Financial Information as of September 30th 2025 (1)

13 November 2025 - 07:00 price sensitive

Generali continues to achieve very strong growth in operating and adjusted net results. Solid capital position confirmed

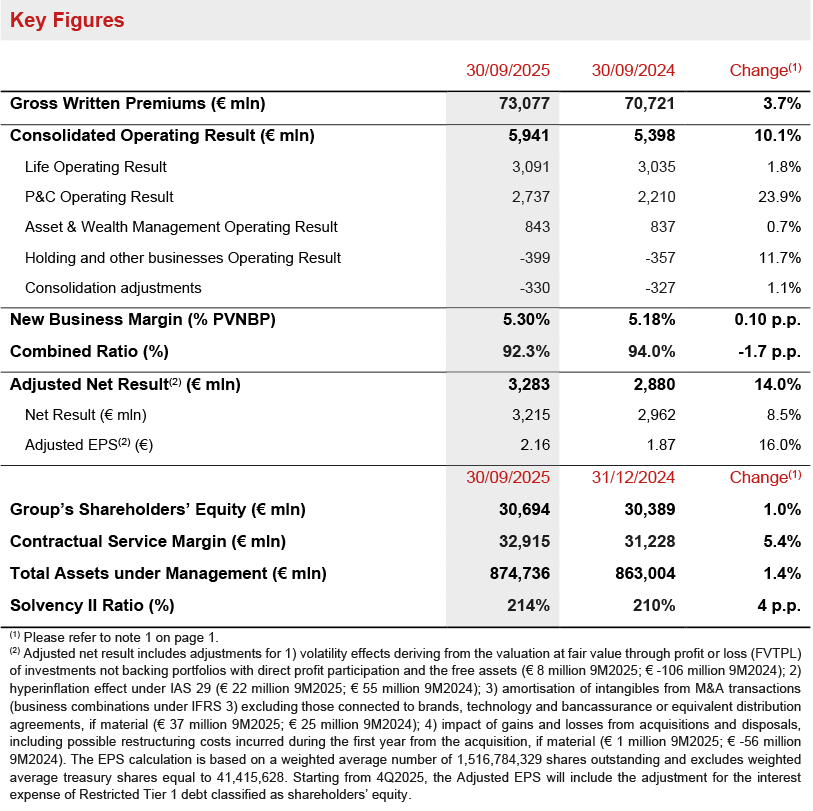

- Gross written premiums reached € 73.1 billion (+3.7%), driven by P&C (+7.2%)

- Life net inflows rose to € 10.4 billion, particularly thanks to the preferred protection & health and hybrid & unit-linked lines

- Very strong growth in operating result to € 5.9 billion (+10.1%), driven by the excellent performance of P&C (+23.9%)

- Combined Ratio improved significantly to 92.3% (-1.7 p.p.); undiscounted Combined Ratio continued its very positive development to 94.2% (-2.1 p.p.)

- Adjusted net result grew to € 3.3 billion (+14.0%) thanks to the very strong operating performance. Adjusted EPS rose substantially to € 2.16 (+16.0%)

- Solid capital position confirmed, with Solvency Ratio rising to 214% (210% FY2024), thanks to healthy normalised capital generation and including the € 500 million share buy-back programme

Generali Group CFO, Cristiano Borean, said: “The first nine months of 2025 confirm the very strong start of the Group’s new strategic cycle. All business segments contributed positively to the double-digit growth of the operating result. Life recorded sustained net inflows, driven by preferred business lines. P&C enjoyed healthy top-line growth and confirmed our technical excellence, with a further improvement in the undiscounted combined ratio. After two years of significant Nat Cat experience, 2025 was benign so far, with nine month Nat Cat claims of € 573 million, just over half of the full year Nat Cat budget. With continued strong focus on the implementation of our ‘Lifetime Partner 27: Driving Excellence’ strategic plan, we opted to take advantage of this positive Nat Cat development to further strengthen our balance sheet and to increase our confidence of exceeding the targets of our three-year plan. We will continue delivering value for the benefit of all our stakeholders, building on this positive momentum, with the adjusted EPS up 16% year-on-year, and enjoying the benefit of a strong balance sheet, diversified sources of cash generation as well as a solid capital position”.

Executive Summary

Milan - At a meeting chaired by Andrea Sironi, the Generali Board of Directors approved the Financial Information of the Generali Group at September 30th 2025.2

The Group’s gross written premiums reached € 73.1 billion, thanks to strong performance of P&C. Life net inflows recorded robust growth, reaching € 10.4 billion (+54.9%), with all key geographies showing higher net flows compared to the same period last year.

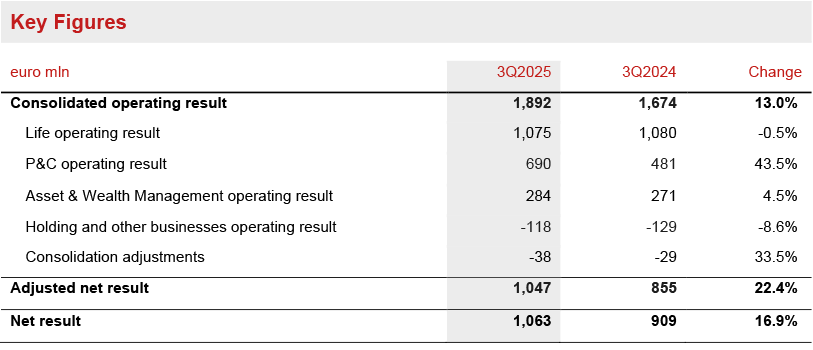

The operating result grew significantly to € 5,941 million (+10.1%), driven by the very strong performance of P&C and supported by positive contributions from all business segments.

P&C operating result increased significantly to € 2,737 million (+23.9%) with the undiscounted Combined Ratio improving to 94.2% (96.3% 9M2024) reflecting the strong improvement of the current year attritional loss ratio.

In light of the benign Nat Cat experience at 9M2025, the Group opted to record a lower benefit from previous years compared to 9M2024. This will allow a further strengthening of the balance sheet and increase the probability of exceeding the key financial targets of the “Lifetime Partner 27: Driving Excellence” plan.

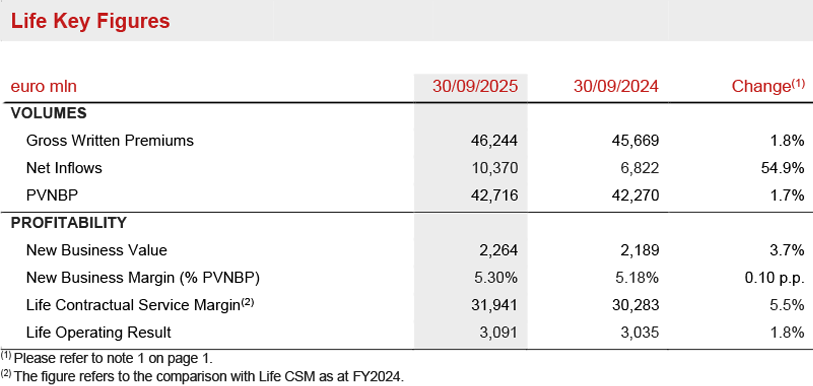

The Life operating result grew to € 3,091 million (+1.8%). New Business Value (NBV) amounted to € 2,264 million (+3.7%), supported by higher volumes and improved profitability.

Asset & Wealth Management operating result grew to € 843 million (+0.7%), thanks to the performance of Asset Management, mainly reflecting the consolidation of Conning Holdings Limited (“CHL”).

The operating result of Holding and Other Businesses was € -399 million (€ -357 million 9M2024).

The adjusted net result3 increased by 14.0% to € 3,283 million (€ 2,880 million 9M2024) thanks to the Group’s strong operating performance, leading to an adjusted EPS of € 2.16, marking a 16.0% year-on-year growth.

The net result amounted to € 3,215 million (€ 2,962 million 9M2024), with the comparison to the prior year reflecting strong non-operating investment result at 9M2024, which also included a non-recurring capital gain (€ 58 million net of taxes) related to the disposal of TUA Assicurazioni.

The Group’s Shareholders' Equity increased to € 30.7 billion (€ 30.4 billion FY2024). The growth is mainly attributable to the Group’s net result for the period of € 3,215 million, partially offset by the combination of the 2024 dividend of € 2,172 million paid in May 2025 and the share buyback of € 663 million4.

The Contractual Service Margin (CSM) grew to € 32.9 billion (€ 31.2 billion FY2024).

The Group's total Assets Under Management (AUM) were € 874.7 billion (€ 863.0 billion FY2024).

The Group confirmed its solid capital position, with the Solvency II Ratio at 214% (210% FY2024), resulting from € 51.1 billion of Eligible Own Funds and € 23.9 billion of Solvency Capital Requirement.

The increase reflected the sound contribution of normalised capital generation and positive market variances. These factors more than offset the negative regulatory changes, non-economic variances, M&A operations and capital movements stemming from the impact of the dividend for the period and the share buy-back programme, net of the subordinated debt issuance.

The normalised capital generation, which includes the full impact from the share buy-back for the Long-Term Incentive Plan (LTIP) executed in the first half, was supported by the performance of Life, P&C and Financials.

Life

- Life net inflows were very positive at 10.4 billion (+54.9%)

- Life CSM grew to € 31.9 billion (+5.5%)

- New business margin was 5.3% (+0.10 p.p.)

Life gross written premiums5 increased by 1.8% to € 46.2 billion. This development was achieved despite the comparison with a strong 9M2024, during which targeted commercial actions were implemented to sustain net inflows in Italy and France and extraordinary new production was recorded in Asia during 1Q2024. Protection & health and traditional saving confirmed their solid growth trajectory (+8.0% and +10.3% respectively), while hybrid & unit-linked decreased by 4.7%, despite a healthy performance, reflecting the aforementioned comparison with 2024.

Life net inflows increased very significantly, reaching € 10,370 million (+54.9%), thanks to positive inflows across all key geographies as well as lower surrenders. All business segments contributed positively, with protection & health achieving € 3,654 million, hybrid & unit-linked € 4,672 million and traditional saving € 2,044 million.

New Business Volumes (expressed in terms of present value of new business premiums - PVNBP) rose to € 42.7 billion (+1.7%), driven by strong protection & health growth across all regions. Traditional saving and hybrid & unit-linked were both stable, thanks to solid Q3 production. New Business Value (NBV) reached € 2,264 million (+3.7%), supported by higher volumes and improved profitability. New Business Margin on PVNBP (NBM) increased to 5.30% (+0.10 p.p.) reflecting favorable product mix and features, partially offset by the impact of lower interest rates.

The Life Contractual Service Margin (Life CSM) increased to € 31.9 billion (€ 30.3 billion FY2024). The positive development was enabled by the contribution of the New Business CSM for € 2.2 billion and of the expected return for € 1.1 billion, which more than offset the Life CSM Release of € 2.4 billion.

The Life operating result grew to € 3,091 million (€ 3,035 million 9M2024) thanks to the increase in the operating insurance service result to € 2,443 million (€ 2,246 million 9M2024). This more than compensated the decline in the operating investment result to € 647 million (€ 789 million 9M2024), which reflected positive one-off items in 2024, higher insurance finance expenses and the reallocation of Life excess capital to P&C in Argentina.

P&C

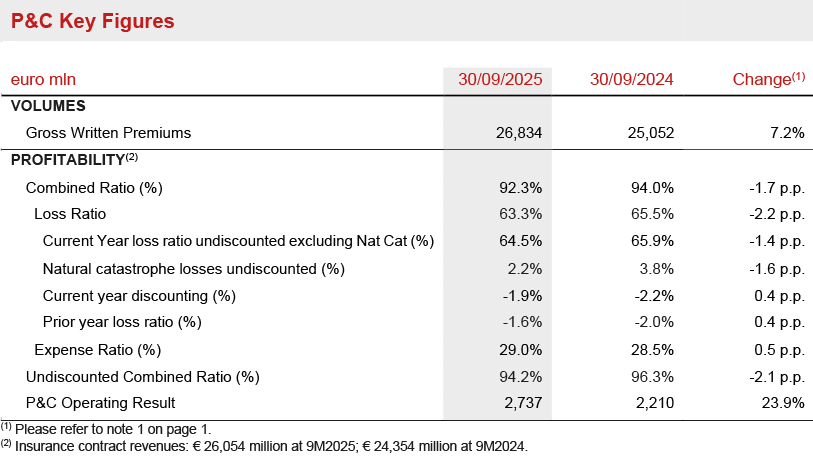

- Premiums increased to € 26.8 billion (+7.2%)

- Combined Ratio improved substantially to 92.3% (-1.7 p.p.). Undiscounted Combined Ratio continued its positive development to 94.2% (-2.1 p.p.)

- Operating result grew very strongly to € 2,737 million (+23.9%)

P&C gross written premiums grew to € 26.8 billion (+7.2%), driven by the positive performance of both business lines.

Non-motor increased by 7.6%, achieving widespread growth across all main areas. Including also the accepted business of Europ Assistance, non-motor top line growth was 8.0%.

The motor line rose by 7.1% across all main areas, with particularly positive business dynamics in Germany (+11.3%). Excluding the contribution from Argentina, motor line premiums increased by 5.4%.

The Combined Ratio improved substantially to 92.3% (94.0% 9M2024) thanks to the positive development of the loss ratio at 63.3% (-2.2 p.p.). The main positive drivers of the loss ratio were the strong improvement in the undiscounted current year attritional loss ratio (-1.4 p.p.) and the lower impact from Nat Cat (-1.6 p.p.) of € 573 million. These positive drivers were partially reversed by a lower discounting benefit (+0.4 p.p.) and lower contribution from previous years (+0.4 p.p.). Therefore, the contribution from previous years in the 3Q2025 in isolation was -0.1 p.p. (+1.9 p.p. compared to 3Q2024).

The expense ratio was 29.0% (28.5% 9M2024), despite an improvement in the administrative component, due to higher acquisition expenses.

The undiscounted Combined Ratio improved to 94.2% (96.3% 9M2024).

The P&C operating result increased very strongly to € 2,737 million (+23.9%). The operating insurance service result grew to € 2,001 million (€ 1,454 million 9M2024), thanks to both improved profitability and higher business volumes, despite a lower discounting effect of € 486 million (€ 544 million in 9M2024) following the decline in interest rates. The undiscounted operating insurance service result improved very substantially to € 1,514 million (€ 910 million 9M2024).

The operating investment result was € 736 million (€ 755 million 9M2024). This reflected a € 41 million decline in the operating investment income to € 1,224 million, which more than compensated the € 21 million improvement in the insurance finance expenses to € -488 million. The reduction in the operating investment income was entirely related to Argentina, due to the very significant decline in the local inflation rate. The operating investment income excluding Argentina improved to € 1,160 million (€ 1,099 million 9M2024), reflecting larger volumes as well as reinvestment yields higher than the maturing coupons.

Asset & Wealth Management

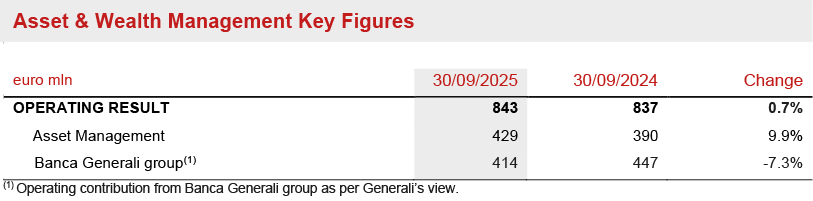

- Asset & Wealth Management operating result was € 843 million (+0.7%)

- Asset Management operating result rose to € 429 million (+9.9%)

- Banca Generali group operating result at € 414 million (€ 447 million 9M2024)

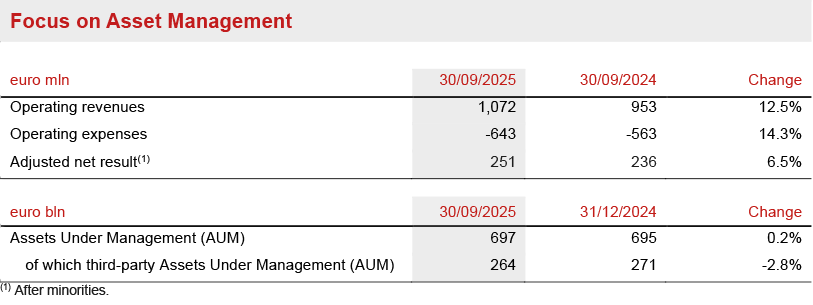

The operating result of Asset Management increased to € 429 million (+9.9%), reflecting a € 57 million contribution from CHL. Without CHL, the operating result would have been slightly higher year-on-year (+ 3.5%). Operating revenues posted a positive development (+12.5%, or +4.5% excluding CHL) thanks to CHL (€ 250 million) and benefitting from higher average AUM compared to 9M2024 and the contribution from Asian entities. Operating expenses rose to € 643 million (+14.3%), mainly due to CHL (€ 192 million). Excluding CHL the increase would have been +5.4%, driven by higher compensation costs.

The operating result of the Banca Generali group was € 414 million (€ 447 million 9M2024), due to lower non-recurring fees from a record high € 122 million in 9M2024 to € 72 million in 9M2025. Total net inflows at Banca Generali at 9M2025 were € 4.4 billion.

Asset Management adjusted net result rose to € 251 million (+6.5%), reflecting the operating trends mentioned above.

AUM pertaining to the segment were € 697 billion at the 30th of September 2025, broadly in line with FY2024, due to a negative FX rate impact of approximately € 27 billion, offsetting positive net flows of € 11 billion, of which € 7.2 billion were from third-party clients. Third-party AUM managed by the Asset Management companies stood at € 264 billion, including € 149 billion from CHL.

Holding and Other Business

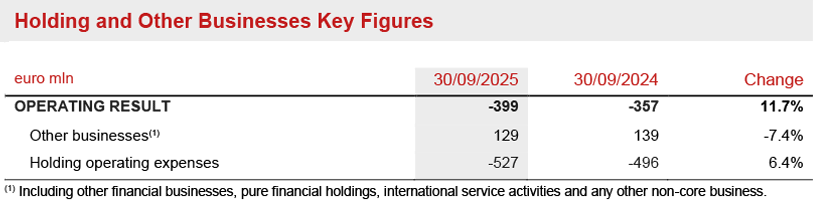

- Operating result stood at € -399 million (€ -357 million 9M2024)

The operating result of Holding and Other Businesses was € -399 million (€ -357 million 9M2024). The contribution from Other businesses was € 129 million (€ 139 million 9M2024), primarily affected by a one-off exit tax payment in 1Q2025 related to the closure of a foreign entity. Holding operating expenses increased to € -527 million, primarily driven by the implementation of strategic projects.

Outlook

Following a period of subdued growth expectations at the beginning of 2025, global forecasts have partially recovered. The risks of an economic setback appear limited, especially if financial conditions remain favourable. The euro area economy has so far demonstrated resilience in the face of external challenges, including the imposition of U.S. import tariffs. The global disinflation trend remains intact as weakening labour markets help moderating wage growth. In the euro area, inflation has stabilized around the 2% target. While the ECB’s monetary easing cycle may have reached its conclusion, rate hikes are unlikely to occur before 2027.

In this context, with the “Lifetime Partner 27: Driving Excellence” strategic plan, which focuses on excellence in customer relationships, core capabilities and the Group operating model, the Group will accelerate profitable growth in Life by capitalising on its broad customer base and strong distribution footprint. In addition, the Group will improve technical proficiency to increase profitability and enhance effectiveness by scaling Group-wide assets across the value chain. Focus will remain on simplification and innovation, offering updated and integrated solutions to adapt to evolving customer needs throughout their lifetime.

In Life, primary focus areas include protection and health, as well as capital-light savings with the aim to create a wide range of insurance solutions adapted to different risk and investment profiles for the benefit of both the policyholder and the Group. For protection and health products, the Group aims to offer integrated end-to-end services and will also further upgrade customer experience and distribution. Hybrid and unit-linked offerings will continue to be a priority to address growing customer needs for financial security with the objective of becoming the go-to partner for retirement and savings.

In P&C, Generali's objective is to maximise profitable growth with a focus on the non-motor line, strengthening its position and offering especially in countries with high growth potential. The Group confirms and strengthens its adaptive approach towards tariff adjustments, also considering rising needs for insurance coverage for natural catastrophes. The non-motor offer will continue to be enhanced with additional modular solutions designed to meet specific customer needs, providing improved and innovative prevention, assistance and protection services, enabled by the latest digital tools.

With reference to the investment policy, the Group will continue to pursue an asset allocation strategy aimed at ensuring consistency with liabilities and, where appropriate, at increasing current returns. Selective investments in private and real assets continue to be an important part of the Group’s strategy, following a prudent approach that considers the lower liquidity of these instruments. In the real estate sector, the Group is pursuing both geographical and sector diversification, closely monitoring and evaluating market opportunities as well as asset quality.

In Asset & Wealth Management, Asset Management will continue to expand the product offering, particularly in real assets and private assets, enhance distribution capabilities, and extend its presence in new markets further supported by the acquisition of Conning Holdings Limited, completed in 2024. In Wealth Management, the Banca Generali group will continue to focus on its targets of size, profitability and high shareholder remuneration.

The Group is committed to delivering – through the new “Lifetime Partner 27: Driving Excellence” plan – ambitious 2025-2027 growth targets:

- strong earnings growth: 8-10% EPS CAGR6

- solid cash generation: > €11 billion Cumulative Net Holding Cash Flow7

- increasing dividend per share8: > 10% DPS CAGR9 with ratchet policy

With a clear capital management framework with increased focus on shareholder returns:

- more than € 7 billion in cumulative dividends10 (2025-2027)

- committed to at least € 1.5 billion share buyback11 over the plan horizon

- € 500 million buyback for 2025, approved by the Annual Shareholder Meeting 2025 and launched on August 6th 2025.

Significant events after September 30th 2025

On October 1st Generali Investments completed the acquisition of a majority stake in MGG Investment Group, a U.S. private direct lending investment firm with over $ 6.5 billion in assets under management. The estimated impact on the Generali Group’s Solvency II Ratio is approximately -2 p.p. to be recorded in 4Q2025.

On October 16th, the 2026 Generali Corporate Events Calendar has been published.

Other significant events that occurred after the end of the period are available on the website.

***

The glossary and the description of alternative performance indicators are available in the Group Annual Integrated report 2024.

Q&A Conference Call

The Group CFO, Cristiano Borean, the Group General Manager, Marco Sesana and the CEO Insurance, Giulio Terzariol, will host the Q&A session conference call for the results of the Generali Group as of 30th 2025, which will be held on November 13th 2025, at 12.00 pm CET.

To follow the conference call, in a listen only mode, please dial +39 02 8020927.

***

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

Generali 3Q 2025 Results

1 Changes in premiums, Life net inflows and new business are on a like-for-like basis (i.e., at constant exchange rates and scope of consolidation). Changes in total AUM, Solvency Ratio II, Shareholders’ Equity, CSM and Life CSM are calculated with reference to the corresponding figures at the end of the previous year.

2 The Financial Information at September 30th 2025 is not an interim Financial Report according to the IAS 34 principle.

3 For definition of the adjusted net result, please refer to page 2.

4 € 333 million related to the 2024-2026 Long-Term Incentive Plan and € 330 million related to the execution of the 2025 strategic share buyback as of September 30th.

5 Including premiums from investment contracts equal to € 1,258 million (€ 1,145 million 9M2024).

6 3-year CAGR based on the Group’s adjusted net result.

7 Expressed on cash basis.

8 Subject to all relevant approvals.

9 3-year CAGR with 2024 baseline at € 1.28 per share.

10 Subject to all relevant approvals.

11 Subject to all relevant approvals.