Financial Information as of 31 March 2022(1)

19 May 2022 - 07:31 price sensitive

Excellent profitability with growth in premiums and operating result. Extremely solid capital position. Net result affected by impairments on Russian investments

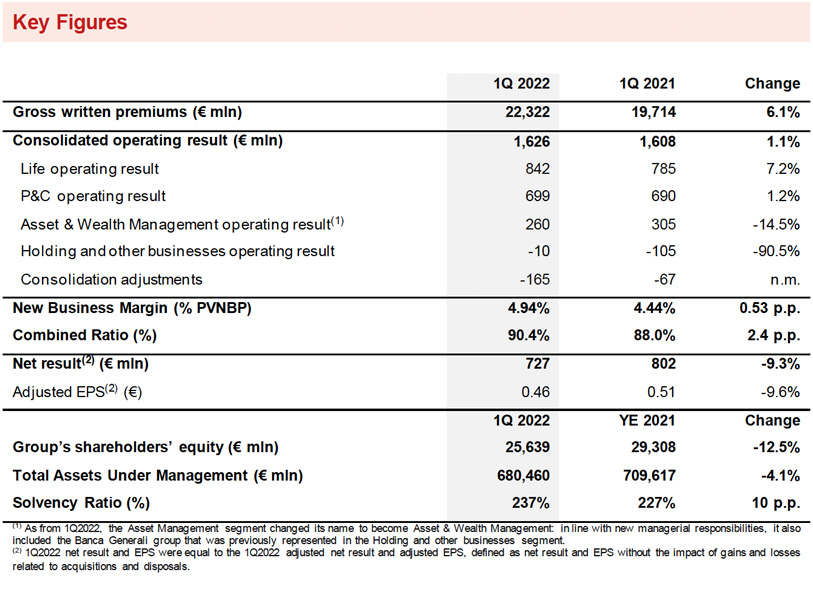

- Gross written premiums increased to € 22.3 billion (+6.1%), up in the P&C (+6.4%) and Life (+6%) segments. Life net inflows, entirely focused on the unit-linked and protection lines, grew to € 3.9 billion (+19.3%)

- Operating result rose to € 1.6 billion (+1.1%), thanks to the positive performance of the Life, P&C and Holding and other businesses segments. The Combined Ratio was at 90.4% (+2.4 p.p.) and the New Business Margin was excellent at 4.94% (+0.53 p.p.)

- Net result reached € 727 million (€ 802 million 1Q2021), affected by impairments on Russian investments amounting to € 136 million. Excluding this impact, the net result would have been € 863 million

- Solvency Ratio remained extremely solid at 237% (227% FY2021)

Generali Group CFO Cristiano Borean commented: "The results for the first quarter confirm the excellent performance of Generali, despite a context characterised by uncertainty due to the conflict in Ukraine. The business development in the most profitable segments demonstrates the Group’s ability to consistently generate value, while maintaining a solid and industry leading capital position. In the first three months of the year, the Group also launched the new strategic plan 'Lifetime Partner 24: Driving Growth', focused on strong growth in earnings per share, increased cash generation and higher dividends.

The Group will continue to stand in solidarity and remain close to the people impacted by the conflict in Ukraine, helping them thanks to an emergency donation of € 3 million and a global fundraising campaign carried out by employees and through The Human Safety Net Foundation, to back UNICEF in its efforts to support those suffering due to this war.”

EXECUTIVE SUMMARY

Milan - At a meeting chaired by Andrea Sironi, the Board of Directors of Assicurazioni Generali approved the Financial Information at 31 March 20222.

The Group's gross written premiums increased by 6.1% to € 22,322 million thanks to growth in both the Life and P&C segments. Life net inflows rose to € 3.9 billion (+19.3%) and confirmed the positive trend in the unit-linked and protection lines of business. Life technical provisions were € 423.4 billion, essentially stable (-0.3%) compared to FY2021 reflecting the performance of financial markets on the unit-linked component, despite the increase in net inflows.

The Group's operating result reached € 1,626 million (+1.1%).

The Life segment showed an increase in the operating result by 7.2% and confirmed excellent technical profitability, with the New Business Margin at 4.94% (4.44% 1Q2021).

The operating result of the P&C segment was positive (+1.2%), also thanks to the contribution of the Cattolica group. The Combined Ratio stood at 90.4% (+2.4 p.p.), mainly reflecting a higher loss ratio.

The operating result of the Asset & Wealth Management segment decreased to € 260 million (-14.5%), solely due to the reduction in performance fees in the Banca Generali group compared to the significant result in the first three months of 2021, also following the performance of financial markets.

The operating result of the Holding and other businesses segment improved, mainly thanks to the results from real estate.

The Group's non-operating result stood at € -375 million (€ -275 million 1Q2021) due to impairments on Russian available for sale investments.

The net result was € 727 million. The decrease of 9.3% reflected the aforementioned impairments, including the impact of € 96 million related to Russian fixed income instruments3 directly held by the Group and € 40 million for the stake in Ingosstrakh. Without this impact, the net result would have reached € 863 million.

The Group's total Assets Under Management amounted to € 680.5 billion, down 4.1% compared to FY2021, mainly due to the performance of financial markets.

Regarding the Group’s exposure in Russia, following impairments in the quarter, the stake in Ingosstrakh and fixed income instruments directly held by the Group amounted to € 176 million (€ 384 million FY2021) and to € 40 million (€ 188 million FY2021), respectively.

The Group also had negligible Russian and Ukrainian indirect investments and unit-linked investments, which amounted to € 43 million (€ 111 million FY2021) and to € 34 million (€ 117 million FY2021), respectively.

The Group's shareholders' equity was € 25,639 million (-12.5% compared to FY2021). The change was due to a € -4,797 million decrease in the AFS reserves, deriving mainly from the performance of fixed income instruments.

The Group confirmed its excellent capital position, with the Solvency Ratio at 237% (227% FY2021). The 10 p.p. increase mainly reflected the positive market variances of the quarter (driven by the rise in interest rates and the narrowing of spreads on government bonds, only partially offset by the fall in the equity market, the increase in volatility and inflation) which, coupled with the sound contribution from normalised capital generation, more than offset the negative impacts deriving from M&A transactions, dividend provision for the period, and the anticipated regulatory changes of the quarter (linked to EIOPA changes on the risk-free reference rates definition).

LIFE SEGMENT

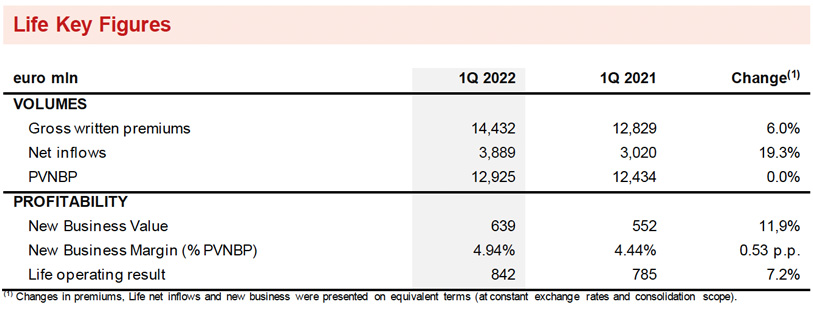

- Life net inflows increased to € 3.9 billion (+19.3%)

- The New Business Margin was excellent at 4.94% (+0.53 p.p.); the New Business Value (NBV) rose to € 639 million (+11.9%)

- The operating result was € 842 million (+7.2%)

Life net inflows, entirely focused on the unit-linked and protection lines, stood at € 3.9 billion4 (+19.3%). The increase in the unit-linkedline (+12.5%) was driven above all by the development in Italy, France and Germany. The protection line also made a positive contribution (+1.9%), thanks to the trends observed in almost all the main areas of operation. In line with the Group’s strategy, net inflows for the savings and pension line were negative and amounted to € -106 million (€ -346 million 1Q2021); the partial recovery compared to the first three months of 2021 was mainly attributable to the trend observed in Asia.

Gross written premiums of the Life segment rose to € 14,432 million (+6.0%). The unit-linked line grew significantly (+13.3%), particularly in Italy, Germany and France. The protection line also grew (+3%), mainly in Italy, France, Germany and ACEE5, as well as the savings and pension line (+3.3%), above all in Asia.

New business (expressed in terms of PVNBP - present value of new business premiums) stood at € 12,925 million, stable compared to the first three months of 2021. The relevant increase in the unit-linked business (+17%), boosted by the significant contribution from hybrid products, offset a fall in the protection (-8.7%) and savings (-8.4%) lines, that recorded a particularly high production in the first quarter of 2021.

The New Business Margin on PVNBP rose to 4.94%, a significant increase compared to the first three months of 2021 (+0.53 p.p.) thanks to the rebalancing of the business mix towards the most profitable unit-linked components, the continuous improvement in the features of new products and the rise in interest rates. Thanks to stable premiums and an improved margin, the New Business Value (NBV) stood at € 639 million (+11.9% compared to the first three months of 2021).

The operating result of the Life segment rose by 7.2% to € 842 million. The technical margin, net of insurance expenses, increased (+19.7%) thanks to the growth in unit-linked and protection products. The net investment result (-2.1%) decreased due to lower net realized gains.

P&C SEGMENT

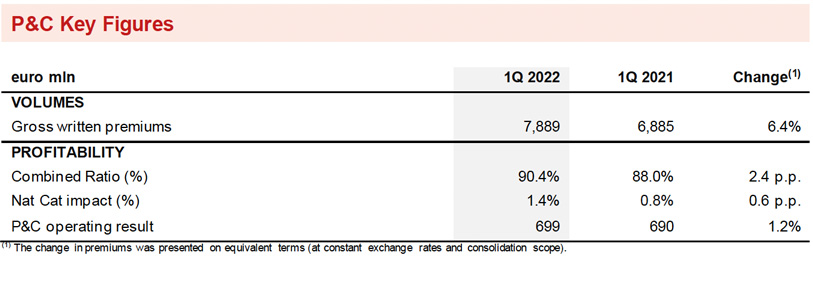

- Premiums rose to € 7,889 million (+6.4%)

- The Combined Ratio stood at 90.4% (+2.4 p.p.)

- The operating result increased to € 699 million (+1.2%)

Gross written premiums of the P&C segment amounted to € 7,889 million6 (+6.4%), boosted by the performance of both lines of business.

The motor line rose by 2.5%, particularly in France, ACEE and Argentina (also following adjustments for inflation), the performance of which more than offset the reduction in Italy and Germany.

The non-motor line strongly improved (+8.2%), observing widespread growth in almost all of the Group's main areas of operation.

The premiums of Europ Assistance, which in 2021 were still impacted by the pandemic, especially in the travel business, continued to rise (+66.5%) also thanks to new partnerships.

The Combined Ratio was 90.4% (+2.4 p.p.), reflecting the higher loss ratio (+2.2 p.p.). In particular, the contribution from prior years decreased, and was -2.7% (+1 p.p.). The natural catastrophe loss ratio increased by 0.6 p.p.; during the first three months of 2022, natural catastrophe claims were € 87 million (€ 43 million 1Q2021), including claims for storms that hit Germany, ACEE and France. The non-catastrophe current year loss ratio rose (+0.6 p.p.), due to the trend in the motor line, which in the first three months of 2021 had still benefitted from the lockdown effects in some of the Group's areas of operation. Large man-made claims were stable.

The expense ratio increased to 28.9% (+0.2 p.p.), showing a rise in the administration costs component (+0.2 p.p.), which entirely reflected the line-by-line consolidation of the Cattolica group as from November 2021.

The operating result of the P&C segment stood at € 699 million (+1.2%). The fall in the technical result (-12.6%), which reflected the cited trend of the Combined Ratio, was partly offset by the improvement in the investment result (+39.1%), which also benefited from higher dividends from private equity and Banca Generali.

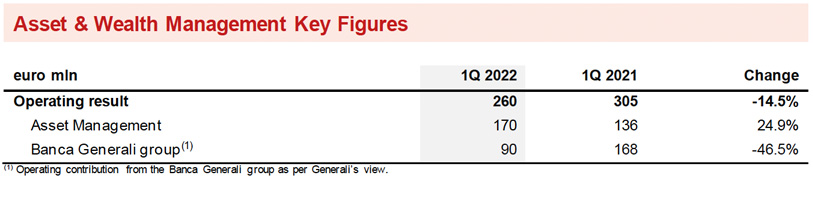

ASSET & WEALTH MANAGEMENT SEGMENT

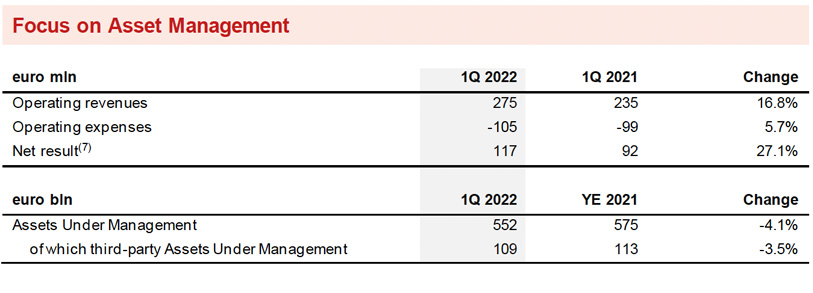

- The operating result of Asset Management rose to € 170 million (+24.9%) and the net result7 to € 117 million (+27.1%)

- The operating result of the Banca Generali group was € 90 million (-46.5%) due to the reduction in performance fees

The operating result of the Asset & Wealth Management segment stood at € 260 million (-14.5%). In particular, the operating result of Asset Management grew to €170 million (+24.9%), boosted by the increase in operating revenues (+16.8%) thanks to both higher beginning of period Assets Under Management level and higher non-recurring performance fees, which rose to € 38 million (€ 13 million 1Q2021).

The operating result of the Banca Generali group was € 90 million (-46.5%); the change reflected the performance of financial markets in the period that led to a reduction in performance fees from € 111 million in 1Q2021 to € 14 million. Excluding the impact of performance fees, the operating result would have strongly increased. Net inflows reached an excellent level of € 1.5 billion in 1Q2022.

The net result7 of Asset Management segment stood at € 117 million (+27.1%).

The value of Assets Under Management of Asset Management companies was € 552 billion (-4.1% FY2021).

Third-party Assets Under Management of Asset Management companies stood at € 108.9 billion compared to € 112.9 billion at year-end 2021.

The decrease reflected the negative performance of financial markets during the first quarter of 2022, following the volatility caused by the war in Ukraine.

Net inflows from third-party clients amounted to € 1,097 million, despite the difficult context resulting from the ongoing war and the volatility of financial markets.

HOLDING AND OTHER BUSINESSES SEGMENT

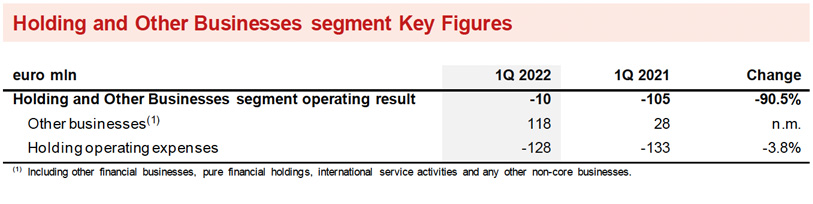

- The operating result increased to € -10 million

- Positive contribution from real estate

The operating result of the Holding and other businesses segment reached € -10 million (€ -105 million 1Q2021 excluding the contribution from the Banca Generali group, that is currently represented in the Asset & Wealth Management segment).

Other businesses also provided a positive contribution. In particular, the result from real estate, which was impacted also by the ongoing pandemic restrictions in 2021, improved.

Holding operating expenses decreased (-3.8%), reflecting the reduction in expenses especially in the International area.

OUTLOOK

The global insurance sector may be affected by uncertainty due to an economic slowdown, an increase in inflation and the risks of escalation following the Russian invasion of Ukraine.

In this context, the Group confirms and continues with its strategy to rebalance the Life portfolio to further increase its profitability, with more efficient capital allocation, also as interest rates continue to rise. Simplification and innovation will continue to be key, with the introduction of a range of modular product solutions, designed for the specific requirements and new needs of customers, and marketed through the most suitable, efficient and modern distribution channels. In the P&C segment, the Group’s objective for the mature insurance markets in which it operates is to maximise profitable growth and, in parallel, gain ground in high growth potential markets by expanding our presence and offer. In the Asset & Wealth Management segment, on the one hand, Asset Management activities identified for the new plan will continue, with the aim of extending the product catalogue, in particular for real assets & private assets, and enhancing distribution competences; on the other hand, the Banca Generali group will be focused on the targets for size, profitability and shareholders’ remuneration defined in its strategic plan announced in February.

The Group confirms its commitment to pursue sustainable growth, enhance its earnings profile and lead innovation in order to achieve a compound annual growth rate in earnings per share8 between 6% and 8% in the period 2021-2024, to generate net holding cash flow9 exceeding € 8.5 billion in the period 2022-2024 and to distribute a cumulative dividend10 to shareholders for an amount between € 5.2 billion and € 5.6 billion in the period 2022-2024, with a ratchet policy on dividend per share.

SIGNIFICANT EVENTS AFTER 31 MARCH 2022

The 2022 Shareholders’ Meeting approved the 2021 financial statements and appointed the new Board of Directors, that is composed of: Andrea Sironi (subsequently appointed as independent Chairman), Clemente Rebecchini, Philippe Donnet (subsequently appointed as Managing Director and Group CEO), Diva Moriani, Luisa Torchia, Alessia Falsarone, Lorenzo Pellicioli, Clara Furse, Umberto Malesci, Antonella Mei-Pochtler, Francesco Gaetano Caltagirone, Marina Brogi and Flavio Cattaneo.

Generali completed the acquisition from Future Enterprises Limited of 25% of the shares of Future Generali India Insurance (FGII) and will now hold a stake of around 74% in FGII.

Generali received the approval from the relevant regulatory and competition authorities.

Moody’s upgraded Generali’s Insurer Financial Strength(IFS) rating to A3 from Baa1 and the Group’s debt ratings by one notch. The outlook was stable.

On 12 May, the Board of Directors of Assicurazioni Generali resolved to establish the Board Committees and appoint their members, also ascertaining their compliance with the requirements of good standing, professionalism and independence set by the Italian laws for insurance companies. The Directors Marina Brogi, Francesco Gaetano Caltagirone and Flavio Cattaneo renounced, at that time, to be part of the Board Committees, requesting the establishment of a Board Committee for the prior assessment of strategic transactions. The Board of Directors instructed the Appointments and Governance Committee to prepare a proposal in light of the request, considering the benchmark from market best practice.

Please refer to the press releases available to download on the website for further events.

The glossary and the description of alternative performance indicators are available in the Annual Integrated Report and Consolidated Financial Statements 2021.

Q&A CONFERENCE CALL

The Group CFO, Cristiano Borean, will participate to the Q&A session conference call for the Financial Information at 31 March 2022, which will take place on 19 May 2022 at 12:00 CEST.

To follow the conference call, in a listen only mode, please dial +39 02 802 09 27.

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

1Changes in premiums, Life net inflows and new business were presented on equivalent terms (at constant exchange rates and consolidation scope); as a result, the contribution of the Cattolica group was neutralised in the calculation for changes on equivalent terms. Changes in the operating result, general account investments and Life technical provisions excluded any assets under disposal or disposed of during the same period of comparison; as a result, they considered the contribution from the Cattolica group in percentage changes.

2The Financial Information at 31 March 2022 is not an Interim Financial Report according to the IAS 34 principle.

3Under IAS 39, each change in fair value in the coming quarter will be accounted in the Income Statement.

4The contribution from the Cattolica group was € 191 million, almost all from bancassurance agreements.

5As from 1Q2022, the ACEER area changed name in ACEE, following the Group’s decision to close its Moscow representative office, resign from positions held on the Board of Directors of the Russian insurer Ingosstrakh and wind down Europ Assistance business in Russia.

6The contribution from the Cattolica group was € 521 million.

7After minorities.

83 year CAGR; adjusted for impact of gains and losses related to acquisitions and disposals. Target based on current IFRS accounting standards.

9Net holding cash flow and dividend expressed in cash view.

10Subject to regulatory recommendations.