Interim Financial Information as of 31 March 2018 - Press Release (1)

04 May 2018 - 07:30 price sensitive

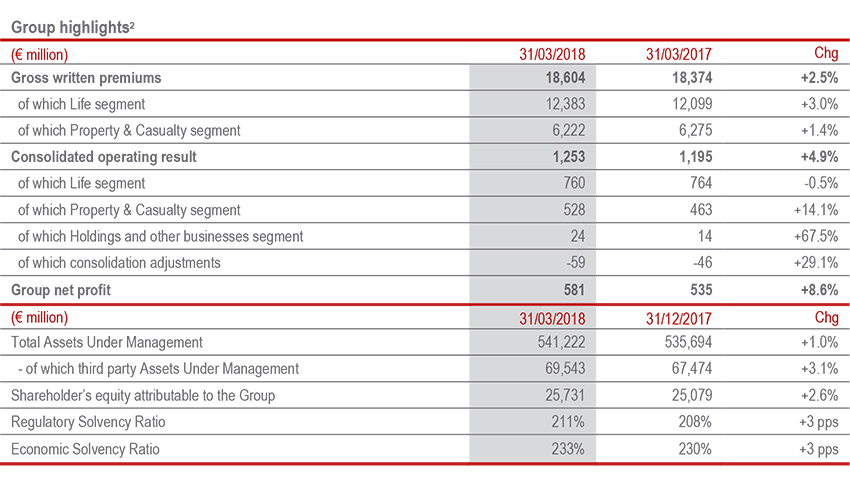

Operating result grew to € 1.3 billion (+4.9%), net profit at € 581 million (+8.6%). Strong capital position

- Operating result improved thanks to excellent performance from the Property & Casualty segment, despite higher natural catastrophe claims, as well as from the Investments, Asset & Wealth Management unit. Life segment result remained solid

- Combined Ratio at outstanding levels (91.4%, -1.6 pps). Excellent profitability in Life new business; NBM increased to 4.55% (+0.7 pps). Life technical reserves at € 385 bln, up 0.3%

- Annualised operating RoE at 13.2%, in line with the target (>13%)

- Premiums increased to € 18.6 bln (+2.5%) thanks to growth in both business segments. Life net cash inflows at € 2.4 bln

- Capital position further strengthened, with Regulatory Solvency Ratio at 211% and Economic Solvency Ratio at 233%

Generali Group CFO, Luigi Lubelli, commented: "The results that we present today highlight the on-going positive trend in the Group's economic and financial performance, as well as the effective execution of the strategic plan that is being implemented with discipline and determination. We continue to develop the business and create value as evidenced on one hand, by the growth in premium income, robust Life net cash inflows, and increasing Assets Under Management and on the other, by further improvement in the Combined Ratio and the Life new business margin. The results of the first quarter allow us to look at the rest of the year with optimism as we successfully complete our strategic plan."

Paris. At a meeting chaired by Gabriele Galateri di Genola, the Board of Directors of Assicurazioni Generali approved the Interim financial statements as at 31 March 2018.

Premiums and New Business

- The Group's total premium sposted growth of 2.5% compared to the previous year, reaching €18,604 million, as a result of positive trends on equivalent terms in both business segments.

With reference to the business lines, Life posted an increase of 3%, mainly deriving from growth in unit- linked products (+9.9%) observed in almost all the countries in which the Group operates. Life net cash inflows exceeded € 2.4 billion; the decrease of 20.7% derived from the strategic approach aimed at increasing the profitability of the Life portfolio, also reflected in the new business value and in the performance of traditional savings products, for which written premiums fell by 4.3%, particularly in Italy, Germany, ACEER3 and Spain.

The Property & Casualty premiums also recorded growth (+1.4% on equivalent terms) deriving from the positive performance of both business lines. The Motor business increased 1.6% due to growth in ACEER (+4.9%) and Americas and Southern Europe (+21.1%). Italy posted a decline (-4.5%), following the contraction in the average premium and the portfolio, as did Germany (-1.4%), mainly due to initiatives focused on further improving profitability, especially in the broker channel. France remained essentially stable. The Non-Motor business also increased (+0.6%), as a result of the increase by 3.1% in ACEER and by 11.3% in Europ Assistance that grew in mature markets due to the increase in travel insurance and roadside assistance. Italy decreased 2.3% mainly due to the drop in premiums for the Global Corporate & Commercial businesses while premiums were stable for the remainder of the Italian Non-Motor portfolio. - New business in terms of PVNBP (present value of new business premiums) stood at € 11,165 million (-6.6%), posting a decline in savings products (-13.8%) and protection products (-5.9%), which was heavily influenced by the slowdown in Germany, offset in part by the increase in premiums from unit- linked products (+3.3%).

The new business value (NBV) was € 508 million (€ 463 million in 1Q17), up 10.3% compared to the first three months of 2017.

The new business margin on PVNBP stood at 4.55% (3.84% in 1Q17) with an increase of 0.70 pps due to the better business mix, reduction of financial guarantees, and improvement of financial assumptions compared to the first three months of 2017.

Economic Performance

- The operating result amounted to € 1,253 million, posting growth of 4.9%, driven by the Property & Casualty segment, up 14.1% due to performance of the technical result. The Combined Ratio continued at excellent levels (91.4%; -1.6 pps over 1Q17), despite the impact of € 76 million of catastrophe claims for 1.5 pps (1.1 pps in 1Q17) related to storms that mainly affected Germany and France in January. The current year non-catastrophe loss ratio showed considerable improvement across all of the main countries where the Group operates. The contribution from prior years was stable.

The operating result of the Life segment was essentially stable, reflecting, on one hand, the improvement in the technical result net of insurance and other operating expenses and, on the other, the contraction in the financial margin following lower current returns and realized gains.

Lastly, the operating result of the Holding and other businesses segment was positive, due in particular to the favourable development of Investments, Asset & Wealth Management activities. Holding operating expenses were stable. - Group net profit stood at € 581 million, up 8.6%. In addition to the improvement in the operating resultas mentioned above, it mainly reflects4:

- the improvement in the non-operating investment result, in particular due to further lower impairments;

- the higher impact of taxes. The tax rate rose from 29.5% to 33.1%, reflecting, among other effects, the impact of the changed composition of the investment result compared to the first quarter of last year;

- the result of discontinued operations of € 14 million. - The P&L return on investments was 0.7%5 (0.8% at 1Q17), slightly down due to lower realized gains and a marginal drop in current profitability compared to the prior period.

Balance Sheet and Capital Position

- The Group shareholders’ equity stood at € 25,731 million (€ 25,079 million as at 31 December 2017), up 2.6% due to the result for the period attributable to the Group and the increase in the reserve for unrealised gains and losses on available for sale financial assets.

- Third party Assets Under Management posted an increase of 3.1%, mainly due to performance in China and Banca Generali.

- The Preliminary Regulatory Solvency Ratio – which represents the regulatory view of the Group’s capital and is based on the use of the internal model, solely for companies that have obtained the relevant approval from IVASS, and on the Standard Formula for other companies – stood at 211% (208% YE17; +3 pps).

The Economic Solvency Ratio, which represents the economic view of the Group’s capital and is calculated by applying the internal model to the entire Group perimeter, stood at 233% (230% YE17; +3 pps).

The increase is due to normalised generation of capital, net of accrued dividend.

For significant events that occurred during and after the period ended 31 March 2018, please refer to the press releases available for download at www.generali.com.

The Manager in charge of preparing the company’s financial reports, Luigi Lubelli, declares, pursuant to paragraph 2 article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

The glossary and the description of alternative performance measures are available in the 2017 Annual Integrated Report and Consolidated Financial Statements of the Group.

1 Changes in premiums, Life net cash inflows and PVNBP (present value of new business premiums) are presented in equivalent terms (at equivalent exchange rates and consolidated scope). Changes in operating results, own investments and Life technical reserves exclude entities sold during the comparative period.

2 With reference to the disposals of the Irish and Belgian businesses, pending the issue of the necessary regulatory authorisations, these assets were classified as disposal groups held for sale, in application of IFRS 5. As a result, these investments were not excluded from consolidation but total assets, liabilities and profit after tax were recognised separately in the specific financial statement items. Similarly, the comparative data were restated (2017 data also included Dutch operations whose sale was completed in February 2018).

3 As communicated to the market on 21 February 2018, Austria was integrated into the new regional structure known as Austria, Central and Eastern European Countries & Russia (ACEER), effective 1 January 2018. In addition, the Americas and Southern Europe area was created within the International regional structure, comprising Argentina, Brazil, Chile, Ecuador, USA, Portugal, Greece and Turkey.

4 The following figures are shown net of the effect of taxes and minority interests.

5 The return is not annualized.