09 August 2021

Fed: recovery on its way, tapering approaching

Generali Investments’ Market Perspectives

- The July meeting brough little new information. The Fed remains confident that the labour market recovery will gather speed and that the spike in inflation is temporary, although may last longer than expected.

- Upside risks to inflation seems to be more concerning than downside risks to growth related to a new wave of infection.

- The FOMC has started discussing tapering, and we continue to expect it to begin in January.

Author: Paolo Zanghieri, Senior Economist, Generali Investments

In a rather uneventful meeting, the Fed presented again its view of a strengthening economy with only temporary pressures on inflation. The press release duly noticed that the progress of the economy is incomplete, but also signalled that the appropriate moment to withdraw support is getting closer.

As in the past meetings, chair Powell noted that the “substantial further progress” in the labour market the Fed needs to see before reducing stimulus has not been met yet. The large disconnect between high unemployment and booming job posting is due to the fact that a substantial share of unemployed is getting a new job rather than going back to the old one, and this creates speed limits to job creation. Moreover, bottlenecks related to residual COVID scare, childcare and generous employment benefit are fading The FOMC expects a strong recovery of the labour market over the coming months, but there is still some ground to cover. Our indicator, which seeks to consider the aggregate behaviour of the labour market and the performance differentials across groups, shows a still substantial gap with respect to the pre-pandemic situation.

The Fed is not afraid of the rapid increase in wages. Unit labour costs are under control, reducing the risk of a wage-price spiral.

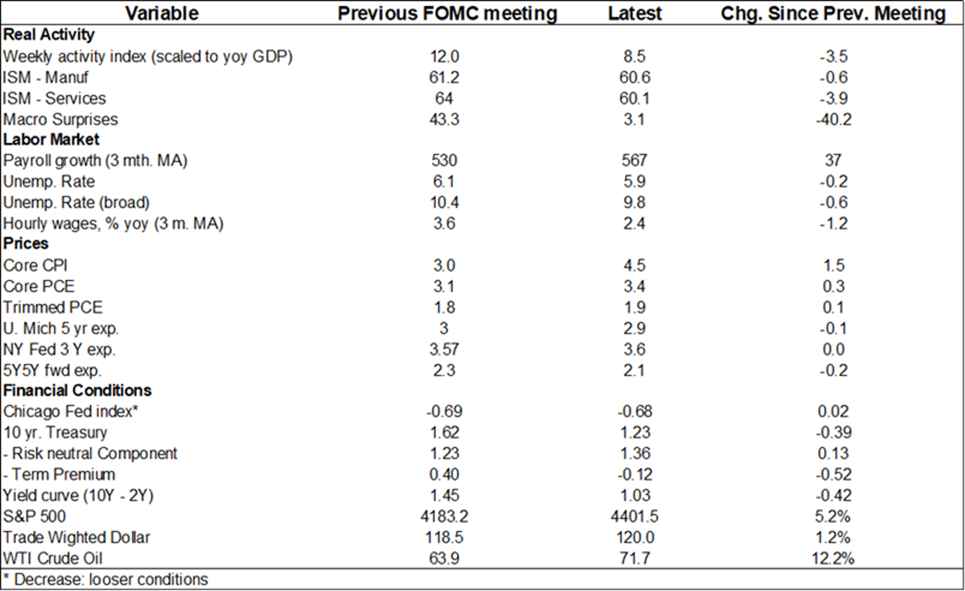

The progress the whole economy has made has been noted, as well as the temporary bottlenecks constraining supply in the automotive and other industries. The Fed does not seem concerned by the signs of deceleration in activity flagged by a few indicators (see table at the bottom) nor by the risks related to the spreading of the Delta variant. Chair Powell noted that each strain of infection has been progressively less harmful to the economy, and expects the same to happen with the Delta variant.

The view on inflation remains unchanged. The current spike is due to transitory factors limited to few sectors, heavily affected by the reopening of the economy, and base effects that are already receding. Inflation is mostly caused by supply temporarily failing to catch up with demand, something the Fed will not respond too. Yet, chair Powell admitted that timing the normalisation of inflation is very hard. Risks remain tilted to the upside, at least in the short term. Any discussion on whether average inflation has reached the target is up to the FOMC, chair Powell stressed. But this is relevant only for the first rise in rates, which is not in the Fed’s radar screen.

Both financial markets and households are indeed getting more confident in the temporary nature of the bout, revising down long-term expectations. The inflation expectations gauge introduced by the Fed rose in Q2 back to the 2014 levels (just below 2.1%). Our nowcast for Q3 points to a further, but much smaller, increase.

As the economy evolves according to expectations, the appropriate time for tapering approaches. Powell admitted that the discussion on how to reduce purchases is ongoing, and FOMC members will strive to be as transparent as possible, providing advance notice of any move. The option of tapering MBS faster than Treasury in order to rein in price increase finds little support within the committee but is being discussed. We stick to the view of tapering beginning in January, with some preliminary announcement at the forthcoming Jackson Hole conference (Aug. 26- 28)