26 January 2018

Blockchain, a revolution?

What is the potential of this new platform?

While stories about Bitcoin have been making the news recently, little has been said about the technological platform on which it is based, an innovation that is opening up all manner of possibilities and generating some potentially disruptive solutions.

Until a few months ago its name was known only to those in the sector. But in recent weeks the largest fluctuation in recent years turned the spotlights onto Bitcoin. We may not know the true identity of its inventor, nor what the future holds, but today pretty much everyone knows what it is: a digital currency, which is held in virtual wallets, that can be used to make payments, transfer money or as an investment. Less noted is that Bitcoin is based on a technology, Blockchain, which in reality can enable a whole range of applications: virtual currencies are just one example of its potential.

Bitcoin functions based on a peer-to-peer protocol, just like those used for exchanging music and films online, in which every computer becomes a node in the network of peers. Each user’s computer retains a copy of all operations in a sort of database, a ledger file that contains an accounting system in which all of the transactions of all users are always registered: this is Blockchain.

Bitcoin is just one possible declination, while Blockchain is the platform or the architecture for the management of any type of transaction and exchange of information and data. Rivers of ink have been used to write about the oscillations in value of the cryptocurrency but insufficient attention has been paid to the model that enables it all to take place, a technology that also promises to enable some highly significant future advances. The phrase not being able to see the wood for the trees comes to mind.

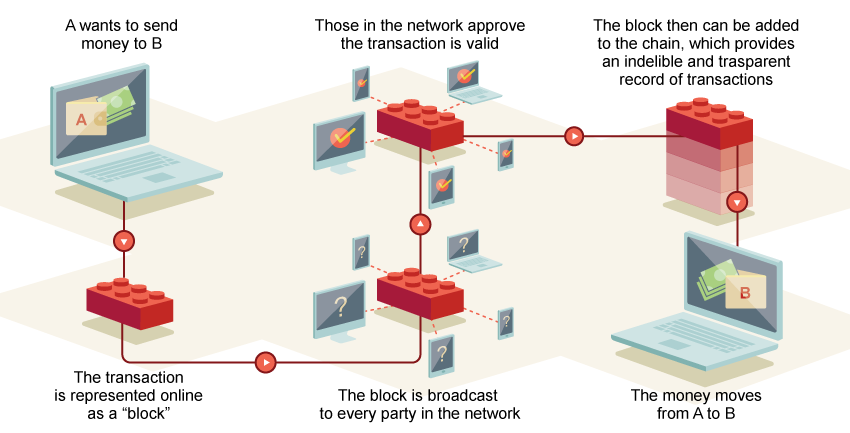

Why is it called Blockchain? Because the platform is structured into blocks or nodes on the network that are all connected together in a chain in such a way as to ensure that every transaction must be validated by the network. Each node is then called to observe, control and approve all of the transactions, thus creating a network that ensures the traceability of all of the transactions. Each block in turn also serves as an archive of the transactions that, in order to be approved by the network and exist on all of the network nodes, are unalterable. What’s more, cryptographic tools guarantee the security of each transaction.

For some, Blockchain is the new frontier of the Internet. For others it is the digital representation of a kind of utopia that has already been achieved, a new concept of trust based on four features: decentralisation, transparency, security and immutability. According to a video produced by the World Economic Forum in 2016, Blockchain is destined to become a decentralised source of trust worldwide and its uses are potentially infinite. Some have posited its possible use in logistics, manufacturing and fashion. Within ten years Blockchain could even be used to collect taxes, facilitate political elections or combat financial fraud. Blockchain is probably destined also to reduce the role of financial institutions and public authorities in a process of disintermediation that is not new to the digital world (just think about the sharing economy). The main feature, in fact, is that its functioning is not guaranteed by a central organisation, rather each individual transaction is validated by the interaction between all of the nodes. The so-called “timestamp” enables the association of a finite and legally valid date and time to an IT document and prevents that the operation, once completed, can be altered or annulled.

For example, in the case of Bitcoin, the owners are anonymous and identified only by a code. Each transaction is indicated by a public key identifying the recipient and used by all of the devices to verify the operation, and by a private key that serves to enable the users involved to authorise the transaction. If the private key is lost, the money is also lost. A transaction is registered only when it has effectively taken place and in the only place that monitors how many Bitcoins exist and who they belong to. In this way, users are unable to spend the same Bitcoins more than once because the fact that they have already been spent is registered in the Blockchain of everyone who uses Bitcoins. Falsifying Bitcoins is extremely complicated and practically impossible. However, no one today can prevent that the traffic in Bitcoins can hide the flow of funds from illegal activities.

Just a few months ago The Economist referred to a “Bitcoin bubble”, when the value of the virtual currency reached almost 10 thousand dollars after having attracted the interest of investment funds and banks. According to British press agency Reuters Bitcoin’s potential to become a mainstream tool used and traded by the general public, inflated the value of the cryptocurrency. There is already talk of other cryptocurrencies such as Ripple and Ethereum, respectively the second and third largest in terms of market capitalisation.

For the time being, Wall Street is watching from the sidelines, in order to understand whether Blockchain will become either its greatest ally or its executioner. In September the Chinese financial authorities banned all platforms from trading in Bitcoins.

Nouriel Roubini, professor of Economics at New York University who predicted the 2008 financial crisis, described Bitcoin as a “gigantic speculative bubble,” whereas Blockchain “creates an enormous chance to increase productivity in many companies and I think the technology to be something very good.” Derek Thompson in The Atlantic, has written that Blockchain has a guaranteed future even if the Bitcoin bubble bursts.

It is precisely the element of trust that is central to understanding the disruptive potential of this new platform. A recent article in Wired claimed that Blockchain is “redefining the concept of trust”. We are at the same point as the Web in 1993, at the dawn of something that is coming into life, which we do not yet fully understand and that could revolutionise the way in which we exchange data and information.