Report on share buyback for the purposes of the Long Term Incentive Plan (LTIP) 2022-2024 as well as the Group's incentive and remuneration plans under execution

13 February 2023 - 12:36

REPORT ON SHARE BUYBACK FOR THE PURPOSES OF THE LONG TERM INCENTIVE PLAN (LTIP) 2022-2024 AS WELL AS OF ALL REMUNERATION AND INCENTIVE PLANS APPROVED BY THE SHAREHOLDERS’ MEETING AND STILL UNDER EXECUTION, IMPLEMENTING THE RESOLUTION OF THE SHAREHOLDERS’ MEETING OF 29 APRIL 2022.

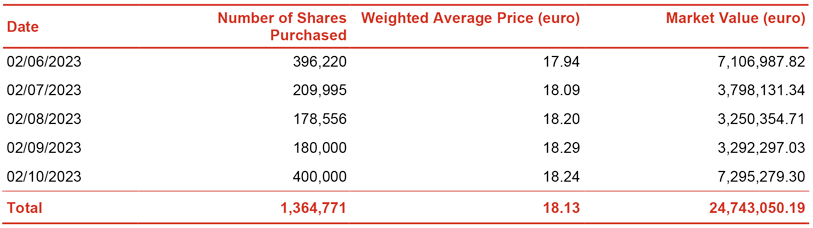

Trieste - Assicurazioni Generali S.p.A. (or the "Company") announces that it has purchased on the Euronext Milan market, organised and managed by Borsa Italiana S.p.A., during the period from 6 February 2023 to 10 February 2023, no. 1,364,771 treasury shares at a weighted average price per share equal to 18.13 euro, for an aggregate amount of 24,743,050.19 euro.

The purchase of treasury shares follows the announcement made on the 19 January 2023 concerning the start of the share buyback for the purposes of the Long Term Incentive Plan (LTIP) 2022-24 as well as the group's incentive and remuneration plans under execution, implementing the resolution of the Shareholders’ Meeting of 29 April 2022 and the announcement made in the press release of 29 April 2022.

On the basis of the information provided by the intermediary appointed to carry out the purchases, please find below a table that summarises, in a daily and aggregate form, the Company’s ordinary shares’ purchases transactions carried out by the same intermediary on the Euronext Milan market during the period indicated above.

Following these purchases, as of 10 February 2023 the Company and its subsidiaries owns no. 45,322,996 treasury shares, equal to 2.86% of its share capital.

Please find also below the daily breakdown of purchases of Assicurazioni Generali ordinary shares (ISIN code IT0000062072) carried out during the period from 6 February 2023 to 10 February 2023.