Covid paralysis recedes as political risk rises

By Generali Investments’ Research Team

- After a buoyant August for risk assets, the rally is likely to flatten out. Rising new infections into the autumn, a levelling recovery pace and diverse political risks (US politics, Brexit, geopolitics) will keep a lid on risk sentiment.

- Yet recovering data, committed central banks, falling Covid-19 lethality and optimism about vaccines still support a slight pro-risk bias.

- We keep a prudent overexposure to risky assets, centred in high-quality buckets of Credit. Look to increase the pro-cyclical bias in portfolios as the Covid paralysis fades out.

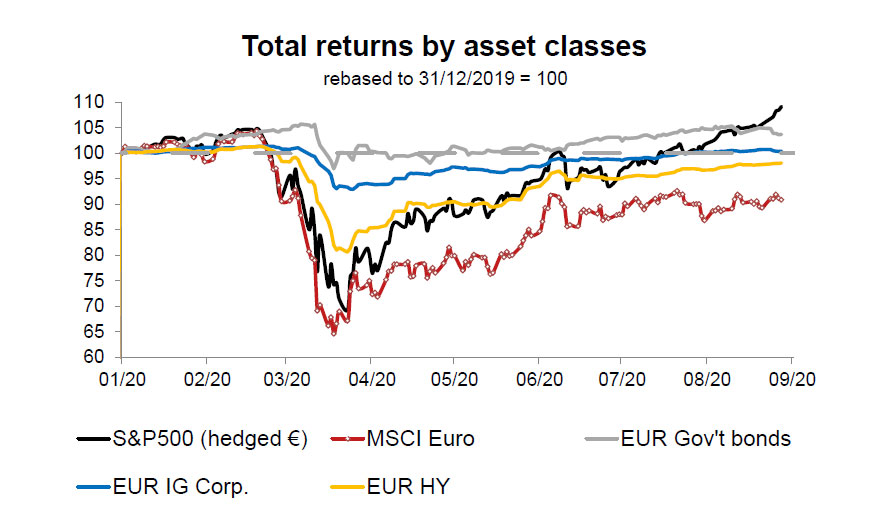

Even after the large risk rally in summer and despite the persistent spreading of Covid-19, equities advanced fast in August (MSCI World up by another 6.6%), helped by recovering data, better-than-expected earnings and vaccine hopes. The S&P has reached new record highs, led by tech firms. Credit spreads compressed further, largely offsetting the modest increase in underlying core yields. These trends paid off nicely for our (cautious) pro-risk tilt expressed in July.

Rising new cases in Europe and renewed restrictions into the autumn remind us that the crisis is not over. The epidemics is still not fully understood, and seasonality could be a factor. Yet, if anything our concerns for the autumn have slightly diminished of late. Global infections seem to have peaked, with US cases now pulling back. Mortality has been declining, in part because hospitals have developed better protocols. Vaccines are expected on the market by 21H1 – another headwind for equity bears. Falling mortality rates and larger spare capacities in ICUs will allow governments to avoid blunt lockdowns.

Recovery facing intensifying political risks

The economic recovery has legs, even though after the Q3 rebound, its momentum will ease. Persistently high US unemployment claims (still >1m per week) and a surprise drop in European August PMIs are fresh reminders that we are not amidst a V-shape recovery. After the strong initial rebound, economic scars will heal only gradually.

Political crosscurrents are mounting, unfortunately. While the US/China trade war has been put to the backburner, US president Trump has turned his ire on key Chinese tech firms (TikTok, WeChat, Huawei). Meanwhile China’s geopolitical assertiveness in the South China Sea is rising. Brexit negotiations need to be concluded by October, and the lack of progress so far suggests that the deal, if any, will be minimalist (a lose-lose). Sabre-rattling between Turkey and Greece in the Mediterranean Sea looks increasingly dangerous.

US political risk is weighing too. Congress remains at loggerheads over a new fiscal package, including enhanced support to the unemployed that expired in July (Trump‘s executive orders only a partial fix). November elections may result in a ‘blue sweep’ (Democrats winning both presidency and Congress) that markets fear for tax hikes on corporates and wealthy individuals. In a worst case, Trump would dispute the results, leaving scope for weeks of constitutional uncertainties.

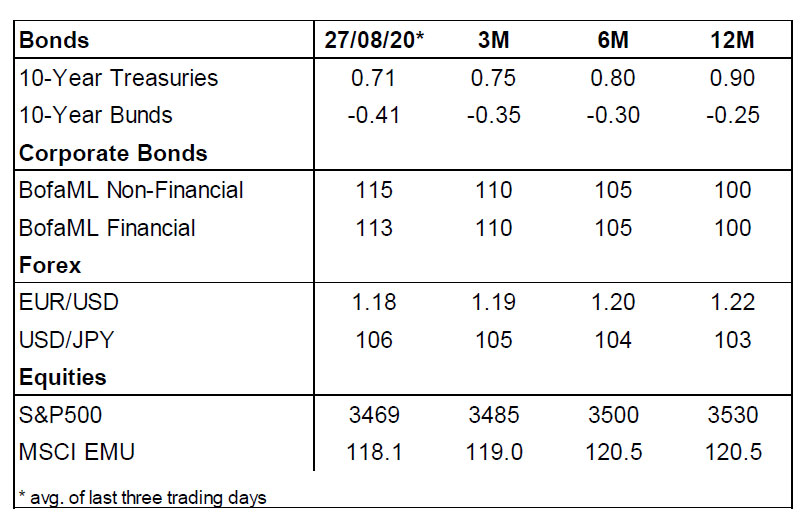

In all, the outlook for risky assets remains tilted to the upside, but now appears less sanguine. With the economy still recovering and central banks reassuring on long-term policy support (as just implied by the Fed’s revamp of its monetary policy strategy - see US section), markets may still benefit from mildly supportive risk sentiment amid a persistent search for yield. We maintain a prudent overweight in Credit, largely thanks to the carry, especially in safer buckets and longer maturities. Negative core yields are likely to keep trading range-bound and offer little value (mind 10-30y steepening potential). We keep a small overweight in equities, and will look to increase the pro-cyclical bias as the Covid paralysis recedes. The mid-term outlook remains bleak for the greenback, even though short term the EUR/USD rally is set to flatten out.