Financial Information at 30 September 2023 (1)

17 November 2023 - 07:31 price sensitive

Generali achieves continued growth in operating and net result. Confirmed solid capital position

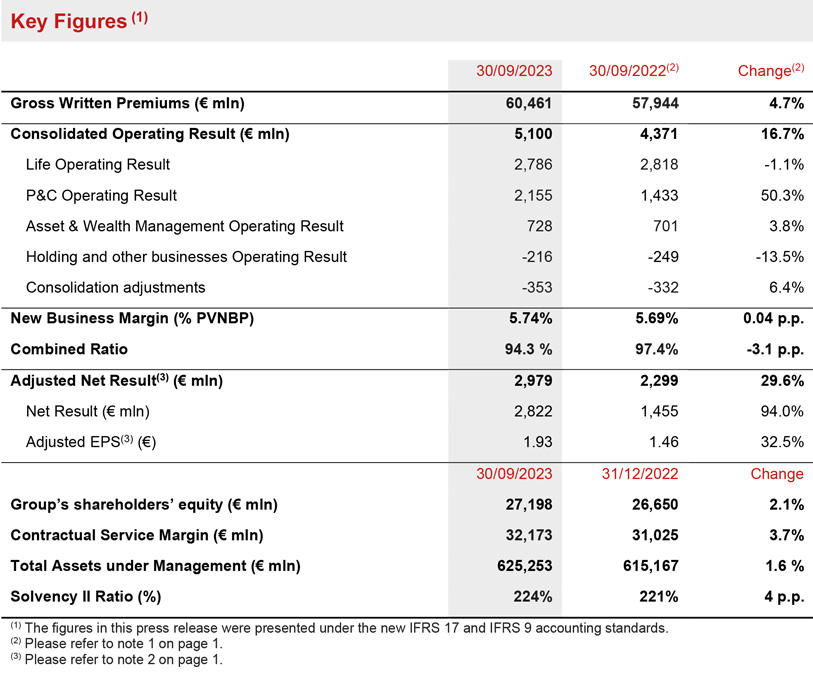

- Gross written premiums increased to € 60.5 billion (+4.7%), driven by strong P&C growth (+11.4%). Life net inflows were entirely focused on unit-linked and protection, consistent with the Group’s strategy

- Continued growth in operating result to € 5.1 billion (+16.7%), led by P&C segment, offsetting impact from natural catastrophes. The Combined Ratio improved to 94.3% (-3.1p.p.). Solid Life segment performance and excellent New Business Margin at 5.74% (+0.04 p.p.)

- Ongoing growth in adjusted net result2 rising to € 2,979 million (+29.6%)

- Solid capital position confirmed, with Solvency Ratio at 224% (221% FY2022)

Generali Group CFO, Cristiano Borean, said: “The Group has continued to grow profitably in the first nine months thanks to the strong increase in both operating and net results, despite the higher impact from the weather events, confirming its resilience in a challenging macroeconomic and geopolitical context. In line with our strategy, we maintain our commitment to technical excellence in the P&C segment, while in Life we will continue to build on the most profitable business lines. Thanks to its diversified business model and solid capital position, Generali remains fully on track to successfully achieve all the targets of our ‘Lifetime Partner 24: Driving Growth’ strategy.”

Executive summary

Milan - At a meeting chaired by Andrea Sironi, the Assicurazioni Generali Board of Directors approved the Financial Information at 30 September 20233 of the Generali Group.

The Group’s gross written premiums increased by 4.7% to € 60,461 million, mainly thanks to strong growth in the P&C segment. Life net flows were € -1,194 million, showing a trend improvement in the third quarter compared to the previous quarters of the year and confirming resilient positive net inflows in both unit-linked and protection. This is in line with the Group's strategy to reposition its Life business portfolio and it also reflects the industry trends observed, particularly in the banking channel, in Italy and in France.

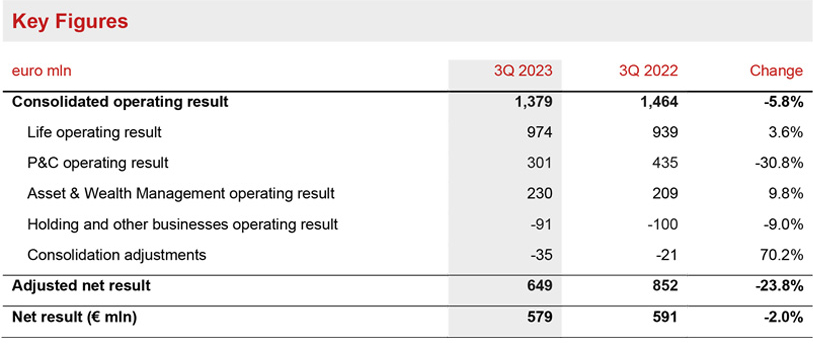

The operating result grew to € 5,100 million (+16.7%), also benefitting from the diversification of profit sources and the contribution from acquisitions.

On a business unit level, the operating result of the P&C segment increased strongly to € 2,155 million (+50.3%). The Combined Ratio improved to 94.3% (-3.1 p.p.), benefitting from a lower loss ratio, primarily thanks to a higher discounting effect, offsetting the significant impact from natural catastrophes.

The Life operating result was € 2,786 million (-1.1%), with an improving trend in 3Q2023 compared to 2Q2023. The New Business Margin increased to 5.74% (+0.04 p.p.).

The operating result of the Asset & Wealth Management segment rose to € 728 million (+3.8%), thanks to a strong contribution from Banca Generali.

The operating result of the Holding and other businesses segment improved to € -216 million (€ -249 million 9M2022).

The adjusted net result4 increased substantially to € 2,979 million (€ 2,299 million 9M2022). This was mainly thanks to the improved operating result, which benefitted from diversified profit sources, a non-recurring capital gain related to the disposal of a London real estate development (€ 193 million net of taxes), and also reflecting the € -93 million impact from Russian fixed income instruments recorded at 9M2022.

The net result improved to € 2,822 million (€ 1,455 million 9M2022).

The Group’s shareholders' equity increased to € 27.2 billion (+2.1% compared to FY2022).

The Contractual Service Margin (CSM) was at € 32.2 billion (€ 31.0 billion FY2022).

The Group's Total Assets Under Management were € 625.3 billion (+1.6% compared to FY2022).

The Group confirmed the solid capital position, with the Solvency Ratio at 224% (221% FY 2022). The increase mainly reflected the solid contribution of the normalized capital generation which, together with the generally favourable market variances, more than offset the negative impacts stemming from regulatory changes, non-economic variances and capital movements (dividend provision for the period net of the recent subordinated debt issuance).

Life Segment

- Operating result stood at € 2,786 million (-1.1%)

- Excellent New Business Margin at 5.74% (+0.04 p.p.)

- New Business Value (NBV) was € 1,729 million (-8.0%)

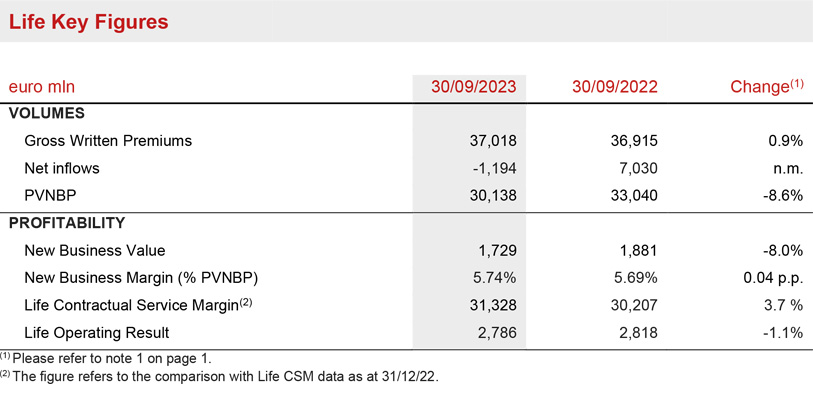

Gross written premiums in the Life Segment reached € 37,018 million (+0.9%). The savings line improved (+7.6%), with positive trends in Asia, Italy and France. The protection line confirmed its healthy growth trajectory (+4.9%), driven in particular by France and Italy. The unit-linked line was down (-12.2%), driven mainly by Italy and France, also reflecting the very strong 9M2022 business dynamics.

Life net flows were € -1,194 million. The protection and unit-linked lines recorded positive net inflows, with protection net inflows reaching € 3,552 million, led by France and Italy, while net inflows in the unit-linked line stood at € 3,963 million, demonstrating the resilience of both lines. Net outflows from savings (€ -8,709 million) were in line with the Group's strategy to reposition its Life business portfolio and they also reflect the industry trends observed, particularly in the banking channel, in Italy and in France.

New business volumes (expressed in terms of present value of new business premiums - PVNBP) were € 30,138 million (-8.6%), partially recovering from 1H2023 (-14.0%) thanks to the positive 3Q2023 new business production. The overall 9M2023 PVNBP contraction reflected the unfavorable economic environment amplified by the higher interest rates. The volumes, when expressed in annual premium equivalent terms, were otherwise basically flat (-0.4%).

New Business Margin on PVNBP maintained excellent levels at 5.74% (+0.04 p.p.) continuing to benefit from disciplined technical underwriting, as well as from the increased interest rates environment. The combination of these trends resulted in a New Business Value (NBV) of € 1,729 million (-8.0%).

The Life Contractual Service Margin (Life CSM) increased by over € 1 billion to € 31,328 million (€ 30,207 million FY2022). The positive development was mainly driven by the contribution of the Life New Business CSM of € 2,105 million, which, coupled with the expected return of € 1,275 million, more than offset the Life CSM release of € 2,219 million. The latter also represented the main driver (approximately 80%) of the operating result, which stood at € 2,786 million (€ 2,818 million 9M2022).

P&C Segment

- Premiums increased to € 23,444 million (+11.4%)

- Combined Ratio improved significantly to 94.3% (-3.1 p.p.)

- Strong growth in operating result to € 2,155 million (+50.3%)

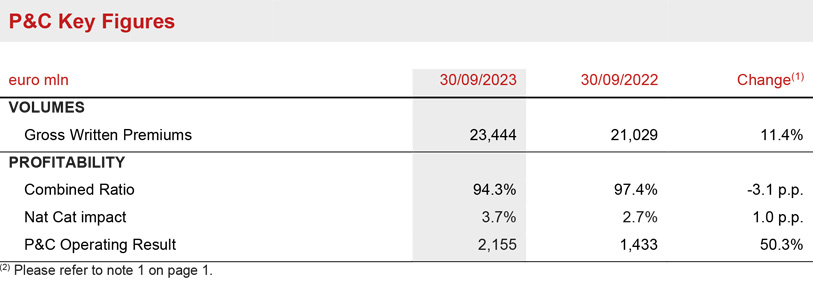

P&C gross written premiums grew to € 23,444 million (+11.4%) driven by the positive performance of both business lines.

Non-motor improved strongly (+10.1%), achieving widespread growth across all main areas. Europ Assistance premiums grew by 32.4%, thanks to the continued volume expansion in the travel business.

The motor line rose by 12.9%, across all the main areas with particularly positive dynamics in Italy, France, CEE and Argentina. Excluding the contribution from Argentina, a country impacted by hyperinflation, total motor line premiums increased by 5.1%.

The Combined Ratio reached 94.3% (97.4% 9M2022) thanks to an improvement in the loss ratio to 64.9%

(-3.9 p.p.), partly offset by a slightly higher expense ratio at 29.4% (+0.8 p.p.). The increase in the expense ratio was driven by higher acquisition costs. The positive dynamics in the loss ratio benefitted from a higher discounting effect. Natural catastrophes impacted the reported Combined Ratio by 3.7 p.p., compared to 2.7 p.p. in 9M2022, mainly driven by the impact from floods and hailstorms in Italy, CEE and Greece during the third quarter. The undiscounted losses from natural catastrophes net of reinsurance were € 875 million at 9M2023, or € 837 million on a discounted basis.

The contribution from prior year development at 9M2023 stood at -2.8%; this was -0.3 p.p. at 9M2022 due to a specific inflation-related reserves strengthening action.

The undiscounted combined ratio – which excludes the discounting effect from claims reserved – improved to 97.9%, from 99.4% at 9M2022.

The operating result grew to € 2,155 million (+50.3%). The operating insurance service result was € 1,299 million (€ 533 million 9M2022) benefitting from € 816 million of discounting effect compared to € 400 million at 9M2022, leading to an undiscounted insurance service result of € 483 million. The discounting effect of € 816 million is due to € 762 million from the current year and to € 54 million from the previous year.

The investment result was € 855 million (€ 900 million 9M2022), reflecting a € 172 million increase in the operating investment income that was more than compensated by € 217 million increase in the insurance finance expenses.

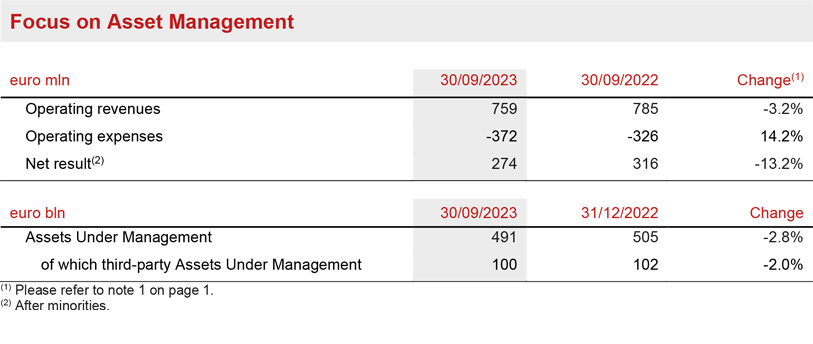

Asset & Wealth Management Segment

- Asset & Wealth Management operating result grew to € 728 million (+3.8%)

- Banca Generali group operating result rose to € 340 million (+40.6%)

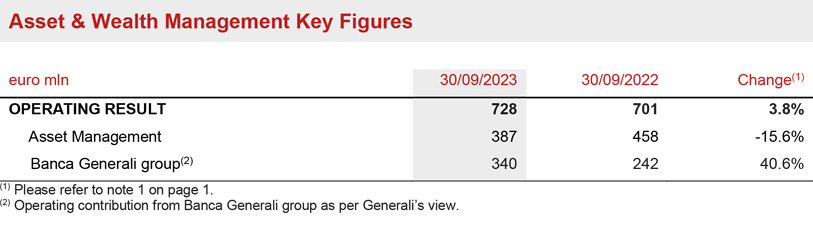

The operating result of the Asset & Wealth Management segment rose to € 728 million (+3.8%).

The Asset Management operating result was € 387 million (-15.6%) with operating revenues decreasing to € 759 million (-3.2%) mainly reflecting the market effect on average Assets Under Management compared to 9M2022, and a decline in performance fees to € 5 million in the period, compared to € 38 million at 9M2022. Transaction fees originated from real estate and infrastructure investments contributed € 38 million.

Operating expenses rose to € 372 million (+14.2%), reflecting higher compensation costs and IT expenses, as well as costs related to the opening of the new affiliate ‘Sosteneo’ which broadened Generali’s offering in the field of sustainable energy transition.

The operating result of the Banca Generali group rose to € 340 million (+40.6%), thanks to the improvement in the net interest margin and the diversification of the business. The vast majority of the operating result for the period was recurring.

Total net inflows at the Banca Generali group in 9M2023 were € 4.3 billion, confirming the strong commercial development of volumes.

The net result of the Asset Management segment was € 274 million (-13.2%).

The total Assets Under Management were € 491 billion (-2.8% compared to FY2022). Third-party Assets Under Management were € 100 billion (-2.0% compared to FY2022), with net outflows of € 0.9 billion, entirely related to the non-renewal of a single institutional mandate.

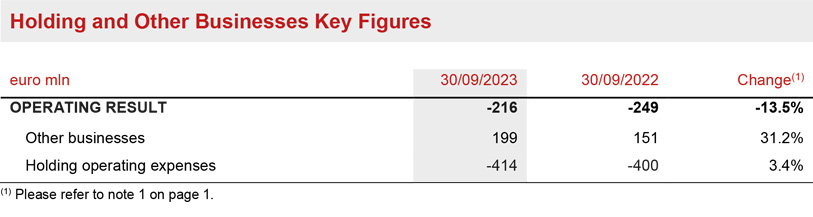

Holding and other business Segment

- Operating result improved to € -216 million

- Positive contribution from France and Planvital

The operating result of the Holding and other businesses segment improved to € -216 million (€ -249 million 9M2022). The contribution from Other businesses was positive, mainly due to the improvement recorded in France, primarily thanks to higher intragroup dividends, and Planvital. Holding operating expenses increased by 3.4%, mainly driven by costs related to personnel and projects for the implementation of new strategic initiatives.

Outlook

In coming months, financial markets in the US and Europe are likely to be driven by the evolving stance of central banks, which are considering pausing or ending their monetary tightening cycle, as well as by upcoming macroeconomic data, especially on inflation, which is expected to slightly subside. At the same time, new risks have emerged, including the geopolitical tensions in the Middle East. In a context still characterized by mixed data regarding labour markets, combined with softer demand, there are more signs of a possible slowdown of the global economy, which may affect the insurance sector.

In this context and in line with the priorities set out in the ‘Lifetime Partner 24: Driving Growth’ plan, in the Life segment the Group confirms that it will continue to rebalance its portfolio to further increase its profitability, with more efficient capital allocation. Simplification and innovation will continue to be key, with a range of modular product solutions, designed for the specific requirements and new needs of customers. In the P&C segment, the Group’s objective for the mature insurance markets in which it operates is to maximise profitable growth at scale, which will also benefit from the purchase of Liberty Seguros from 2024 onwards. The Group maintains its focus on the profitable non-motor line. In high growth potential markets, the Group’s priority is to gain market share by expanding its presence and offer. The Group also continues to follow an adaptive approach towards pricing adjustments, following those undertaken during 2022 and throughout 2023, which have translated into a tangible increase in the annual average premium, as well as other technical measures aimed at improving profitability. In the Asset & Wealth Management segment, Asset Management continues to implement its strategy, with a focus on extending the product catalogue, in particular for real assets & private assets, enhancing distribution competences, and expanding its presence in new markets. The recent acquisition of Conning Holdings Limited will contribute to the strategy starting from the second half of 2024. In Wealth Management, the Banca Generali group will continue to focus on its targets in terms of size, profitability and shareholders’ remuneration as defined in its strategic plan.

With reference to the investment policy, the Group confirms its asset allocation strategy aimed at ensuring consistency with liabilities to policyholders and increasing current returns, as well as selective investments aimed at improving the portfolio diversification and inflation protection in the long term.

The Group confirms the commitment on sustainability, also through a focus on the continuous improvement of the governance system. The Board of Directors approved the Policy for Management Board Engagement with Investors and Other Relevant Stakeholders, in order to extend the scope of the current one, concerning direct engagement of the Board with investors only, also to other stakeholders relevant to the Company and the Group. The new version of the policy provides an additional tool for the Board in order to pursue the sustainable success, as recommended by the Corporate Governance Code, also in line with the entry into force of the Corporate Sustainability Reporting Directive. The approval of this policy, which will become effective as of January 1st 2024, positions the Company at the forefront, nationally and internationally, in terms of openness to dialogue with its stakeholders.

Thanks to the business actions taken to maintain profitability as well as the strategic initiatives launched in line with the plan, the Group confirms its commitment to pursue sustainable growth, enhance its earnings profile and lead innovation in order to achieve a compound annual growth rate in earnings per share5 between 6% and 8% in the period 2021-2024, to generate net holding cash flow6 exceeding € 8.5 billion in the period 2022-2024 and to distribute cumulative dividends to shareholders for an amount between € 5.2 billion and € 5.6 billion in the period 2022-2024, with a ratchet policy on dividend per share.

Significant events after 30 September 2023

On 12 October, Generali announced an agreement with Allianz for the disposal of TUA Assicurazioni S.p.A.

Other significant events that occurred after the end of the period are available on the website.

***

The glossary and the description of alternative performance indicators are available in the Half-Yearly Consolidated Financial Report 2023.

Q&A conference call

The Group CFO, Cristiano Borean, and the Group General Manager, Marco Sesana, will host the Q&A session conference call for the results of the Generali Group at 30 September 2023, which will be held on 17 November 2023, at 12.00 pm CET.

To follow the conference call, in a listen only mode, please dial +39 02 8020927.

***

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

Generali 3Q 2023 Results

1 Starting from 1Q2023 the bancassurance JVs of Cattolica (Vera and BCC companies) are considered a ‘disposal group held for sale’ under IFRS 5 and therefore their results are reclassified in the ‘Result of discontinued operations’. Consequently, the Group 9M2022 results presented last year have been restated. Starting from 9M2023 Generali Deutschland Pensionskasse is classified as ‘non-current asset held for sale’ under IFRS 5 and so its assets and liabilities at 9M2023 are classified as the ‘Non-current assets or disposal groups classified as held for sale’.

Changes in premiums, Life net inflows and new business were presented on equivalent terms (at constant exchange rates and consolidation scope). The amounts were rounded and may not add up to the rounded total in all cases. Also the percentages presented can be affected by the rounding.

2 Adjusted net result and EPS definitions include adjustments for 1) profit or loss on assets at fair value through profit or loss (FVTPL) on non-participating business and shareholders’ funds, 2) hyperinflation effect under IAS 29, 3) amortisation of intangibles related to M&A, 4) impact of gains and losses from acquisitions and disposals. The EPS calculation is based on a weighted average number of 1,541,612,523 shares outstanding and is excluding weighted average treasury shares equal to 28,467,800.

3 The Financial Information at 30 September 2023 is not an Interim Financial Report according to the IAS 34 principle.

4 For the definition of the adjusted net result, please refer to note 2 on page 1.

5 3 year CAGR based on 2024 Adjusted EPS (according to IFRS17/9 accounting standards and Adjusted Net Result definition currently adopted by the Group), versus 2021 Adjusted EPS (according to IFRS4 accounting standards and Adjusted Net Result definition adopted by the Group until 2022).

6 Net holding cash flow and dividend expressed in cash view.