too. It is unprecedented and would make the government’s task very hard, given that both parties would need to seek changing majorities on most issues in the lower and the upper house.

Muted market impact

With a coalition including the far Left off the table, market responses to the upcoming negotiations will likely prove muted. The EUR and yields showed little reaction to the election outcome, while the strong start on European stocks may have been supported by the voters’ exclusion of a government including the far Left.

Pro-European forces in parliament have been strengthened, with the far left and far right losing. An SPD-led government would likely be more open to deeper European integration, while the hurdles would be higher under a conservative chancellor. This may imply somewhat more support to Southern European debt in case of a traffic-light coalition. Yet with the FDP and Greens as the most opposed forces to be part of any government, any market impact on European issues is likely to prove muted.