07 February 2018

The power of data

Interview with Alessandra Chiuderi, Head of Analytics Solutions Centre

Today, data analysis is fundamental to understanding market trends and being more effective. How does Generali’s Analytics Solutions Centre support the Group’s business units to deal with the challenges of digital transformation?

When talking about Digital Transformation often we think (only) of web sites and mobile apps, while a Company’s digital transformation starts from how data is collected and managed to be more efficient and effective.

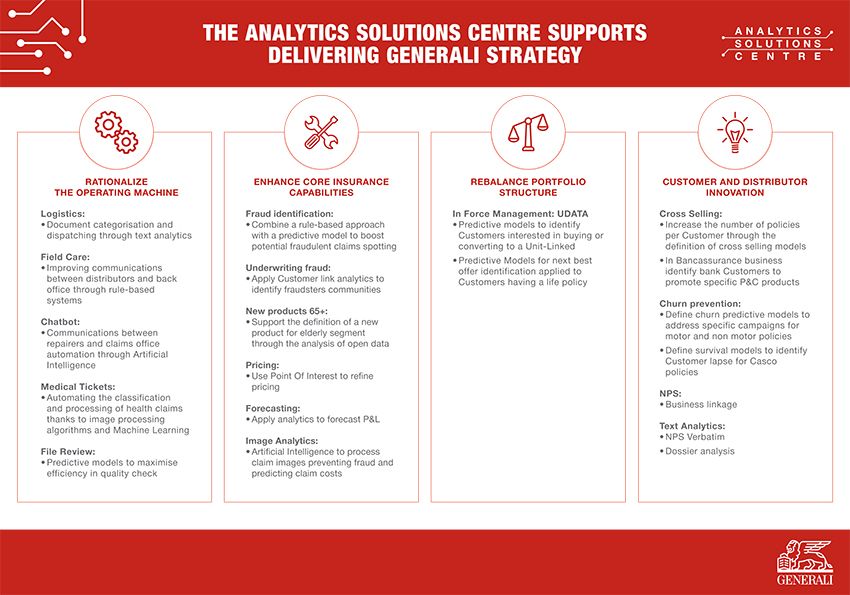

The Analytics Solutions Centre was created two years ago to foster the digital transformation of the Group Companies by promoting and actively supporting the adoption of data analytics in every step of the insurance value chain.

The projects we are working on together with our Business Units range from providing new insights for product definition to strengthening existing fraud detection systems, from back-office automation to claims management streamlining, from identifying the best Customers for specific products to helping the NGOs that are part of The Human Safety Net.

In recent years, there has been a lot of buzz around Big Data and how managing it can transform traditional business models. Can you describe what the challenges and opportunities will be for the insurance sector?

Personalisation, internal process optimisation and Customer management are surely amongst the most interesting and toughest challenges we have to face.

Let’s begin from the fact that our Customers are also Clients of companies that have based their success on personalising their offer, are providing an outstanding Customer experience and show an impressive efficiency thanks to their ability to manage enormous amounts of data (Google, Amazon, Netflix, Facebook, etc.).

For our Clients, receiving goods a few hours after ordering them or getting targeted and appropriate suggestions on movies to watch is absolutely normal nowadays, so they expect a similar capacity on our part in providing products that suit their needs.

They have learned that, by analysing large amounts of data, it is possible to forecast and therefore prevent risks. They expect us to move from the traditional reactive approach where the Customer first experiences the loss and then receives a reimbursement to the proactive one where insurance offers a prevention and protection service.

These same Customers expect the payment of a simple motor claim to be as easy and straightforward as paying their restaurant bill through a mobile app.

All of this means that we need to strengthen our skills in managing and analysing the data we have, and do it fast, before other players seize this opportunity.

Data and data analysis underlie the development of innovative and customised solutions. Can you provide a practical example of solutions developed with the support of the activities carried out by the Analytics Solutions Centre?

Since this function was set up two years ago, we have improved and extended the capacities of the fraud detection systems of some Group Companies, we have developed a prototype, which will soon be released in production, which automates medical expense reimbursement management, we have implemented models to identify which are the most appropriate products for a specific Customer and we are starting to work on image analytics for motor claims to automate the settlement of simple claims.

Can you describe the main Artificial Intelligence techniques used today?

Artificial Intelligence is a term that can include different techniques and areas depending on the context, so let’s focus on the broadest sense, which includes Machine Learning systems and Deep Learning, the ability to analyse and understand texts and concepts (Text Analytics) and Robotics to automate specific tasks and procedures.

Models and techniques employed by the Analytics Solutions Centre vary considerably depending on the project and the Company we are working with: we go from rule based systems to Machine Learning to set up predictive models (through for example Gradient Boosting, Random Forest, Genetic Algorithms), we have developed strong competencies in Text Analytics integrated with RPA (Robotics Process Automation) and we are starting 3 different projects on image analytics relying on Deep Learning.

In the next few years, what will the main trends be in terms of big data, artificial intelligence and the internet of things?

All the analysts and the major insurance Companies agree that systems based on Artificial Intelligence (in its broader sense) represent one of the major transformational levers for the insurance business not only because they make it possible to automate processes and low value added activities, leading to cost reduction and increased throughput, but also because they will be able to perform tasks that cannot be carried out by humans such as comparing images to avoid fraudulent multiple usage of the same picture in different claims.

Besides the initial hype on this topic, we expect that the application of AI to company processes will grow constantly in the next few years until it becomes standard, as happened with Text to Speech technology, one of the first AI applications in early 80s that is now considered quite basic.

IoT also represents a tremendously interesting and disruptive transformational factor for the world of insurance: it makes it possible to acquire a massive amount of data and to establish an interactive relationship with the Customer (especially if compared with the once-a-year touchpoint for traditional insurance products) leading to the proactive prevention service approach we mentioned earlier, and, last but not least, it opens up the possibility of creating service ecosystems connecting different stakeholders (doctors, physiotherapists, relatives, tools and applications) which represent the natural evolution of our economy.