Financial Information at 30 September 2019 – Press Release (1)

07 November 2019 - 07:30 price sensitive

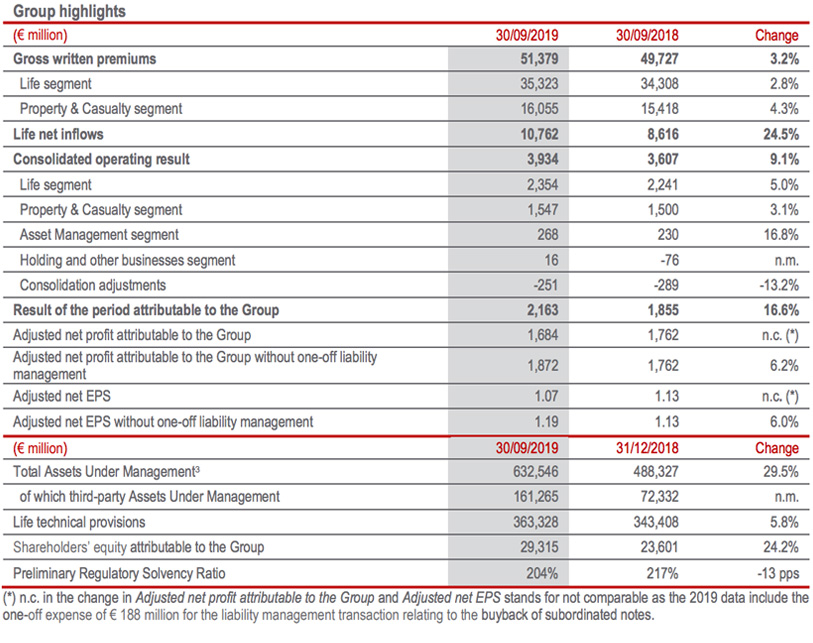

Operating result grew to € 3.9 billion (+9.1%) and net profit increased to € 2.2 billion (+16.6%). Solid capital position

- Strong operating result at € 3.9 billion (+9.1%) thanks to the improvements in all business segments. P&C technical profitability remained at an excellent level with a combined ratio of 92.5% (-0.3 pps). Life New Business Margin (NBM) at 4.28% (-0.25 pps);

- Group net profit up to € 2,163 million (+16.6%), in part reflecting the result of disposals. Adjusted net profit2 was € 1,872 million (+6.2%), excluding the one-off expense of € 188 million associated with the liability management transaction;

- P&C premiums up 4.3% thanks to the development in the Group’s main markets. In Life, net inflows at over € 10 billion (+24.5%) and technical provisions up to € 363.3 billion (+5.8%). Total gross written premiums stood at € 51.4 billion, an increase of 3.2% thanks to the development of both business segments;

- Solid Group capital position with a Preliminary Regulatory Solvency Ratio of 204%.

Generali Group CFO, Cristiano Borean, stated: “Generali has achieved strong results in the first nine months of the year thanks to the growth in all business lines. Technical excellence has been confirmed; in particular, in the P&C segment with an outstanding combined ratio and further premium growth as well as in the Life segment, thanks to a solid new business margin and growing net inflows. Within the context of persistent low interest rates, the Group’s capital position remains solid.”

Mogliano Veneto (TV). At a meeting chaired by Gabriele Galateri di Genola, the Board of Directors of Assicurazioni Generali approved the Financial Information at 30 September 2019.

Premiums, New Business and Volumes

- Due to the positive performance of both business segments, the Group's gross written premiums grew by 3.2% compared to last year, standing at € 51,379 million.

Life net inflows remained at an excellent level, exceeding € 10 billion. The significant growth (+24.5%) reflected the positive performance in almost all the main countries in which the Group operates. In particular, Italy and Asia benefited from fewer surrenders, while France gained from higher premiums. The Group’s Life premiums showed an increase of 2.8% resulting from the growth in protection (+8.1%, with growth spread across the countries in which the Group operates) and in savings (+3.2%, thanks to the growth in France and Germany). Unit-linked premiums were down by 6.8%, mainly in Italy, improving the trend witnessed in the first half of the year.

P&C premiums also increased (+4.3%) thanks to the positive performance of both business lines. There was a 2.8% increase in the motor line, mainly due to growth in Austria, CEE & Russia (ACEER), France as well as the Americas and Southern Europe. The non-motor line also grew (+4.3%), reflecting the positive trends across the markets in which the Group operates, in particular in the ACEER region. - New business in terms of PVNBP (present value of new business premiums) stood at € 31,275 million, up 7%. The increase was due to the growth in savings (+12.6%) and protection products (+20.7%).

Despite the less favourable financial assumptions, the new business margin on PVNBP remained high at 4.28% (down -0.25 pps) thanks to an improvement in the features of new products and the further recalibration of financial guarantees.

As a result, the New Business Value (NBV) was € 1,340 million, a modest increase on the first nine months of 2018 (+1.1%). - Third-party Assets Under Management grew to € 161,265 million, primarily due to integration of the new boutiques as well as to the contribution of assets of a number of companies disposed of during the year, previously held by the Group and retained under its management as a result of the sale agreements.

- There was an increase in Life technical provisions to € 363,328 million (+5.8%), reflecting the growth of net inflows as well as the increase in the unit-linked component driven by financial market performance.

Economic Performance

- The operating result stood at € 3,934 million, up 9.1% as a result of the positive contribution of all business segments of the Group.

The operating result of the Life segment grew by 5%, reflecting both the development of the technical margin net of insurance expenses and the positive contribution from the investment result.

The operating result of the P&C segment also rose (+3.1%), driven by the technical result, which more than offset the decrease in net current investment income. The combined ratio remained at an excellent level (92.5%; -0.3 pps compared to 9M18) due to the improvement in the non-catastrophe current year loss ratio. Natural catastrophe claims in the period amounted to approximately € 262 million, equal to 1.7 pps on the combined ratio (1.5 pps at 9M18).

The operating result of the Asset Management segment grew by 16.8%, mainly following an increase in operating revenues that also reflects the consolidation of the new boutiques.

Finally, the operating result of the Holding and other businesses segment also improved due to the higher contribution of Banca Generali, increased income from private equity and real estate as well as the positive development of the Planvital pension fund (Chile). - The Group net profit stood at € 2,163 million, up 16.6%. In addition to the improvement in the operating result mentioned above, this mainly reflects:

- the decrease in the non-operating result, following the decline in the investment result, mainly relating to € 245 million4 of expenses for the liability management transaction announced in September 2019 which involved the buyback of three series of subordinated notes with an aggregate nominal amount of approximately € 1 billion;

- the lower impact of taxation, which went from 32.6% to 31.6%, mainly due to the increase in deductible acquisition costs in China;

- the higher result from discontinued operations, which overall amounted to € 475 million from the disposal of Generali Leben and the business in Belgium.

Excluding the one-off expense of € 188 million for the liability management transaction relating to the buyback of subordinated notes, the adjusted net profit was € 1,872 million (+6.2%). - The net profit of the Asset Management segment was up to € 189 million (+20%).

- The P&L return on investments stood at 2.4% (2.2% at 9M18), an increase thanks mainly to a higher contribution from assets valued at fair value through profit and loss.

Balance Sheet and Capital Position

- The Group shareholders’ equity stood at € 29,315 million (€ 23,601 million at 31 December 2018), up by 24.2% mainly due to an increase in the reserve for unrealized gains and losses on available-for-sale financial assets resulting from the performance of bonds.

- The Preliminary Regulatory Solvency Ratio - which represents the regulatory view of the Group’s capital and is based on the use of the internal model, solely for companies that have obtained the related approval from IVASS, and on the standard formula for other companies - stood at 204% (217% FY18; -13 pps). The positive normalised capital generation, net of the accrued dividend, only partially offset the negative market and capital variances. Market variances were mainly linked to the fall in interest rates and capital variances included the early repayment of part of the subordinated debt. Regulatory changes and minor model changes on the SCR had an overall impact of 8 pps.

The decrease witnessed in the third quarter is largely attributable in part to market variances - with the fall in interest rates not fully compensated by the narrowing of government bond spreads - and in part to effects associated with new investments in line with the Group’s asset allocation strategy.

For significant events that occurred during and after the period ended 30 September 2019, please refer to the press releases available for download at www.generali.com.

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

The glossary and the description of alternative performance measures are available in the 2018 Annual Integrated Report and Consolidated Financial Statements of the Group.

1Changes in premiums, Life net inflows and PVNBP (present value of new business premiums) are presented in equivalent terms (at constant exchange rates and scope of consolidation). Changes in the operating result, own investments and Life technical provisions exclude assets disposed of during the comparison period.

2Adjusted for the impact of gains and losses from disposals.

3The figure representing Assets Under Management at Group level at year-end 2018 excluded the entities that were to be sold or were sold in the period, in line with IFRS 5.

4This amount, after taxes, was € 188 million.