“The Italian insurer presented its new 2024 plan on Wednesday. It offered shareholders a bit of everything. The group forecast annual earnings per share would rise 6 to 8 per cent. It promised dividends totalling almost €6bn. A €500m buyback will be the first in 15 years. … Investment metrics point to Donnet having done a decent job… Independent shareholders should support him.”

Industry-leading investor returns

Generali is a recognised sustainability leader and a proud contributor to its communities

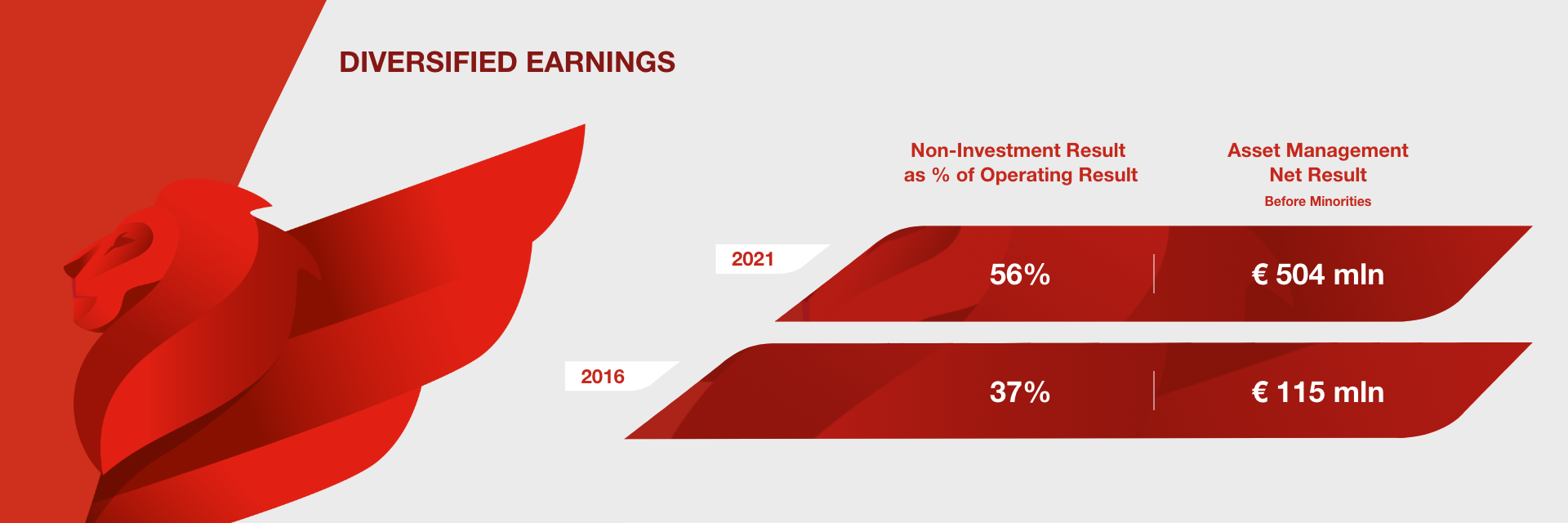

We have ambitious 2024 targets focused on delivering sustainable growth

Generali in the news

Best practice board composition and corporate governance

1. The Return on Equity was 12.4% and 12.1% in 2019 and 2021 respectively. Excluding the 2020 RoE which was impacted by Covid-19 and one-offs, the average RoE was above the target of > 11.5%.

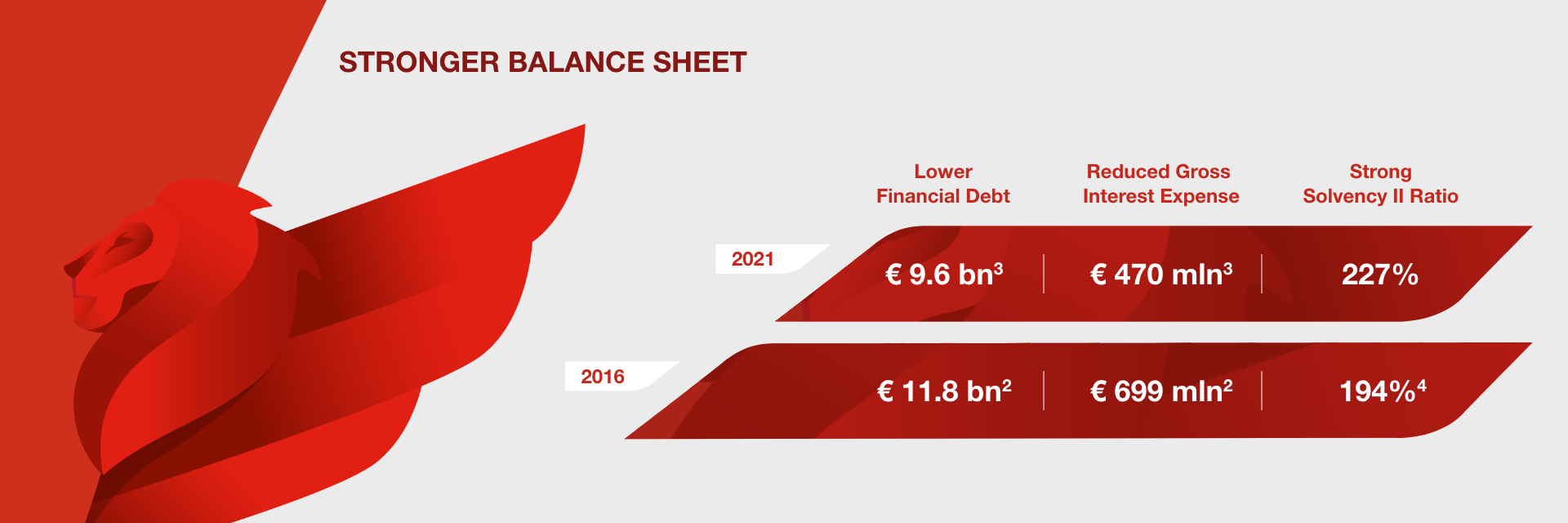

2. Not including the subordinated bond issued in June 2016, for a nominal amount of € 850 million to refinance 2017 callable hybrid bond.

3. Not including Adriatic Slovenica and Cattolica subordinated debt as well as the € 500 million subordinated debt issued in June 2021 to partially refinance 2022 maturities.

4. Internal model view.

5. Reference indices are FTSE MIB (ITA), CAC 40 (FRA), DAX 30 (GER), FTSE 150 (UK), IBEX 35 (ESP).