Generali Group Consolidated Results as of 31 December 2018 (1)

14 March 2019 - 07:30 price sensitive

ALL 2015-2018 PLAN TARGETS EXCEEDED

- Cumulative Net Operating Cash at €8 billion (target > €7 billion)

- Cumulative Dividends at €5.1 billion2 (target > €5 billion)

- Average 2015 - 2018 Operating RoE at 13.4% (target >13%)

2018 ANNUAL RESULTS

STRONG NET PROFIT AT €2.3 BILLION (+9.4%), OPERATING RESULT AT €4.9 BILLION (+3%), PROPOSED DIVIDEND INCREASE BY 5.9% TO €0.90 PER SHARE

- Operating result increased thanks to improvements in all Group business segments

- Life New Business Margin increase continues at 4.35%. Combined Ratio at 93% (+0.1 p.p.), the best among its peers even considering the impact of natural catastrophes and man-made claims

- Excellent Life net inflows of €11.4 billion (+5.2%). Life technical reserves up to €343 billion (+2.2%). Total gross premiums of €66.7 billion, up by 4.9% thanks to improvements in both Life and Property & Casualty segments

- Net result in Asset Management increased by 24% to €235 million

- Capital position enhanced with a Regulatory Solvency Ratio of 216% (207% at FY2017; +9 p.p.)

- Proposed dividend per share of €0.90, up by 5.9% (€0.85 in FY2017)

Generali Group CEO, Philippe Donnet, declared: "With the results presented today, Assicurazioni Generali has completed the 2015-18 strategic plan exceeding all the targets and successfully concluding its industrial turnaround. This was accomplished even considering the difficult macro scenario, confirming our ability to execute and create sustainable value for all stakeholders. For this achievement, the merit goes to the dedication of everyone who works for Generali in 50 countries all over the world as well as to our distribution network and to all of the Group’s partners. Further, in 2018 -- when we posted strong growth in net profit -- Generali confirmed its position as the leader in technical performance with the best New Business Margin and Combined Ratio compared to its direct peers. As of January 1, the whole Group is committed to implementing the new plan ‘Generali 2021’ whose objective is to generate increasing value for our shareholders through investing in profitable growth, innovation and digital transformation of our business. Our ambition is to be life-time partners for our customers.”

Milan – At a meeting chaired by Gabriele Galateri di Genola, the Assicurazioni Generali Board of Directors approved the consolidated financial statements and the Parent Company’s draft financial statements for the year 2018.

EXECUTIVE SUMMARY

Thanks to the results achieved in 2018, the Group completed the 2015-2018 strategic plan having exceeded all of its targets and is best positioned to pursue the targets announced in its new strategy presented during its Investor Day on 21 November 2018.

In 2018, the Group’s operating result increased by 3% to €4,857 million as a result of the contribution of all business segments. The average 2015-2018 Operating RoE was 13.4%, exceeding the strategic target (>13%).

The non-operating result came to €-1,361 million (€- 1,109 million in FY 2017), due in particular to impairments on equity investments and lower net realised gains, which reflects the planned strategy of supporting future returns of our own investments.

The net profit of €2,309 million (+ 9.4%) reflects the improvement in the operating result as well as the contribution from discontinued operations or disposals.

Life net cash inflows amounted to €11,369 million (+5.2%), one of the best levels in the industry, benefitting in particular from final quarter growth. Life technical reserves reached €343 billion (+2.2%).

Life new business margin improved by 0.26 p.p. to 4.35% thanks to the higher profit margins of risk products as well as savings products.

Life segment premiums reached €46,084 million (+5.7%), confirming the growth witnessed during the course of the year.

P&C premiums totalled €20,607 million (+3.3%), confirming the development witnessed during the year thanks to positive trends in both business lines. The combined ratio, substantially stable at 93%, remained the best among peers in the market. The total premiums of the Group amount to €66,691 million, an increase of 4.9%.

In line with what was announced in 2017 and 2018, the net result of the Generali Asset Management unit increased by 24% to €235 million thanks to the acceleration of its business in Europe and the first fruits of its global expansion.

The Group’s solid solvency is confirmed with a Regulatory Solvency Ratio3 of 216%, up by 9 p.p. despite financial market performance.

DIVIDEND PER SHARE

The dividend per share that will be proposed at the upcoming Shareholders' Meeting is €0.90, up by €0.05 cents per share (+5.9%) compared to the previous year (€0.85 FY2017). The pay- out ratio is 61.2% (63% in 2017).

The total dividend relating to outstanding shares is €1,413 million. The dividend payment date is May 22, while shareholders will be entitled to receive the dividend on May 21. The coupon date is May 20.

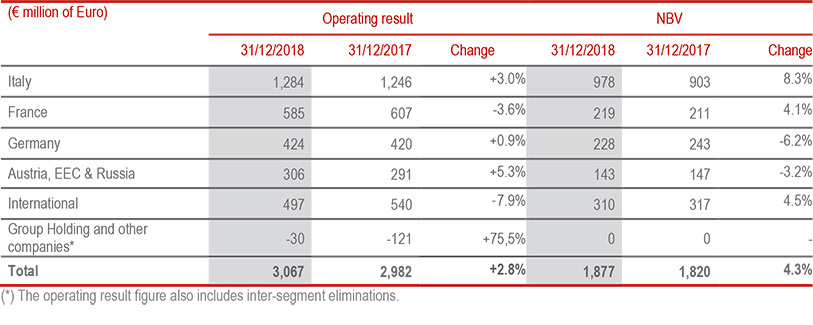

LIFE SEGMENT

- Net cash inflows at €11.4 billion (+5.2%) and premiums up to €46.1 million (+5.7%)

- New business margin rises to 4.35% and new business value (NBV) at €1,877 million, in line with the objective of creating long-term value

- Operating result up to €3.1 billion (+2.8%)

Life net cash inflows came to €11,369 million (+5.2%), with quarterly performance building upon the growth witnessed at nine months. These trends enabled Life technical reserves to grow by 2.2% to €343.4 billion. The growth witnessed in the course of the year was confirmed by Life segment premiums, which reached €46,084 million (+5.7%). In terms of the business lines, savings policies increased 5.7%, reflecting particularly the positive trend in Italy (+8.2% thanks to actions undertaken on the existing collective policy portfolio for €1.2 billion), Asia (+23.8%) and France (+1.3%). Unit-linked inflows were also up by 1.8% due to excellent performance in Germany and France. Protection and health products posted an increase of 10.7%, confirming overall growth in the countries in which the Group operates.

New business in terms of present value of new business premiums (PVNBP) amounted to €43,202 million, down by 1.8%. With respect to the business lines, the protection product business rose by 2.1% in all areas of Group with the exception of Germany. The unit-linked business was down (-1.5% as a result of the performance posted in Italy and Germany), as was the savings product business (-3.7%), in line with the Group strategy aiming to reduce guaranteed business.

New business margins (margin on PVNBP) improved by 0.26 p.p. to 4.35% (4.01% at 31 December 2017), thanks to higher profit margins on risk products (+0.51 p.p.), primarily due to improvements in France and Spain, as well as savings products (+0.29 p.p.), positively impacted by the continuous reduction in financial guarantees as well as the improving economic environment.

Following these actions, the new business value (NBV) rose by 4.3% to €1,877 million (€1,820 million at 31 December 2017).

The operating result of the Life segment came to €3,067 million, up by 2.8% compared to €2,982 million at the end of 2017, thanks to technical margin trends net of insurance and other operating expenses. The investment result was down due to greater impairments on financial instruments, particularly in the final quarter of the year.

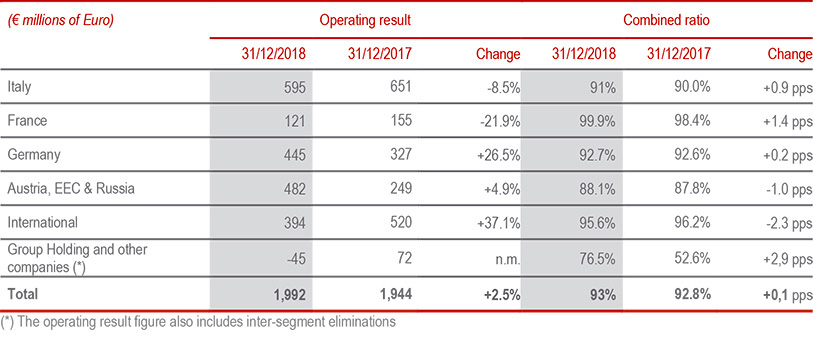

PROPERTY&CASUALTY SEGMENT

- Premiums up to €20.6 billion (+3.3%) in the motor (+3.4%) and non-motor (+2.7%) segments

- Combined Ratio at 93% (+0.1 p.p.), the best among peers

- Operating result increase to €2 billion (+2.5%)

P&C segment premiums confirmed the development witnessed during the year, reaching €20,607 million, up by 3.3% thanks to positive trends in both business lines.

Development in the motor segment4 (+3.4%) is supported by the growth witnessed in ACEER5 (+5.7%), France (+4.2%), the Americas and Southern Europe (+19.2%). Although there was a recovery in Italy in the second part of the year, motor inflows in Italy fell by 1.7%, following the measures adopted to support retail portfolio profitability whose average premium remained substantially stable at year-end. As a result of these measures, the Combined Ratio motor for this market improved by 2.3 p.p.

Non motor premium inflows rose by 2.7% thanks to positive trends widespread throughout the area where the Group operates. Inflows increased in ACEER (+4.1%), France (+2.7%), Germany (+1.8%) and International (+7.2%) that was driven by Europ Assistance due to improvements in travel insurance and roadside assistance in mature markets.

The decline posted in Italy (-1.5%) can mainly be attributed to the downturn of the Global Corporate & Commercial lines and the health sector.

This segment’s operating result, including of €342 million in catastrophe claims and around €290 million in man-made claims, rose by 2.5% to €1,992 million, primarily due to the investment result and the positive contribution of other operating items.

The Combined Ratio, the best among its peers, stood at 93% (+0.1 p.p. compared to 31 December 2017) despite 1.7 p.p. deriving from catastrophe claims and 1.5 p.p. following man- made claims.

This change in the combined ratio is entirely attributable to expense ratio performance, in particular to support non-motor premiums.

ASSET MANAGEMENT SEGMENT6

The Asset Management net result rose from €189 million in 2017 to €235 million in 2018 (+24%). This improvement was driven by capital deployed into real assets by Generali’s insurance companies, net growth of external clients, improvements on cost efficiencies, and, to a lesser extent, the market share increase in Unit Linked of Generali Asset Management products.

HOLDING AND OTHER BUSINESSES SEGMENT

The operating result of the Holding and Other Business segment came to € -70 million, marking an improvement compared to €-163 million at 31 December 2017. In particular, the operating result of the financial and other businesses segment came to €397 million (€291 million at 31 December 2017). The increase of 36.3% mainly reflects the performance of Other businesses. The result of Banca Generali was down slightly to €233 million.

Net holding operating expenses totalled €-467 million (€-454 million as at 31 December 2017), reflecting the higher costs linked to discontinued operations in Germany, the implementing of the new asset management strategy and lower brand fee revenues.

OUTLOOK

The current economic growth trends are expected to slow down on the whole in 2019. In the Eurozone, GDP growth should fall to 1% from 1.9% in 2018. The European Central Bank will likely carefully monitor inflation to decide on when to implement the first rate hike, which could take place not before the half of 2020. In this context, the Group will continue with its portfolio rebalancing strategy to further strengthen profit margins in the Life segment with a more efficient capital allocation approach. In the P&C segment, premium inflows are expected to improve in the Generali Group’s main geographical areas, with a considerable focus on high growth potential markets. In the Asset Management segment, actions will continue to identify investment opportunities and sources of income for all of its clients, at the same time managing risks through the expansion of the multi-boutique platform. The Group’s investment policy will continue to be based on an asset allocation intended to consolidate current profit margins and guarantee consistency with liabilities towards policyholders.

APPROVAL OF A CAPITAL INCREASE TO IMPLEMENT THE LONG TERM INCENTIVE PLAN 2016

The Board of Directors also approved a capital increase for €4.435.531 to implement the "Long Term Incentive Plan 2016", having ascertained the occurrence of the conditions on which it was based. The execution of the resolution of the Board is subject to the authorization of the related amendments to the Articles of Association by IVASS.

SHARE PLAN FOR GENERALI GROUP EMPLOYEES

Moreover, the Board of Directors resolved to submit to the approval of the Annual Shareholders Meeting the proposal of a share plan for Generali Group employees, providing the opportunity to purchase at favourable conditions Company ordinary shares arising from a buy-back program for the purposes of the plan.

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

1The changes in Life net inflows and premiums are compared on the same basis; that is, considering the same exchange rates and scope of consolidation consistent with IFRS 5. The changes in Operating Result, Investments/Assets Under Management and Operating RoE are calculated by re-determining, in application of IFRS 5, the comparative data for 2017 following the disposals that are closed or disposals pending closure. The 2017 data relating to new business are at a historic perimeter ratio; that is, they do not exclude companies being divested.

2Also inclusive of the dividend proposed for 2018, submitted for approval to the Shareholders' Meeting to be held on 7 May 2019.

3Starting from 31 December 2018, the Economic Solvency Ratio, which represented the economic vision of the Group's capital and is calculated by applying the internal model to the entire scope of the Group, will no longer be published because the difference between the regulatory and economic views has narrowed, given the reduced number of entities still in the approval phase (Austria for the health business and Spain).

4Details about motor and non–motor are supplied on direct business

5Austria, Central - Eastern Europe and Russia

6The Asset Management segment includes the business carried out only by the Asset Management companies operating as part of the Generali Group. This segment operates as a provider of products and services for Generali Group insurance companies as well as third-party clients. The products include equity and fixed-income funds as well as alternative products.

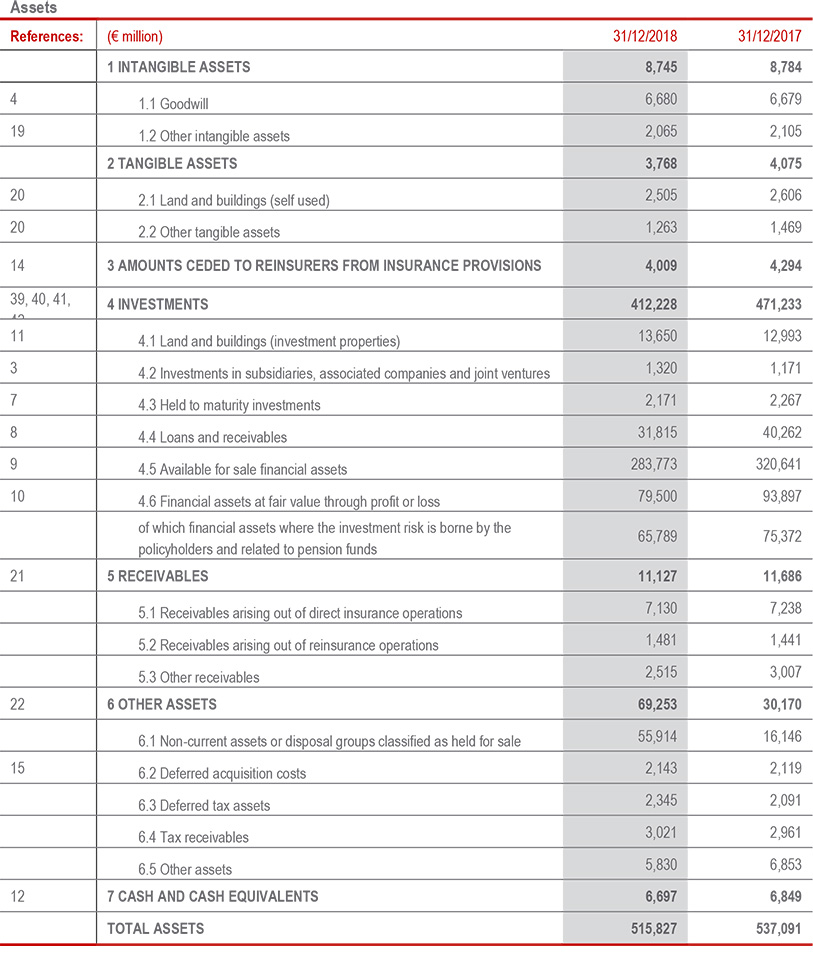

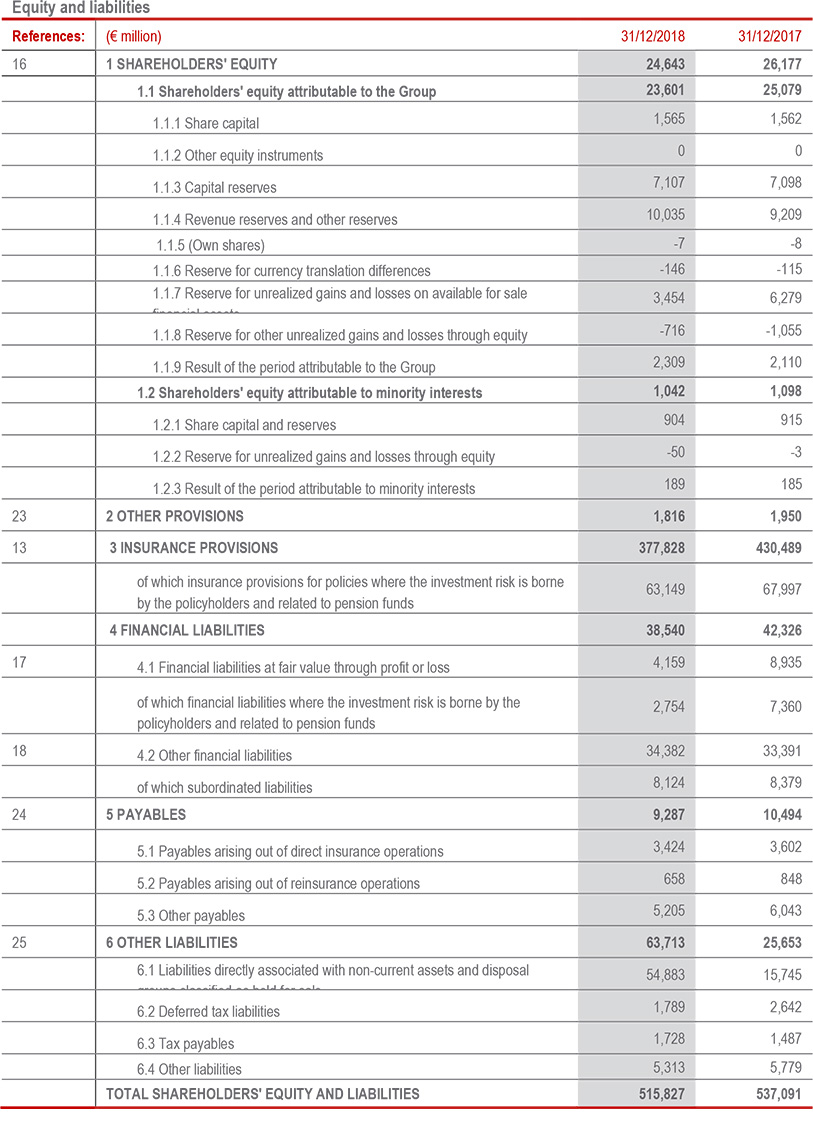

Group balance sheet and income statement

BALANCE SHEET

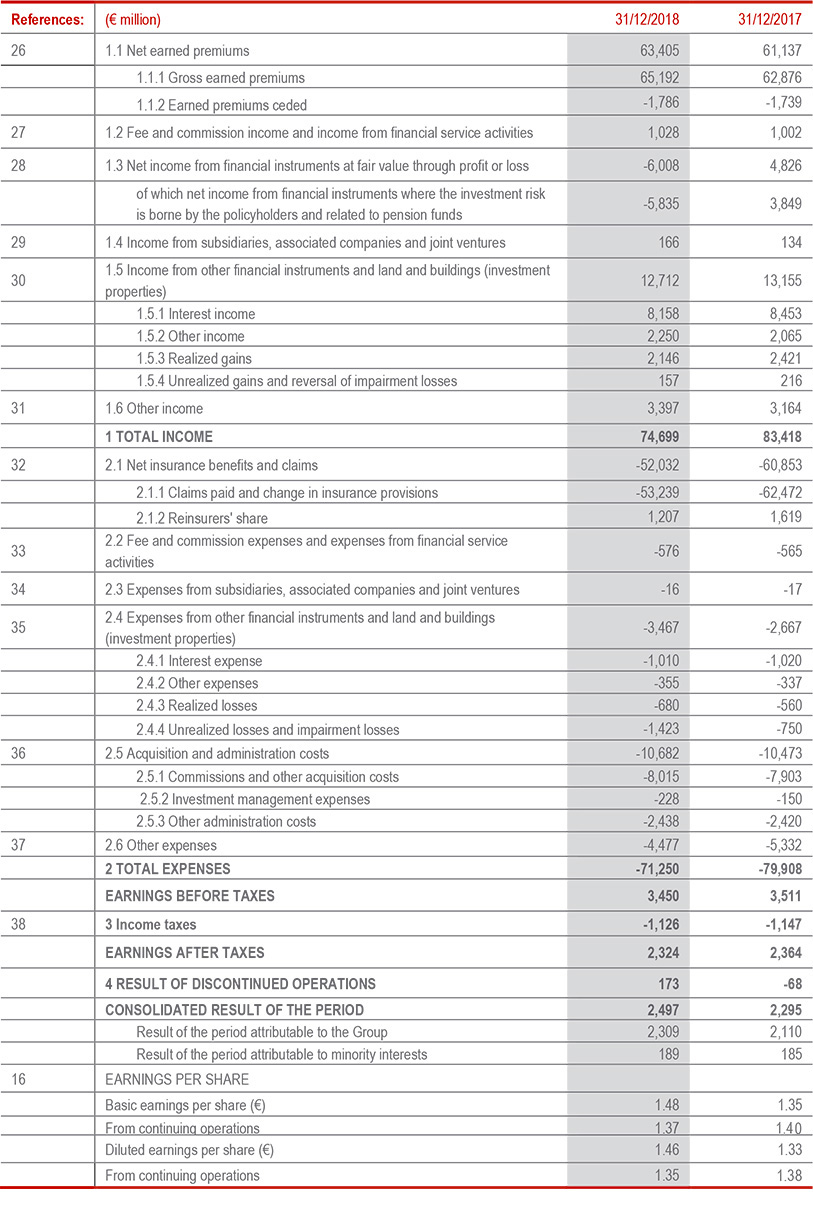

GROUP'S INCOME STATEMENT

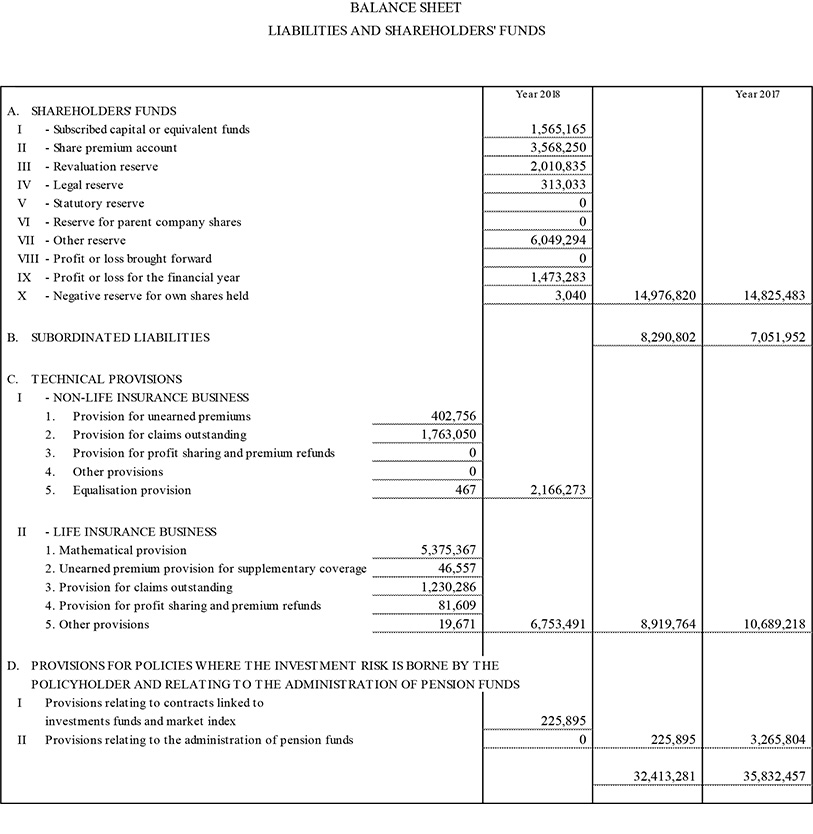

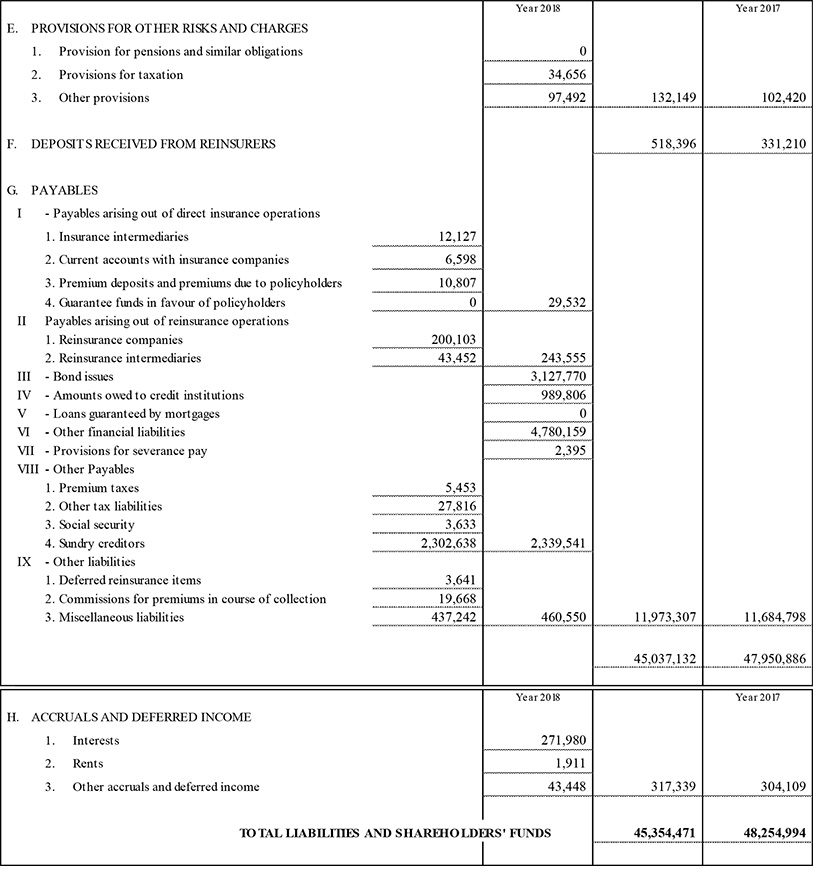

Parent Company's balance sheet and income statement

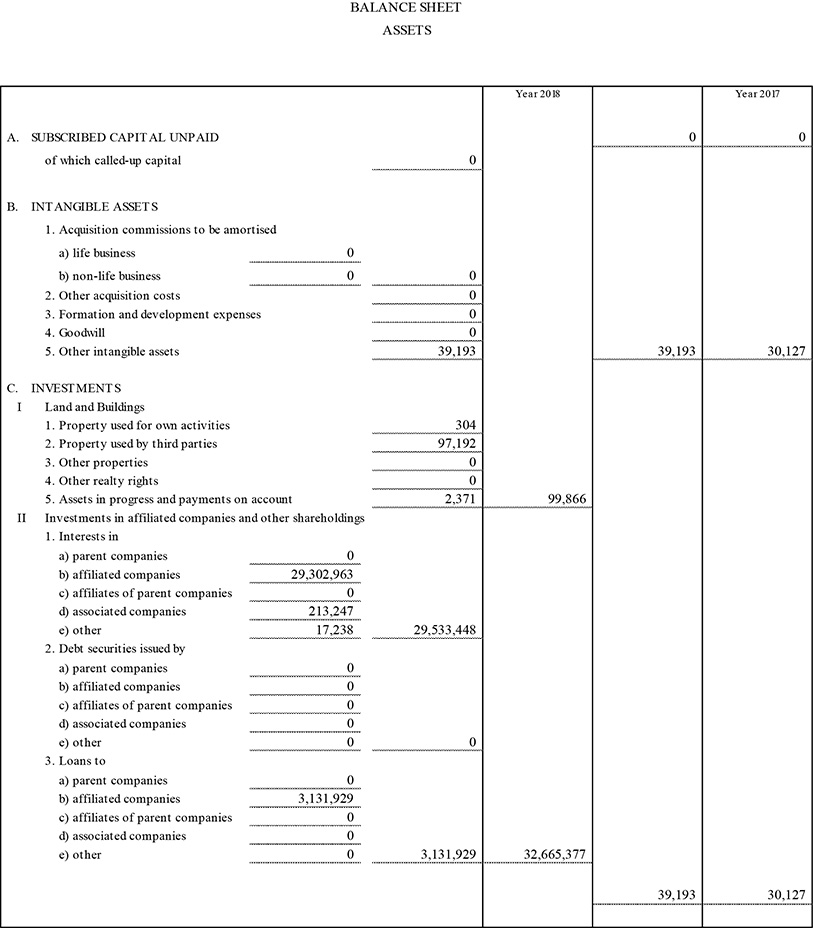

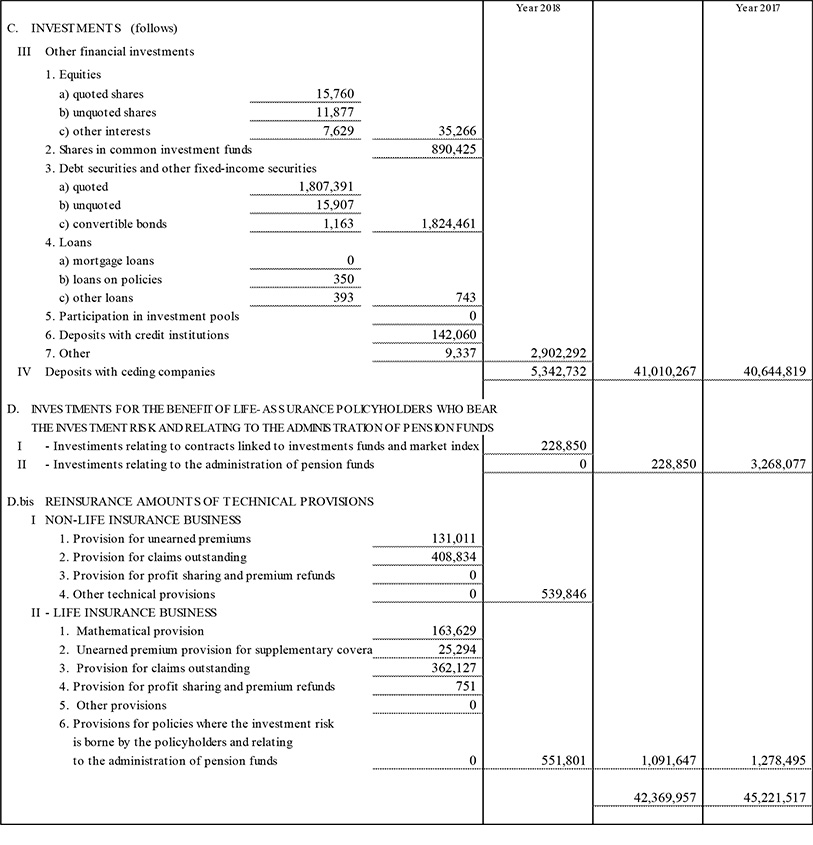

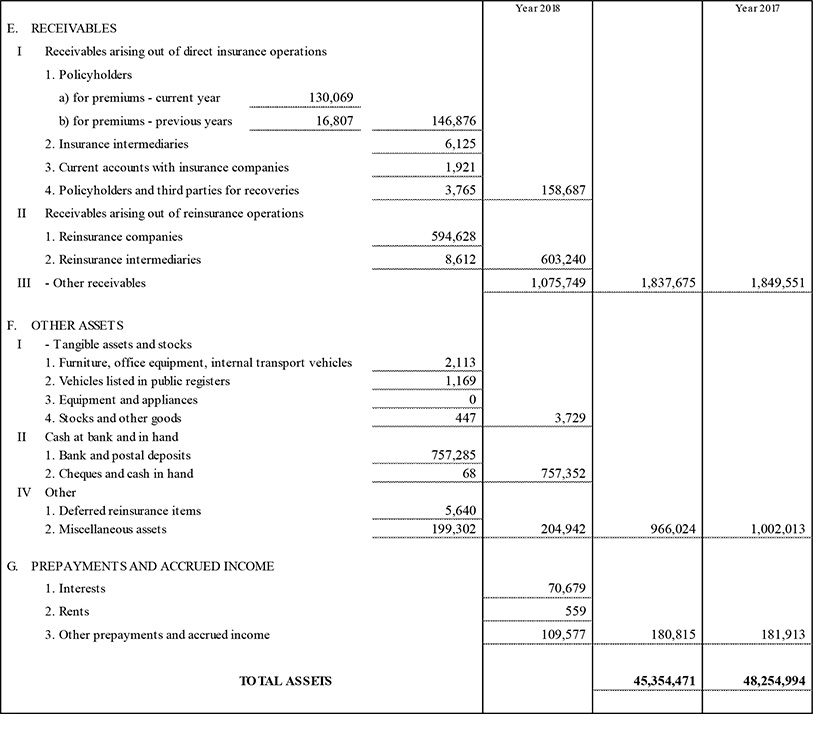

BALANCE SHEET

(in thousands euro)

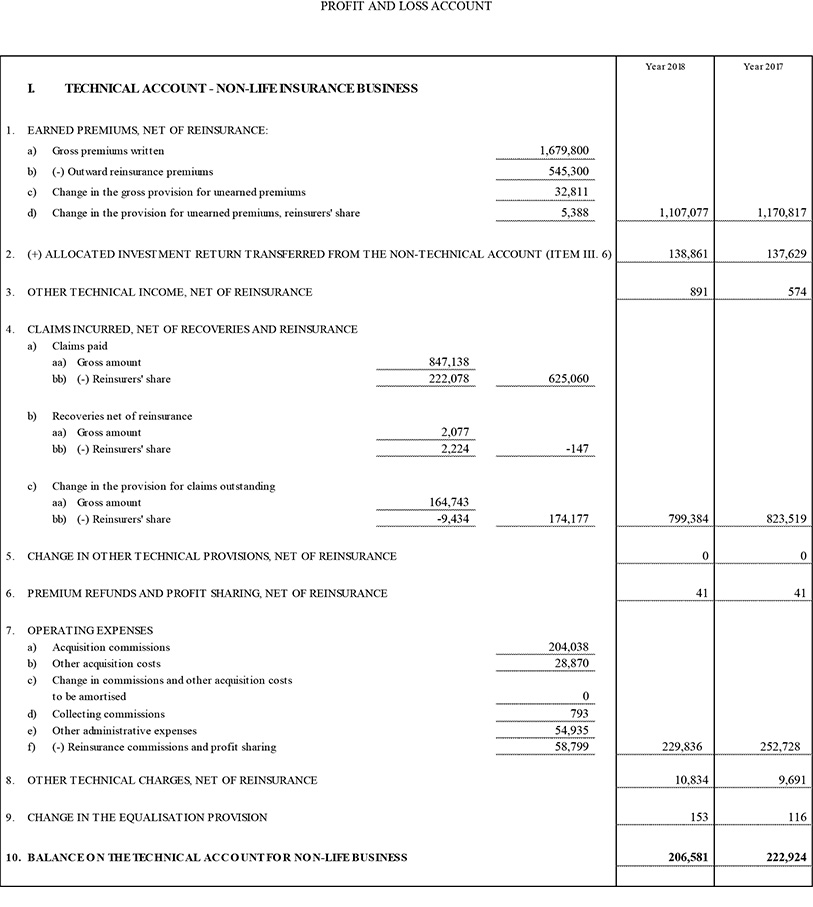

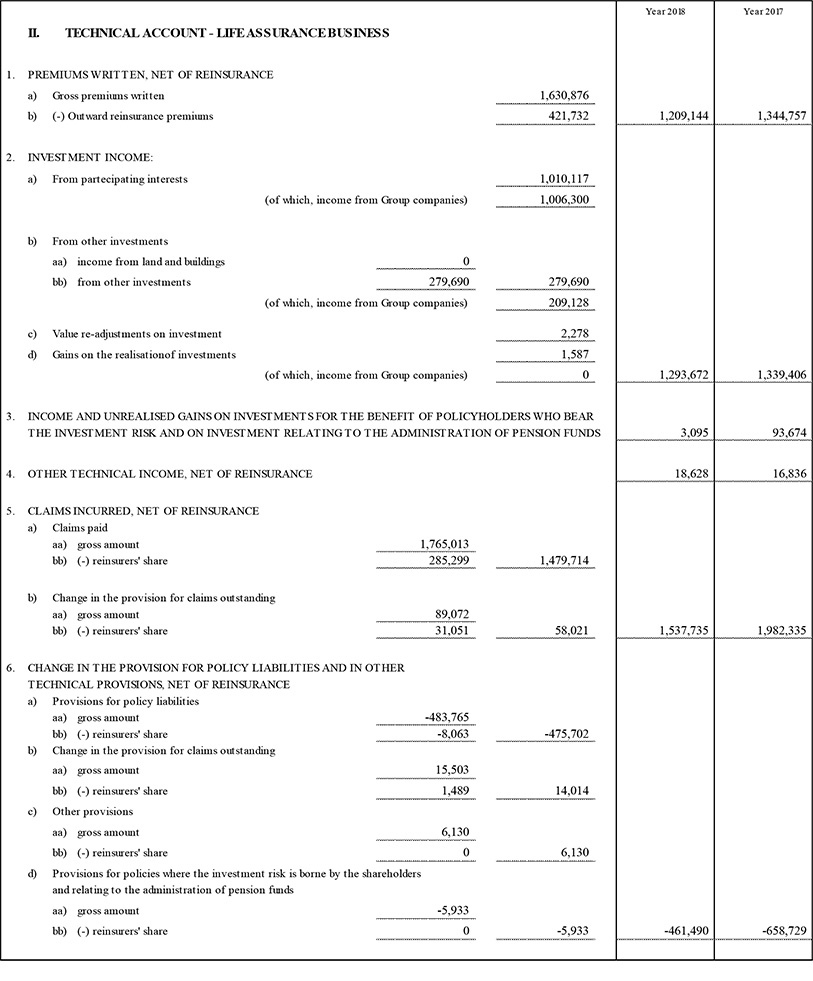

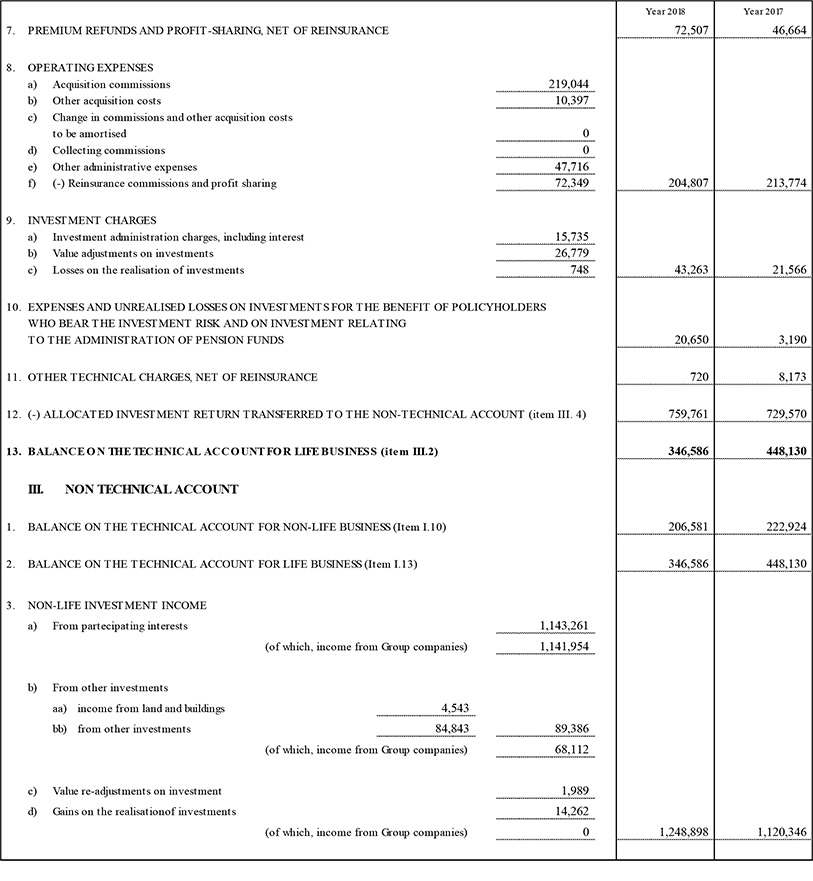

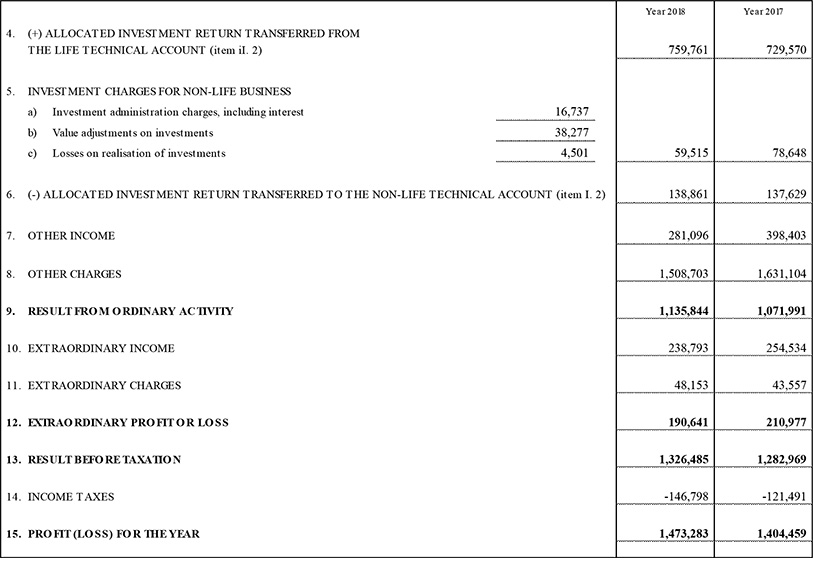

PROFIT AND LOSS ACCOUNT

(in thousands euro)