Generali Group Consolidated Results as of 31 December 2021(1)

15 March 2022 - 07:31 price sensitive

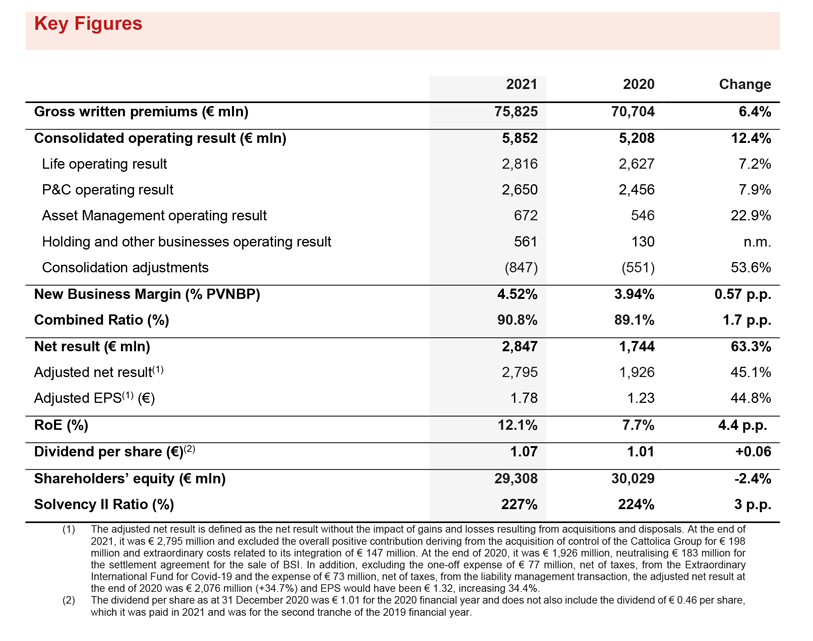

Generali achieves record results. Strong growth in premiums, the operating and net result and an extremely solid capital position. Successful conclusion of the ‘Generali 2021’ strategic plan

- Best ever operating result rising to € 5.9 billion (+12.4%), thanks to positive growth across all business segments

- Total gross written premiums reached € 75.8 billion (+6.4%) up in both the Life (+6.0%) and P&C (+7.0%) segments. Life net inflows grew to € 12.7 billion (+4.4%) entirely focused on the unit-linked and protection lines. The New Business Margin was excellent at 4.52% (+0.57 p.p.) while the Combined Ratio was the best and least volatile among peers at 90.8% (+1.7 p.p.)

- Net result showed strong growth to € 2,847 million (+63.3%). The adjusted net result2 was € 2,795 million

- Extremely solid capital position confirmed with the Solvency Ratio at 227%, thanks to capital generation of € 3.8 billion

- Proposed dividend per share of € 1.07

- ‘Lifetime Partner 24: Driving Growth’ strategic plan underway with focus on sustainable growth, enhanced earnings and continued delivery of best-in-class returns

Generali Group CEO Philippe Donnet commented: “The excellent results we present today mark the successful conclusion of the ‘Generali 2021’ strategic plan, demonstrating once again that we deliver on our promises. Over the past two strategic cycles, we have reinforced our leadership in Europe and have become the Lifetime Partner to 67 million customers worldwide thanks to the talent and skills of our employees and agents. Generali is now best-in-class in terms of its capital position, profitability and growth, it has strengthened its presence in high potential markets and grown its asset management business. We are now effectively implementing our new strategy ‘Lifetime Partner 24: Driving Growth,’ focused on sustainable growth, an enhanced earnings profile and the creation of value for all stakeholders. A rigorous and disciplined capital deployment approach, sustainability fully embedded into the business and increased investment in technology and digital transformation will be key drivers of our new plan’s success. Finally, it is impossible not to mention the crisis in Ukraine. As with the Covid-19 pandemic, Generali and its employees have taken immediate action to help refugees. Our Group has historic ties with Central and Eastern Europe and will continue to support the communities impacted by the war.”

EXECUTIVE SUMMARY

Milan – At a meeting chaired by Gabriele Galateri di Genola, the Assicurazioni Generali Board of Directors approved the consolidated financial statements and the Parent Company’s draft financial statements for the year 2021.

The Group’s operating result was, for the third consecutive year, its best ever performance, reaching € 5,852 million (€ 5,208 million FY2020) thanks to positive growth across all segments.

The Life and P&C segments confirmed excellent technical profitability with the New Business Margin at 4.52% (+0.57 p.p.) and the Combined Ratio was the best and least volatile among peers at 90.8% (+1.7 p.p.).

The operating result of the Asset Management segment rose to € 672 million (€ 546 million FY2020). This growth was mainly boosted by operating revenues, in particular thanks to the overall increase of assets under management and the continued expansion of the real assets strategy.

The Group’s non-operating result was € -1,306 million (€ -1,848 million FY2020). Impairments on available for sale investments reduced - mainly in the equity component - which amounted to € -251 million (€ -530 million FY2020). Net realised gains reached € 368 million (€ 32 million FY2020), driven by real estate transactions. The non-operating result was also affected by the overall positive contribution deriving from the acquisition of control of the Cattolica Group for € 198 million and the extraordinary costs of € 212 million3 related to its integration. It should be noted that in 2020, in particular, non-operational expenses included the establishment of the Extraordinary International Fund launched by the Group to deal with the Covid-19 emergency in support of national healthcare systems and the economic recovery, further local initiatives in the main countries of operation and, in France, an extraordinary obligatory contribution to the national healthcare system requested of the insurance sector.

The net result grew significantly to reach € 2,847 million (€ 1,744 million FY2020) thanks in particular to the positive improvement in operating and non-operating results. The adjusted net result - excluding € 52 million relating to the acquisition of control of the Cattolica Group and extraordinary costs related to its integration - increased to € 2,795 million (+45.1%, € 1,926 million FY2020, which neutralised € 183 million from the settlement agreement for the sale of BSI)4.

Gross written premiums of the Group amounted to € 75,825 million (+6.4%) with a positive contribution from both the Life (+6.0%)5 and P&C (+7.0%) segments. Life net inflows grew by 4.4% to reach € 12.7 billion, entirely focused on the unit-linked and protection lines. Life Technical Reserves increased to € 424 billion (+10.3%).

The Group had Total Assets Under Management equal to € 710 billion (+8.4%)6.

The Group shareholders’ equity was € 29,308 million (-2.4%). The change is mainly due to the result of the period attributable to the Group, which more than offset the distribution of the dividend and the change in other profits or losses recognised to shareholders’ equity (change in AFS reserves).

The RoE stood at 12.1% (+4.4 p.p.).

The Group confirmed an excellent capital position, with the Solvency Ratio at 227%. The increase compared to FY2020 (224%) was driven by the very positive contribution from normalised capital generation and the positive development in financial markets which more than offset the negative impact deriving from regulatory changes, M&A transactions and dividend provision for the period.

The normalised capital generation was confirmed at a solid level at € 3.8 billion (€ 4.0 billion FY2020).

Net Holding cash flows stood at € 2.6 billion. The decrease compared to 2021 was entirely due to capital management initiatives in 2020, as well as the one-off fiscal elements from the previous year.

Also thanks to these results the Group has successfully concluded the ‘Generali 2021’ strategic plan in a market environment characterised by Covid-19.

This includes the financial targets:

- Growing earnings per share: 7.6% (Target: 6%-8% EPS CAGR range 2018-20217);

- Growing dividend: € 4.52 billion (Target: € 4.5-5.0 billion cumulative dividend pay-out);

- Higher return for shareholders: the Return on Equity was 12.4% and 12.1% in 2019 and 2021 respectively. Excluding the 2020 RoE which was impacted by Covid-19 and one-offs, the average RoE was above the target of > 11.5%.

In addition, a € 500 million share buyback8 - the first in 15 years - was announced at the 2021 Investor Day, which will be proposed to the next Annual General Meeting.

Regarding ESG targets:

- € 6.0 billion of new green and sustainable investments, achieved one year in advance (Target: € 4.5 billion);

- Exceeding the target of +7%-9% GWP of social and environmental products, was stood at € 19.9 billion FY2021;

- # 1 in Relationship Net Promoter Score among European international peers, (up +14.2);

- Reskilling employees: 68% of employees reskilled (Target: 50%);

- Employee engagement score at 83% (+1 p.p. vs. 2019 and + 1 p.p. vs. market benchmark).

DIVIDEND PER SHARE

The dividend per share that will be proposed at the next Shareholders’ Meeting is € 1.07, payable as from 25th May 2022, shares will trade ex-dividend as from 23rd May 2022, while shareholders will be entitled to receive the dividend on 24th May 2022.

The dividend proposal represents a total maximum pay-out of € 1,691 million.

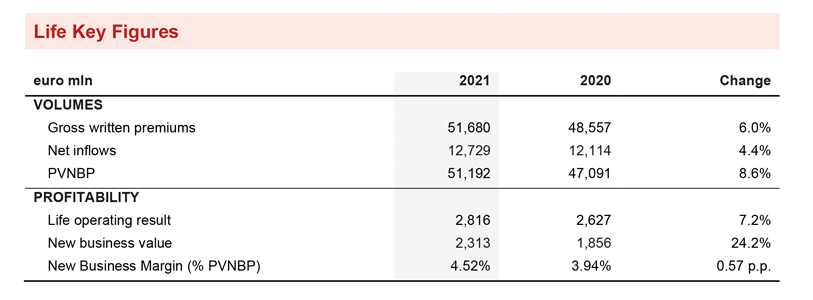

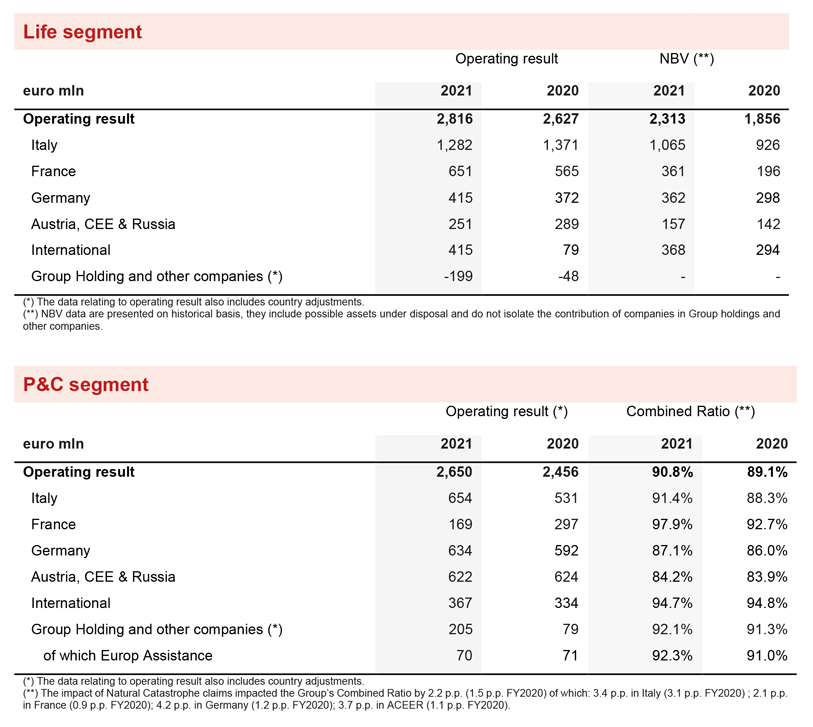

LIFE SEGMENT

- High quality Life net inflows rose to € 12,729 million (+4.4%) entirely focused on the unit-linked and protection lines

- New Business Margin was confirmed at an excellent level at 4.52% (+0.57 p.p.) and new business value (NBV) strongly increased to € 2,313 million (+24.2%)

- The operating result grew to € 2,816 million (+7.2%)

Gross written premiums increased to € 51,680 million (+6.0%). The increase would have been 9.5%, excluding the one-off effect of premiums from a collective Life pension fund in Italy signed in 2020, equal to approximately € 1.5 billion. On the business line level, growth was recorded throughout the year including in the unit-linked line (+19.8%), in particular in France, Germany and Italy. Excluding the cited pension fund, the Group’s unit-linked premiums would have grown by 36.1%. The protection line also performed well throughout the year (+6.0%), reflecting widespread growth in the countries in which the Group operates, driven in particular by Asia, Italy and ACEER9.

Life net inflows rose to € 12,729 million (+4.4%; +19.4%, excluding the cited pension fund). In regard to the business mix, net inflows were entirely focused on the unit-linked and protection lines. The savings line contracted, mainly in Italy, due to lower premiums and higher redemptions as a result of the Group's strategy to reposition its portfolio towards products with low capital absorption. Life technical reserves increased to € 424 billion (+10.3%).

New business in terms of PVNBP (Present value of new business premiums) was € 51,192 million (+8.6%; +15.0%, excluding the cited pension fund).

The New Business Margin was maintained at an excellent level, reaching 4.52% (+0.57 p.p. FY2020) thanks to the rebalancing of the business mix towards more profitable unit-linked products and the continued improvement in the features of new products. The profitability of the protection line further improved thanks to an increase in high margin products in Italy.

The new business value (NBV) increased strongly, reaching € 2,313 million (+24.2%, € 1,856 million FY2020).

The operating result of the Life segment grew by 7.2% to reach € 2,816 million (€ 2,627 million FY2020). Both the technical margin - net of insurance expenses - and the investment result improved, which in 2020 had been impacted by the negative performance of financial markets and provisions for guarantees to policyholders in Switzerland. The technical margin for 2021 was estimated10 to be impacted by € -119 million as a result of the Covid-19 pandemic, resulting from higher claims in the protection line, mainly in the Parent Company, France, the Americas and Southern Europe. The impact in FY2020 was estimated to be € -63 million.

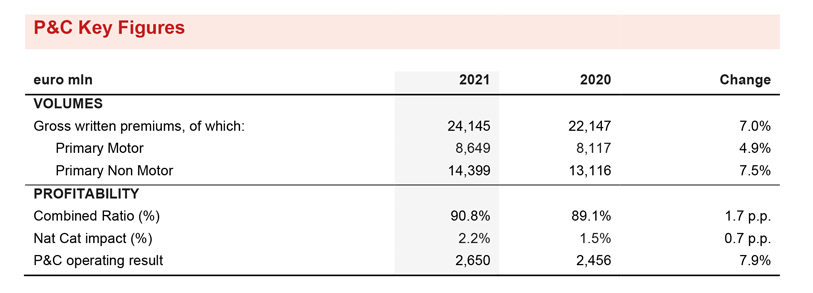

P&C SEGMENT

- Premiums grew to € 24,145 million (+7.0%) thanks to the positive contributions from both business lines

- The Combined Ratio was 90.8% (+1.7 p.p.) and confirmed as the best and least volatile among peers

- Strong growth in the operating result, which reached € 2,650 million (+7.9%)

Gross written premiums of the segment grew to € 24,145 million (+7.0%) with positive growth throughout the countries in which the Group operates. The auto line grew by 4.9%, particularly in ACEER, Argentina, France and Italy. The non-motor line also improved, up by 7.5%, with widespread growth throughout all countries in which the Group operates, in particular in Italy, France and ACEER. The premiums of Europ Assistance, which were impacted by the pandemic in 2020, increased significantly.

The operating result of the segment increased by 7.9% to € 2,650 million (€ 2,456 million FY2020). The fall in the technical result, which reflected the trend of the Combined Ratio, was more than offset by the improvement in the financial result (which also benefitted from the contribution of the Cattolica Group, dividends from Banca Generali and increased dividends from private equity).

The Combined Ratio was 90.8% (+1.7 p.p.). The increase reflected the larger impact from natural catastrophe claims and the loss-ratio in the motor line where the progressive removal of lockdown restrictions compared to 2020 led to an increased claims frequency. The impact of natural catastrophe claims - including storms that hit Spain in January and continental Europe in the summer, as well as floods that mainly affected Germany in July - was limited, reaching 2.2% (1.5% FY2020) thanks to the annual comprehensive reassurance provision. The impact from large man-made claims slightly decreased (-0.2 p.p.). The contribution from prior years was stable, standing at -3.7%. The expense ratio was essentially stable at 28.2% (28.1% FY2020).

The Group estimated11 its Combined Ratio excluding Covid-19 impacts to be 92.3%.

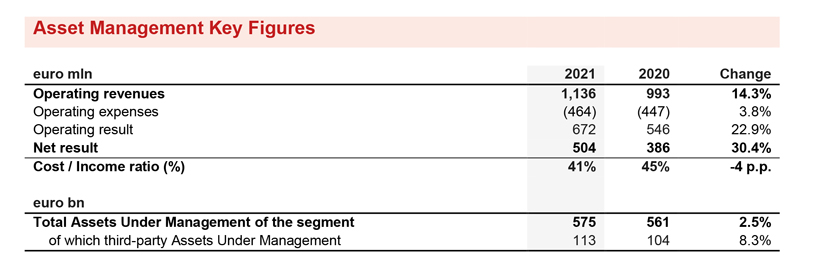

ASSET MANAGEMENT SEGMENT

- The operating result of the segment was € 672 million (+22.9%)

- The net result of the segment reached € 504 million (+30.4%)

The operating result of the segment rose to € 672 million (+22.9%). This performance was partly thanks to increased operating revenues which reached € 1,136 million (+14.3%), following the increase in assets under management – driven by positive net inflows - the strong performance of financial markets, the growth in revenues from the companies which are part of the multi-boutique platform and from positive contribution from the stake in Guotai (China).

Performance fees decreased to € 57 million (€ 122 million FY2020). Operating expenses increased (+3.8%) to € 464 million, mainly due to investments to strengthen the operating machine. The cost / income ratio, which is calculated as operating costs by operating revenues, was reduced by 4 p.p. to reach 41% (45% FY2020).

Total Assets Under Management of the segment rose to € 575.3 billion as of 31 December 2021, up 2.5%.

Third-party Assets Under Management were € 112.9 billion as of 31 December 2021, (€ 104.0 billion FY2020) up thanks to € 8.5 billion of net inflows.

The contribution from third-party clients was 30% of total revenues, stable compared to FY2020.

The net result of the Asset Management segment increased to € 504 million (+30.4%).

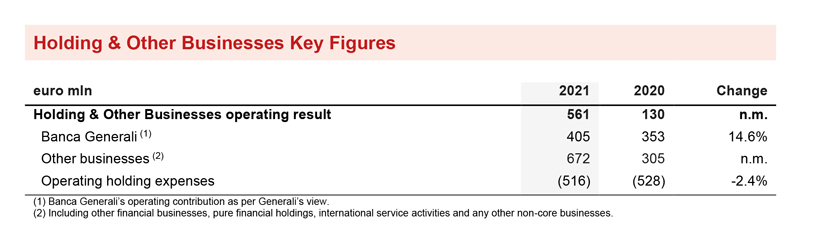

HOLDING AND OTHER BUSINESSES SEGMENT

- The segment's operating result was € 561 million

- Continued positive contribution from Banca Generali

- Positive contribution from private equity

The operating result of the Holding and other businesses segment grew strongly to reach € 561 million (€ 130 million FY2020). In particular, Banca Generali's result rose to € 405 million (+14.6%) - also thanks to the development of performance fees - partially offset by the provision of € 80 million12 in the first half of 2021 in order to protect customers.

Other businesses also provided a positive contribution, driven entirely by private equity.

Net Holding operating expenses stood at € -516 million (€ -528 million FY2020) thanks to a reduction in expenses, especially in the Parent Company and in Asset & Wealth Management.

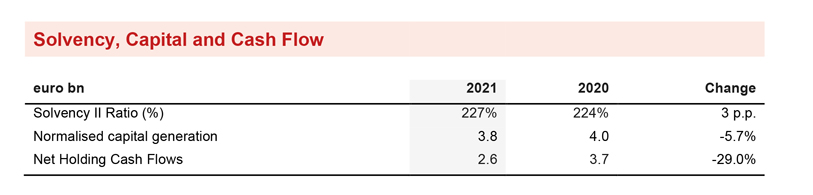

BALANCE SHEET, CASH AND CAPITAL POSITION

- Extremely solid capital position, with the Solvency Ratio at 227%

- Capital generation stood at € 3.8 billion

- Net holding cash flows at € 2.6 billion

The Solvency Ratio was 227%. The increase compared to FY2020 (224%) was due to the very positive contribution of normalised capital generation (tied, above all, to the further expansion of new business in the Life segment and the solid contribution from the P&C segment) which, together with the positive impact from the performance of financial markets (characterised by a sharp rise in interest rates and the excellent was 227%. The increase compared to FY2020 (224%) was due to the very positive contribution of normalised capital generation (tied, above all, to the further expansion of new business in the Life segment and the solid contribution from the P&C segment) which, together with the positive impact from the performance of financial markets (characterised by a sharp rise in interest rates and the excellent performance of the equity sector), more than offset the negative impact deriving from regulatory changes, M&A transactions and dividend provision for the period.

The decrease of 6 p.p. compared to the capital position at 30 September 2021 (233%) was primarily due to the effect from the acquisition of control of the Cattolica Group.

The normalised capital generation was confirmed at a solid level at € 3.8 billion (€ 4.0 billion FY2020) thanks, above all, to the further expansion of new business in the Life segment and the solid contribution from the P&C segment.

Net Holding cash flows were € 2.6 billion. The decrease compared to 2021 was entirely due to capital management initiatives in 2020, as well as to the one-off fiscal elements from the previous year.

OUTLOOK

In respect to forecasts of a further recovery in the global economy in 2022, the recent Russian-Ukrainian conflict has resulted in a context of greater uncertainty and volatility and a risk of a downward revision of growth estimates. To date, the development of the conflict remains unpredictable and consequently it is not possible to make a reasonable estimate of the effect of the crisis on the markets and on the insurance business.

In this context, the Group confirms and continues with its strategy of rebalancing the Life portfolio to further strengthen profitability and with a logic of more efficient capital allocation, also supported by an extensive analysis of existing portfolios. In P&C, Generali’s objective in the mature insurance markets in which the Group operates is to maximize growth and, at the same time, to gain ground in high potential markets.

With regard to the Asset Management segment, the activities identified in the new strategic plan will continue in 2022 in order to extend the product catalog in terms of real & private assets, high conviction and multi-asset strategies.

In line with the ‘Lifetime Partner 24: Driving Growth’ strategic plan, the Group intends to pursue sustainable growth, enhance its earnings profile and lead innovation in order to achieve a compound annual growth rate in earnings per share13 between 6% and 8% in the period 2021-2024, to increase the net holding cash flow14 in excess of € 8.5 billion in the period 2022-2024 and to distribute cumulative dividends15 to shareholders for an amount between € 5.2 billion and € 5.6 billion in the period 2022-2024, with a rachet policy on the dividend per share16.

SHARE CAPITAL INCREASE RESOLUTION IN IMPLEMENTATION OF THE LONG-TERM INCENTIVE PLAN

The Board of Directors also approved a capital increase of € 5,524,562 to implement the ‘Long-Term Incentive Plan 2019-2021,’ having ascertained the occurrence of the conditions on which it was based. The execution of the resolution of the Board is subject to the authorisation of the related amendments to the articles of association by IVASS.

Furthermore, the Board of Directors resolved to submit to the approval of the Annual General Meeting the proposal of the ‘Long-Term Incentive Plan 2022-2024,’ supported by a buyback program for the purposes of the plan.

NEW SHARE PLAN FOR GENERALI GROUP EMPLOYEES

The Board of Directors resolved to submit to the approval of the Annual Generali Meeting the proposal of the new share plan for Generali Group employees, providing the opportunity to purchase at favourable conditions Company ordinary shares arising from a buy-back program for the purposes of the plan.

SIGNIFICANT EVENTS OF 2022

Significant events that occurred following the end of the period are available in the 2021 Annual Integrated Report and Consolidated Financial Statements.

The Report also contains the description of the alternative performance indicators and the Glossary.

Q&A SESSION CONFERENCE CALL

The Group CEO, Philippe Donnet and the Group CFO, Cristiano Borean will participate to the Q&A session conference call for the financial results of the Generali Group as of 31 December 2021, which will be held on 15 March 2022, at 12.00 pm. CET.

To follow the conference call, in a listen only mode, please dial +39 02 802 09 27.

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

FURTHER INFORMATION BY SEGMENT

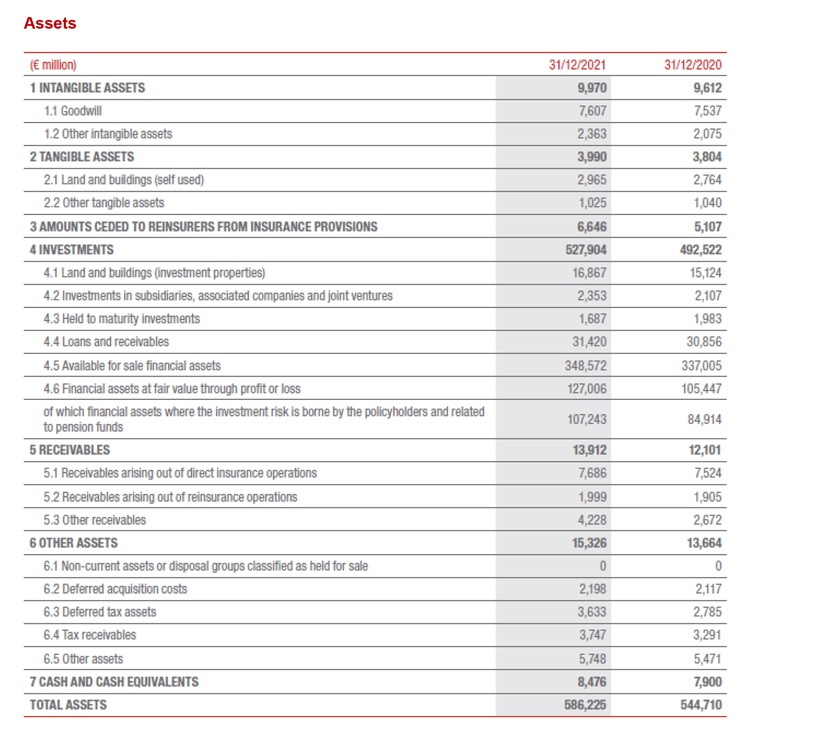

GROUP’S BALANCE SHEET AND INCOME STATEMENT17

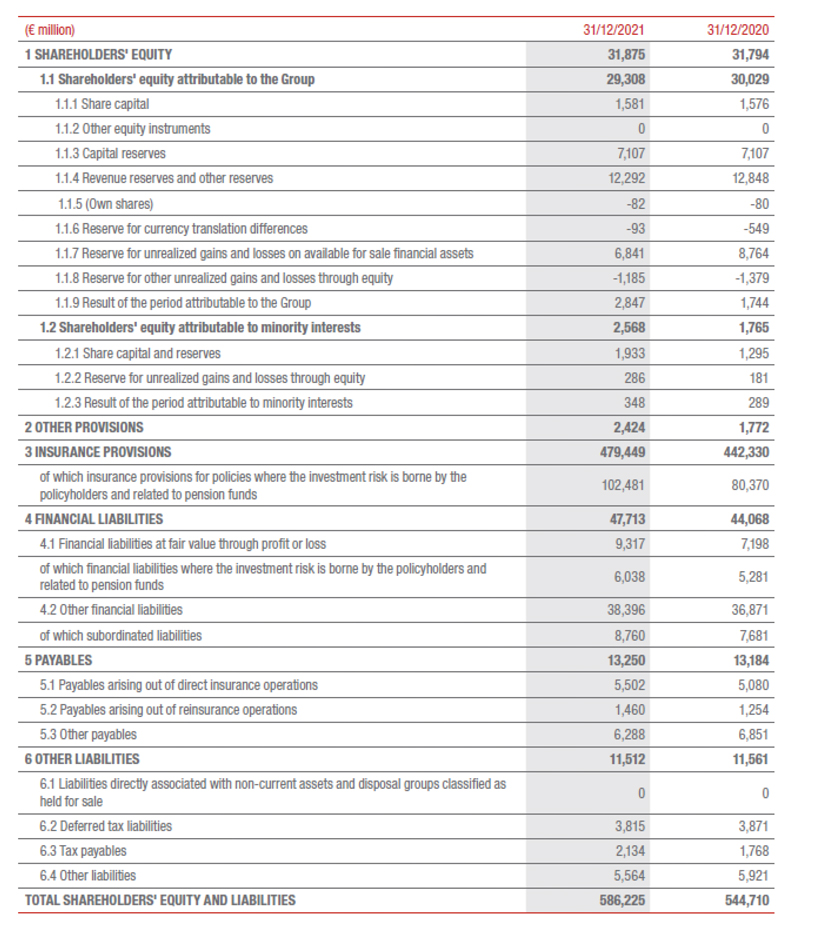

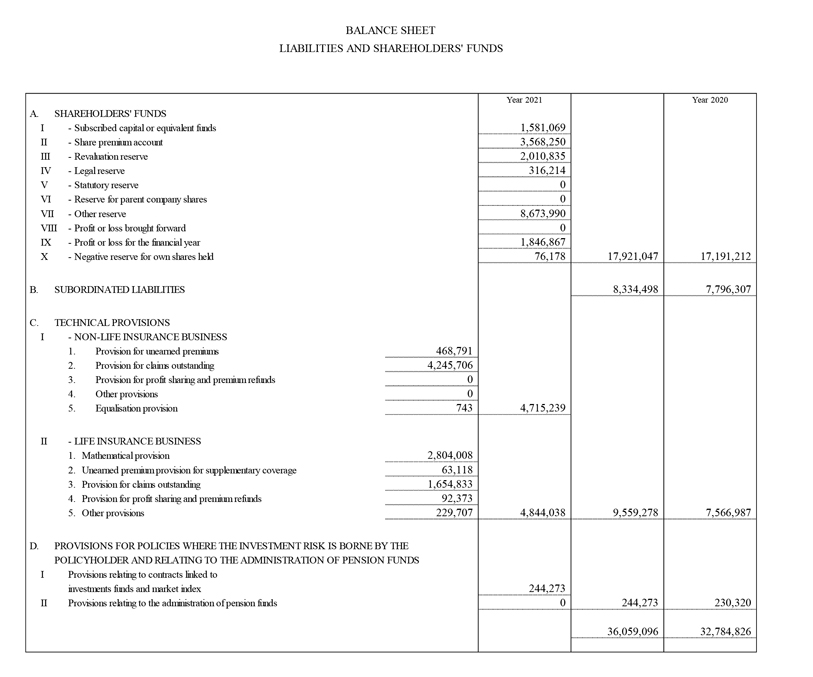

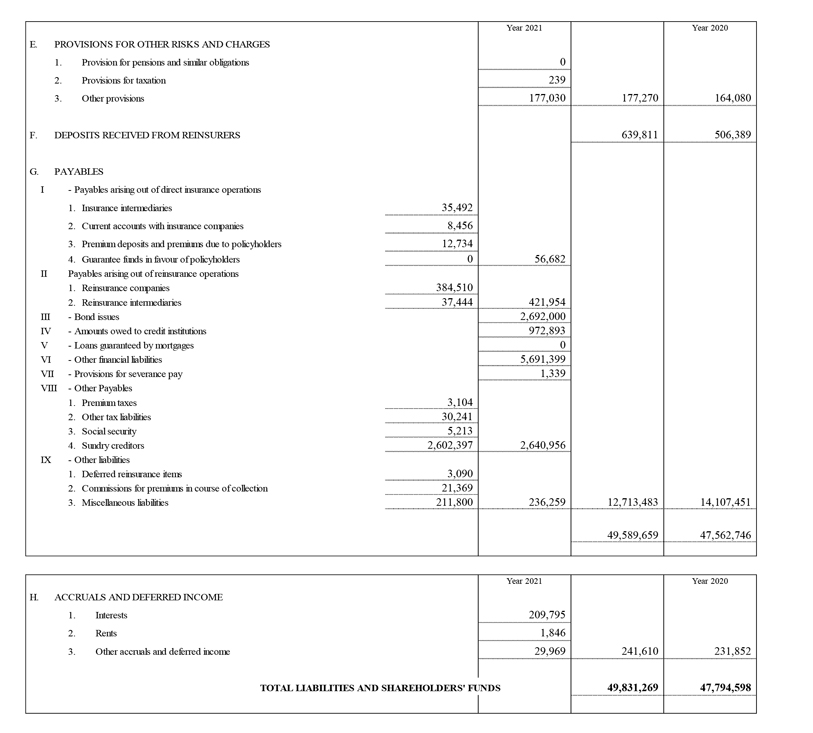

Equity and liabilities

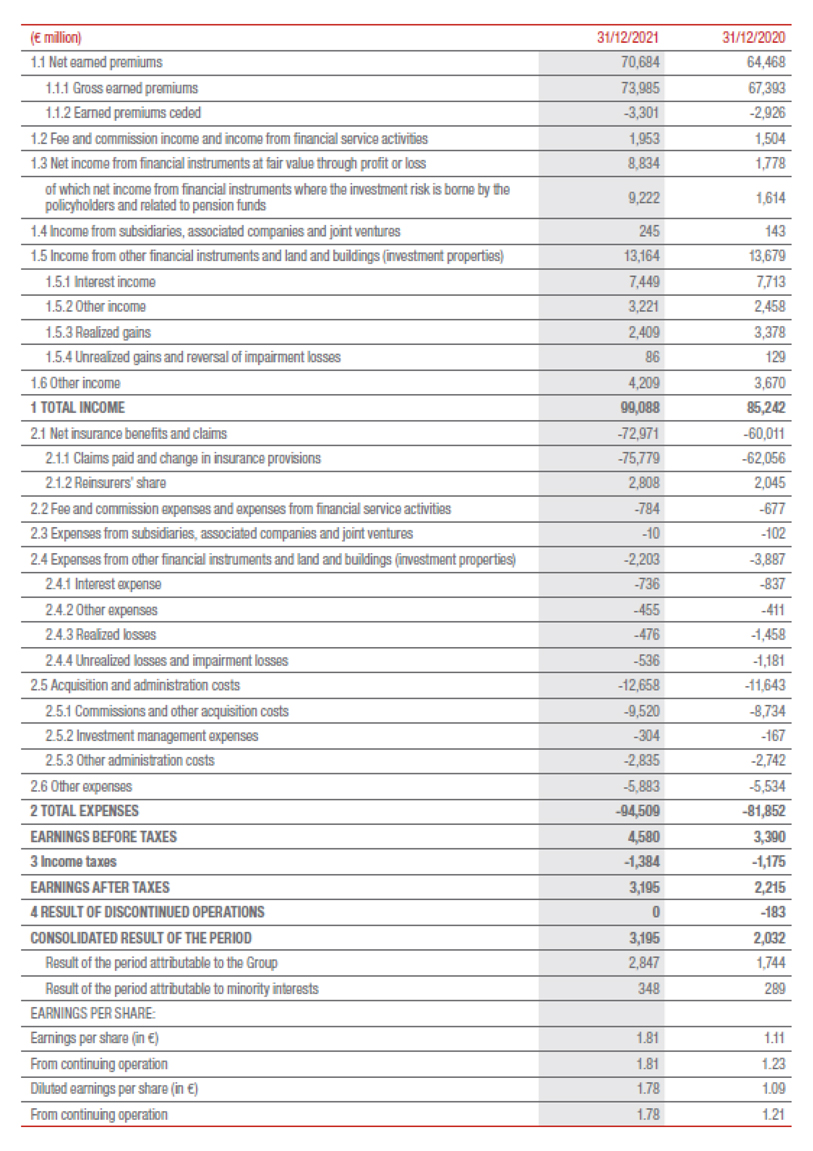

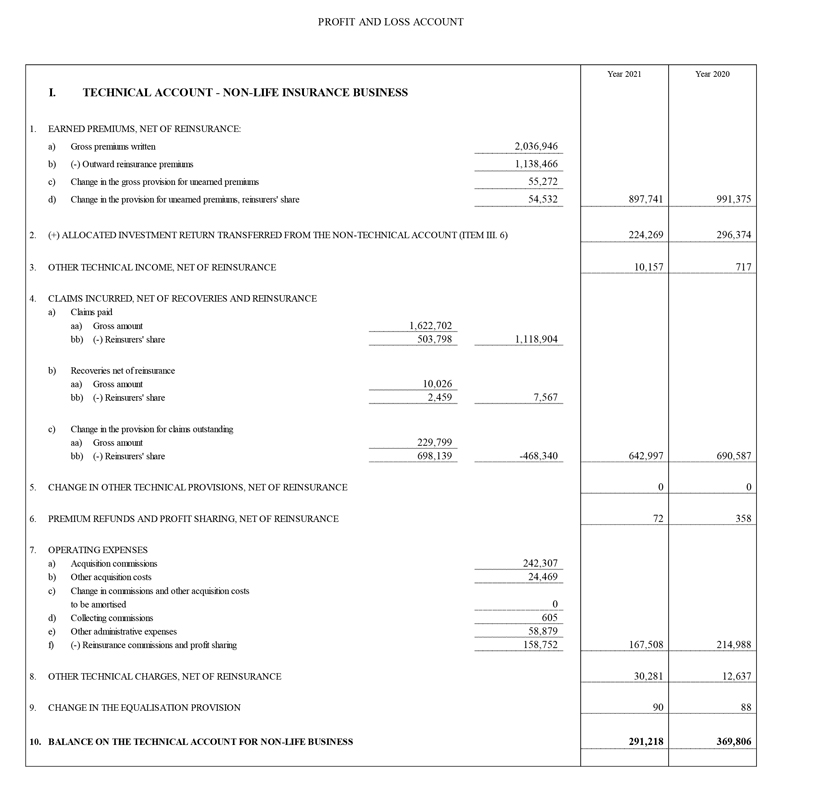

Income statements

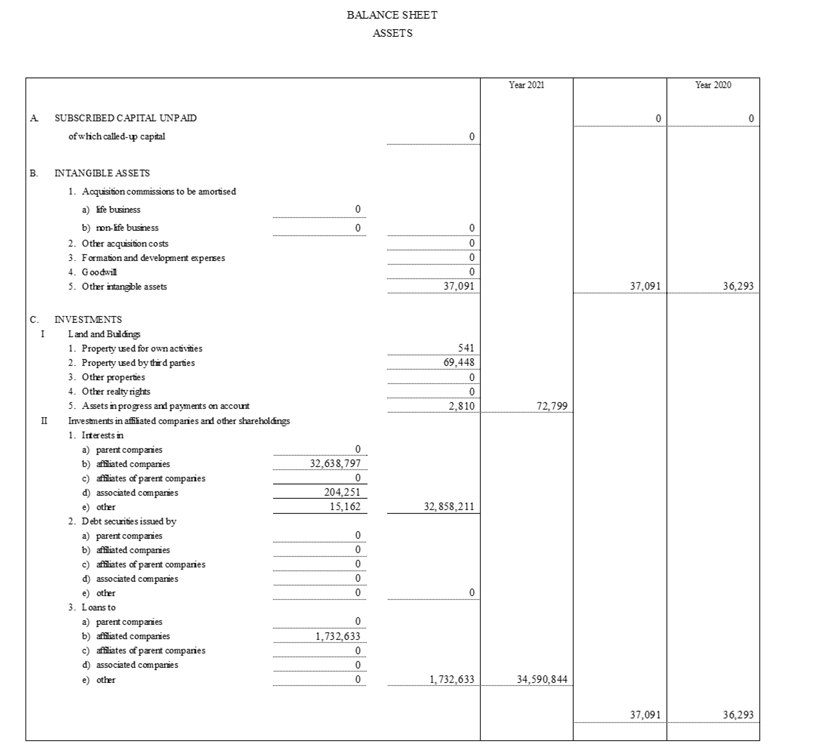

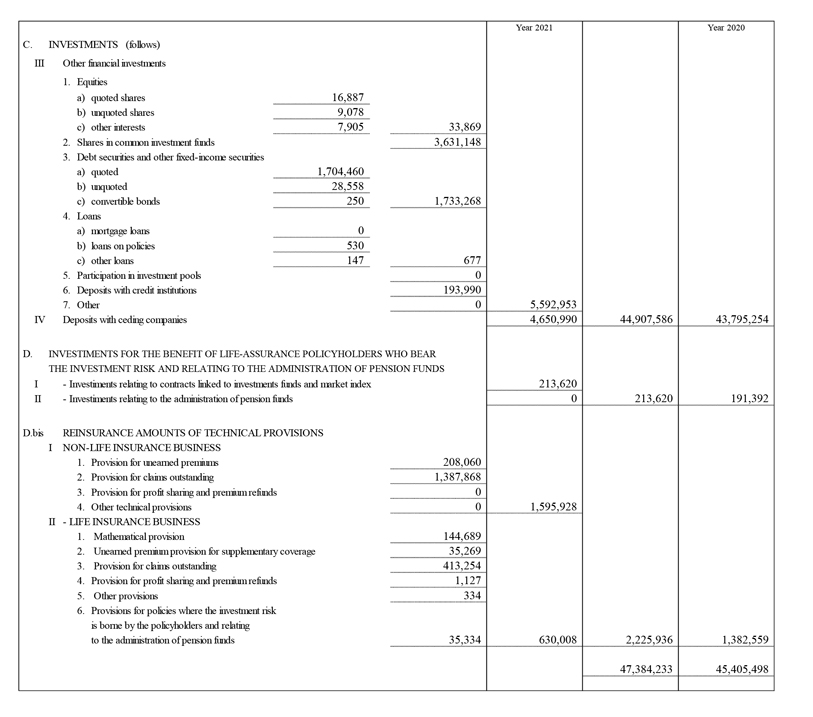

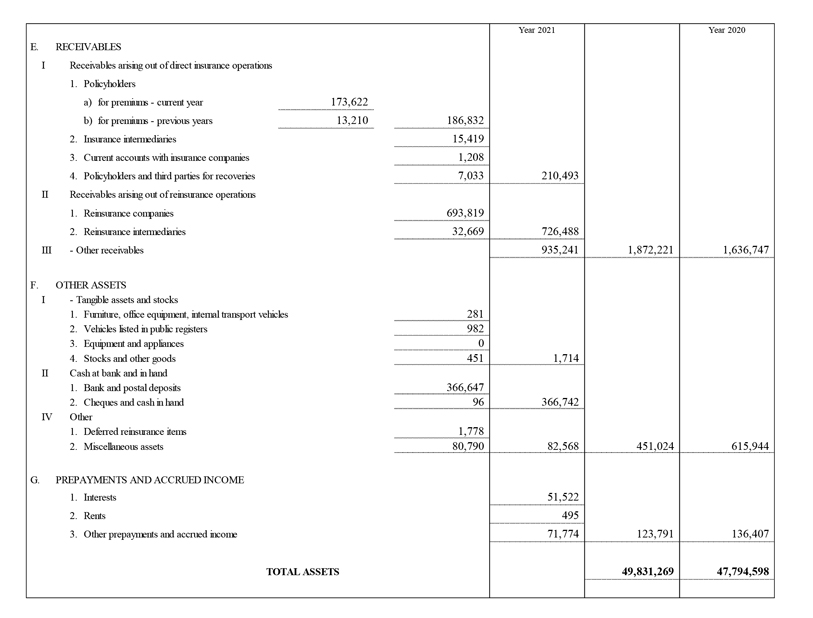

PARENT COMPANY’S BALANCE SHEET AND INCOME STATEMENT18

BALANCE SHEET

(in thousands euro)

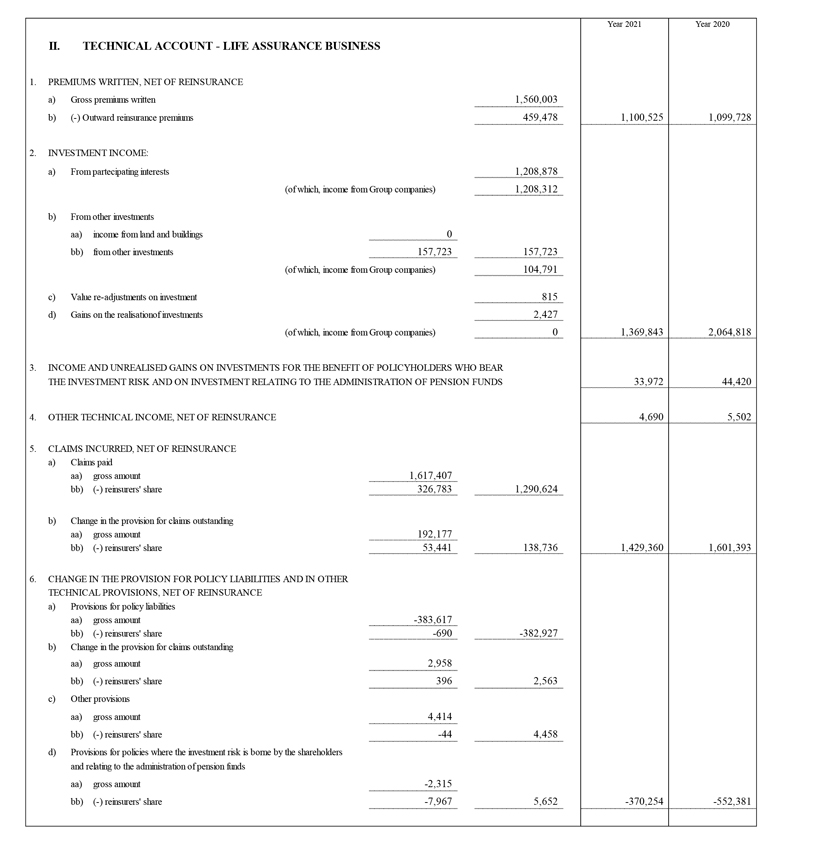

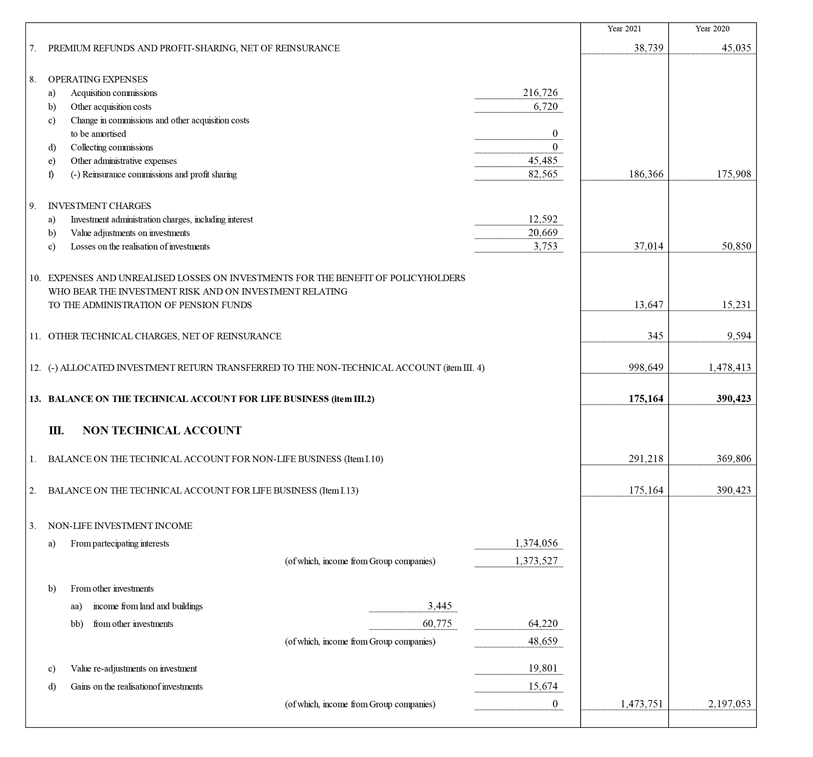

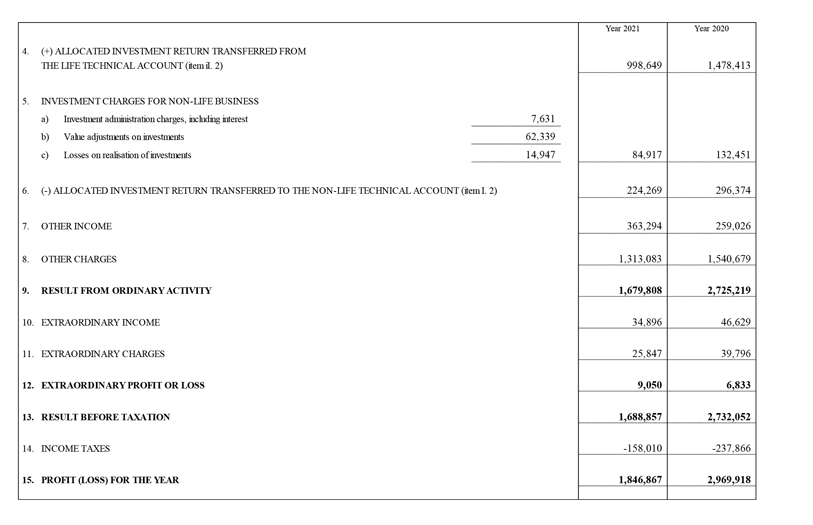

PROFIT AND LOSS ACCOUNT

(in thousands euro)

1Changes in premiums, Life net inflows and new business were presented in equivalent terms (at constant exchange rates and consolidation scope), as a result, the contribution of the Cattolica Group is neutralised in the calculation for variations on equivalent terms. Changes in the operating result, own investments and Life technical provisions excluded any assets under disposal or disposed of during the same period of comparison, as a result it considers the contribution from the Cattolica Group in percentage changes. The present value of new business premiums (PVNBP) and new business value does not include the Cattolica Group.

2The adjusted net result is defined as the net result without the impact of gains and losses related to acquisitions and disposals. In 2021 the adjusted net result was € 2,795 million, excluding € 52 million related to the acquisition of control of the Cattolica Group and the extraordinary costs for its integration. At the end of 2020, it was € 1,926 million, neutralising the settlement agreement of € 183 million for the sale of BSI. In addition, excluding the one-off expense of € 77 million, net of taxes, from the Extraordinary International Fund for Covid- 19 and the expense of € 73 million, net of taxes, from the liability management transaction, the adjusted net result at the end of 2020 was € 2,076 million.

3This amount, net of taxes, was € 147 million.

4The 2021 adjusted net result would have grown by 34.7% when compared to € 2,076 million at FY2020 (which also excluded the one- off expense of € 77 million, net of taxes, for the Extraordinary International Fund for Covid-19 and the expense of € 73 million, net of taxes, for the liability management transaction).

5The increase would have been 9.5%, excluding the one-off effect of the premiums of the Cometa collective pension fund (National Complementary Pension Fund for workers in the metalworking industry, installation of plants and related sectors and for employees of the gold and silver sector) signed in 2020 in Italy.

6The 2021 annual reporting takes into account, from a managerial view, a more consistent representation of the third party assets under management. The value of the comparative period was therefore restated, on which the relative change was calculated.

73 year CAGR; adjusted for impact of gains and losses related to acquisitions and disposals.

8Subject to regulatory recommendations.

9It is noted that ACEER will become ACEE from March 2022, following the Group’s decision to close its representative office in Moscow and to resign from positions held on the board of the Russian insurer Ingosstrakh. Europ Assistance will wind down its business in Russia.

10In line with 2020 and in the first nine months of 2021, the impacts of the Covid-19 pandemic on the Group's results, referring to all the segments in which the Group operates, were determined taking into consideration:

- the direct effects deriving from Covid-19, including major claims connected to the pandemic and to other local initiatives to support communities impacted by Covid-19;

- the indirect effects for which it was necessary to resort to an estimate process in order to determine the portion attributable to Covid-19. The effects relating to the decrease in assets under management and the lower loss ratio due to the lockdown restrictions during the year, fall into the latter category.

11See Note 10.

12This amount, net of taxes and minorities, is equal to € 28 million.

133 year CAGR; adjusted for impact of gains and losses related to acquisitions and disposals. Target based on current IFRS accounting standards.

14Cash View.

15Subject to regulatory recommendations.

16Cash view.

17With regard to the financial statements envisaged by law, note that the statutory audit on the data has not been completed. The Group will publish the final version of the Annual Integrated Report and Consolidated Financial Statements 2021 in accordance with prevailing law, also including the Board of Statutory Auditors’ Report and Independent Auditor’s Reports.

18With regard to the financial statements envisaged by law, note that the statutory audit on the data has not been completed. The Group will publish the final version of the Proposal of Management Report and Financial Statements of Parent Company 2021 in accordance with prevailing law.